Income Tax Deduction Health Insurance Premiums For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if they exceed 7 5 of

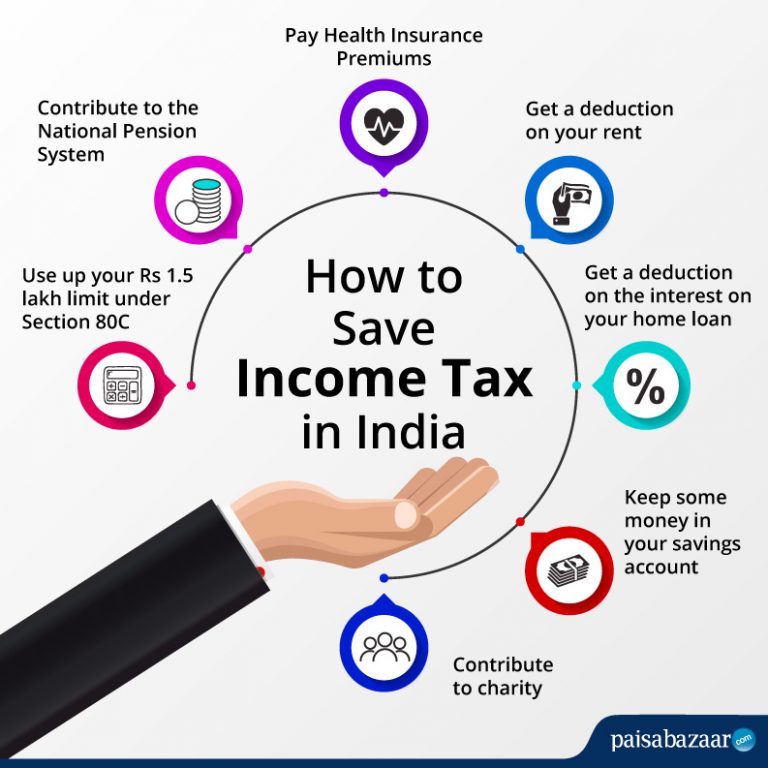

As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction Your health insurance premiums can be tax deductible if you have income from self employment and you aren t eligible to participate in a health plan offered by an

Income Tax Deduction Health Insurance Premiums

Income Tax Deduction Health Insurance Premiums

https://www.theoasisfirm.com/wp-content/uploads/2022/03/Mortgage-Insurance-Premiums-Tax-Deduction-3.png

Income Tax Section 80D Deduction In Respect Of Health Insurance

https://i.pinimg.com/736x/75/7b/98/757b989c22cc8010d2ec260e48a919a4--income-tax-health-insurance.jpg

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you to deduct up to 100 of your premiums Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

If you pay for health insurance after taxes are taken out of your paycheck you might qualify for the medical expense deduction If you paid the premiums for a policy you obtained yourself your health insurance premium is deductible when they are out of pocket costs Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

Download Income Tax Deduction Health Insurance Premiums

More picture related to Income Tax Deduction Health Insurance Premiums

Tax Deduction Thailand 2022 Pay Less With Health Insurance

https://blog.lumahealth.com/hubfs/Blogs/Tax reduction/Tax deduction - banner.png

Can I Get A Tax Deduction For Health Insurance CBS News

https://assets3.cbsnewsstatic.com/hub/i/r/2013/10/15/6dd14fe2-4782-11e3-a5af-047d7b15b92e/thumbnail/1200x630/e6d64cf831e9db78292e577961d05969/Health_Ins_tax_deduction.jpg

Qualified Business Income Deduction And The Self Employed LaptrinhX

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents You may qualify for an income based premium subsidy also called an advance premium tax credit APTC for coverage you bought through the Health Insurance Marketplace Any premium you pay that s reimbursed by an APTC can t be deducted from your taxes But any remaining premium can be deducted

This article will explain how tax deductibility works for health insurance premiums including how the rules differ depending on whether you re self employed and how much you spend on medical costs Health insurance premiums can be tax deductible under some circumstances Taxpayers who itemize may be able to use this deduction to the extent that their total medical and dental expenses including health insurance premiums exceed 7 5 of adjusted gross income

/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

https://www.thebalancemoney.com/thmb/CY6gLZboMF2aiIvY1pHaeOXugPY=/1500x1000/filters:fill(auto,1)/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

https://www.investopedia.com/are-health-insurance...

For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if they exceed 7 5 of

https://cleartax.in/s/medical-insurance

As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction

Margaret Lykaios Is The President And Major Chegg

/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Tax Deduction Template

When Can You Claim A Tax Deduction For Health Insurance

When Can You Claim A Tax Deduction For Health Insurance

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

China s Income Tax Deduction Goes Digital CGTN

The 6 Best Tax Deductions For 2020 The Motley Fool

Income Tax Deduction Health Insurance Premiums - Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction