Income Tax Deduction In Canada These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various

Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay The Canada Revenue Agency allows you to deduct amounts from the tax that you owe based on your taxable income These calculations are carried out in Section 5 of the tax

Income Tax Deduction In Canada

Income Tax Deduction In Canada

https://advisorsavvy.com/wp-content/uploads/2023/06/Self-Employed-Home-Office-Tax-Deduction-in-Canada-In-Post.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

NPS Deduction In Income Tax 2023 Guide InstaFiling

http://instafiling.com/wp-content/uploads/2023/01/NPS-Deduction-in-Income-Tax.png

Start filing When it comes to taxes there s no one size fits all scenario That s why t here are over 400 deductions and credits that the CRA outlines We ve rounded up the top 20 most popular items to help you A tax deduction sometimes referred to as a tax write off is any legitimate expense that can be subtracted from your taxable income Lowering your taxable income reduces the amount of tax

Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes By law an employer must deduct the following amounts from your employment earnings Income tax Employee contributions to Employment Insurance EI Employee

Download Income Tax Deduction In Canada

More picture related to Income Tax Deduction In Canada

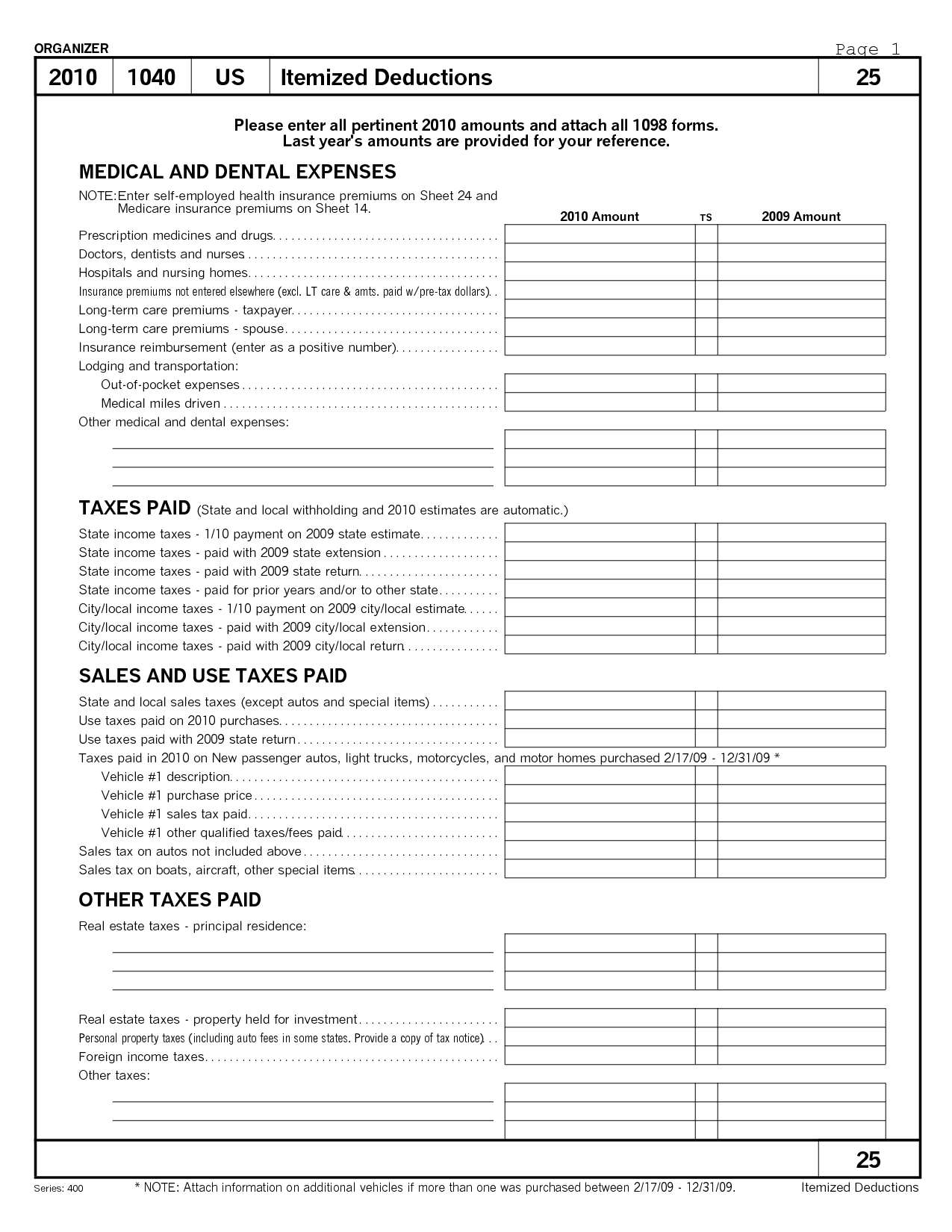

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

Difference Between Tax Exemption Deduction And Rebate

https://housing.com/news/wp-content/uploads/2023/02/Difference-between-tax-exemption-tax-deduction-and-rebate-f.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

A deduction is available with respect to an employee s contributions to a Registered Pension Plan RPP a Pooled Registered Pension Plan PRPP or to a Registered How much you could save You can claim 75 of the contributions up to 400 up to 300 in tax savings 50 for amounts between 400 and 750 for a total tax savings of up to

You can deduct these contributions from your taxable income potentially reducing your tax bill or increasing your tax refund while maximizing RRSP benefits and investment growth Get a quick free estimate of your 2023 income tax refund or taxes owed using our income tax calculator Plus explore Canadian and provincial income tax FAQ and resources

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

https://www.canada.ca/en/revenue-agency/services...

These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various

https://www.canada.ca/en/revenue-agency/services...

Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay

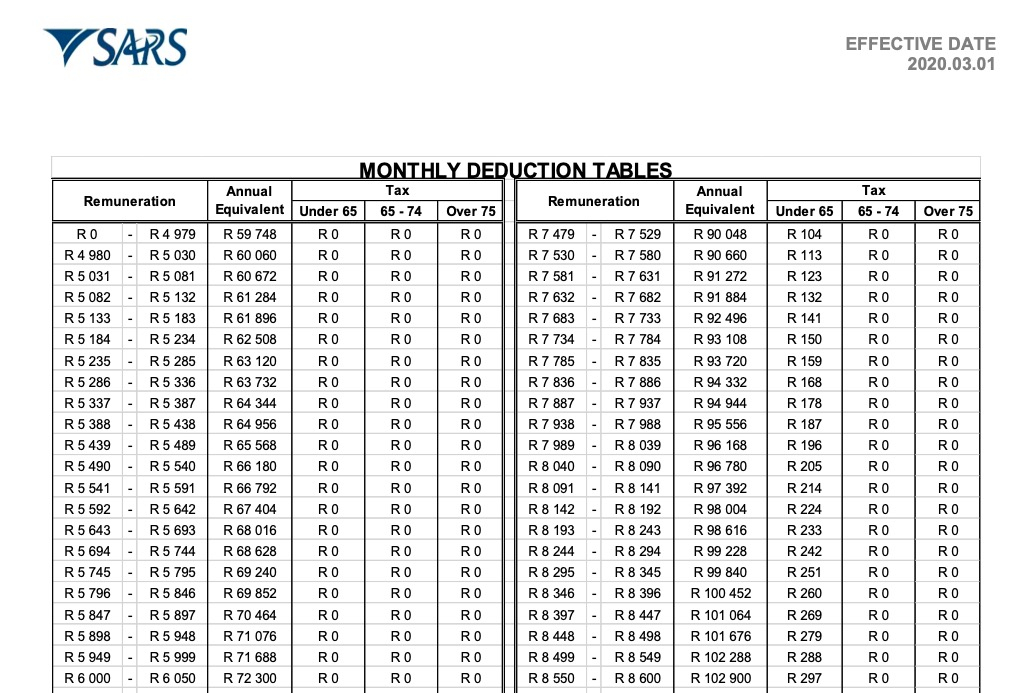

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Advisorsavvy Tax Credit Vs Tax Deduction In Canada

Advisorsavvy Tax Credit Vs Tax Deduction In Canada

Deduction U S 80IA 80IB To Be Reduced From Business Profits For

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Printable Itemized Deductions Worksheet

Tax Deductions For 2023 Ontario Image To U

Can You Claim Rent As A Tenant For Tax Deduction In Canada

Income Tax Deduction In Canada - Start filing When it comes to taxes there s no one size fits all scenario That s why t here are over 400 deductions and credits that the CRA outlines We ve rounded up the top 20 most popular items to help you