Income Tax Deduction Investment Section 80C Deductions on Investments Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments

What investment income is taxable and what investment expenses are deductible Investment interest is deductible as an itemized deduction but limited to net investment income Net investment income is defined as the excess of investment income over investment expenses Sec

Income Tax Deduction Investment

Income Tax Deduction Investment

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Deductible investment interest expenses refer to the interest paid on money borrowed to invest in assets that produce taxable investment income or appreciate in value allowing you to sell at a future In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3

Key Takeaways Net investment income is income received from assets before taxes including bonds stocks mutual funds loans and other investments less related expenses NII is subject to a The benefit of the fiscal scheme is awarded in the form of a wage tax

Download Income Tax Deduction Investment

More picture related to Income Tax Deduction Investment

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

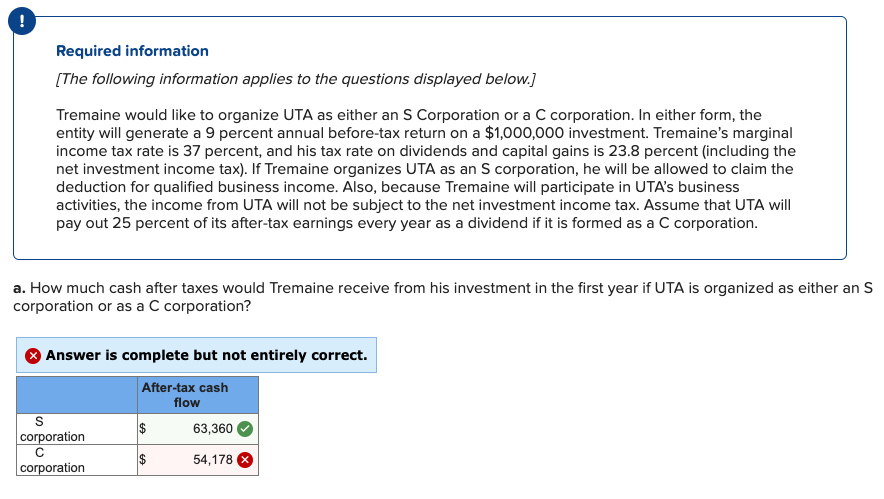

Solved Required Information The Following Information Chegg

https://media.cheggcdn.com/media/bbc/bbc0bf92-f904-4d0c-b168-bf5cf8b7f801/phpQ3FSVE.png

Investment interest is deductible from AGI as an itemized deduction to the extent of net investment income 27 which is calculated as follows Gross investment income Investment expenses Net The most popular tax saving options available to individuals and HUFs in

The IRS allows various tax deductions for investment related How much should I invest in NPS for tax benefit NPS account tax

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

What Are Pre tax Deductions Before Tax Deduction Guide

https://synder.com/blog/wp-content/uploads/sites/5/2023/03/what-are-pre-tax-deductions.png

https://cleartax.in/s/80c-80-deductions

Section 80C Deductions on Investments Section 80C is one of the most popular and favorite sections amongst taxpayers as it allows them to reduce taxable income by making tax saving investments

https://www.irs.gov/forms-pubs/about-publication-550

What investment income is taxable and what investment expenses are deductible

Income Tax Deduction

5 Itemized Tax Deduction Worksheet Worksheeto

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

China s Income Tax Deduction Goes Digital CGTN

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Income Tax Deductions For Fy 2023 24 Printable Forms Free Online

Tax Reduction Company Inc

Extension Of Timelines For Filing Of Income tax Returns And Various

Income Tax Deduction Investment - Investment related expenses can lower your overall return but you may also be able to