Income Tax Deduction Limit For Ay 2022 23 Income Tax Deduction for FY 2023 24 AY 2024 25 Eligible person Maximum deduction available for FY 2023 24 AY 2024 25 Section 80C Investing into

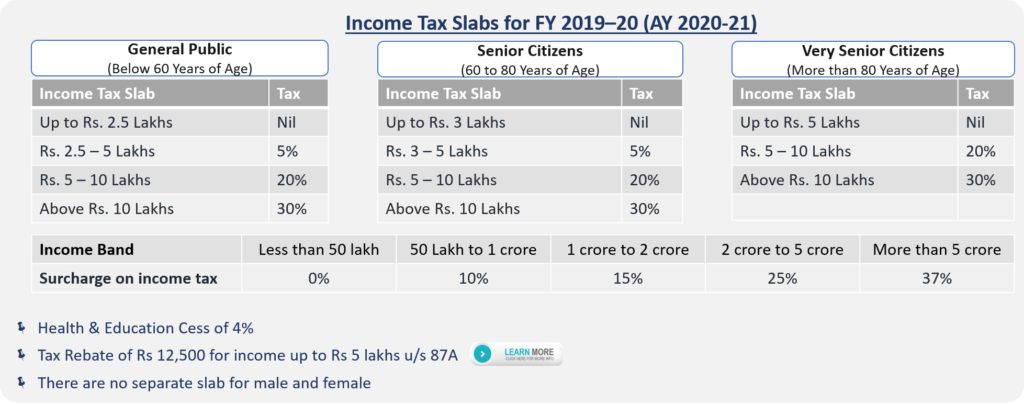

Income tax law has prescribed a basic exemption limit for individuals upto which the taxpayers are not required to pay taxes Such a limit is different for different 276C 1 If tax sought to be evaded exceeds Rs 25 Lakhs 2 Prosecution of 6 months to 7 years with fine for willful failure to furnish return of income under section 139 1 or

Income Tax Deduction Limit For Ay 2022 23

Income Tax Deduction Limit For Ay 2022 23

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

TDS Rate Chart For FY 2022 23 AY 2023 24 SimBizz

https://simbizz.in/wp-content/uploads/2022/06/simbizz.in-blog.png

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

The limit for the deduction is lower of the amount of contribution or 14 of salary for central government employees 10 of salary for other employees It is available Total Income Rs Rate of income tax for AY 2023 24 Up to 2 50 000 Nil deduction of income tax at source on income by way of winnings from online game cases remain

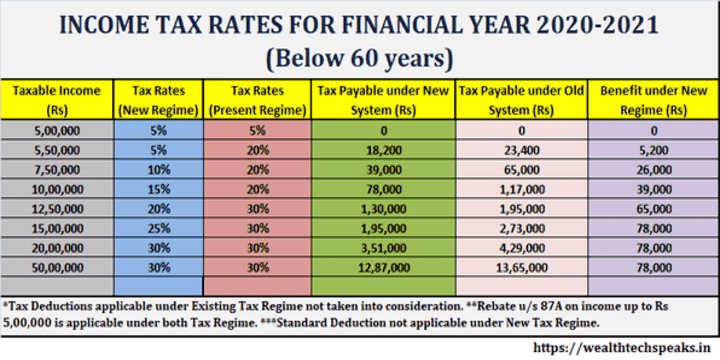

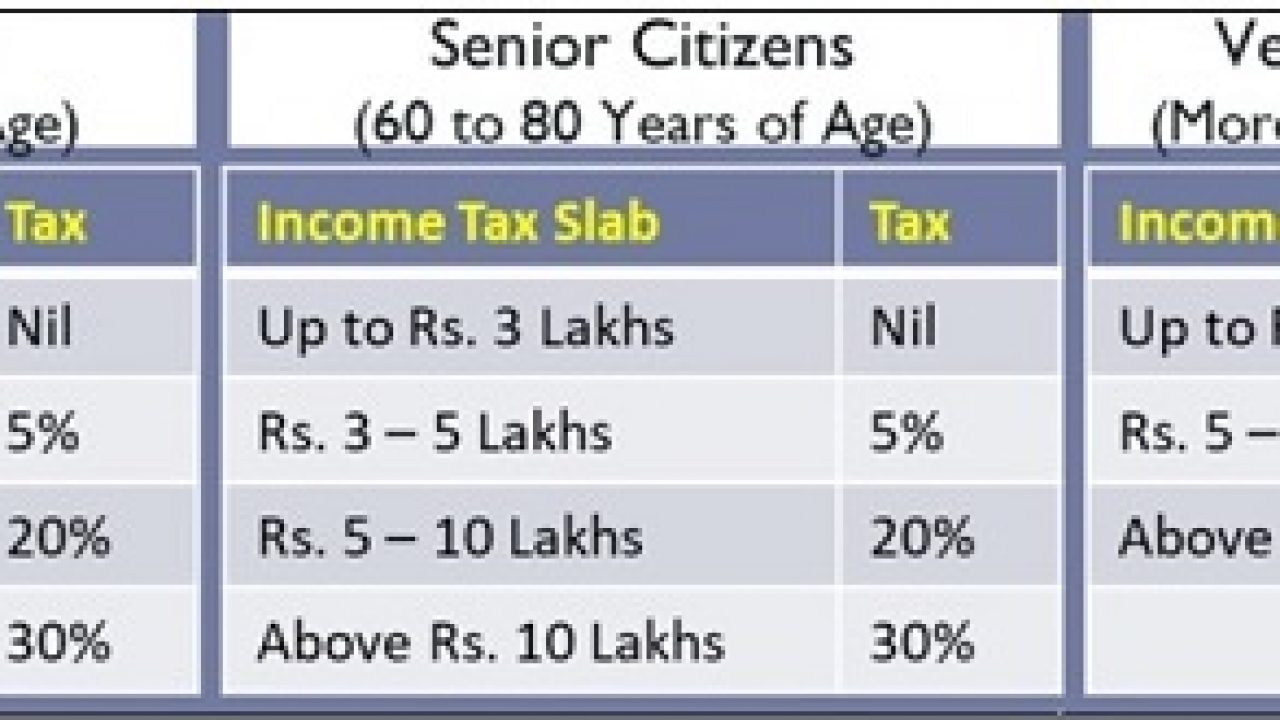

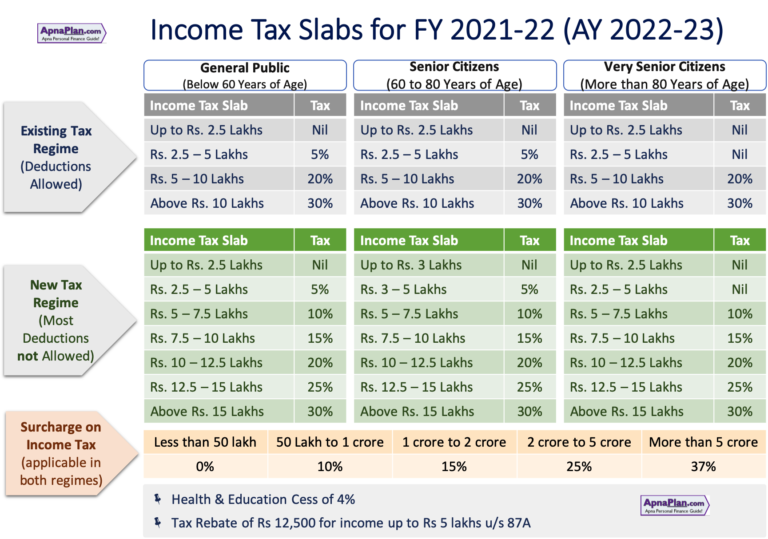

Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5

Download Income Tax Deduction Limit For Ay 2022 23

More picture related to Income Tax Deduction Limit For Ay 2022 23

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

https://cdn.statically.io/img/i0.wp.com/wealthtechspeaks.in/wp-content/uploads/2020/03/Income-Tax-Rates-FY-2020-21.png?resize=160,120

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Income Tax Calculator For FY 2019 20 AY 2020 21 Excel Download

https://www.apnaplan.com/wp-content/uploads/2019/04/Income-Tax-Slabs-for-FY-2019-20-AY-2020-21-1024x404.png

For income of INR 15 lakh if you have the investment amount of INR 2 50 000 or more eligible for tax deduction opt for Old Tax Regime But if your investment is less than I in case where net income exceeds Rs 50 lakh but doesn t exceed Rs 1 Crore the amount payable as income tax and surcharge shall not exceed the total

The standard deduction limit available to salaried taxpayers and pensioners may be increased by 30 35 per cent in the upcoming budget reported The Economic Income tax slab for women below 60 years of age and non resident women for FY 2022 23 Income tax slab for senior citizen women over 60 years of age Income

2022 23 Tax Rates TAX

https://wealthtechspeaks.in/wp-content/uploads/2021/02/Senior-Citizen-New-Tax-System-2021-22.png

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

https://jananiservices.com/blog/wp-content/uploads/2022/08/image-2.png

https://tax2win.in/guide/deductions

Income Tax Deduction for FY 2023 24 AY 2024 25 Eligible person Maximum deduction available for FY 2023 24 AY 2024 25 Section 80C Investing into

https://cleartax.in/s/income-tax-slabs

Income tax law has prescribed a basic exemption limit for individuals upto which the taxpayers are not required to pay taxes Such a limit is different for different

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

2022 23 Tax Rates TAX

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download 2023

New Income Tax Regime FY 2020 21 ELPHOS INVESTMENTS

New Income Tax Regime FY 2020 21 ELPHOS INVESTMENTS

.png)

Itr Form For Ay 2023 24 Printable Forms Free Online

TDS Rate Chart For FY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Deduction Limit For Ay 2022 23 - Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5