Income Tax Deduction Medical Expenses Verkko 31 maalisk 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income

Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the Verkko 20 lokak 2023 nbsp 0183 32 You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040 To receive a tax benefit you have to itemize deductions on Schedule A and your total itemized deductions deductible medical expenses state and local taxes home

Income Tax Deduction Medical Expenses

Income Tax Deduction Medical Expenses

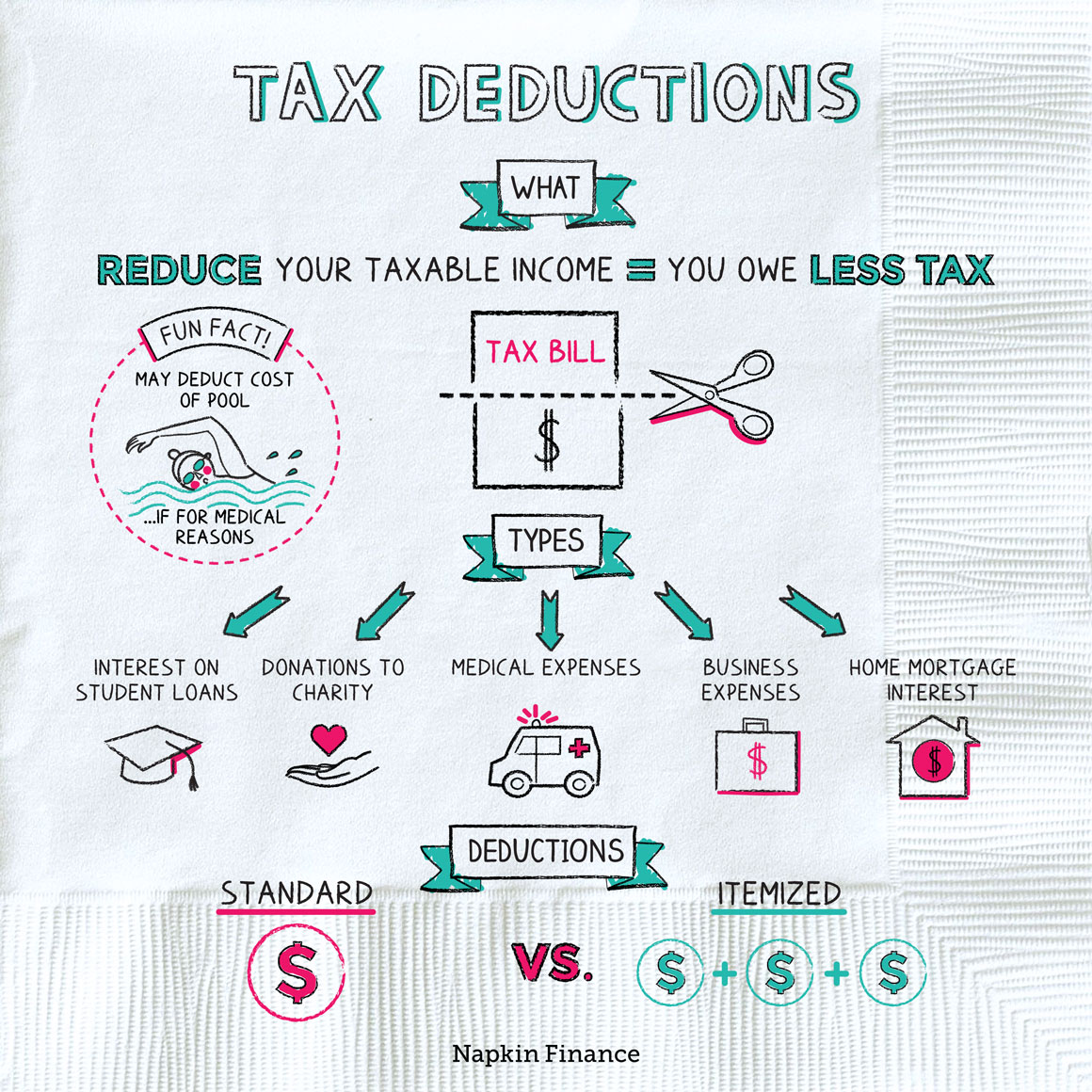

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

FunctionalBest Of Self Employed Tax Deductions Worksheet

https://i.pinimg.com/474x/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Verkko 12 tammik 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your AGI is 65 000 your threshold would be 4 875 or 7 5 of 65 000 You can find your AGI on Form 1040 Verkko 29 huhtik 2023 nbsp 0183 32 The deduction for tax year 2022 covers expenses that exceed 7 5 of your adjusted gross income AGI Medical and Dental Expenses You can deduct unreimbursed qualified medical and

Verkko 27 maalisk 2023 nbsp 0183 32 The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little Verkko You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

Download Income Tax Deduction Medical Expenses

More picture related to Income Tax Deduction Medical Expenses

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

Medical Expenses Deduction Under Income Tax Act 2023 Update

https://instafiling.com/wp-content/uploads/2023/01/Medical-Expenses-Deduction-Under-Income-Tax-Act-1080x675.png

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

Verkko 8 lokak 2021 nbsp 0183 32 If your unreimbursed out of pocket medical bills in 2020 exceeded 7 5 percent of your adjusted gross income AGI you may be able to deduct them on your taxes In addition to meeting the income Verkko 25 lokak 2022 nbsp 0183 32 Medical Expenses Any cost incurred in the prevention or treatment of injury or disease Medical expenses include health and dental insurance premiums doctor and hospital visits co pays

Verkko 8 jouluk 2023 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This deduction is also available for top up health plans and critical illness plans The best part is that it is over and above the Rs 1 5 lakh limit deductions claimed under Section 80C Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 Individuals or families can claim deductions for the following medical expenses 1 Preventive health checkups Under section 80D preventive health checkup expenses are eligible for deduction up to 5000 This deduction is included in the total deduction of 50 000 for senior citizens and 25 000 for non senior citizens

Medical Expense Deduction Tax Benefits McNurlin CPA Denver CO

https://mcnurlincpa.com/wp-content/uploads/2020/09/iStock-1170080115.jpg

Income Tax Deductions For The FY 2019 20 ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/income-tax-deduction-list-2017-18.png

https://www.nerdwallet.com/article/taxes/medical-expense-tax-deduction

Verkko 31 maalisk 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income

https://www.irs.gov/taxtopics/tc502

Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the

Can You Claim A Tax Deduction For Medical Expenses

Medical Expense Deduction Tax Benefits McNurlin CPA Denver CO

Itemized Deductions Spreadsheet In Business Itemized Deductions

Qualified Business Income Deduction And The Self Employed The CPA Journal

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

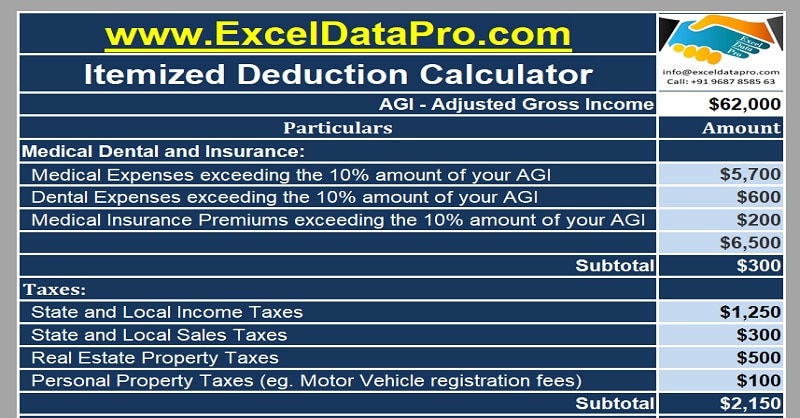

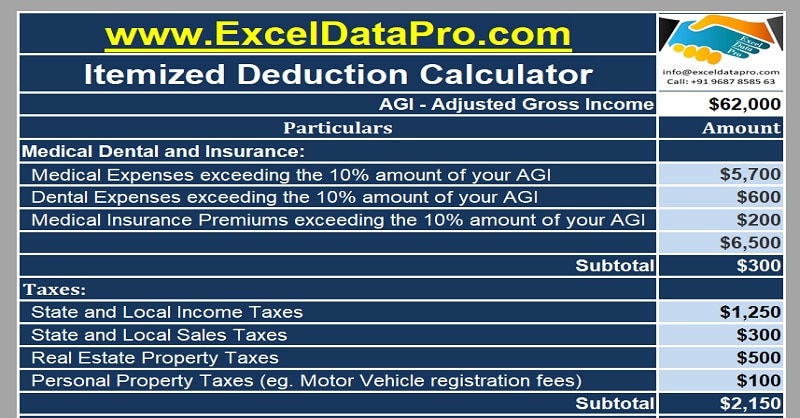

Download Itemized Deductions Calculator Excel Template ExcelDataPro

Download Itemized Deductions Calculator Excel Template ExcelDataPro

1040 Deductions 2016 2021 Tax Forms 1040 Printable

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

Medical Expenses What It Takes To Qualify For A Tax Deduction CSH

Income Tax Deduction Medical Expenses - Verkko 26 jouluk 2023 nbsp 0183 32 The truth is that you can only deduct medical expenses and dental expenses that are greater than 7 5 of your adjusted gross income For example if you have an AGI of 50 000 then 7 5 of that