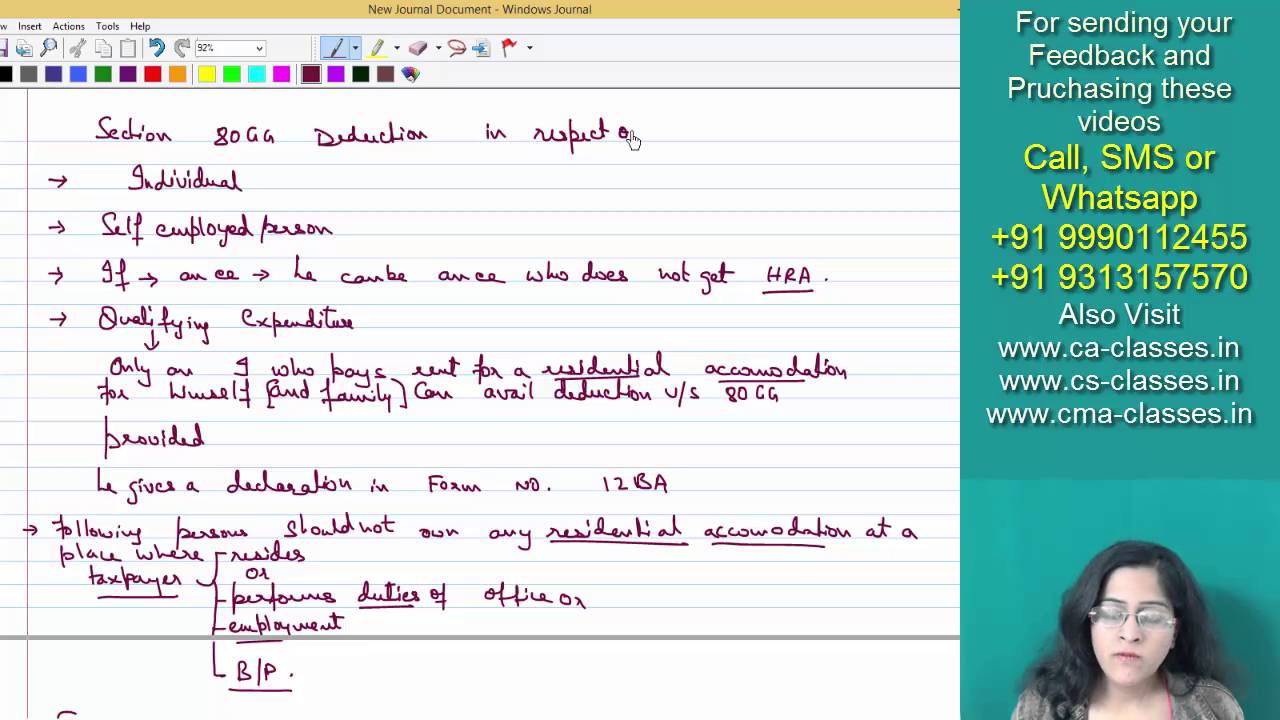

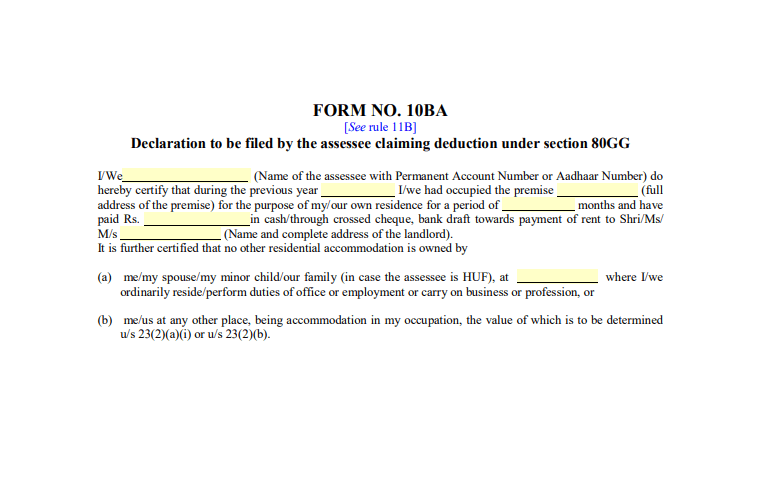

Income Tax Deduction Rent Paid In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

Rental income All rental income and all the expenses that relate to it must be reported If you are an owner of multiple flats apartments or other rental property units you must break down the income and expenses specifically for each one You must report the amounts even if you don t have to pay any tax after the expenses have been deducted Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income taxes Laws are subject to change with each year

Income Tax Deduction Rent Paid

Income Tax Deduction Rent Paid

https://i.ytimg.com/vi/wA-Np2k52e0/maxresdefault.jpg

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

https://gstguntur.com/wp-content/uploads/2021/07/1620198931_form10ba.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned Expenses of renting property can be deducted from your gross rental income You generally deduct your rental expenses in the year you pay them Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment if you rent part of your property or if you change your property to

Topic no 414 Rental income and expenses Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of Deducting rent on taxes is not permitted by the IRS However if you use the property for your trade or business you may be able to deduct a portion of the rent from your taxes The amount you can deduct is based the how many

Download Income Tax Deduction Rent Paid

More picture related to Income Tax Deduction Rent Paid

Income Tax Deduction

http://www.trutax.in/blog/wp-content/uploads/2018/02/income-tax-deduction.png

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

This includes any payments for the use of furniture charges for additional services you provide such as cleaning of communal areas hot water heating repairs to the property Paying tax on Deduction limit u s 80GG The allowable deduction under this section will be the least of the following Total rent paid less 10 of total income INR 5000 per month i e INR 60 000 annually Note Total income for this section means Gross total income less all deductions under chapter VI A except 80GG

1 Property tax Check to see if you pay property taxes as part of your lease agreement If you do you can deduct that portion of your rent or any property tax you pay directly Additionally you can deduct property losses or damage due to a federally declared natural disaster Learn more Tax Relief for Victims of a Natural Disaster 2 Home office The Inland Revenue Amendment Tax Deductions for Domestic Rents Ordinance 2022 was enacted on 30 June 2022 to provide for new deduction for domestic rent with effect from the year of assessment 2022 23 The implementation framework of the new deduction is as follows Eligible Persons A taxpayer chargeable to salaries tax or tax charged

Income Tax Deduction Under 80C Lex N Tax Associates

https://lexntax.com/wp-content/uploads/2018/01/Deduction-Under-Income-Tax-1024x640-1.jpg

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

https://secureservercdn.net/160.153.137.184/mms.194.myftpupload.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received-768x505.jpg

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

https://www.vero.fi/en/individuals/property/rental_income

Rental income All rental income and all the expenses that relate to it must be reported If you are an owner of multiple flats apartments or other rental property units you must break down the income and expenses specifically for each one You must report the amounts even if you don t have to pay any tax after the expenses have been deducted

Tax Deduction On House Rent U S 80GG Without HRA For Employees

Income Tax Deduction Under 80C Lex N Tax Associates

Solved Please Note That This Is Based On Philippine Tax System Please

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Qualified Business Income Deduction And The Self Employed The CPA Journal

Tax Deduction Taxable Income Deduction Viva Business Consulting

Tax Deduction Taxable Income Deduction Viva Business Consulting

Section 80GG Deduction Income Tax IndiaFilings

Income Tax Deductions For The FY 2019 20 ComparePolicy

How To Calculate Income Tax On Salary With Example

Income Tax Deduction Rent Paid - Deducting rent on taxes is not permitted by the IRS However if you use the property for your trade or business you may be able to deduct a portion of the rent from your taxes The amount you can deduct is based the how many