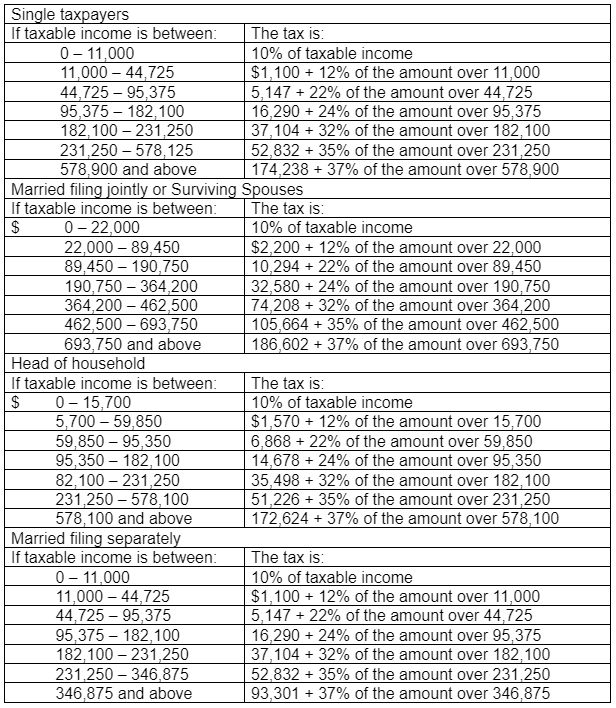

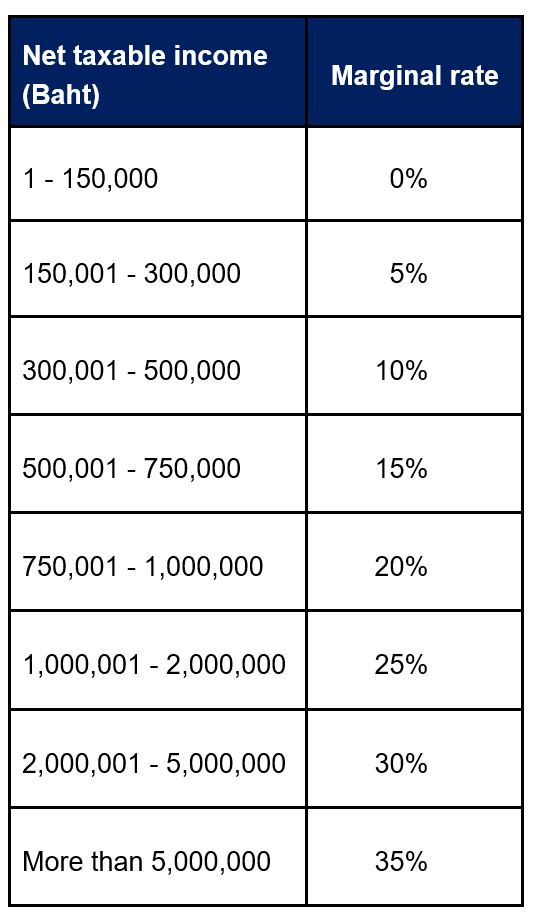

Income Tax Deduction Thailand 2023 The Tax tables below include the tax rates thresholds and allowances included in the Thailand Tax Calculator 2023 Thailand provides an annual Standard Deduction that is deducted from your total income to produce your taxable

This booklet has been prepared to provide general information on Thailand s tax system and primary assistance to those investing in Thailand and it should not be regarded as a basis for ascertaining a liability to tax in specific This tax return is a general return for taxpayers who received income in the tax year 2023 from January 1 to December 31 2023 However if you had income from employment only you

Income Tax Deduction Thailand 2023

Income Tax Deduction Thailand 2023

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Tax Deduction Thailand 2022 Pay Less With Health Insurance

https://blog.lumahealth.com/hubfs/Blogs/Tax reduction/Tax deduction - banner.png

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Thailand taxes its residents and non residents on their assessable income derived from employment or business carried on in Thailand regardless of whether paid in or outside Here we break down the income tax system for expatriates showing tax rates and brackets based on income We also detail the available personal allowances and deductions With recent tax changes impacting

Contributions can be deducted from taxes at a rate of 30 of taxable income up to a maximum of THB 500 000 and for a period of five years In addition a Thai Tax Resident who is over 65 years of age or who is disabled is entitled to personal income tax exemption on the net income up to Baht 190 000 per tax year The

Download Income Tax Deduction Thailand 2023

More picture related to Income Tax Deduction Thailand 2023

Thailand Tax Calculator 2022 Download Thailand Personal Income Tax

https://www.moneymgmnt.com/wp-content/uploads/thailand-tax-calculator.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

2023 Tax Rates And Deduction Amounts Sales Taxes VAT GST United

https://www.mondaq.com/images/article_images/1294928a.jpg

Do I Have to Pay Income Taxes for Foreign Sourced Income Brought into Thailand in 2023 Yes If the income is established in the 2023 tax calendar year and the individual resides in Thailand for 180 days or more in such a year From 1 January to 10 April 2023 Thai taxpayers have the legal obligation of income disclosure to the Revenue Department of Thailand For this you must have an account of your income in Thailand between January 1 and

If you want to reduce your personal income tax in Thailand the key is being aware of all possible income tax deductions and knowing which deductions and allowances to use The free online 2023 Income Tax Calculator for Thailand Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results

Budget 2023 Expectations Rs 5 Lakh Income Tax Deduction On Home Loan

https://img.etimg.com/thumb/msid-96809461,width-1070,height-580,imgsize-869259,overlay-etwealth/photo.jpg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

https://th.icalculator.com › income-tax-rates

The Tax tables below include the tax rates thresholds and allowances included in the Thailand Tax Calculator 2023 Thailand provides an annual Standard Deduction that is deducted from your total income to produce your taxable

https://www.pwc.com › th › en › tax

This booklet has been prepared to provide general information on Thailand s tax system and primary assistance to those investing in Thailand and it should not be regarded as a basis for ascertaining a liability to tax in specific

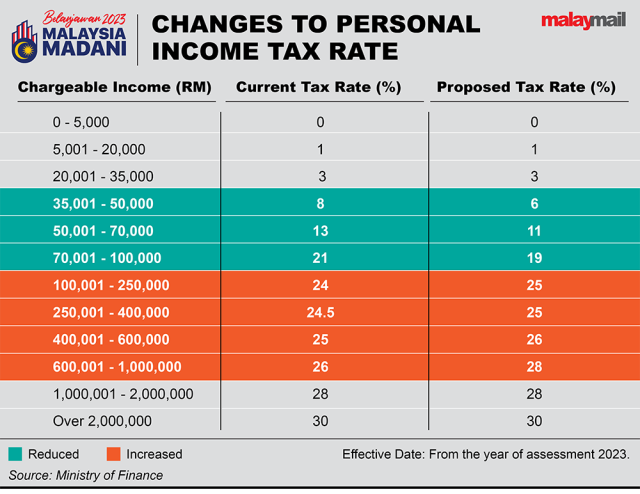

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Budget 2023 Expectations Rs 5 Lakh Income Tax Deduction On Home Loan

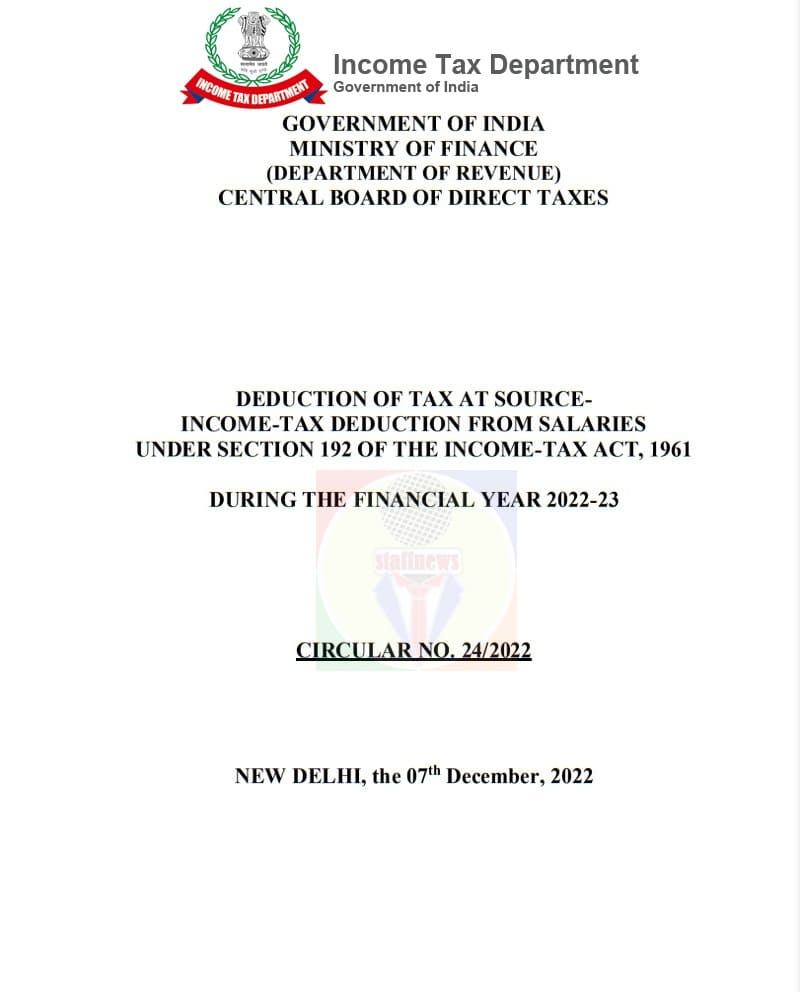

Income Tax Deduction From Salaries During The Financial Year 2022 23

Non Resident Tax Malaysia Charles Dowd

Advance

Tax Prep Checklist Tracker Printable Tax Prep 2023 Tax Checklist Tax

Tax Prep Checklist Tracker Printable Tax Prep 2023 Tax Checklist Tax

Doing Business In Thailand Withholding Tax Jarrett Lloyd

Budget 2023 Income Tax Down For M40 Up For Those Earning Above RM100k

Understanding Income Tax Deductions From Salaries For FY 2021 2022 PDF

Income Tax Deduction Thailand 2023 - For residents of Thailand including foreign residents of Thailand Thai personal income tax law permits the following deductions against assessable income Deductions for expenses