Income Tax Deduction Under 80c To 80u Article explains Income Tax Deduction Available to Individual and HUF under Section 80C Section 80CCG Section 80D Section 80DD Section 80DDB Section

Individuals can claim tax deduction benefits for payments made towards life insurance policies fixed deposits superannuation provident funds tuition fees and construction purchase of residential properties under Section Sections 80C to 80U are provisions in the Indian Income Tax Act that offer tax deductions to individuals and businesses These sections cover

Income Tax Deduction Under 80c To 80u

Income Tax Deduction Under 80c To 80u

https://i.ytimg.com/vi/zEDH4xhkCfE/maxresdefault.jpg

Deduction Under Section 80C To 80U YouTube

https://i.ytimg.com/vi/aVOngu2L6VM/maxresdefault.jpg

Deduction Of 80C 80CCC 80CCD Under Income Tax

https://corpbiz.io/learning/wp-content/uploads/2020/06/Eligible-Instruments-under-Section-80C-1-768x477.png

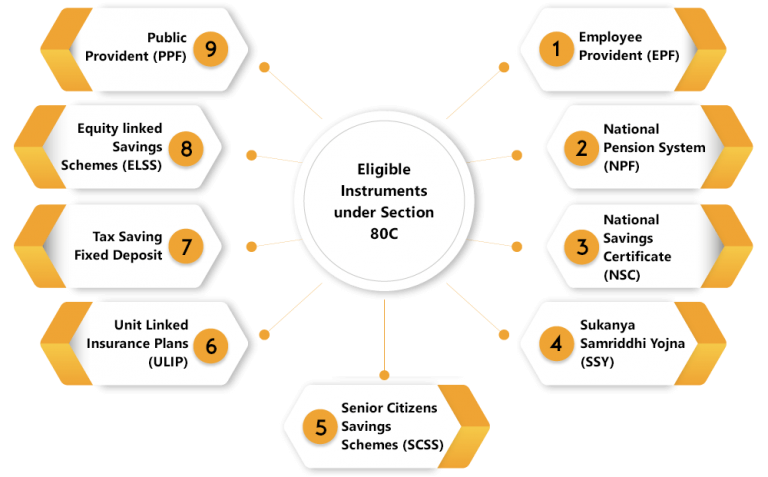

Chapter VIA encompasses Sections 80C to 80U of the Income Tax Act 1961 Each section specifies a particular type of deduction with conditions and limits that taxpayers must adhere 80CCD 1B NPS Employee Contribution Deduction under NPS allows individuals to claim an additional deduction of up to Rs 50 000 over and above the limit of Section 80C By contributing to the NPS taxpayers secure

Section 80C to 80U of the Income Tax Act 1961 in India provides various deductions to individuals and Hindu Undivided Families HUFs to reduce their taxable income and avail tax benefits These deductions are available for The Income Tax Act allows a deduction for interest paid on higher education loans under Section 80E In order to claim the deduction under this Section the loan must be

Download Income Tax Deduction Under 80c To 80u

More picture related to Income Tax Deduction Under 80c To 80u

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deductions under section 80C to 80U are allowed from gross total income to compute total income however deduction is allowed only from normal income Deductions are not allowed from Long term capital gains Section Below is the full list of deductions available under Section 80C of income tax act Section 80CCD of Income Tax Act helps us to contribute towards National Pension Scheme NPS or Atal

According to Section 80A 2 of the Indian Income Tax Act deductions under various sections including Sections 80C to 80U cannot exceed your Gross Total Income GTI This means Explore key income tax deductions under Sections 80C 80CCC 80CCD and 80D for F Y 2023 24 A Y 2024 25 to maximize savings Section 80C to 80U Income tax

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

https://www.100utils.com/wp-content/uploads/2020/03/income_tax_deductions.png

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

https://taxguru.in › income-tax

Article explains Income Tax Deduction Available to Individual and HUF under Section 80C Section 80CCG Section 80D Section 80DD Section 80DDB Section

https://www.bankbazaar.com › tax

Individuals can claim tax deduction benefits for payments made towards life insurance policies fixed deposits superannuation provident funds tuition fees and construction purchase of residential properties under Section

Deductions Under Section 80C Its Allied Sections

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

Deduction From Gross Total Income Section 80c To 80u Graphical Table

Income Tax Deductions Under Sec 80C To 80U Chapter IV Deduction

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

What Is Section 80C Income Tax Deduction Under Section 80C Tax2win

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Income Tax Deduction Under 80c To 80u - To reduce your gross total income and thereby your income tax liability you have to enter details of deductions that you want to claim under sections 80C to 80U of the Act If