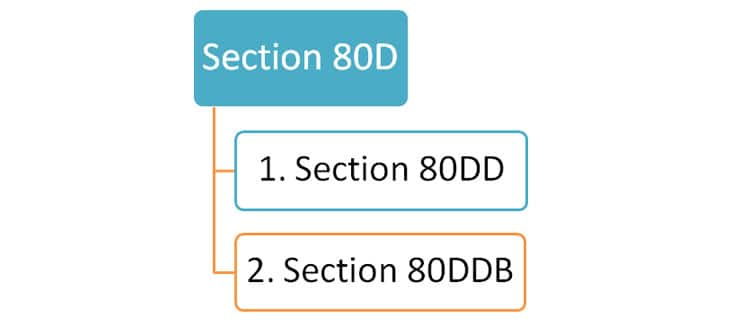

Income Tax Deduction Under Section 80dd Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium To claim a deduction under section 80DD you should submit Form 10 IA and the income tax return filed for the respective assessment year No deduction can be claimed under section 80DD if

Income Tax Deduction Under Section 80dd

Income Tax Deduction Under Section 80dd

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Anything To Everything Income Tax Guide For Individuals Including

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Section 80DD allows a deduction of up to Rs 75 000 a year and if the disability is severe up to Rs 1 25 000 a year Severe disability means a person with 80 per cent What is Section 80DD of the Income Tax Act Section 80DD allows tax deductions to individuals and Hindu Undivided Families HUFs who incur expenses on

Section 80DD of the Income Tax Act 1961 offers tax deductions regarding the medical treatment and maintenance of a dependent with disability Under this section the taxpayer can claim a To claim a deduction under section 80DD of the Income Tax Act eligible taxpayers must submit a medical certificate issued by the prescribed medical

Download Income Tax Deduction Under Section 80dd

More picture related to Income Tax Deduction Under Section 80dd

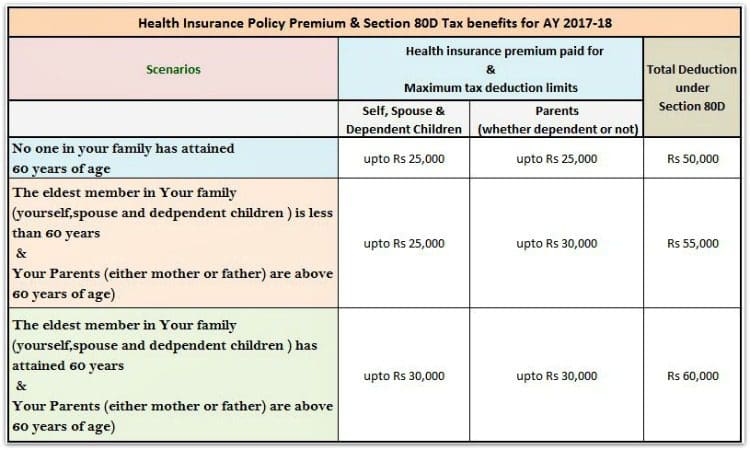

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

https://i.ytimg.com/vi/qT4UE82nHEs/maxresdefault.jpg

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

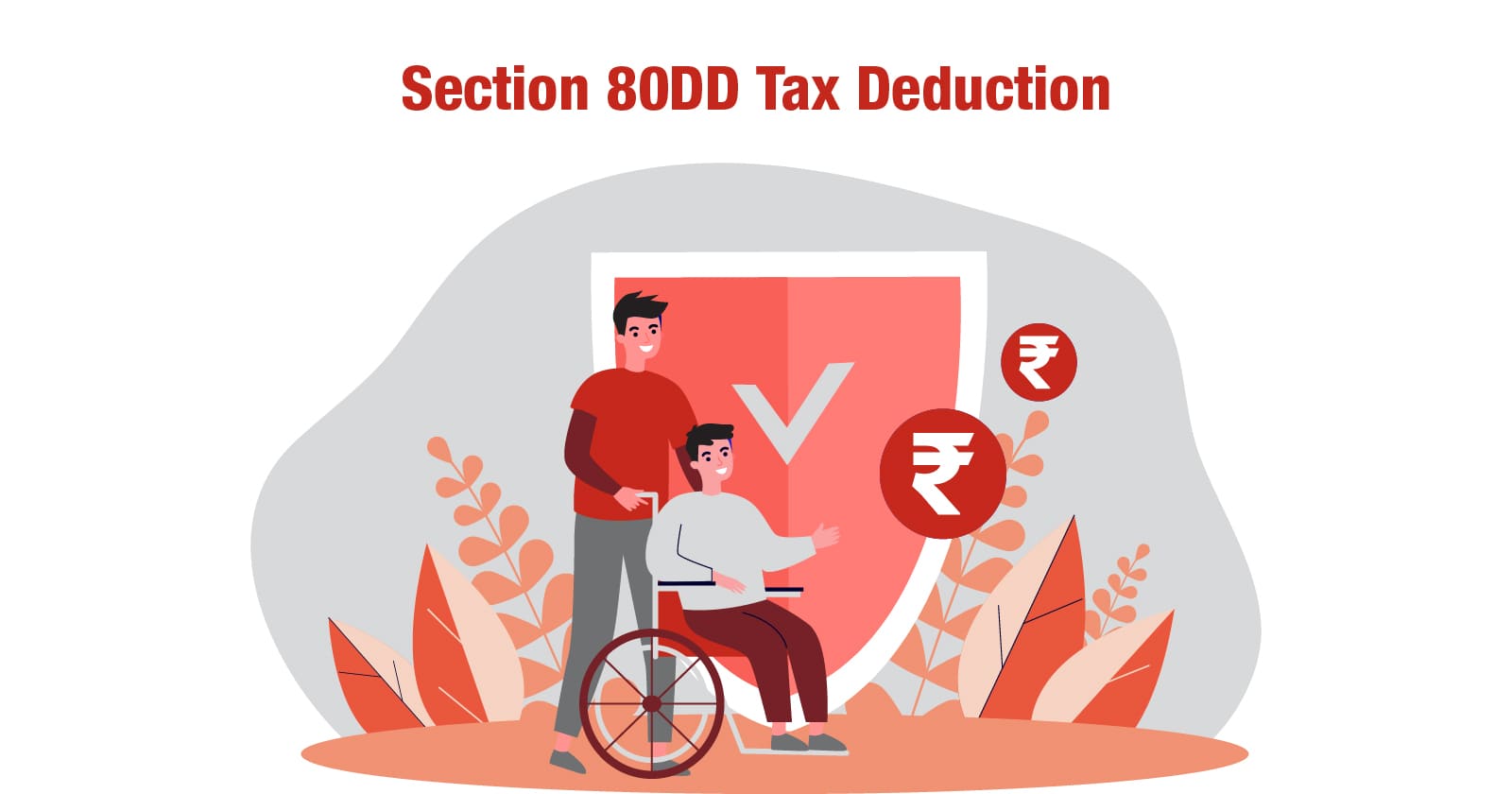

Section 80DD allows for tax deductions for anyone who pays for a disabled dependent Learn its meaning eligibility benefits limitations etc Section 80DD Deduction of the A complete guide on Section 80DD of income tax act Also find out the deduction under Section 80DD for FY 2024 25 AY 2025 26 from Goodreturns

Taxpayers can claim deductions on their income tax return through Section 80DDB for specified diseases treatment The deduction is subject to specific conditions All Indian residents and HUF who have dependent disabled can claim tax deductions under Section 80DD of the Income Tax Act 1961 In other words the amount paid

Section 80DD Tax Deduction For Differently Abled Dependants

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80dd.jpg

Section 80DD Section 80DDB Section 80U Tax Deduction For Disabled

https://imgv2-1-f.scribdassets.com/img/document/230646351/original/6a7f4cdcbf/1587243553?v=1

https://tax2win.in › guide

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical

https://taxguru.in › income-tax

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium

Deduction Under Section 80DD 80DDB And 80U

Section 80DD Tax Deduction For Differently Abled Dependants

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 80DD Deductions Under Section 80DD Of Income Tax Act

Claim Deduction Under Section 80DD Learn By Quicko

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Deduction Under Chapter 6A Of Income Tax Act Section 80D 80DD

Income Tax Deduction Income Tax Standard Deduction 2019 2020

Income Tax Deduction Under Section 80C Empowering The Society

Income Tax Deduction Under Section 80dd - To claim a deduction under section 80DD of the Income Tax Act eligible taxpayers must submit a medical certificate issued by the prescribed medical