Income Tax Deductions For Salaried Employees Fy 2022 23 Here is the income tax deductions list FY 2022 23 Deductions under section 80C 80D Useful for salaried employees tax planning Check chart

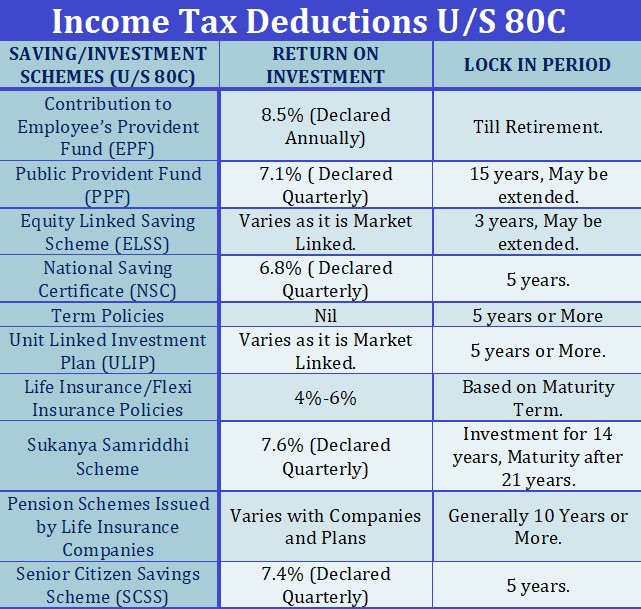

The Income Tax deduction list include Equity Linked Saving Scheme ELSS National Pension Scheme NPS Unit Linked Insurance Plan ULIP Public Provident Fund PPF Sukanya Samriddhi Yojana SSY National Savings Certificate NSC Fixed Deposit FD Employee Provident Fund EPF Here are some tax saving options for salaried individuals for FY 2022 23 in both the tax regimes Last date to complete tax savings for current FY 2022 23 is March 31 2023 A salaried individual is required to choose between the old and new tax regime in every financial year

Income Tax Deductions For Salaried Employees Fy 2022 23

Income Tax Deductions For Salaried Employees Fy 2022 23

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

https://taxconcept.net/wp-content/uploads/2022/07/folders-with-the-label-employees-and-salaries_3e0575f6-3d79-11e8-80b2-0257d29a997a_1656410417035.jpg

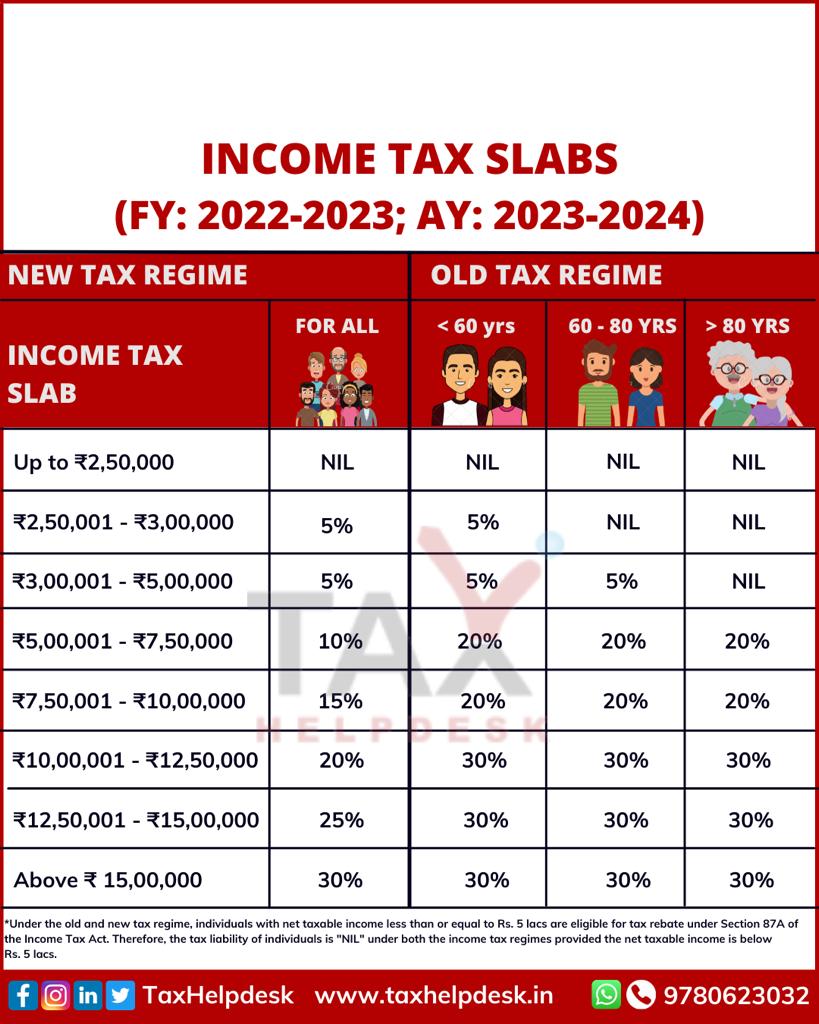

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

New income tax regime vs old tax regime FY 2022 23 Deductions salaried individuals can claim How to maximise income tax savings in FY 2022 23 The Economic Times Business News Wealth Tax New income tax regime vs old tax regime FY 2022 23 Deductions salaried individuals can claim ET Online Feb 18 2023 Income of employee Deductions Exemptions and Tax Deducted at Source for the purpose of Computing Tax Payable Refundable

Salaried taxpayers are eligible for the standard deduction of Rs 50 000 under the old and new tax regime from FY 2023 24 There has been no update in Budget 2024 Standard Deduction in New Tax regime Budget 2020 introduced the Under this new regime the taxpayers have the option to pay concessional tax rates Updated on 20 May 2024 04 53 PM Calculating income tax in India can be complex and intimidating especially for salaried individuals However it s a crucial aspect of managing personal finances The process involves determining taxable salary applicable tax rates and accounting for exemptions and deductions

Download Income Tax Deductions For Salaried Employees Fy 2022 23

More picture related to Income Tax Deductions For Salaried Employees Fy 2022 23

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg

Income Tax Deductions Financial Year 2022 2023 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

Income Tax Slabs For FY 2022 23 FY 2021 22

https://www.taxhelpdesk.in/wp-content/uploads/2022/03/Know-about-the-income-tax-slabs-2022-23-in-india.png

Income Tax Exemptions for Salaried Employees Instant Tax Receipt Top Tax Saving Plans 2024 You Invest 150 000 year Invest For 10 Years Age 30 Year Tax Saving 45 5 L For FY 2022 23 AY 2023 24 the filing date of it would be till 31st Dec 2023 If you missed the 31st Dec 2023 deadline file the Updated return ITR U within the additional time limit only if the specified conditions are met

Income Tax Return filing for salaried employees AY 2022 23 Section 80C deductions on which benefits apply The Income Tax Return ITR deadline for AY 2022 23 or FY 2021 22 is July Learn about income tax benefits for salaried individuals in A Y 2024 25 Explore allowances perquisites and deductions available to employees

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

https://blog.saginfotech.com/wp-content/uploads/2022/02/income-tax-calculation-salaried-employee.jpg

Section 192 TDS On Salary Income Tax Act 1961 EduTaxTuber

https://i0.wp.com/edutaxtuber.in/wp-content/uploads/2023/01/TDS-on-Salary.webp?fit=1200%2C675&ssl=1

https://www. goodmoneying.com /income-tax-deductions

Here is the income tax deductions list FY 2022 23 Deductions under section 80C 80D Useful for salaried employees tax planning Check chart

https:// tax2win.in /guide/deductions

The Income Tax deduction list include Equity Linked Saving Scheme ELSS National Pension Scheme NPS Unit Linked Insurance Plan ULIP Public Provident Fund PPF Sukanya Samriddhi Yojana SSY National Savings Certificate NSC Fixed Deposit FD Employee Provident Fund EPF

Income Tax Calculation Example 2 For Salary Employees 2023 24

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

Income Tax Slabs For FY 2022 23 FY 2021 22

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Income Tax Computation Format In Excel Fy 2023 24 Free Download Free

Calculate My Income Tax SuellenGiorgio

Calculate My Income Tax SuellenGiorgio

Income Tax Slabs FY 2023 24 And AY 2024 25 New Old Regime Tax Rates

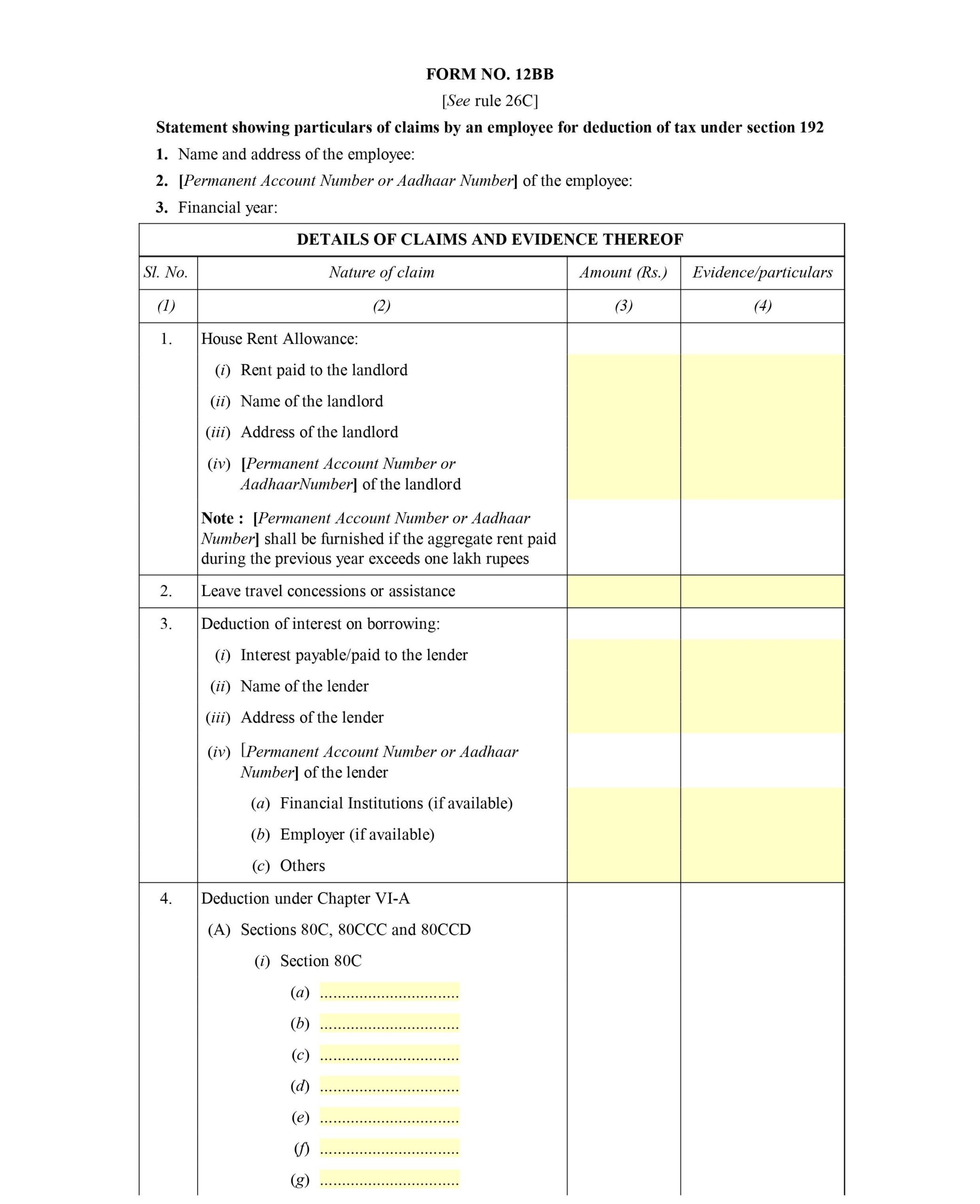

PDF Investment Declaration Form PDF Download

Deductions Allowed Under The New Income Tax Regime Paisabazaar

Income Tax Deductions For Salaried Employees Fy 2022 23 - New income tax regime vs old tax regime FY 2022 23 Deductions salaried individuals can claim How to maximise income tax savings in FY 2022 23 The Economic Times Business News Wealth Tax New income tax regime vs old tax regime FY 2022 23 Deductions salaried individuals can claim ET Online Feb 18 2023