Income Tax Deductions For Salaried Employees Slab Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the

Income Tax Slab for Salaried Person Below 60 Years of Age and HUF FY 2023 24 AY 2024 25 Plan your taxes for the current financial year 2023 24 and check out the Updated on 26 Apr 2024 06 22 PM Calculating income tax in India can be complex and intimidating especially for salaried individuals However it s a crucial aspect of

Income Tax Deductions For Salaried Employees Slab

Income Tax Deductions For Salaried Employees Slab

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

.jpg)

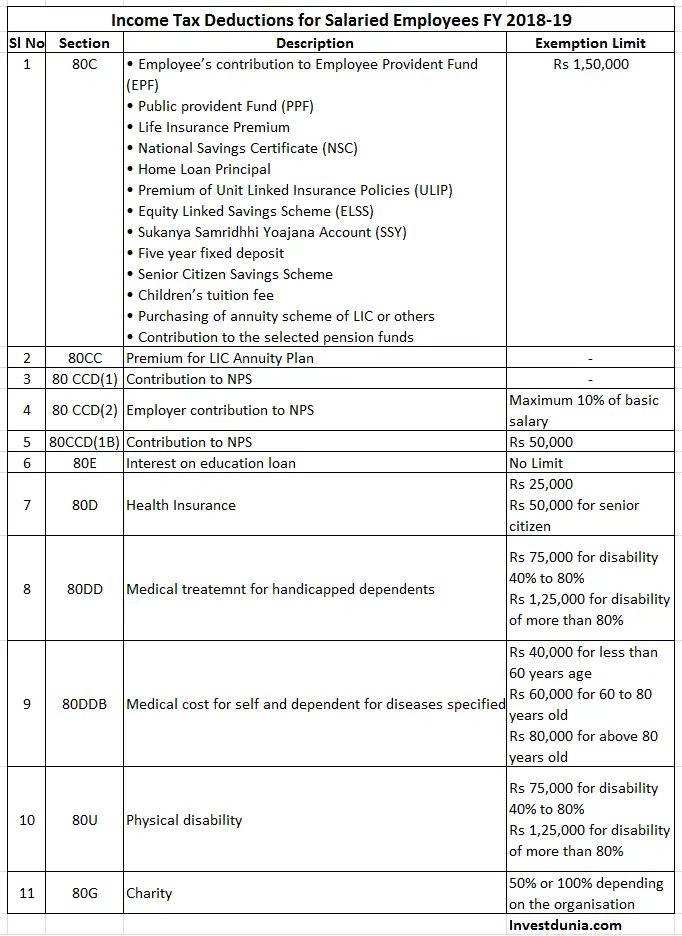

Important Deduction For Income Tax For Salaried Persons Employees On

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/6935e541-d1ae-4702-be59-bae61802b2e3/income-tax-slab-rate-(senior-citizen).jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

The income tax slab for AY 2024 25 for salaried persons will be as per the announcements in budget 2023 It s always advisable As a salaried individual understanding the applicable income tax rates and slabs is crucial for accurate tax planning and management Under the new tax regime

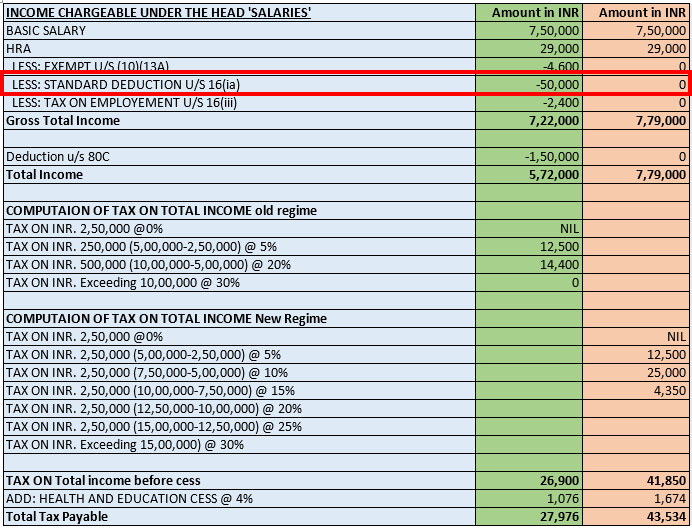

Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for Professional Tax Standard New Tax Regime Slabs and Rates for Salaried Persons Employees ITR Filing in AY 2023 24 FY2022 23 0 to Rs 2 5 lakh NIL Rs 2 5 to Rs 5 lakh 5 above

Download Income Tax Deductions For Salaried Employees Slab

More picture related to Income Tax Deductions For Salaried Employees Slab

Income Tax Deductions For Salaried Employee

https://static.wixstatic.com/media/a27d24_344e7e72fd704484ae6533eda91ee932~mv2.jpg/v1/fit/w_1000%2Ch_637%2Cal_c%2Cq_80/file.jpg

Tax Planning Tips For Salaried Employees ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Planning-Tips-for-Salaried-Employees-1.gif

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Income Tax Slabs Salary Tax Calculator for year 2023 2024 Calculate monthly income and total payable tax amount on your salary Learn more about tax slabs Income Tax Deductions for Salaried Employees Updated on 18 Apr 2024 03 27 PM Salaried employees earn most of their income through their salary and

In the interim fiscal year 2024 25 budget Finance Minister Nirmala Sitharaman announced no changes to the income tax slabs meaning taxpayers will Salaried employees and pensioners can claim a standard deduction of Rs 50 000 under the new income tax regime Getty Images 4 6 Income tax for income of

Income Tax Planning For Salaried Employees FY 2018 19 Investdunia

http://investdunia.com/wp-content/uploads/2018/04/Income-Tax-Planning-for-salaried-employees-FY-2018-19.png

New Revised Income Tax Slabs For Salaried Persons

https://www.glxspace.com/wp-content/uploads/2018/05/Revised-Income-Tax-Slabs-for-Salaried-Persons--542x600.jpg

https://www.incometax.gov.in/iec/foportal/help/...

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the

.jpg?w=186)

https://www.godigit.com/income-tax/income-tax-slab...

Income Tax Slab for Salaried Person Below 60 Years of Age and HUF FY 2023 24 AY 2024 25 Plan your taxes for the current financial year 2023 24 and check out the

Standard Deduction For Salaried Employees Impact Of Standard

Income Tax Planning For Salaried Employees FY 2018 19 Investdunia

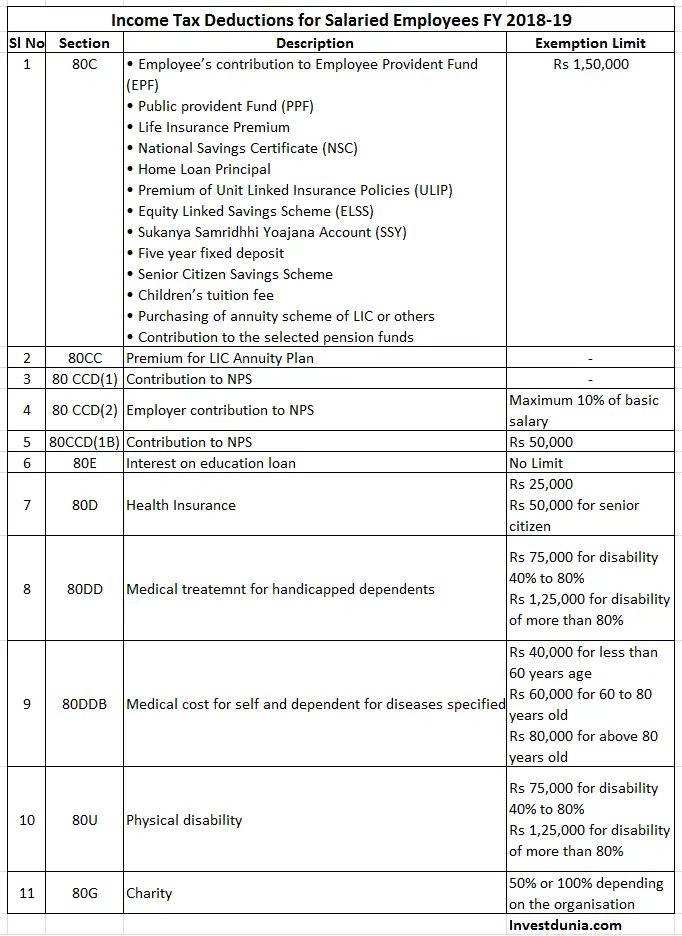

New Income Tax Slabs Introduced For Salaried Class In Budget 2022 23

BUDGET 2020 EXPLAINED FOR SALARIED EMPLOYEES

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

Income Tax Calculator For Salaried Employees Ay 2018 19 In Excel Fasrthai

Income Tax Calculator For Salaried Employees Ay 2018 19 In Excel Fasrthai

Standard Deduction Salaried Individual Professional Utilities

Standard Deduction For Salaried Employees Impact Of Standard

Income Tax Deduction For Salaried Employees

Income Tax Deductions For Salaried Employees Slab - The document provides valuable insights into the income tax benefits available to salaried individuals for the assessment year AY 2024 25 and document