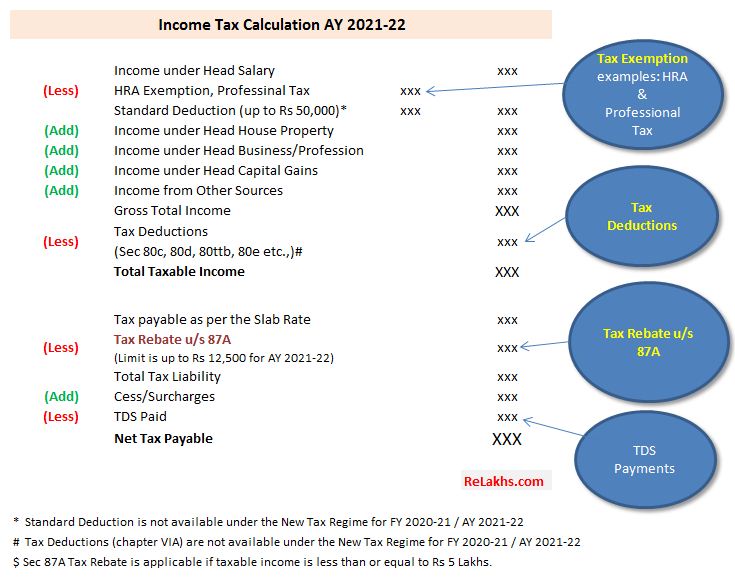

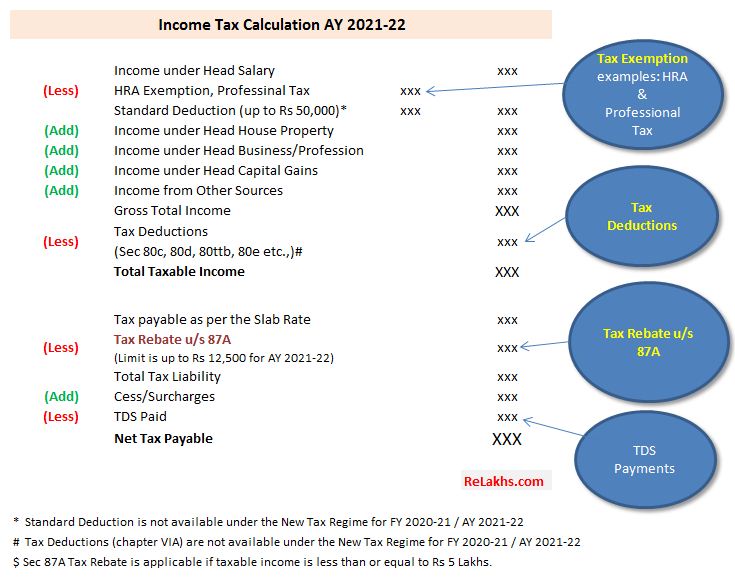

Income Tax Education Rebate Web If anyone receives a refund after 2022 of qualified education expenses paid on behalf of a student in 2022 and the refund is paid before you file an income tax return for 2022 the amount of qualified education

Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a Web 4 avr 2017 nbsp 0183 32 Updated on Dec 28th 2022 3 27 43 AM 5 min read CONTENTS Show An education loan helps you not only finance your

Income Tax Education Rebate

Income Tax Education Rebate

https://i2.wp.com/www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

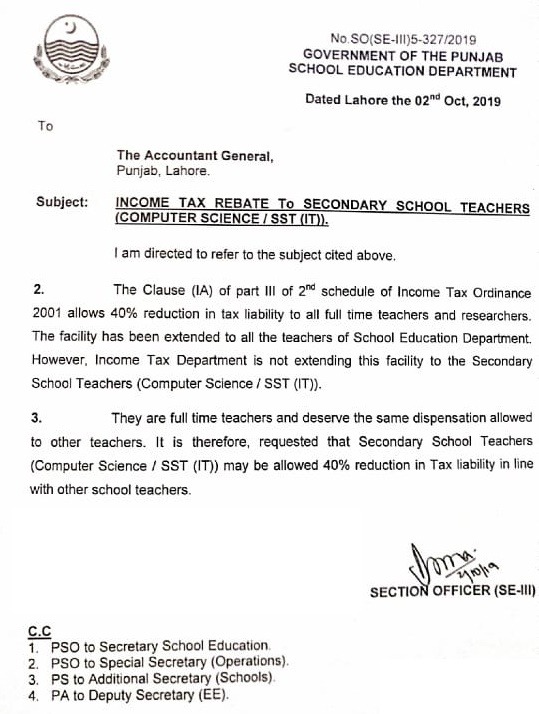

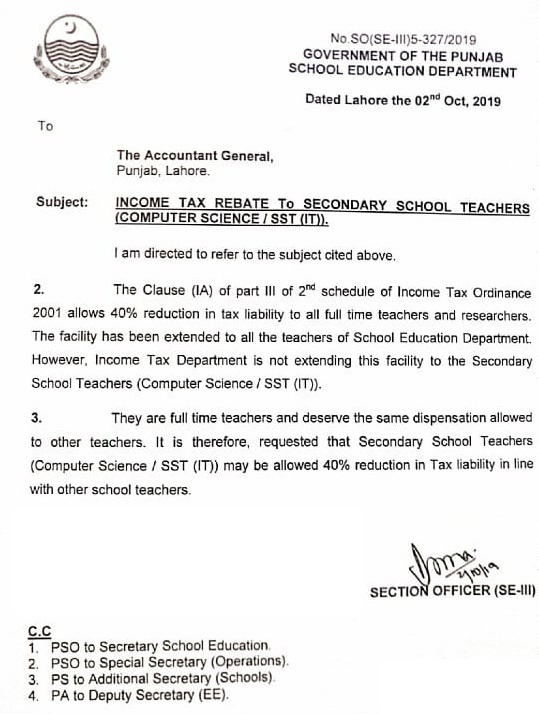

Income Tax Rebate 40 To All Teachers Of School Education Department

https://employeesportal.info/wp-content/uploads/2019/10/Income-Tax-Rebate-40-to-All-Teachers-of-School-Education-Department.jpg

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has Web 14 avr 2017 nbsp 0183 32 The tax benefits offered on children s education are as follows Childrens Education Allowance Hostel Expenditure Allowance Tax deduction on tuition fees

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as

Download Income Tax Education Rebate

More picture related to Income Tax Education Rebate

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Tax Rebate Digital Tax Filing Taxes Tax Services

https://i.pinimg.com/originals/d1/08/d6/d108d680f501d43a50b64f8f43eae623.png

Web 31 mai 2023 nbsp 0183 32 Take Advantage of Two Education Tax Credits The Lowdown on Education Tax Breaks Guide to IRS Form 1099 Q Payments from Qualified Education Programs Deduction for Higher Education Web 3 juil 2023 nbsp 0183 32 Qualified Education Expenses for Education Credits Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are

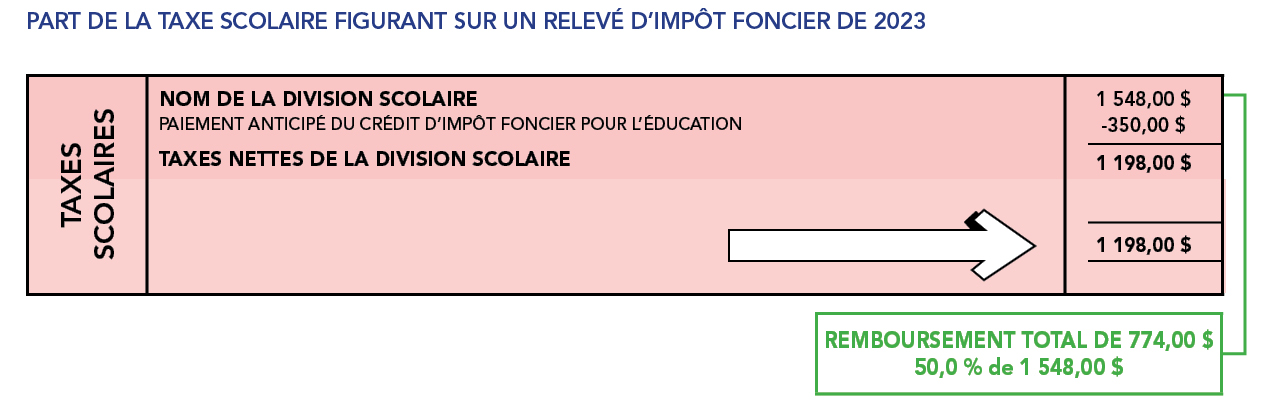

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the Web INFORMATION BULLETIN 123 TAXATION CHANGES BUDGET 2023 Issued March 2023 The following taxation changes were announced by Manitoba Finance Minister the

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

https://i.ytimg.com/vi/M_QfCuqh8wI/maxresdefault.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://www.irs.gov/publications/p970

Web If anyone receives a refund after 2022 of qualified education expenses paid on behalf of a student in 2022 and the refund is paid before you file an income tax return for 2022 the amount of qualified education

https://www.etmoney.com/blog/education-loa…

Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

Province Du Manitoba Imp t Foncier Pour L ducation

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

Rebate Under Section 87A AY 2021 22 CapitalGreen

Rebate Under Section 87A AY 2021 22 CapitalGreen

2007 Tax Rebate Tax Deduction Rebates

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Section 87A Tax Rebate Under Section 87A

Income Tax Education Rebate - Web 6 avr 2023 nbsp 0183 32 Tax band Taxable income Tax rate Personal allowance Up to 163 12 570 0 Starter rate 163 12 571 to 163 14 732 19 Basic rate 163 14 733 to 163 25 688 20