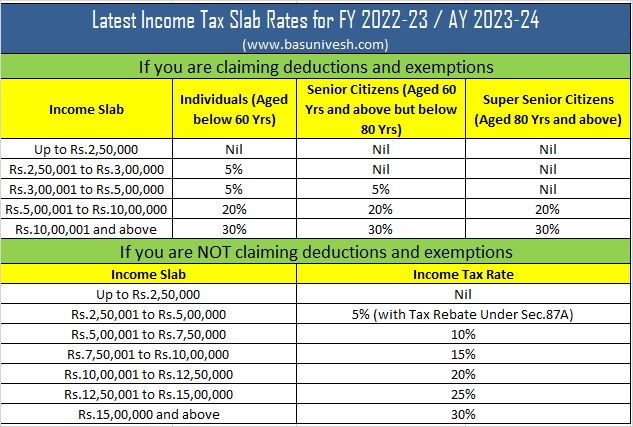

Income Tax Exemption 2023 Income Tax Budget 2023 Highlights Finance Minister Nirmala Sitharaman tweaked the income tax slabs under the new tax regime What s new in the new income tax regime 1 Basic exemption limit is hiked from Rs 2 5 lakh to Rs 3 lakh 2 Rebate under section 87A has been hiked from Rs 5 lakh to Rs 7 lakh

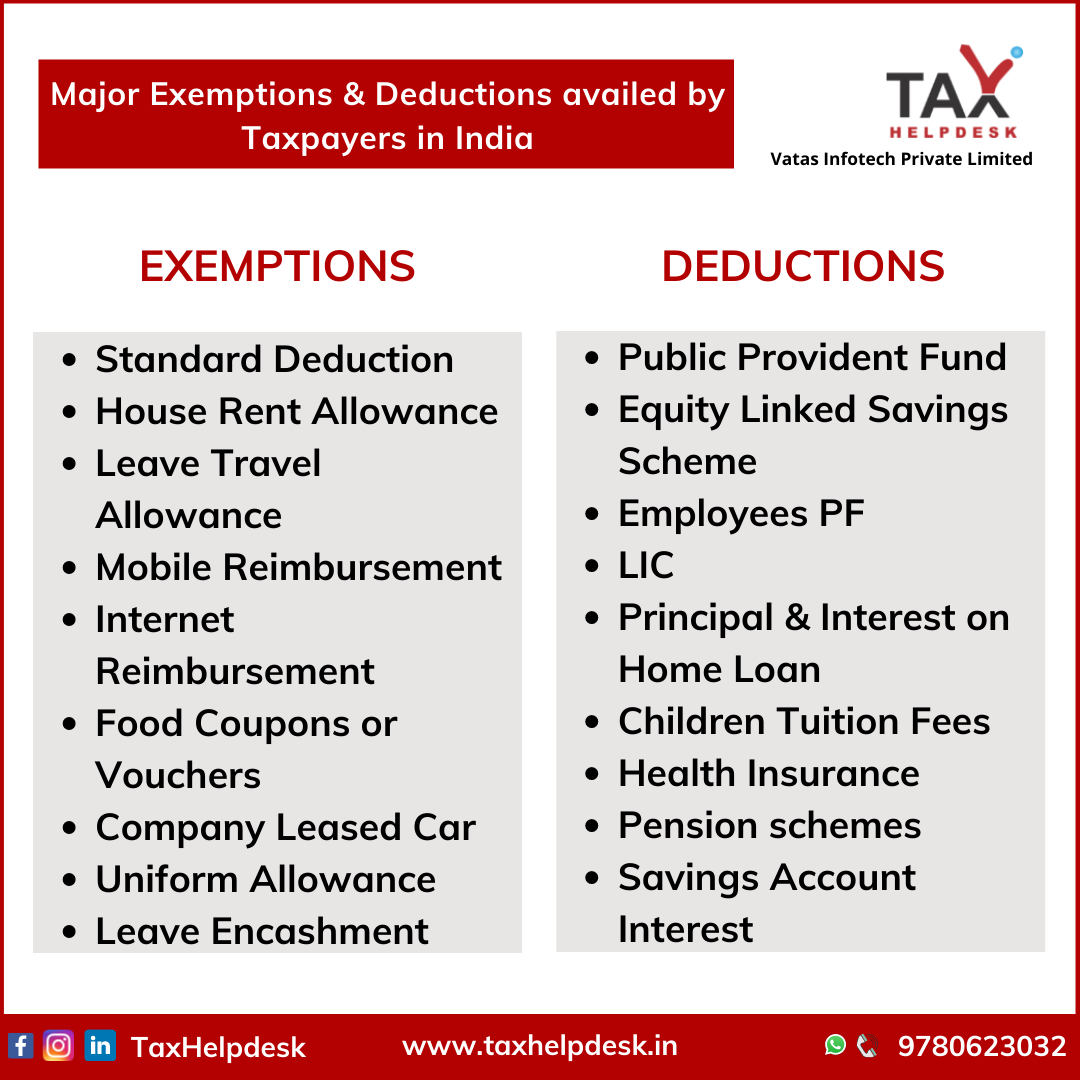

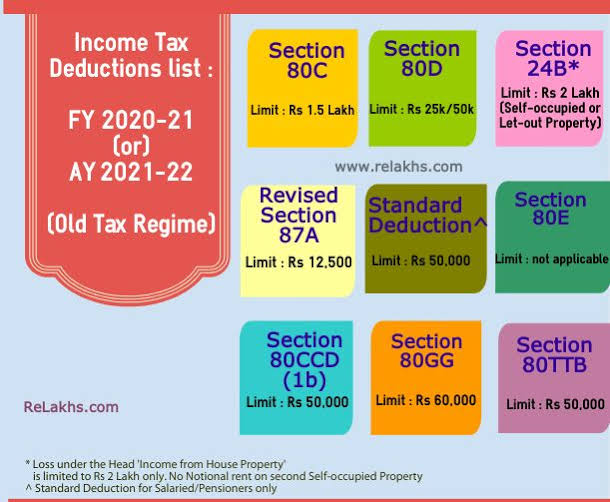

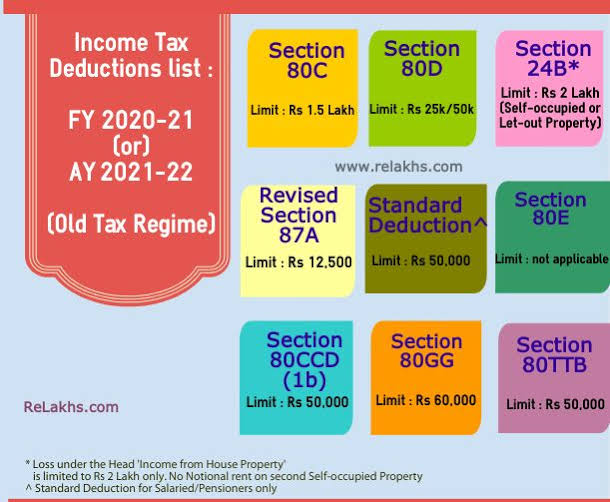

The basic exemption limit has been hiked to Rs 3 lakh under the new tax regime in Budget 2023 According to the current income tax slabs under both the tax regimes old and new the basic exemption limit is Rs 2 5 lakh Further under the old tax regime the basic exemption limit is based on the age of the individuals For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24

Income Tax Exemption 2023

Income Tax Exemption 2023

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

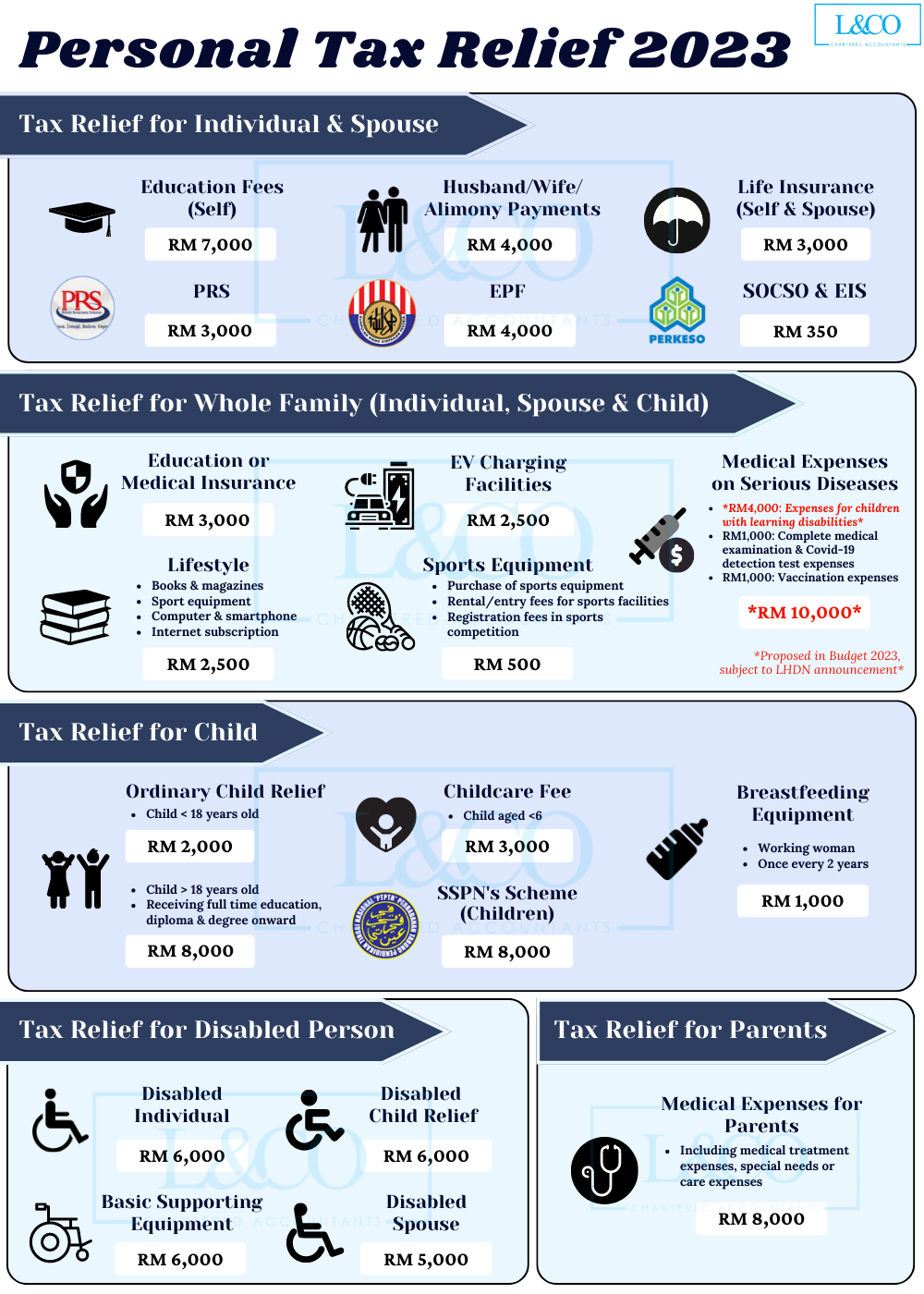

Personal Tax Relief Y A 2023 L Co Accountants

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023.png

Hier Zijn De Federale Belastingschijven Voor 2023 Versus 2022

https://s.yimg.com/ny/api/res/1.2/9OoVAtst.kBuEKSi3_7vLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-01/256761a0-9a65-11ed-b57b-4f397ac4ee71

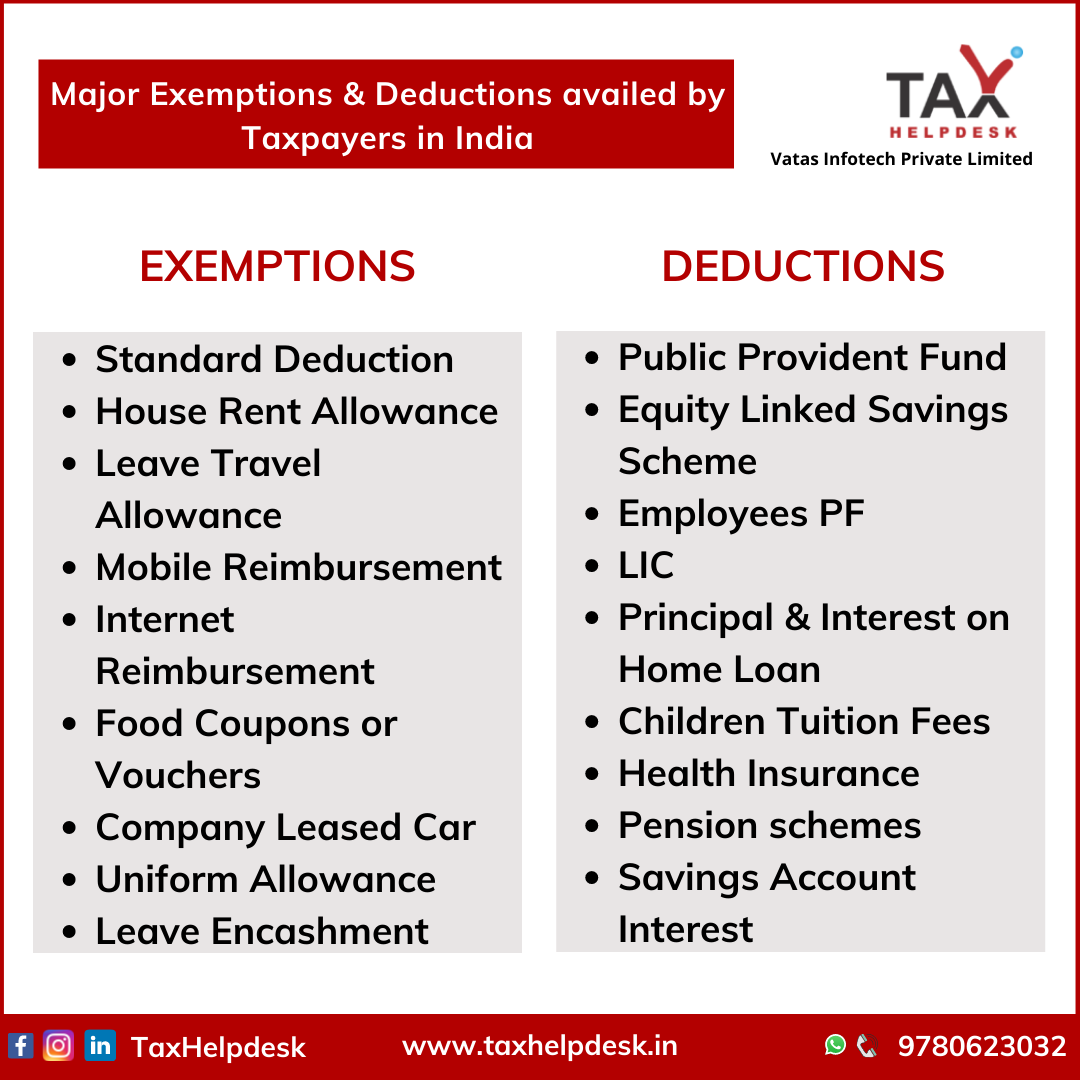

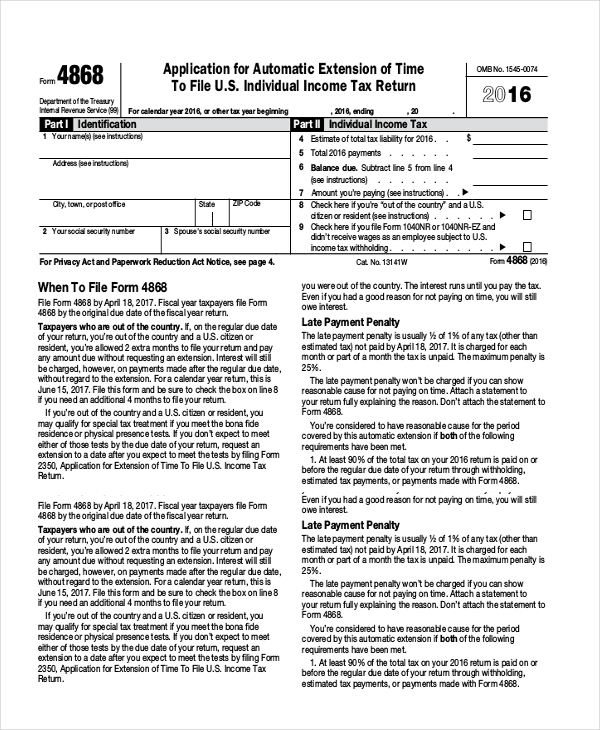

Synopsis Here s a list of the main exemptions and deductions that taxpayers will have to forgo if they opt for the new regime The new income tax regime became effective from April 1 2020 Salaried taxpayers were allowed to select between the new and old tax regime in every financial year The IRS Announces New Tax Numbers for 2023 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023

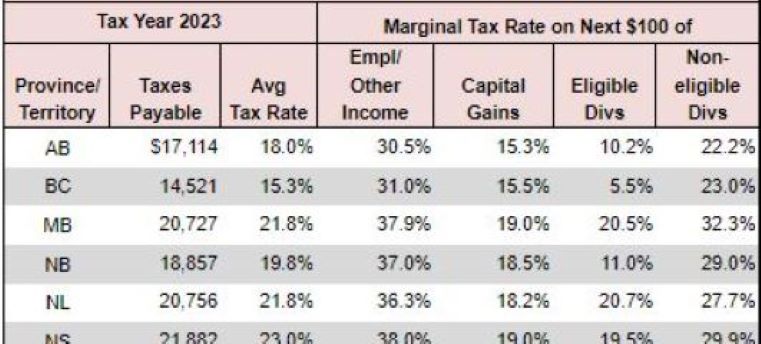

Tax Schedule Effective January 1 2023 and onwards Individuals with an annual taxable income below PHP250 000 are still exempted from paying personal income taxes under the adjusted tax rates 1 What is the basic personal amount 2 What is the proposed change announced on December 9 2019 to the federal basic personal amount 3 Will the new basic personal amount be indexed 4 Will this change affect the Spouse or common law partner amount or the Amount for an eligible dependant 5

Download Income Tax Exemption 2023

More picture related to Income Tax Exemption 2023

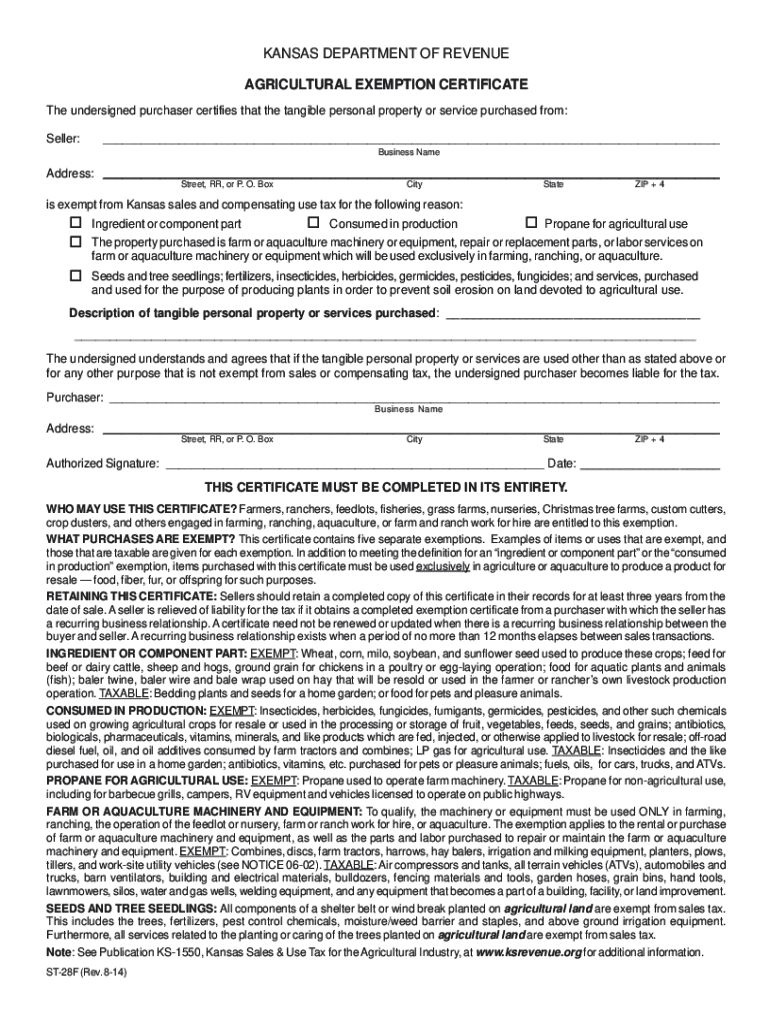

Tax Exempt Form 2020 2021 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/11/44/11044386/large.png

Kansas Exemption Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/568/214/568214227/large.png

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

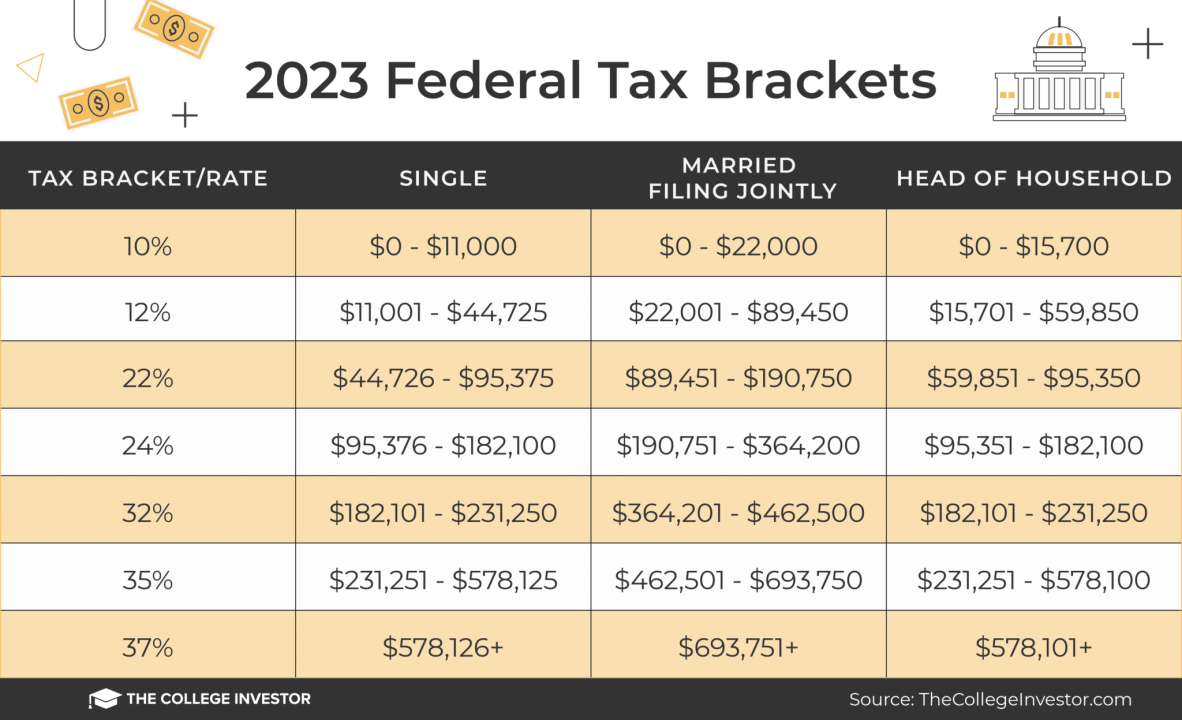

Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up to RM96 000 annually This relief is applicable for Year Assessment 2013 and 2015 only See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher

[desc-10] [desc-11]

Understanding 2023 Tax Brackets What You Need To Know

https://media.licdn.com/dms/image/D5612AQFY6Ri4_mWmhw/article-cover_image-shrink_720_1280/0/1675714697138?e=2147483647&v=beta&t=yGdMCOvsWtgfJmm3g2ioLdQJ1Nh59H8rcLgpUV5D_kU

Federal Estate And Gift Tax Exemption Set To Rise Substantially For

https://mpmlaw.com/wp-content/uploads/2022/09/estate-tax.png

https://economictimes.indiatimes.com/wealth/tax/...

Income Tax Budget 2023 Highlights Finance Minister Nirmala Sitharaman tweaked the income tax slabs under the new tax regime What s new in the new income tax regime 1 Basic exemption limit is hiked from Rs 2 5 lakh to Rs 3 lakh 2 Rebate under section 87A has been hiked from Rs 5 lakh to Rs 7 lakh

https://economictimes.indiatimes.com/wealth/tax/...

The basic exemption limit has been hiked to Rs 3 lakh under the new tax regime in Budget 2023 According to the current income tax slabs under both the tax regimes old and new the basic exemption limit is Rs 2 5 lakh Further under the old tax regime the basic exemption limit is based on the age of the individuals

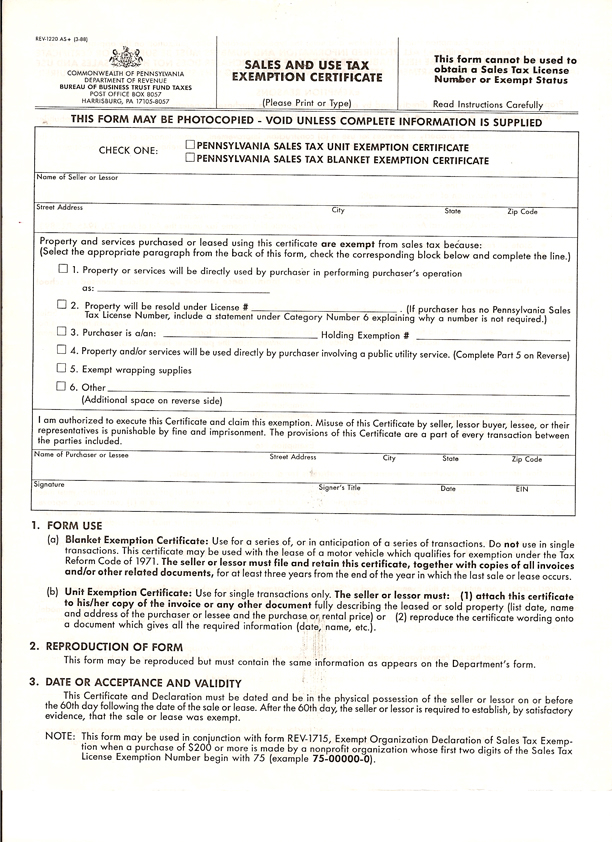

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

Understanding 2023 Tax Brackets What You Need To Know

State Lodging Tax Exempt Forms ExemptForm

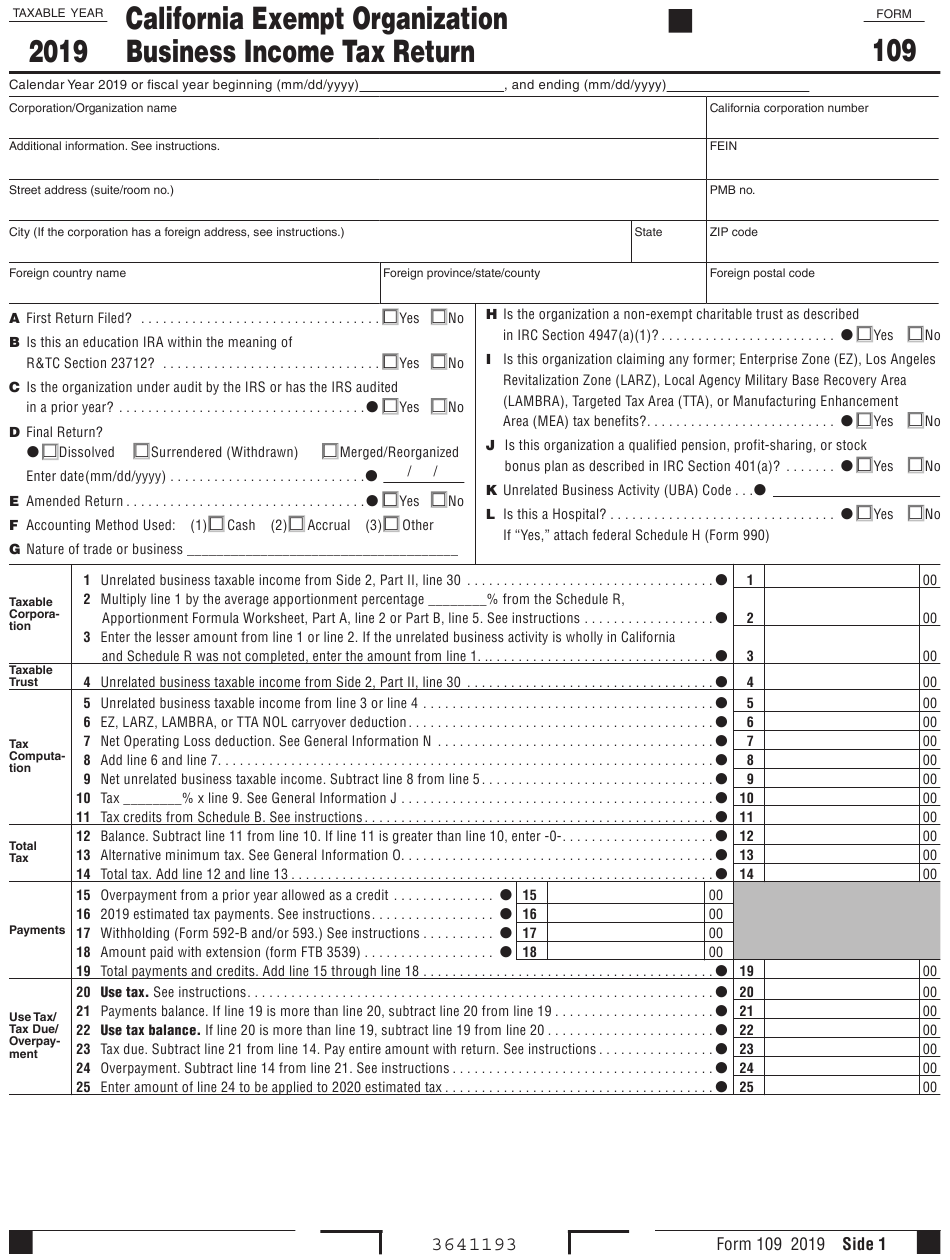

Exemption California State Income Tax Form 2023 ExemptForm

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Sample Letter Exemption Doc Template PdfFiller

2023 Federal Tax Exemption Form ExemptForm

Highlights Of Tax Reform Law TRAIN See The Tax Rates For 2019

Income Tax Exemption 2023 - [desc-13]