Income Tax Exemption For 2nd Home Loan 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available Even under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan One can treat only two

Income Tax Exemption For 2nd Home Loan

Income Tax Exemption For 2nd Home Loan

https://i.ytimg.com/vi/poiiLhFa5Fw/maxresdefault.jpg

Ey Tax Alert Vol 25 No 1 10 January 2022 Malaysian Developments

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a8dd888ff96111b8eb4b35adb52f2e27/thumb_1200_1553.png

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing The answer to that is a resounding yes Read on to know more While purchasing a home has always been considered a good investment option the tax benefits on home loans were earlier restricted to only one loan

While you might not be able to take Section 80C deductions on the loan s principal amount in the instance of your second home you might get an income tax rebate on a second home loan If you need help Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks However if you have previously paid off your house loan in full you will not

Download Income Tax Exemption For 2nd Home Loan

More picture related to Income Tax Exemption For 2nd Home Loan

Tax Exemption Swechha NGO

https://teluguthalli.org/wp-content/uploads/2021/04/near-1536x1110.jpg

Nysc Exemption Letter How To Apply And Collect Nysc Exemption Letter

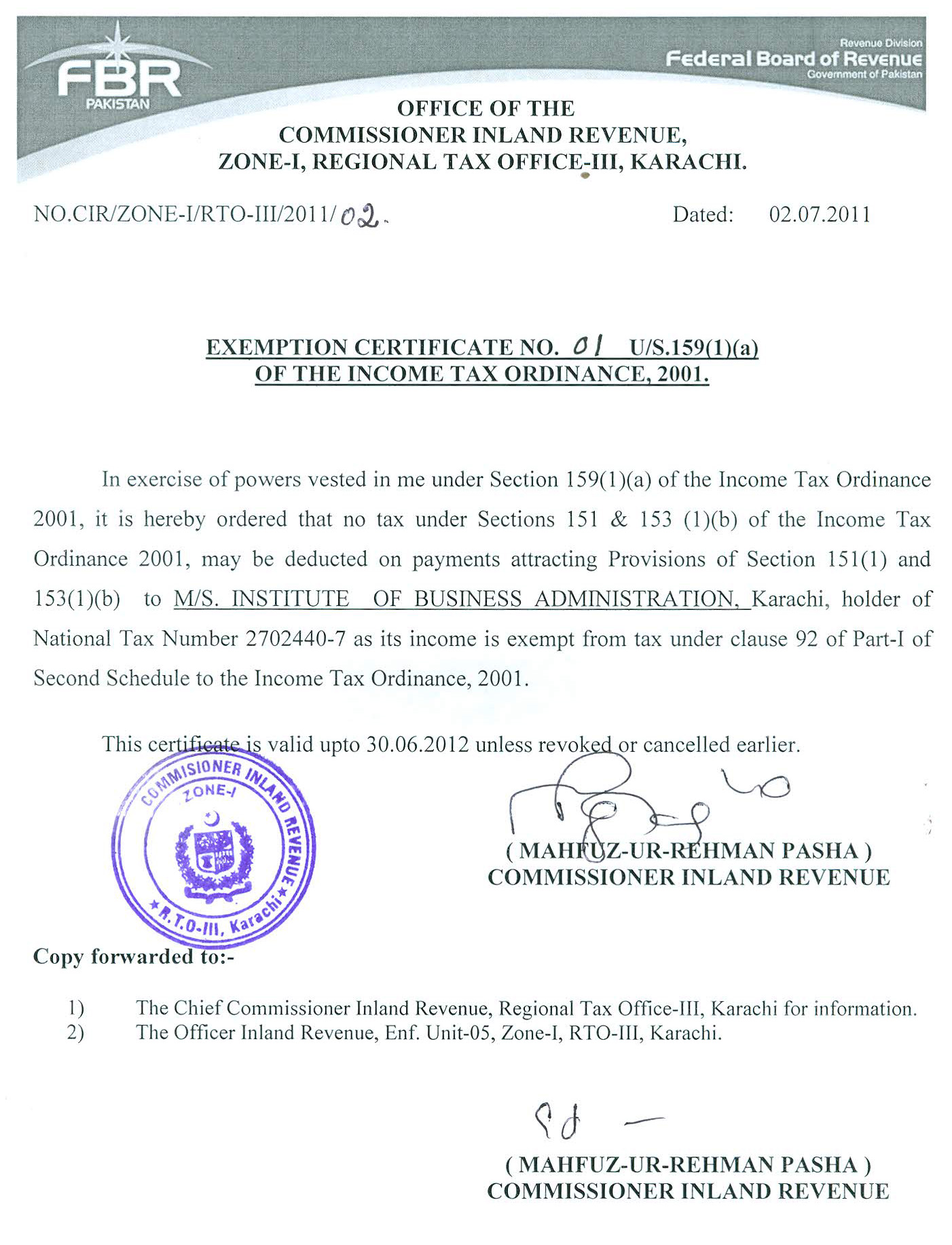

https://www.iba.edu.pk/News/tax/images/Income_Tax_Exemption_Certificate.jpg

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

Here are the key tax benefits for a second home loan in India 1 Interest deduction For self occupied property If you have taken a loan to purchase a second The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether

Multiple homes possession principal property section 24 b section 80c tax benefit video As the law allows a person to own multiple homes and avail of Situations covered assuming no added tax complexity W 2 income Interest or dividends 1099 INT 1099 DIV that don t require filing a Schedule B IRS

Land Tax Exemption For PPR Construction renovation

https://img1.wsimg.com/isteam/ip/3c3bf6dc-20de-47e0-ae92-9e904b35b9d8/land tax exemption.png

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

https://taxguru.in/income-tax/income-tax-benefits...

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000

https://www.hdfcbank.com/personal/resources/...

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available

Five Income Tax Changes In Budget 2021 You Should Know Business League

Land Tax Exemption For PPR Construction renovation

Michigan Use Tax Exemptions Jacklyn Stjohn

Income Tax Calculation Example 2 For Salary Employees 2023 24

INCOME TAX EXEMPTIONS India Posts Retired Officers Association

What Are The Tax Benefits On Personal Loans Web ITB Group News

What Are The Tax Benefits On Personal Loans Web ITB Group News

Tax Exemption On Behance

Estate Tax Exemption Amount Goes Up In 2023

State Lodging Tax Exempt Forms ExemptForm

Income Tax Exemption For 2nd Home Loan - If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing