Income Tax Exemption For Home Loan In 2022 you can deduct 5 of the interest Starting 2023 tax rules no longer allow deductions for paid interest expenses of home loans If you live in a

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self

Income Tax Exemption For Home Loan

Income Tax Exemption For Home Loan

https://www.businessleague.in/wp-content/uploads/2018/07/income-tax_625x300_1530883274558.jpg

How Is Tax Exemption On Home Loan Calculated TESATEW

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Section 80EE First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there are a few conditions to be Under Section 80C of the Income Tax Act a maximum of Rs 1 5 lakh deduction is applicable on your principal repayment amount This deduction amount

New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can

Download Income Tax Exemption For Home Loan

More picture related to Income Tax Exemption For Home Loan

How Is Tax Exemption On Home Loan Calculated TESATEW

https://i.pinimg.com/originals/04/62/34/046234867367b7ad436a0e41931ed5ea.png

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

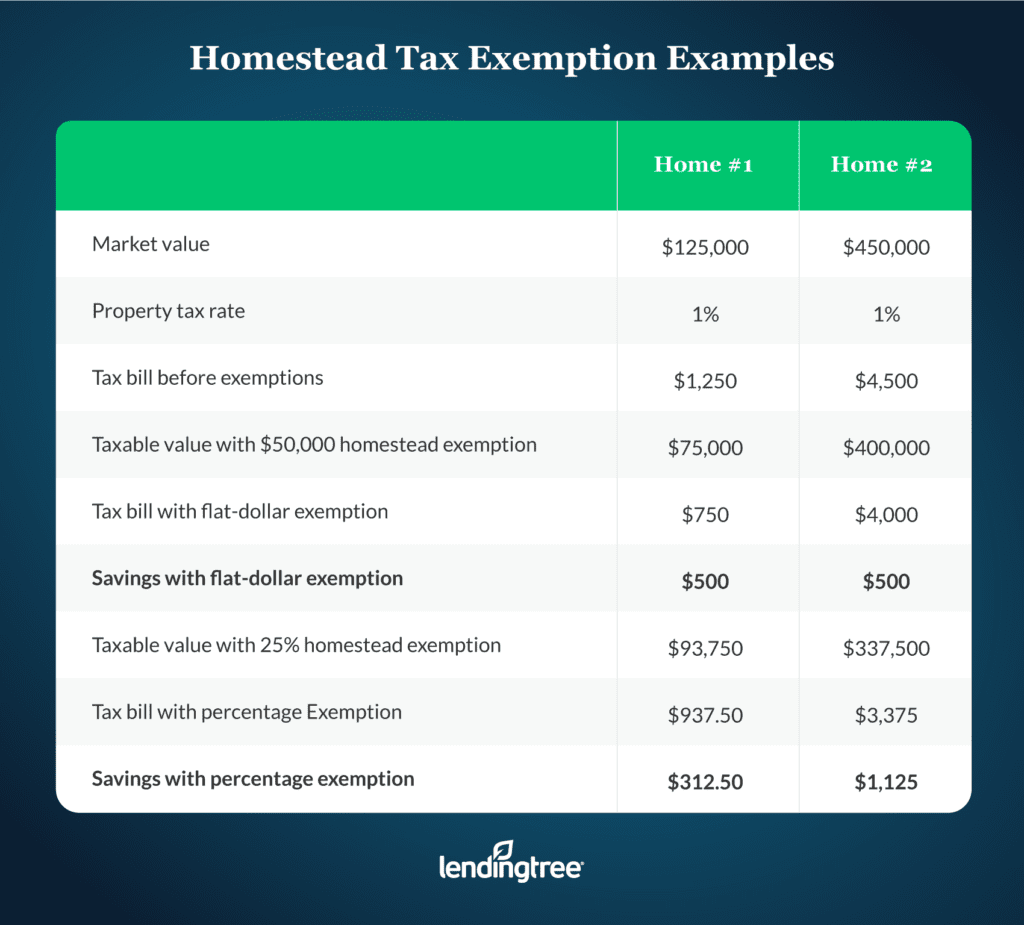

What Is A Homestead Exemption And How Does It Work LendingTree

https://www.lendingtree.com/content/uploads/2020/12/Homestead-Tax-Exemption-Examples-1024x925.png

How Section 24 Affects Your Tax Savings on Under Construction Property As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and above

If you have an ongoing home loan or have taken a home loan recently then there are certain tax benefits you can avail on the equated monthly instalments EMIs Up to Rs 1 50 000 Section 24B Tax Deduction on Interest Paid Up to Rs 2 00 000 Section 26 read with Section 24 Tax Deduction on Home Loan for Joint Owners Up to

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

https://www.relakhs.com/wp-content/uploads/2018/05/Long-Term-Capital-Gains-tax-exemptions-sec-54-54f-on-sale-of-land-or-residential-property-LTCG-2-years.jpg

Housing Loan Interest Tax Exemption Under Section MUNIR2

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

https://www.vero.fi/en/individuals/tax-cards-and...

In 2022 you can deduct 5 of the interest Starting 2023 tax rules no longer allow deductions for paid interest expenses of home loans If you live in a

https://m.economictimes.com/wealth/tax/tax...

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All

How To Choose Between The New And Old Income Tax Regimes Chandan

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Income Tax Exemption Form 5 Here s What No One Tells You About Income

Tax Exemption For Rental Income 2018 Donovan Ho

Deductions Allowed Under The New Income Tax Regime Paisabazaar

Deductions Allowed Under The New Income Tax Regime Paisabazaar

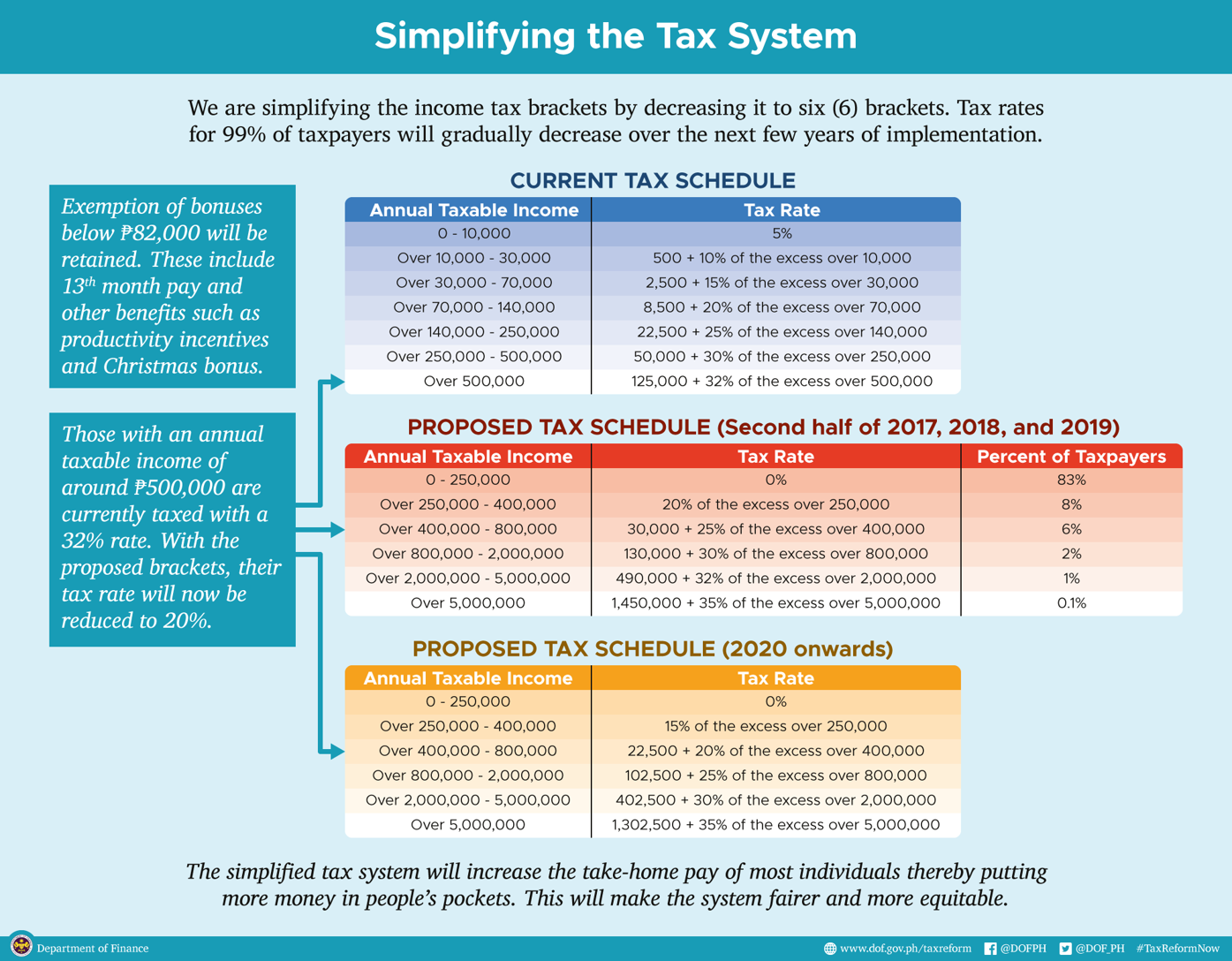

4 Examples On The Impact Of Tax Reform On The Taxpayer s Personal

Filing Exempt On Taxes For 6 Months How To Do This

Federal Income Tax Withholding Exemption 2022 Federal Income Tax TaxUni

Income Tax Exemption For Home Loan - Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or qualifying