Income Tax Exemption For Second Home Loan Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income towards the principal component of home loans and deductions up to

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether

Income Tax Exemption For Second Home Loan

Income Tax Exemption For Second Home Loan

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-800x2483.png

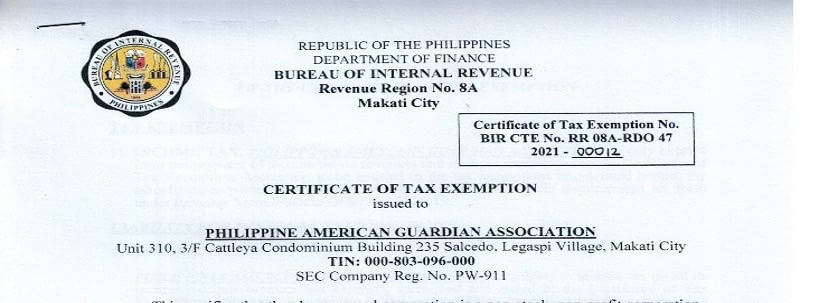

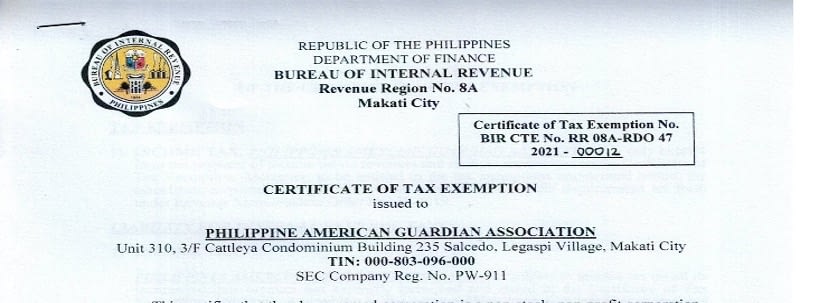

BIR Certificate Of Tax Exemption PAGA

https://mldxg0t9jgcn.i.optimole.com/w:813/h:303/q:auto/https://www.paga.ph/wp-content/uploads/2021/11/bir-tax-exemption.jpg

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under Income tax benefits on second home loan Explained Tax benefits on home loan interest and principal repayment are available for self occupied houses

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing The Indian Income Tax Act of 1961 offers specific benefits for second home loans primarily categorised under two sections Section 80C for the principal amount and Section 24 b for the interest paid

Download Income Tax Exemption For Second Home Loan

More picture related to Income Tax Exemption For Second Home Loan

Tax Exemption Form For Veterans ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/veterans-property-tax-exemption-application-form-printable-pdf-download-1.png

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

Here are the key tax benefits for a second home loan in India 1 Interest deduction For self occupied property If you have taken a loan to purchase a second Resident Investors The withholding tax rate on mutual fund income for resident individuals has been set at 10 However if the annual income from mutual

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be What is the maximum deduction for home loan interest Under section 24 of the Income Tax Act a deduction can be claim on home loan interest upto 2 lakh

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

https://mahanakornpartners.com/wp-content/uploads/2023/02/Spouse-Income-2048x996.png

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

https://cleartax.in/s/home-loan-tax-benefit

Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income towards the principal component of home loans and deductions up to

https://taxguru.in/income-tax/income-tax-benefits...

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be

Income Tax Exemption On Interest Of Education Loan YouTube

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

Income From Digital Assets And Share Trading Need To Disclose Cbdt

Writing Religious Exemption Letters

501 c 3 Tax Exempt Form Definition Finance Strategists

How To Claim Tax Exemption On Home Loan Without Paying Interest In

How To Claim Tax Exemption On Home Loan Without Paying Interest In

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

Want A Tax Exemption For Your Home All Things DFW

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Income Tax Exemption For Second Home Loan - All joint owners can individually avail of tax benefits on a joint home loan provided certain conditions are met Let s examine them It s pertinent to note that