Income Tax Exemption For Senior Citizens Act Senior citizens have an exemption limit of 3 00 000 while very senior citizens have a limit of 5 00 000 offering significant tax relief Senior citizens also benefit from exemptions on advance tax payments if they have

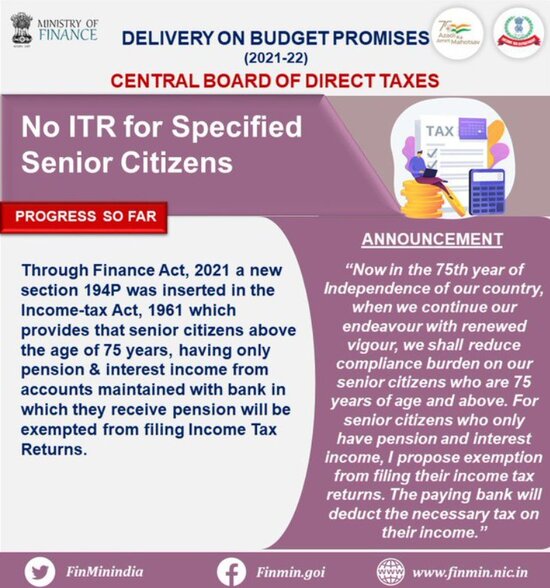

Senior citizens are given basic exemption limit of up to Rs 3 lakh while super senior citizens 80 and above get exemptions on up to Rs 5 lakh income Those who come under the new tax Section 194P of the Income tax Act 1961 was introduced in Budget 2021 to provide conditional relief to senior citizens above the age of 75 years from filing the income tax return Section 139 of the Income Tax Act governs the

Income Tax Exemption For Senior Citizens Act

Income Tax Exemption For Senior Citizens Act

https://assets.nationbuilder.com/americansenioralliance/pages/2258/meta_images/original/KYrP9lKc.jpeg?1649431236

ITR Exemption For Senior Citizens Above 75 Years With Only Pension Income

https://static.toiimg.com/photo/imgsize-2023956,msid-80627944/80627944.jpg

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Section 194P of the Income Tax Act 1961 provides conditions for exempting Sen ior Citizens from filing income tax returns aged 75 years and above Section 194P is Under the old tax regime Senior citizens 60 years and older but less than 80 years Income up to Rs 3 lakh is exempt from tax Super senior citizens 80 years and older Income up to Rs 5 lakh is exempt from tax

TDS Exemption through Form 15H Senior and Super Senior citizens in India can avail themselves of relief from Tax Deducted at Source TDS by submitting Form 15H to the financial institution from which they receive A vital income tax exemption for senior residents in 2024 is beneath Section 80TTB which mainly addresses interest profits Senior residents can declare a deduction of

Download Income Tax Exemption For Senior Citizens Act

More picture related to Income Tax Exemption For Senior Citizens Act

How To Get Tax Exemption On Senior Citizen Interest Income See

https://www.rightsofemployees.com/wp-content/uploads/2023/03/Senior-Citizen-tax-exemption.jpg

House Panel OKs Income Tax Exemption For Senior Citizens

https://storage.googleapis.com/mb-mkt-neo-prod-1-uploads/32243_58f4ac577b/32243_58f4ac577b.jpeg

Understanding Indian Income Tax Benefits For Senior Citizens

https://www.lawgicalindia.com/storage/posts/May2023/0lxJ7oklI7VGjX1iSCaz.webp

Here s a closer look at these senior citizen friendly tax reforms Income Tax Act 1961 Higher Exemption Limits For ordinary taxpayers the basic exemption limit stands at Rs 2 50 lakh for the assessment year 2021 22 Section 194P offers conditional exemption from filing Income Tax Returns ITR for senior citizens aged 75 or above with pension and interest income from specified banks Depending on their income sources and

SEC 8 Availment of Income Tax Exemption of Senior Citizens A Senior Citizen who is a minimum wage earner or whose taxable income during the year does not exceed his personal Find out the income tax slab rates for senior citizens for the financial year 2024 25 Learn about the applicable tax brackets exemptions and deductions to effectively plan

House Of Representatives

https://hrep-website.s3.ap-southeast-1.amazonaws.com/photojournal/images/hrep3260-20210921-133759.jpg

Income Tax Benefits For Senior Citizens Deductions To Save Income Tax

https://i.ytimg.com/vi/VFErXL4RBF0/maxresdefault.jpg

https://taxguru.in › income-tax › what-are-t…

Senior citizens have an exemption limit of 3 00 000 while very senior citizens have a limit of 5 00 000 offering significant tax relief Senior citizens also benefit from exemptions on advance tax payments if they have

https://www.financialexpress.com › money

Senior citizens are given basic exemption limit of up to Rs 3 lakh while super senior citizens 80 and above get exemptions on up to Rs 5 lakh income Those who come under the new tax

No ITR For Specified Senior Citizens Through Finance Act 2021 A New

House Of Representatives

Income Tax Exemption For Senior Citizens Approved By House Panel THE

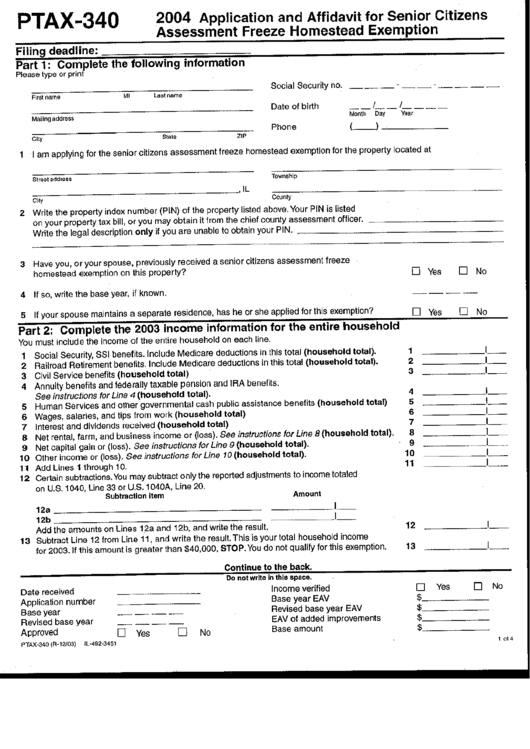

Senior Citizen Assessment Freeze Exemption Cook County Form

Income Tax Rules Big News Senior Citizens Can Avoid Paying 10 TDS On

Income Tax Exemption Big News Senior Citizens Can Avoid Paying 10

Income Tax Exemption Big News Senior Citizens Can Avoid Paying 10

Senior Citizens Granted 20 Discount VAT Exemption For Vitamins

Retire And Earn More

Senior Citizen Property Tax Exemption Second Notices Applied Business

Income Tax Exemption For Senior Citizens Act - A vital income tax exemption for senior residents in 2024 is beneath Section 80TTB which mainly addresses interest profits Senior residents can declare a deduction of