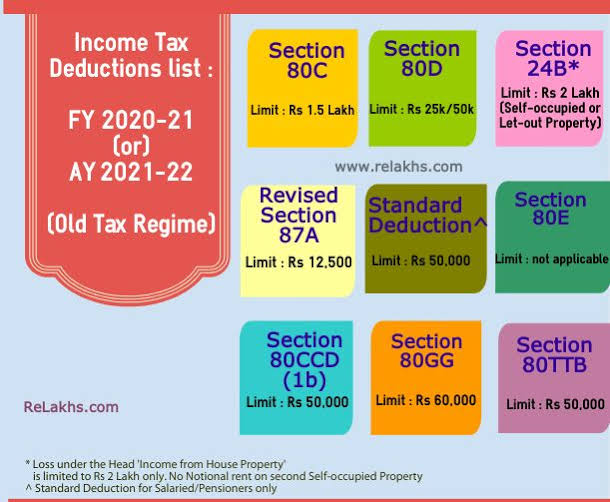

Income Tax Exemption Limit For Housing Loan Interest Section 24 b of the Income Tax Act allows you to deduct the interest paid on your house loan A maximum tax deduction of Rs 2 lakh can be claimed from your

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of

Income Tax Exemption Limit For Housing Loan Interest

Income Tax Exemption Limit For Housing Loan Interest

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Income Tax Saving 9 Income Tax Saving Tips That Also Help Financial

https://img.etimg.com/thumb/msid-88064043,width-1070,height-580,imgsize-188812,overlay-etwealth/photo.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can

Section 80EE of the Income Tax Act was introduced to offer relief on interest payments for home loans This provision allows first time homebuyers to avail an extra Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Download Income Tax Exemption Limit For Housing Loan Interest

More picture related to Income Tax Exemption Limit For Housing Loan Interest

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

http://blog.getdistributors.com/wp-content/uploads/2014/07/Tax-cut.jpg

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15205/housing-loan-tax-exemption.jpg

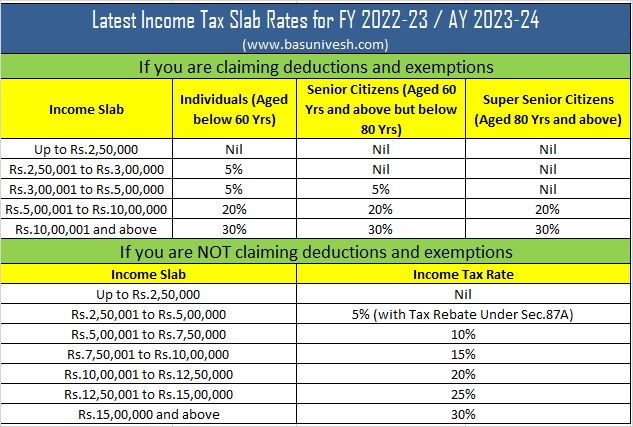

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

The maximum income tax exemption on a Home Loan in India is the sum of the deductions that can be claimed under Section 24 b and Section 80EEA subject to the conditions Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh encompassing

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under

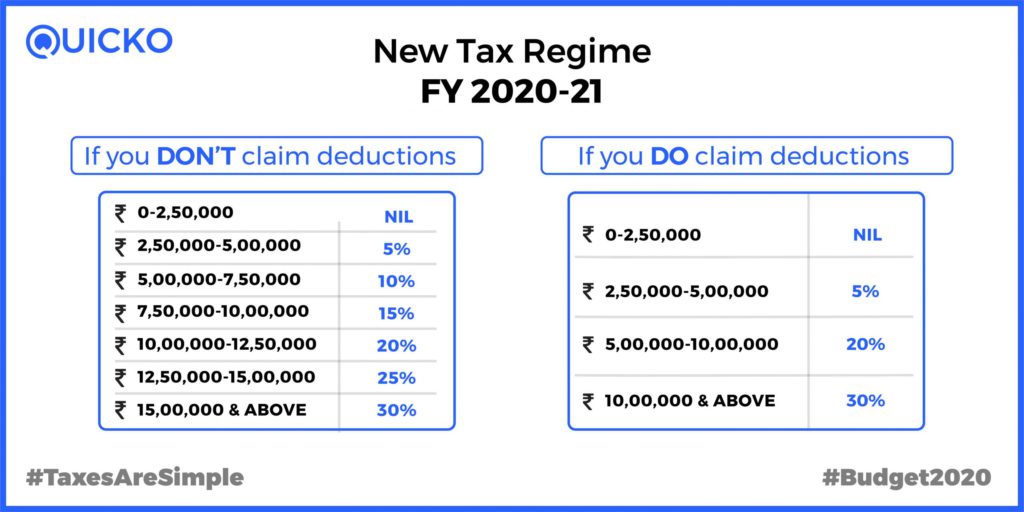

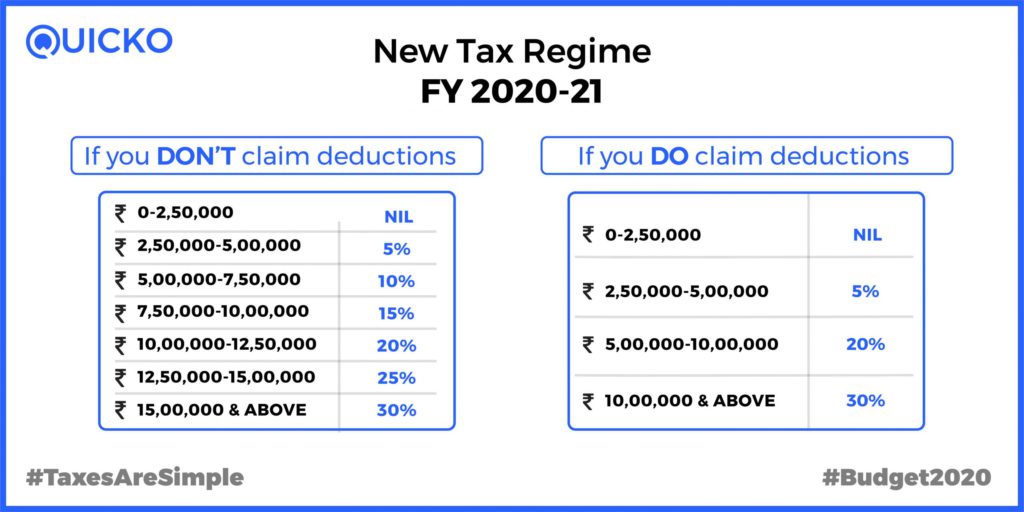

Income Tax Clarification Opting For The New Income Tax Regime U s

https://blog.quicko.com/wp-content/uploads/2020/04/tax-slabs-scaled-1-1024x512.jpg

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 24 b of the Income Tax Act allows you to deduct the interest paid on your house loan A maximum tax deduction of Rs 2 lakh can be claimed from your

https://housing.com/news/home-loans-…

First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

Income Tax Clarification Opting For The New Income Tax Regime U s

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Income From Digital Assets And Share Trading Need To Disclose Cbdt

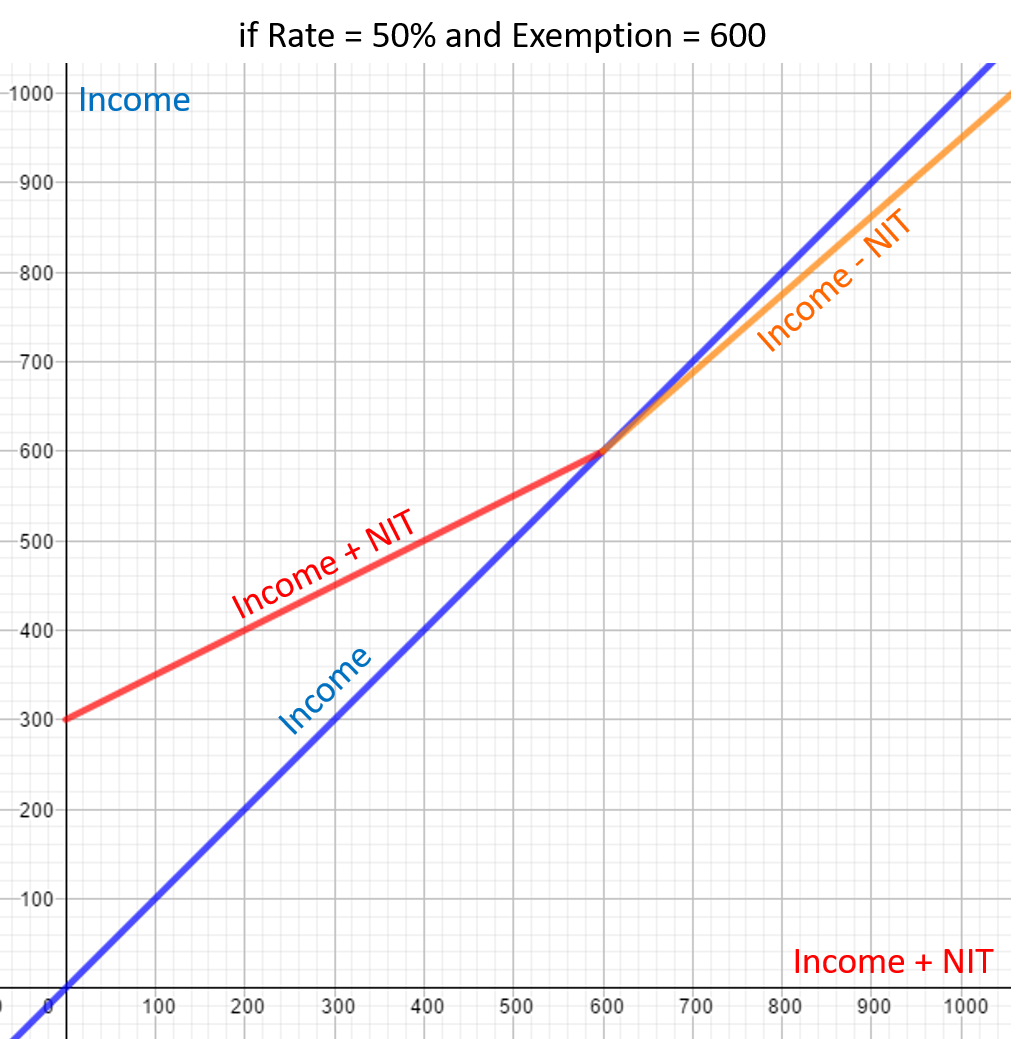

The Negative Income Tax NIT And The Welfare State An Effective

2013 09 27

2013 09 27

New Income Tax Slab 2019 20 Income Tax Income Tax Exemption

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

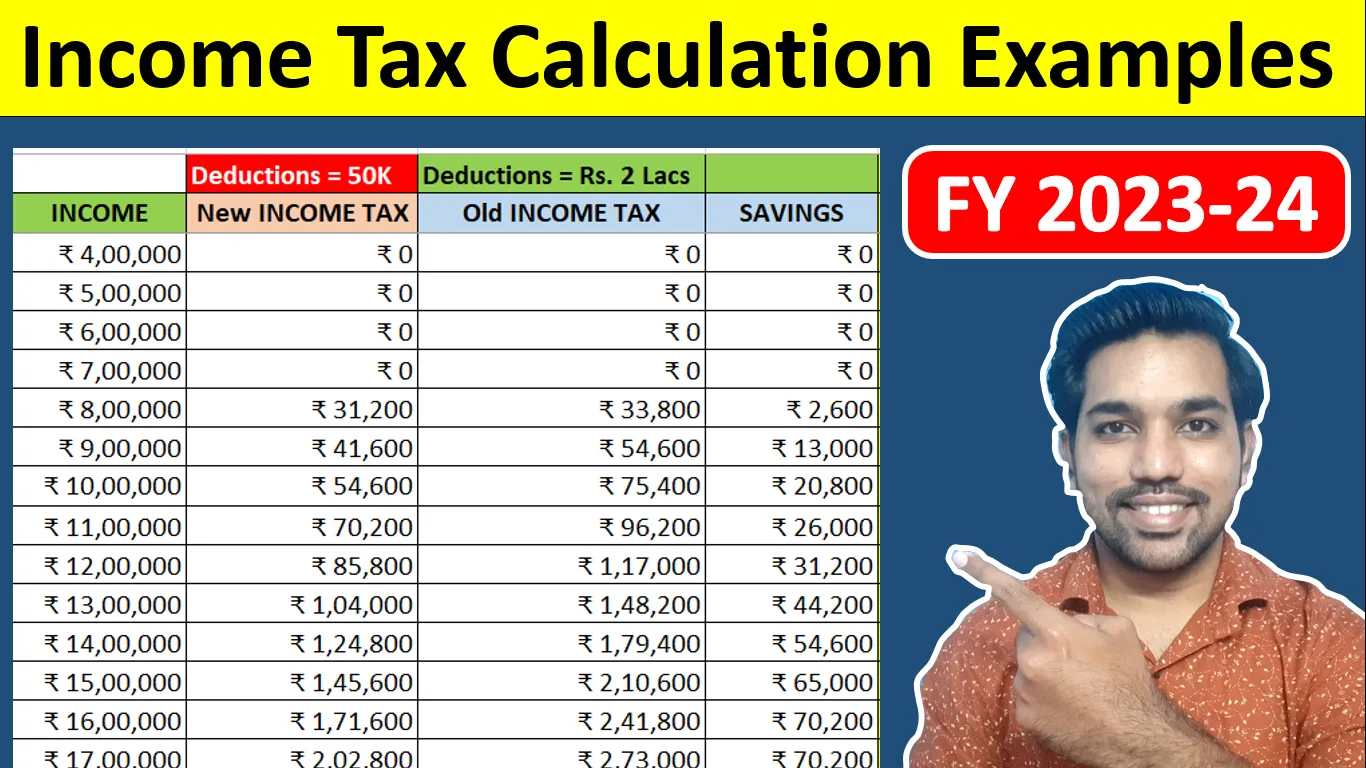

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

Income Tax Exemption Limit For Housing Loan Interest - You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid