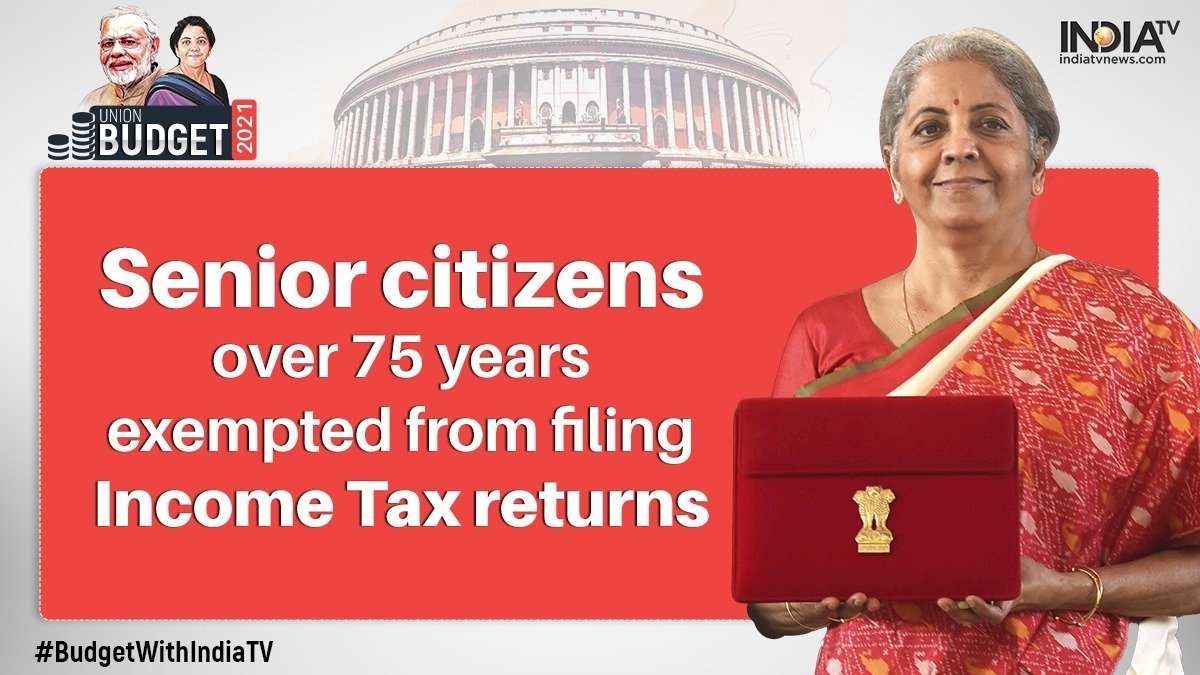

Income Tax Exemption Limit For Senior Citizens Fy 2023 24 Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for

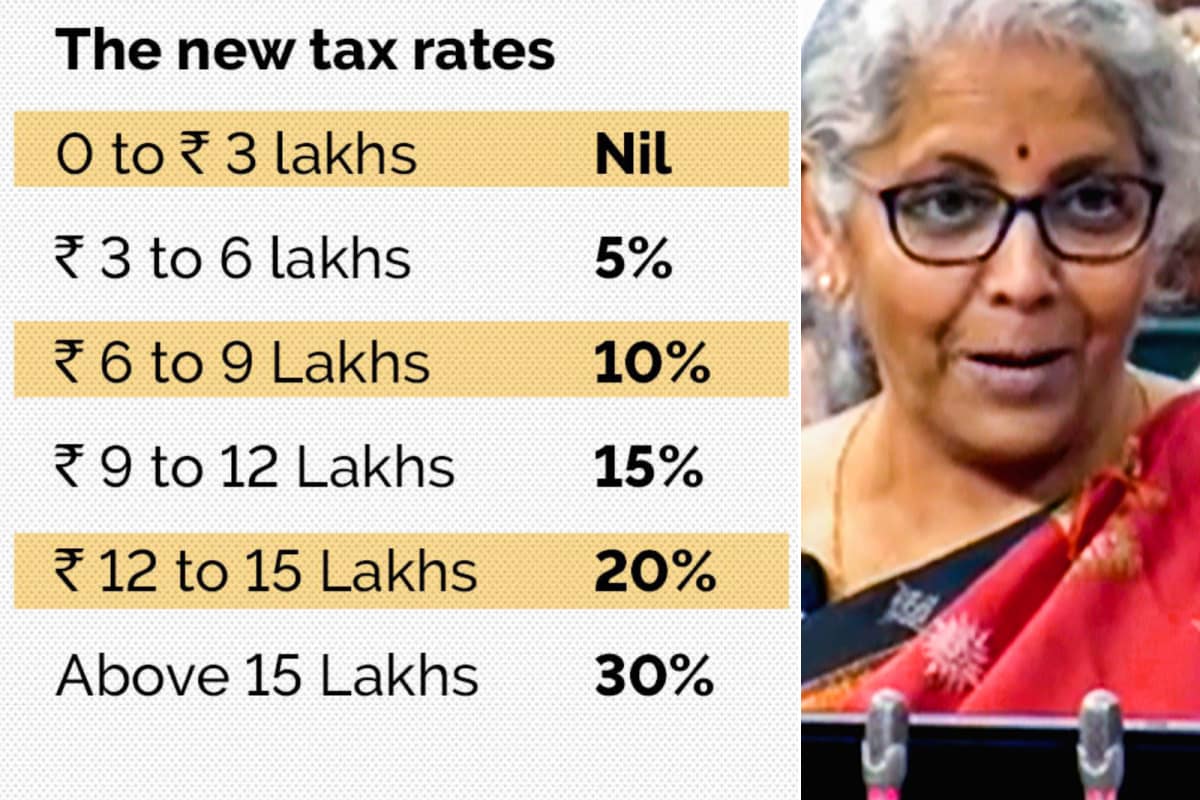

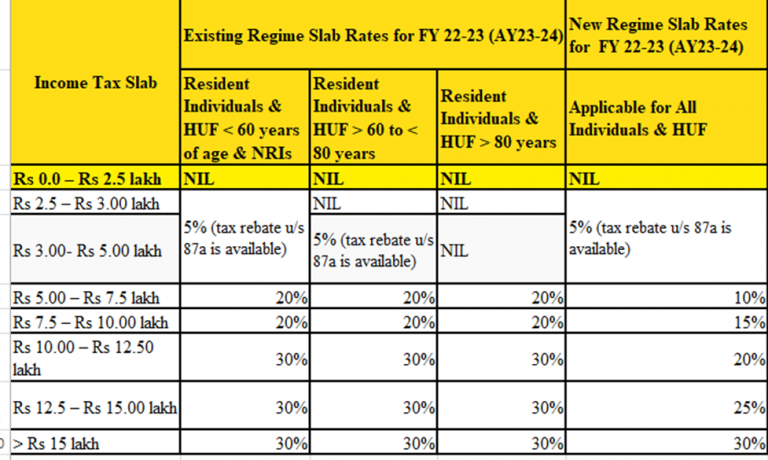

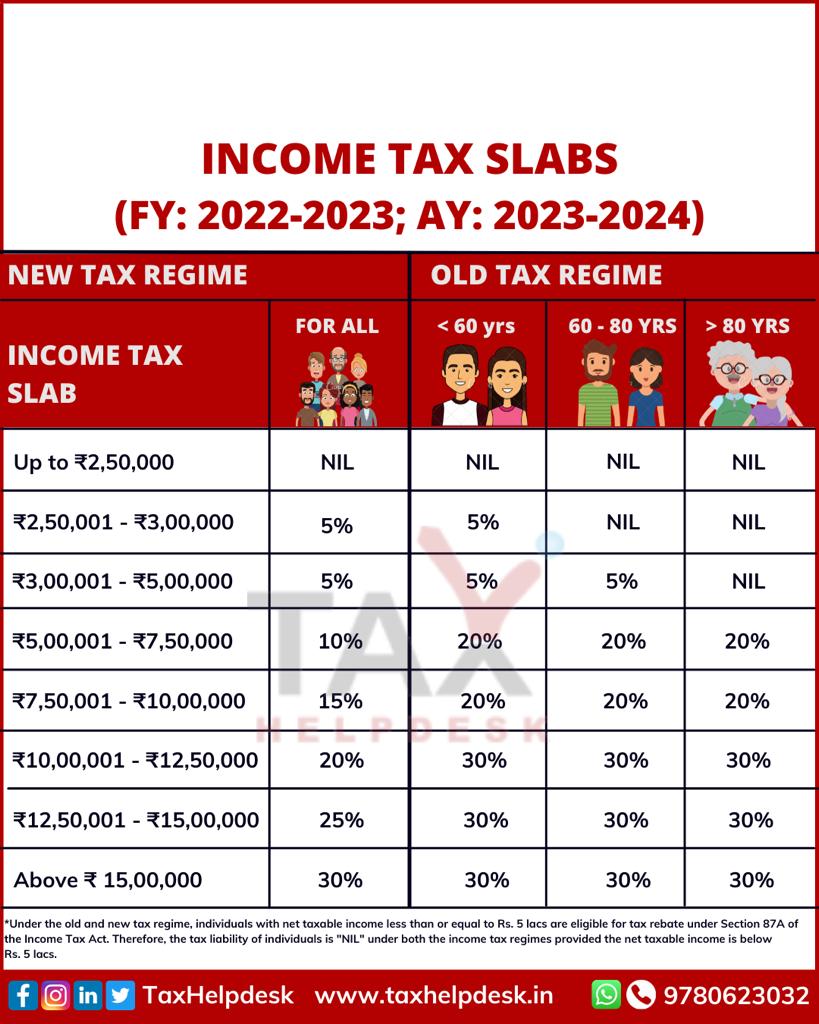

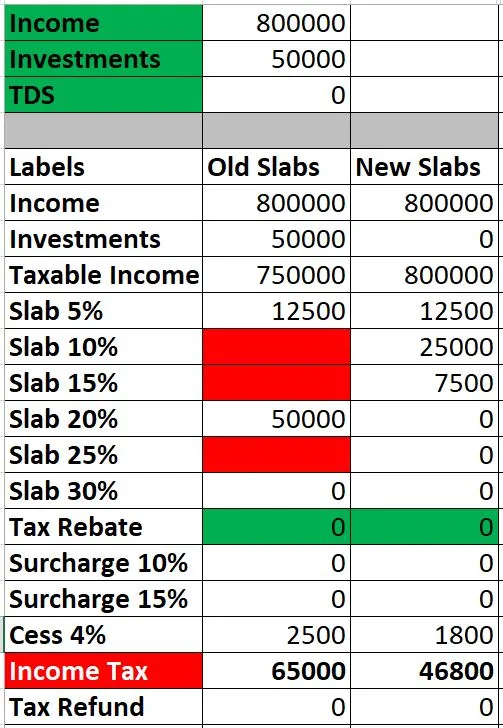

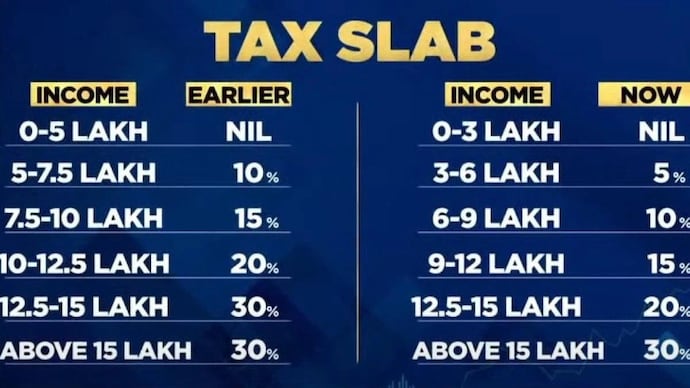

The basic exemption limit for senior citizens individuals aged 60 years or above is currently Rs 3 lakh for the financial year 2024 25 old tax regime In the old tax regime the basic exemption limit for senior citizens is Rs 3 00 000 and for super senior citizens it is Rs 5 00 000 In the new tax regime no income tax is

Income Tax Exemption Limit For Senior Citizens Fy 2023 24

Income Tax Exemption Limit For Senior Citizens Fy 2023 24

https://images.news18.com/ibnlive/uploads/2023/01/untitled-design-9-15-167410920216x9.png

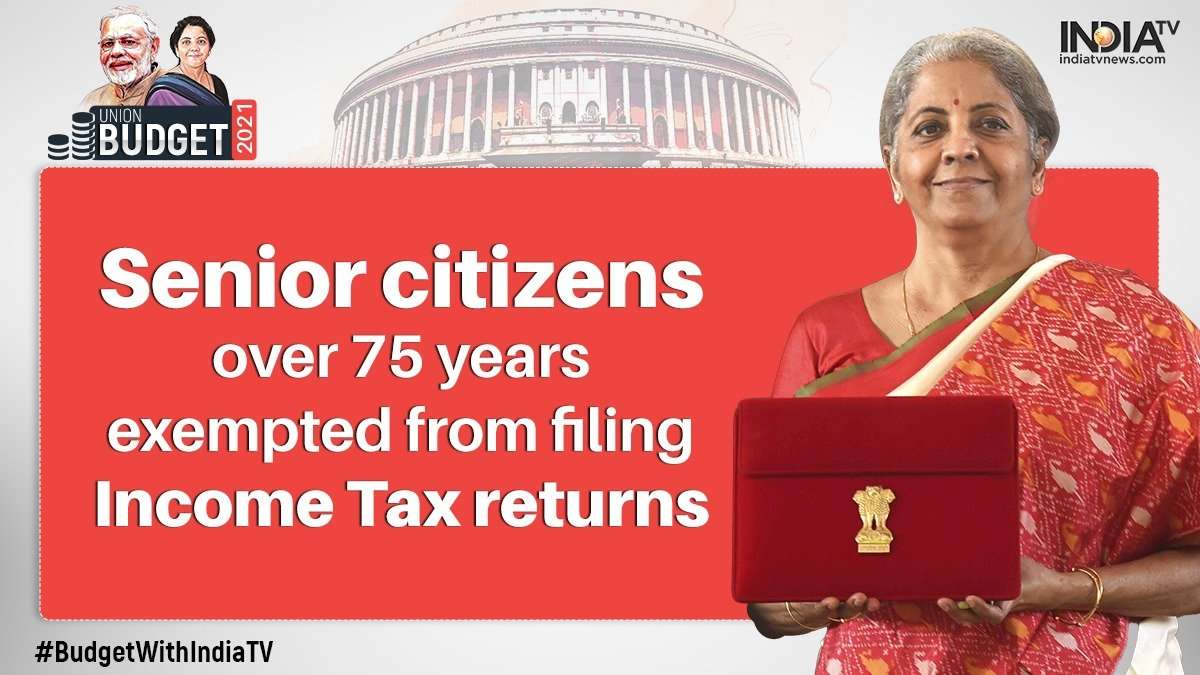

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/centered/newbucket/1200_675/2021/02/eth6sfpu0auony6-1612164111.jpg

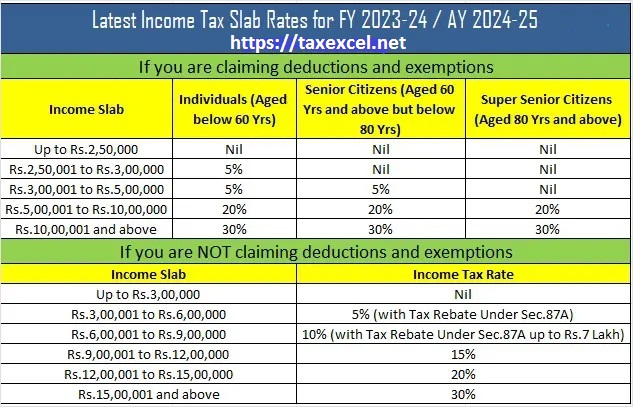

Income Tax Slab For The A Y 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

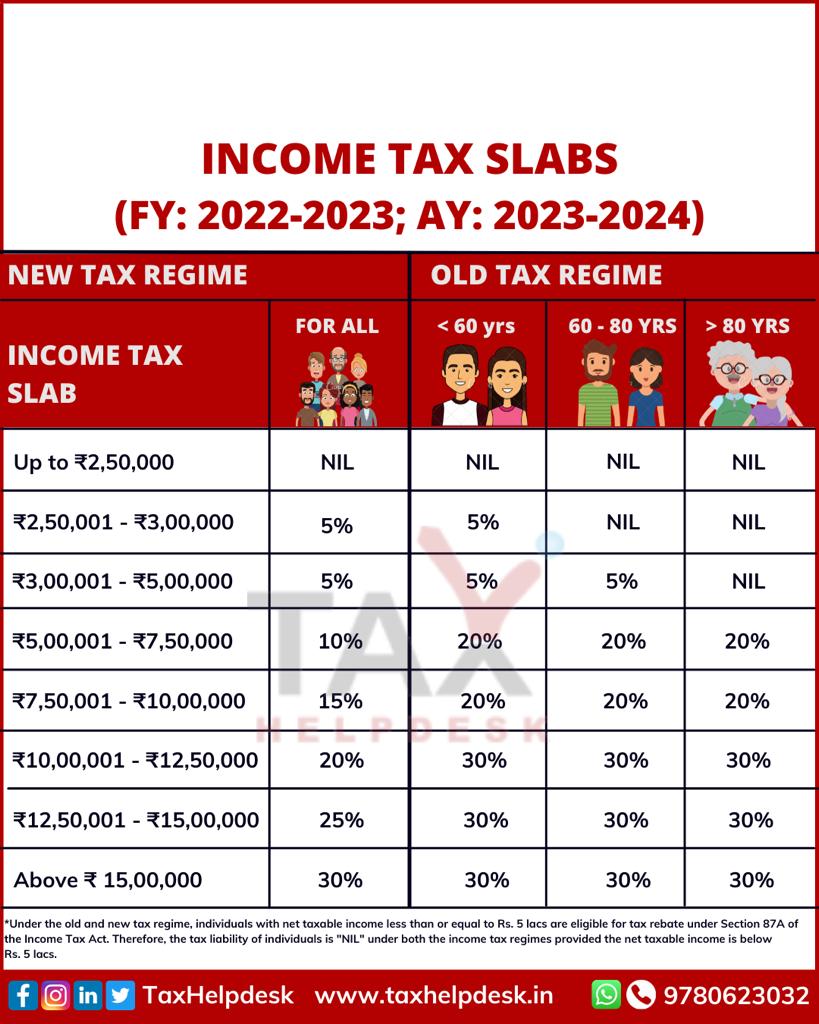

Income tax slab FY 2023 24 AY 2024 25 Check out the latest income tax slab for salaried individuals and senior citizens by the IT department Discover the tax rates for both the new tax regime and the Surcharge on income tax under both old regime and new regime is 10 per cent if income is above 50 lakh and up to 1 crore 15 per cent if income is above 1 crore and up to 2 crore 25 per cent if income

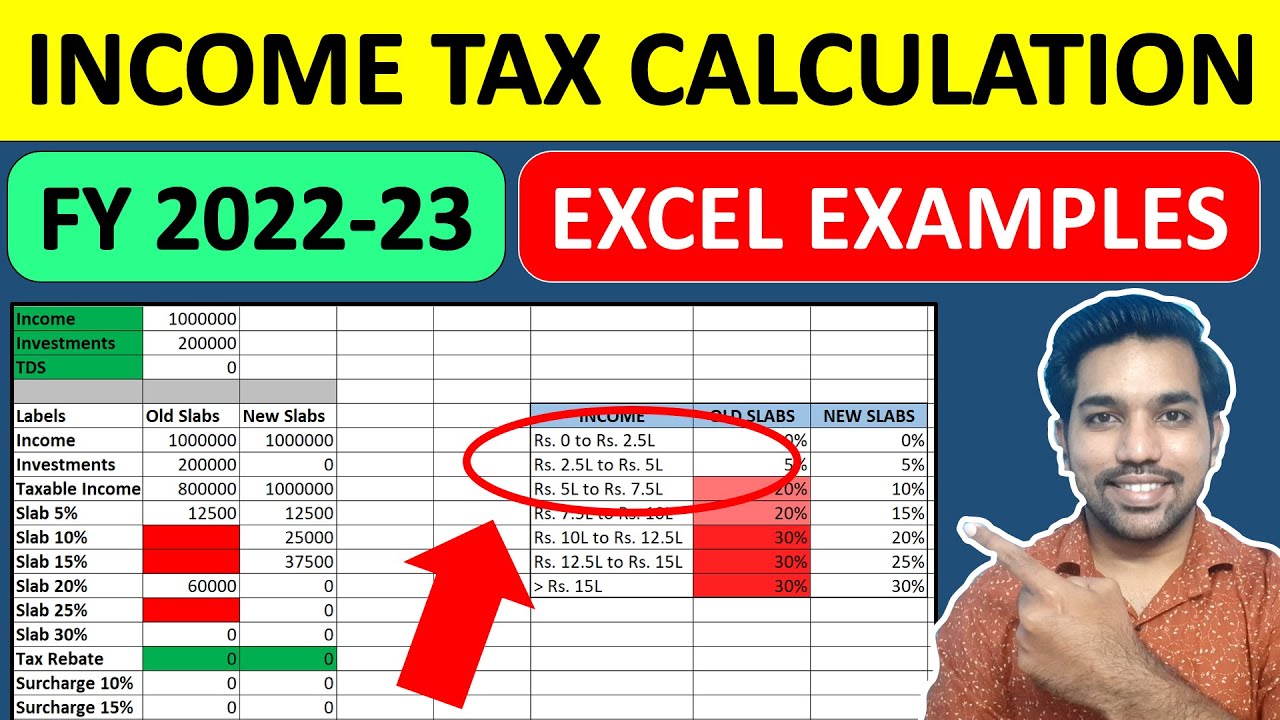

The new tax regime introduced in the Union Budget 2020 offers lower tax rates but fewer deductions The income tax slabs for Indian super senior citizens for the FY 2024 25 are as Senior citizens between the ages of 60 and 80 can avail a higher basic exemption limit under the old tax rules This applies to super senior citizens as well The following income tax slab rates are

Download Income Tax Exemption Limit For Senior Citizens Fy 2023 24

More picture related to Income Tax Exemption Limit For Senior Citizens Fy 2023 24

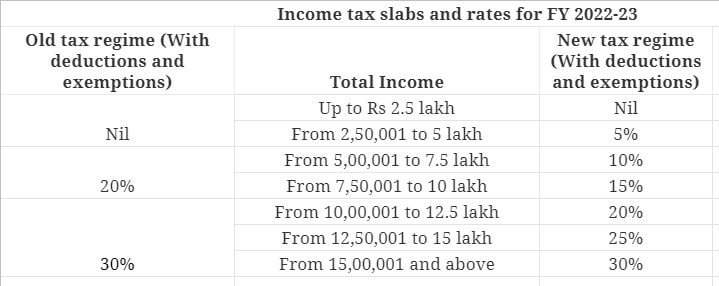

Income Tax Slab For Senior Citizens After Budget 2022 All You Need To Know

https://images.news18.com/ibnlive/uploads/2022/02/in-2.jpg

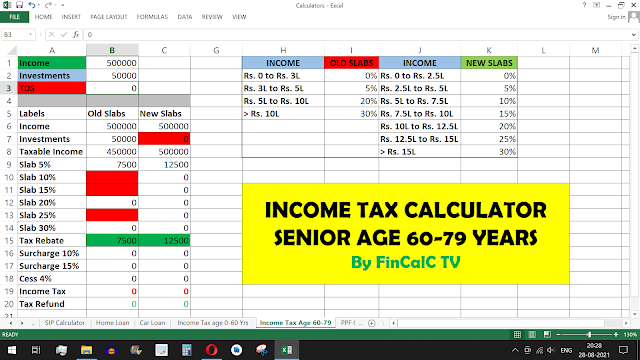

Senior Citizens How To Calculate Income Tax FY 2021 22 VIDEO

https://lh3.googleusercontent.com/-U1e5Z6_6JG0/YSpPbnEJD9I/AAAAAAAABg4/-wgXY_fRowUwDgpuDIQ8U8Iyo4DFkZRLgCLcBGAsYHQ/w640-h360/image.png

Budget 2023 New Income Tax Regime Vs Old Regime Which One Should You

https://images.news18.com/ibnlive/uploads/2023/02/income-tax-nirmala-sitharaman-budget-2023-2-16752389263x2.png

Starting from FY 2023 24 the new income tax regime will be considered the default tax regime If you wish to switch to the old regime you must submit a form i e Form 10 The basic exemption limit under the new scheme is revised to 3 lakh from 2 5 lakh and it is effective from FY 2023 24 So for the first 3 lakh tax would be zero The next 3 lakh falls in the 2nd slab and the

Know about the income tax slab rates for the FY 2023 24 and 2024 25 Get the information about the old and new income tax slabs for individuals senior citizens and super senior As per the Income Tax Act 1961 tax payers above 80 years of age are considered as super senior citizens and they get a higher exemption limit of Rs 5 lakh under the old

Income Tax Slabs For FY 2022 23 FY 2021 22

https://www.taxhelpdesk.in/wp-content/uploads/2022/05/IMG-20220509-WA0031.jpg

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjgH5E3CzzJ-EczNDbw-wI_pL5VZC0SNmhsDQowAPaGKZ6vduNsvxSJgeHlrZQtukMAJ5XecqFbniw9tA-_vkdXcMzNSddLdSt_vXTyfHJpqrXqGUqYaoF0gOS4P268HUqM2FEsnkUirI00ycY1vH7KW4JJO-KNdRmEld1-DcyaNNeA0HqXHo7AIBxH-w/w1200-h630-p-k-no-nu/income tax return due date 2023-24 (1).png

https://www.incometax.gov.in/iec/foportal/help/...

Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for

https://tax2win.in/guide/income-tax-for-senior-citizens

The basic exemption limit for senior citizens individuals aged 60 years or above is currently Rs 3 lakh for the financial year 2024 25 old tax regime

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Income Tax Slabs For FY 2022 23 FY 2021 22

Senior Citizen Income Tax Calculation 2022 23 Excel FinCalC Blog

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

Income Tax Slabs FY 2023 24 And AY 2024 25 New Old Regime Tax Rates

Income Tax Slabs FY 2023 24 And AY 2024 25 New Old Regime Tax Rates

Income Tax Slab For FY 2022 23 FY 2021 22 Revised Tax Slabs New

Income Tax Calculator Calculate Taxes For FY 2023 24 2022 23 2024

Historical Estate Tax Exemption Amounts And Tax Rates

Income Tax Exemption Limit For Senior Citizens Fy 2023 24 - Senior citizens between the ages of 60 and 80 can avail a higher basic exemption limit under the old tax rules This applies to super senior citizens as well The following income tax slab rates are