Income Tax Exemption Limit Under Section 80d Verkko As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr Citizen mode other than cash

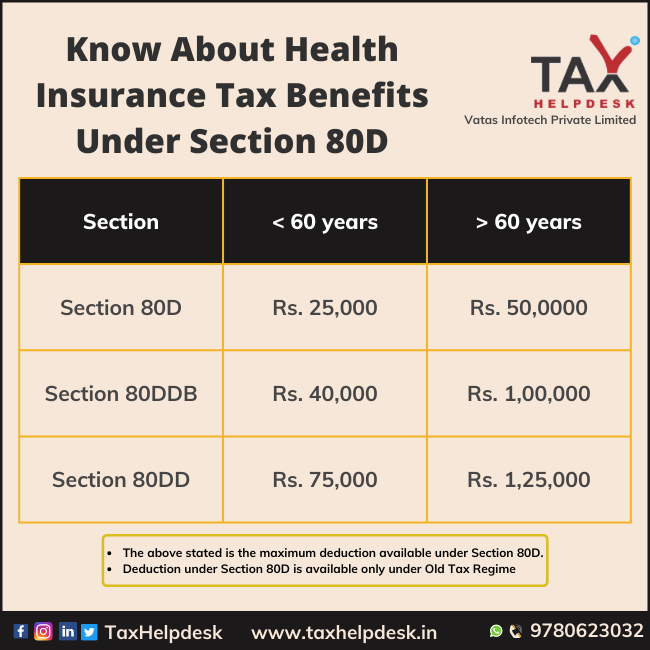

Verkko 28 jouluk 2023 nbsp 0183 32 Q What is the limit of income tax deduction under section 80D The maximum limit u s 80D is Rs 25000 in case senior citizen Rs 50 000 and in case both assessee and parents are senior citizens then the amount can Verkko 9 maalisk 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s family situation the limit could be Rs 25 000 Rs 50 000 Rs 75 000 or Rs 1 lakh See Section 80D and you

Income Tax Exemption Limit Under Section 80d

Income Tax Exemption Limit Under Section 80d

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Verkko 4 toukok 2022 nbsp 0183 32 What is the deduction limit under Section 80D of the Income Tax Act 1961 The maximum deduction on policies taken for you and your family is 25 000 However if you are a senior citizen 60 years or more the maximum deduction limit is Verkko Individuals can claim maximum Rs 25000 every financial year as deduction under Section 80D of Income Tax Act For Senior citizens the 80D exemption limit is Rs 50 000 For parents below than 60 years of age the maximum limit is Rs 25 000 for health insurance premium paid

Verkko 27 tammik 2023 nbsp 0183 32 Your salary package may include different allowances like House Rent Allowance HRA conveyance transport allowance medical reimbursement etc Additionally some of these allowances are exempt up to a certain limit under section 10 of the Income Tax Act For eg Medical allowance is exempt up to INR 15 000 on a Verkko 3 jouluk 2022 nbsp 0183 32 According to Sec 80D Ravi will be able to claim the following exemptions on his taxable income Tax deduction of Rs 25 000 on the Rs 30 000 that he paid as a health insurance premium for himself and his family members Tax deduction of Rs 33 000 on the entire amount paid for his parents medical insurance policy

Download Income Tax Exemption Limit Under Section 80d

More picture related to Income Tax Exemption Limit Under Section 80d

How To Claim Tax Exemptions Here s Your 101 Guide

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

Section 80d Of Income Tax Section 80d Medical Expenditure Trutax

https://www.trutax.in/blog/wp-content/uploads/2021/05/section-80d-of-income-tax-act-1-1024x576.png

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

Verkko 22 hein 228 k 2020 nbsp 0183 32 For individual and family An individual can claim a maximum tax deduction of 25 000 every year on the premium paid on their medical insurance and their family s A senior citizen can claim a maximum tax deduction of 50 000 every year on the premium paid towards medical insurance Verkko 14 maalisk 2022 nbsp 0183 32 Section 80D allows taxpayers to avail tax deductions on the premiums paid towards health and medical insurance in a financial year March 14 2022 10 59 IST Section 80D permits a deduction of

Verkko The Deduction that can be claimed under Sec 80D at the time of filing of income tax return is the sum of the following In case the payment of medical insurance premium is paid by the assesse for himself spouse dependent children Rs 25 000 In case the person insured is a Senior Citizen the deduction allowed should be Rs 30 000 Verkko 15 helmik 2023 nbsp 0183 32 The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable income falls in If an individual s taxable income after claiming deduction of Rs 25 000 under Section 80D falls between Rs 2 5 lakh and Rs 5 lakh then the tax rate is 5

Section 80D Deduction For Medical Insurance Health Checkups

https://www.paisabazaar.com/wp-content/uploads/2017/04/02-5.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Verkko As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr Citizen mode other than cash

https://tax2win.in/guide/section-80d-deduction-medical-insurance...

Verkko 28 jouluk 2023 nbsp 0183 32 Q What is the limit of income tax deduction under section 80D The maximum limit u s 80D is Rs 25000 in case senior citizen Rs 50 000 and in case both assessee and parents are senior citizens then the amount can

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80D Deduction For Medical Insurance Health Checkups

Section 80D Deduction In Respect Of Health Or Medical Insurance

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Exemption Limit Under Section 80d - Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 The tax system in India provides several avenues for individuals to save on their taxable income through various deductions and exemptions One such provision is the medical insurance for parents tax exemption which can be particularly beneficial for those looking to secure health coverage for their parents The 80D exemption for