Income Tax Exemption On Home Loan Interest Before Possession Under income tax laws the tax benefits in respect of home loans under Section 24b for interest and under Section 80C for principal repayment can only be claimed from the year in which the

In our considered view for claiming deduction of interest under Sec 24 b of the Act there is neither any such precondition nor an eligibility criteria prescribed that the assessee should have taken possession of the property so purchased or acquired by him In this case Home Loan borrowers can claim tax rebates up to a maximum of Rs 1 5 Lakh on payments made towards principal repayment under Section 80C of the Income Tax Act However when it comes to payments made towards interest repayment one cannot claim a Home Loan tax exemption during the pre construction phase

Income Tax Exemption On Home Loan Interest Before Possession

Income Tax Exemption On Home Loan Interest Before Possession

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

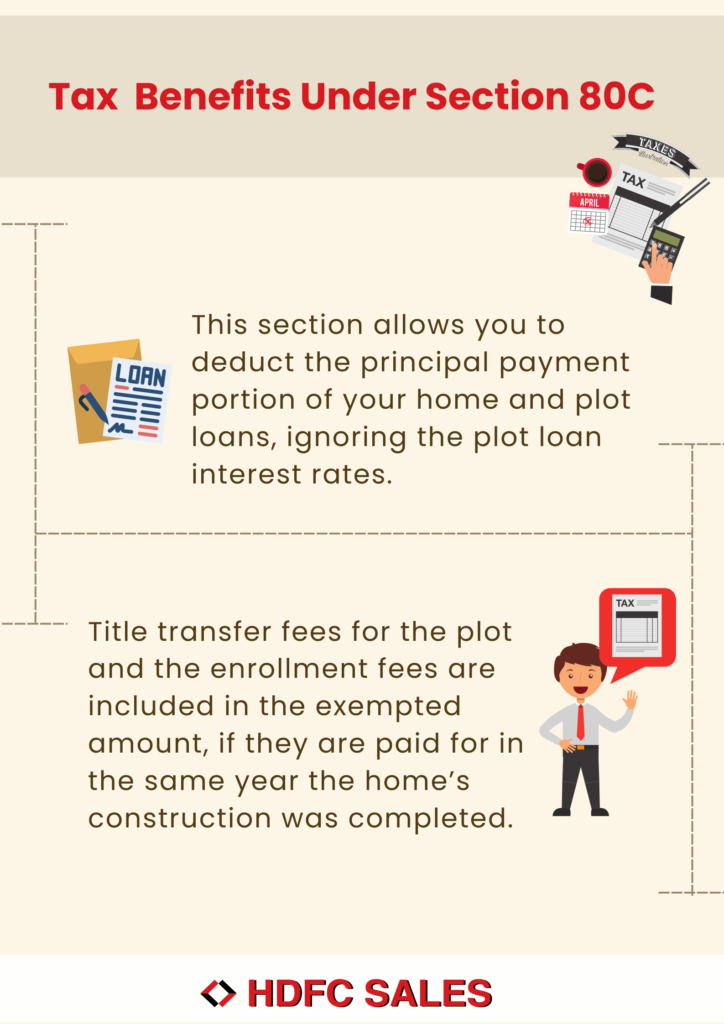

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

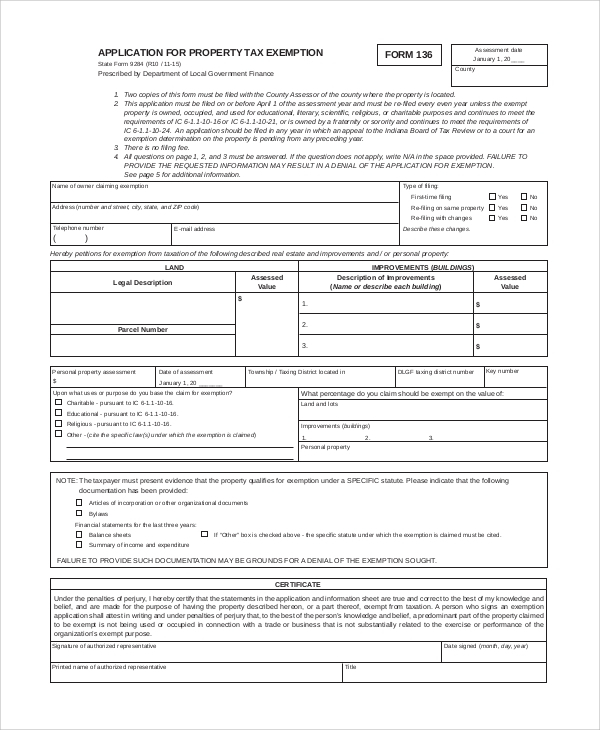

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh Note Under the New tax regime no deduction is allowed in respect of interest on loans borrowed for self occupied property whereas deduction is allowed with no ceiling limit for interest on loans borrowed for let out property irrespective of the tax regime you choose

A borrower of a home loan may be eligible for an income tax exemption on interest payments up to 2 lakh and an additional 1 5 lakh under Section 80 C for principal repayment As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction phase Even if you have already started repaying the housing loan through EMIs during the construction phase

Download Income Tax Exemption On Home Loan Interest Before Possession

More picture related to Income Tax Exemption On Home Loan Interest Before Possession

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15205/housing-loan-tax-exemption.jpg

Gratuity Under Income Tax Act All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Gratuity-under-Income-Tax-Act-All-You-Need-To-Know.png

IRS Tax Exemption Letter Peninsulas EMS Council

https://www.pemsc.org/images/Tax_Exempt_Page_2.jpg

In accordance with Section 24 of the Income Tax Act 1961 hereinafter referred to as the IT Act the taxpayer would not be allowed to claim the benefit of interest deduction unless the Otherwise the deduction claimed earlier will be added back to your income in the year of sale This deduction will be within the overall limit of Rs 1 5 lakh mandated for 80C The interest portion of construction period

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

Income Tax Exemption On Interest Of Education Loan YouTube

https://i.ytimg.com/vi/6NRHslwXCcM/maxresdefault.jpg

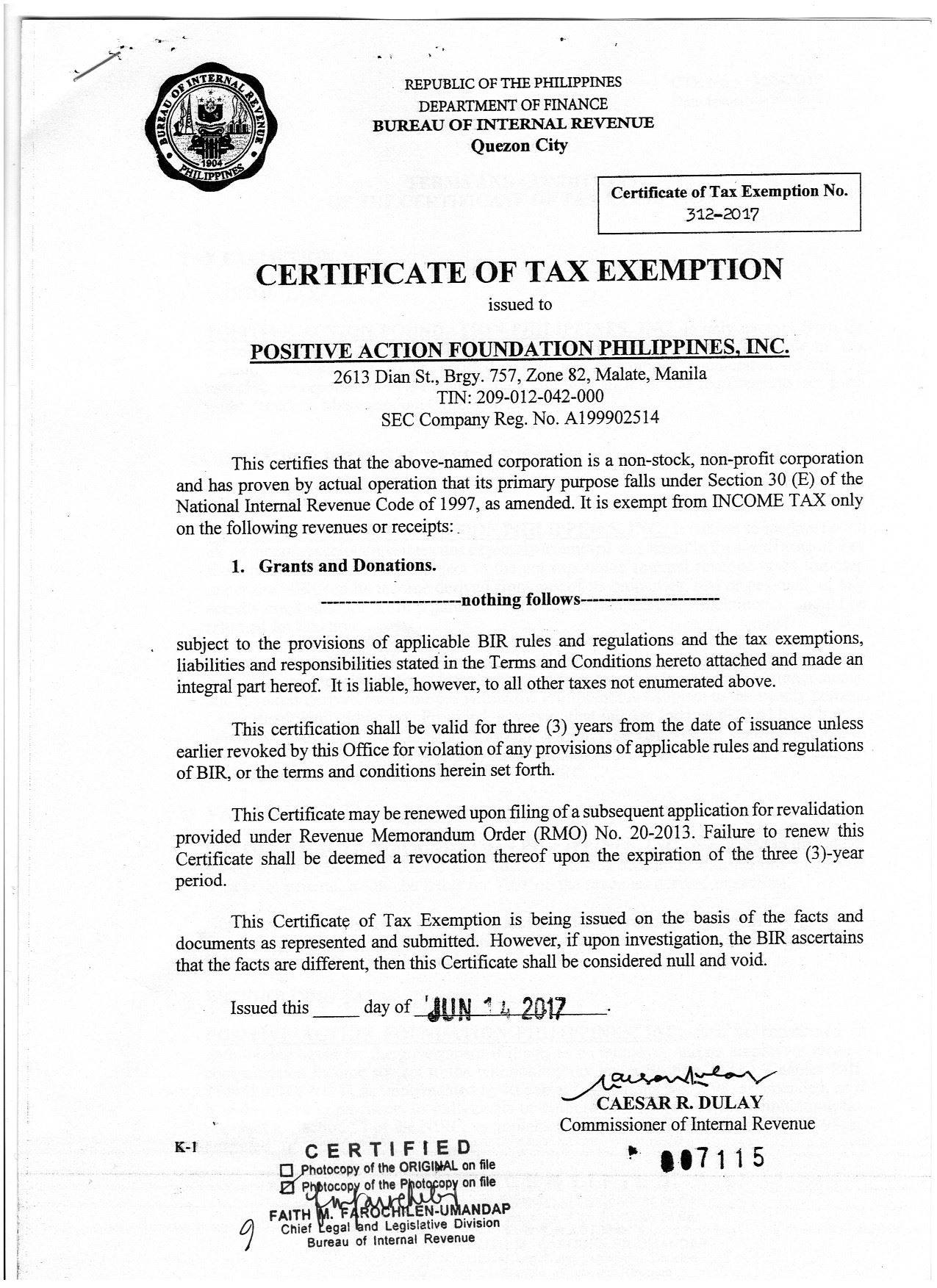

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

https://www.livemint.com/money/personal-finance/...

Under income tax laws the tax benefits in respect of home loans under Section 24b for interest and under Section 80C for principal repayment can only be claimed from the year in which the

https://taxguru.in/income-tax/possession-property...

In our considered view for claiming deduction of interest under Sec 24 b of the Act there is neither any such precondition nor an eligibility criteria prescribed that the assessee should have taken possession of the property so purchased or acquired by him

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Income Tax Exemption On Interest Of Education Loan YouTube

Hike In Income Tax Exemption Limit To Job Creation Expectations From

Tax Benefits Of Home Loan

Claim Income Tax Exemption On Home Loan Interest Payments

APSirvaiya Law Difference Between Tax Exemption And Tax Deduction

APSirvaiya Law Difference Between Tax Exemption And Tax Deduction

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

How To Claim Tax Exemption On Home Loan Without Paying Interest In

Free Sample Template Of Certificate Of Exemption

Income Tax Exemption On Home Loan Interest Before Possession - Note Under the New tax regime no deduction is allowed in respect of interest on loans borrowed for self occupied property whereas deduction is allowed with no ceiling limit for interest on loans borrowed for let out property irrespective of the tax regime you choose