Income Tax Exemption On House Rent Paid Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Calculating House Rent Allowance HRA for salaried employees involves considering specific parameters outlined in the Income Tax Act The HRA exemption relief from income tax liabilities is determined based on the least of three components

Income Tax Exemption On House Rent Paid

Income Tax Exemption On House Rent Paid

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Big Update For Income Tax Exemption Increased From 5 Lakh To 7 Lakh

https://i0.wp.com/taxconcept.net/wp-content/uploads/2023/02/20230201_122248.jpg?fit=2966%2C1189&ssl=1

If you rent a furnished or unfurnished place and do not receive House Rent Allowance as part of your salary you can claim a deduction for the rent paid under Section 80 GG of the Income tax Act To claim this deduction you need to submit Form 10B Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at source In case the annual rent payment is over 1 00 000 per annum you will also need to HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary of the individual and the location of the rental housing Individuals who are self employed may also qualify for the HRA exemption under Section 80GG of the Income Tax Act

Download Income Tax Exemption On House Rent Paid

More picture related to Income Tax Exemption On House Rent Paid

HRA Exemption House Rent Exemption U S 10 13A

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2019/01/House-Rent-Exemption-Under-Section-1013A.jpg

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

HRA is house rent allowance paid by employer to meet tax payer rent expenses and this amount is tax free up to certain extent Updated per latest Union Budget 2024 Calculation HRA is exempt to the extent of the minimum of the following 3 amounts Actual HRA Amount Received Excess of Rent paid by the tax payer over 10 of salary From FY 2020 21 onwards House Rent Allowance Exemption is only available if an employee opts for the Old Tax Regime Exemption Rules and Calculation The amount of Exempt HRA will be the least of the following amounts Actual House Rent Allowance received Actual rent paid less 10 of salary

Save tax as a family By submitting rent receipts and paying them you will be able to claim exemption on HRA Your parents can deduct property taxes and also claim a 30 standard deduction on the rental income House Rent Allowance is an employer granted allowance for employee housing rent HRA is usually included in employee CTC Only rent paid amount can be claimed for a tax free HRA exemption

Get More Tax Exemptions For Income Tax In Malaysia IMoney

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-800x2483.png

Unlock Your Tax Freedom Master The Art Of Non Taxable Income With Our

https://thesoulfulpage.com/wp-content/uploads/2023/11/tax-exemption-on-these-5-earnings.jpg

https://cleartax.in/s/hra-house-rent-allowance

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Get More Tax Exemptions For Income Tax In Malaysia IMoney

Gratuity Under Income Tax Act All You Need To Know

Income Tax

IRS Tax Exemption Letter Peninsulas EMS Council

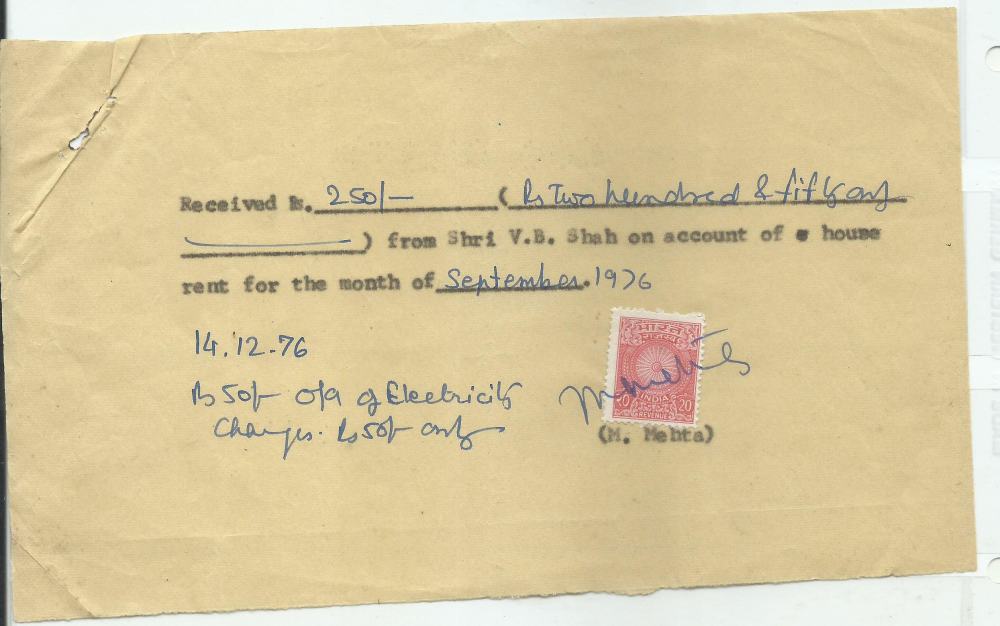

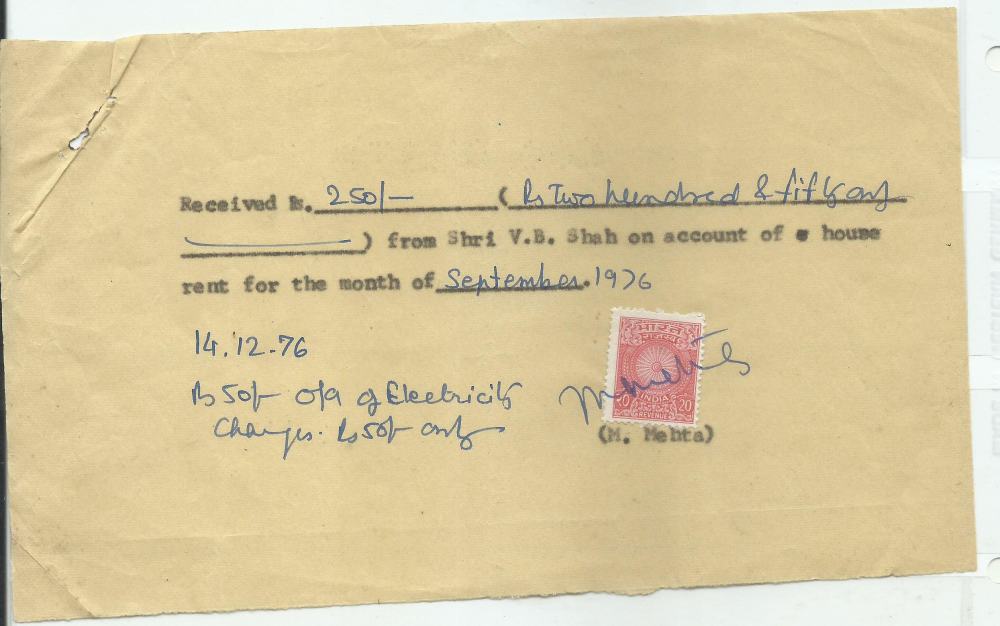

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

Request For Income Tax Exemption PDF Nonprofit Organization Tithe

House Rent Allowance Income Tax Act Ideas Of Europedias

2017 PAFPI Certificate of TAX Exemption Certificate Of

Income Tax Exemption On House Rent Paid - An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies