Income Tax Exemptions For Salaried Employees 2021 22 Pdf ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

97 rowsLearn about income tax benefits for salaried Income tax exemptions for salaried employees 2021 22 The Income Tax Act 1961 mandates certain income tax allowances exemptions for the salaried class These exemptions thus

Income Tax Exemptions For Salaried Employees 2021 22 Pdf

Income Tax Exemptions For Salaried Employees 2021 22 Pdf

https://blogger.googleusercontent.com/img/a/AVvXsEgLDCnTZQuLnWBa8kiTwkdPhtVgzZiHH6BxGRp2eAYcysQ8S_DEuU7UQePjlrHlAZS4ajTVqfOZ3GbxKKR-63sbcNJATyghfwcQyN_7zwg2cdneuk46ffaLrRqHZe5vj5ZJJY-r8PDsrxyB6vOJoq-yCfY1agw1LwqrF1mAlhf71MR8MYMRP3uGWEVXRg=s16000

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

https://i0.wp.com/taxconcept.net/wp-content/uploads/2021/12/WhatsApp-Image-2021-12-10-at-12.22.57-PM.jpeg?fit=700%2C410&ssl=1

How Salaried Employees Can Calculate Standard Deductions For FY 2023

https://images.livemint.com/img/2023/03/19/1600x900/incometax-kctF--621x414_1679242287753_1679242287992_1679242287992.jpg

The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about those These instructions are guidelines for filling the particulars in Income tax Return Form 2 for the Assessment Year 2021 22 relating to the Financial Year 2020 21 In case of any doubt

For individuals being a resident other than not ordinarily resident having total income upto Rs 50 lakh having Income from Salaries one house property other Find out the list of benefits available to a salaried person in India and save your tax legally

Download Income Tax Exemptions For Salaried Employees 2021 22 Pdf

More picture related to Income Tax Exemptions For Salaried Employees 2021 22 Pdf

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Income Tax Exemptions For Salaried Employees F Y 2022 23 With

https://blogger.googleusercontent.com/img/a/AVvXsEgVhIJ1sPYAQi1O3hhMl62JV4DwDoBF9O6SrNwurXL744kVE31qfW8mXTAGZjfLbj4PBHdONNw2EDnKmcZegvDsQRYMPdFDqtawCo_buP81ASKiSePWpVoB_Tb10y1dRIMN0jh-ywJjDFDFiOtpio50rg02CHPYG6pNxlVxXyq7q0s_eJqIskh-kRRn=w640-h310

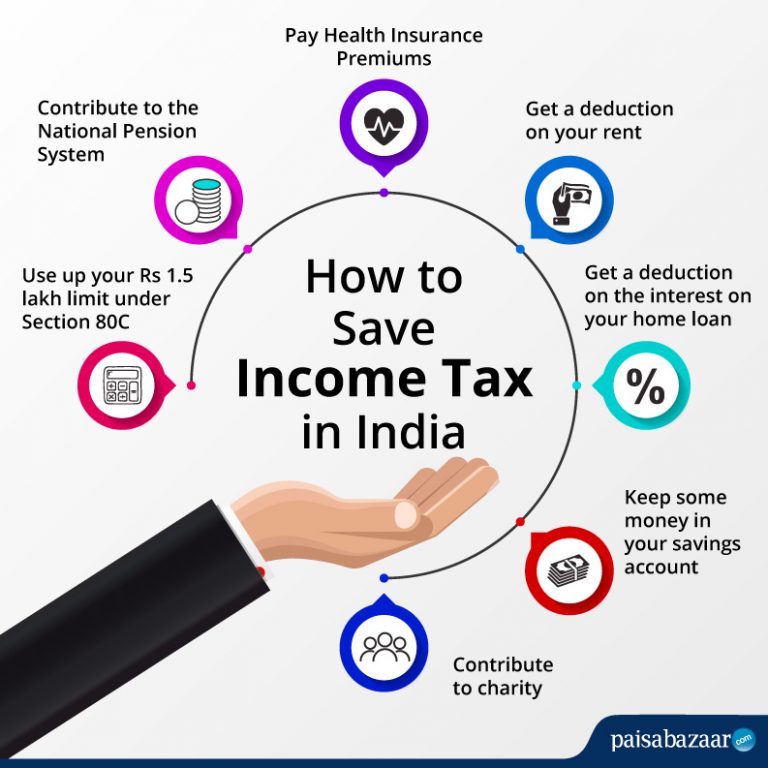

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/06/How-to-Save-Income-Tax-Photo-768x768.jpg

Section 115BAC the new tax regime system came into force from FY 2020 21 AY 2021 22 The new tax regime introduced concessional tax rates with reduced 17 rowsIf you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in

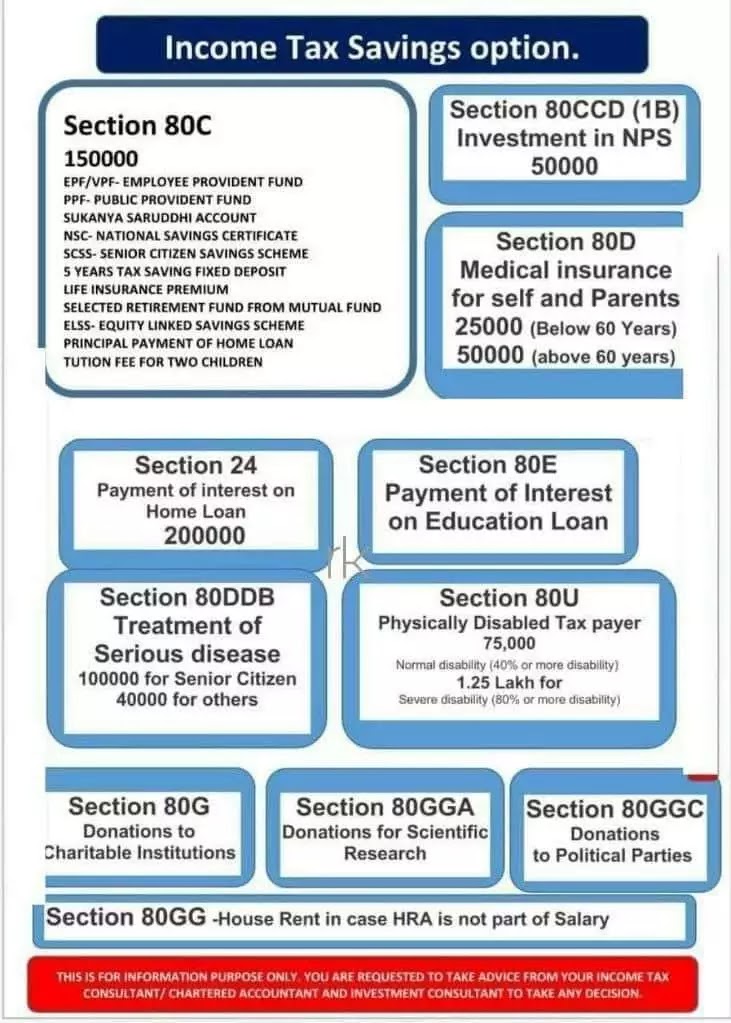

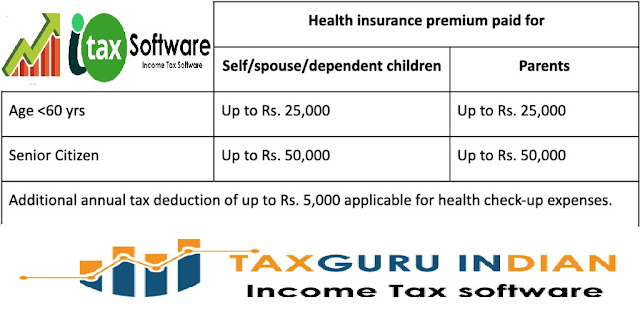

These instructions are guidelines to help the taxpayers for filling the particulars in Income tax Return Form 1 for the Assessment Year 2021 22 relating to the Financial The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating

Income Tax Exemptions For Salaried Employees

https://jupiter.money/content/images/size/w1000/2021/12/rsz_tax_deductions.jpg

Tax Exempt Status Federal Regulations YouTube

https://i.ytimg.com/vi/l75StVaY8v4/maxresdefault.jpg

https://www.incometax.gov.in/iec/foportal/help/...

ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

https://taxguru.in/income-tax/list-incom…

97 rowsLearn about income tax benefits for salaried

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Income Tax Exemptions For Salaried Employees

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

Income Tax Exemptions For Salaried Employees 5min Guide

Income Tax Exemptions For Salaried Employees 5min Guide

The Last Date For Filing Income Tax Returns ITR Extended Kanakkupillai

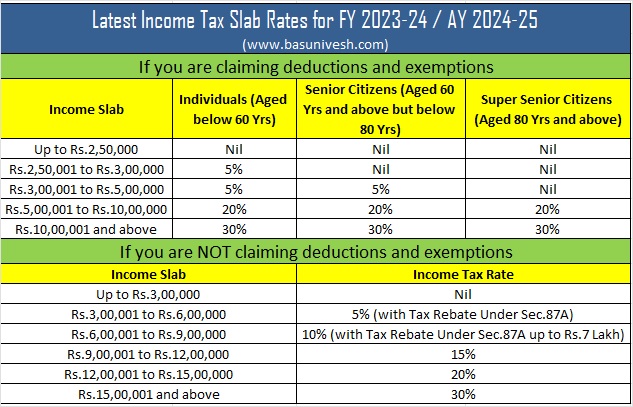

Revised Latest Income Tax Slab Rates FY 2023 24

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

Income Tax Exemptions For Salaried Employees 2021 22 Pdf - Find out the list of benefits available to a salaried person in India and save your tax legally