Income Tax Exemptions For Salaried Employees 2022 23 In India ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

97 rowsLearn about income tax benefits for salaried Updated on Jan 2nd 2024 14 min read New Tax Regime 2023 Check out here about all the frequently asked questions about new income tax regime 2023 slabs calculator

Income Tax Exemptions For Salaried Employees 2022 23 In India

Income Tax Exemptions For Salaried Employees 2022 23 In India

https://tax.net.pk/wp-content/uploads/2021/07/Updated-tax-exemptions-and-tax-credits.jpeg

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

https://fsconline.info/wp-content/uploads/2022/06/Govt-Announced-Seven-Slabs-for-Salaried-Class-in-Budget-2022-23.jpeg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

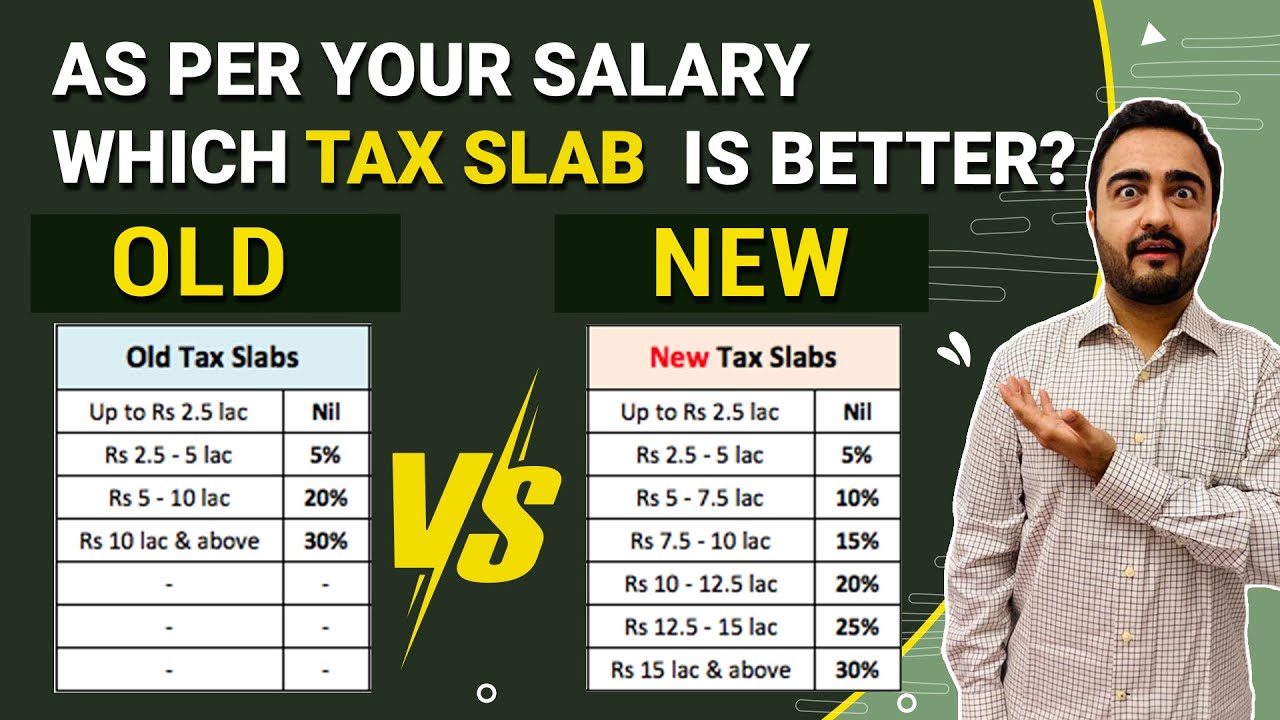

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5

The following are some of the most common income tax exemptions in India Table of Contents You may also like D ownload and Prepare at a time 50 Employees Form 16 Budget 2023 Update Till FY 2022 23 the limit of the standard deduction of Rs 50 000 was available only under the old regime As per Budget 2023 salaried

Download Income Tax Exemptions For Salaried Employees 2022 23 In India

More picture related to Income Tax Exemptions For Salaried Employees 2022 23 In India

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

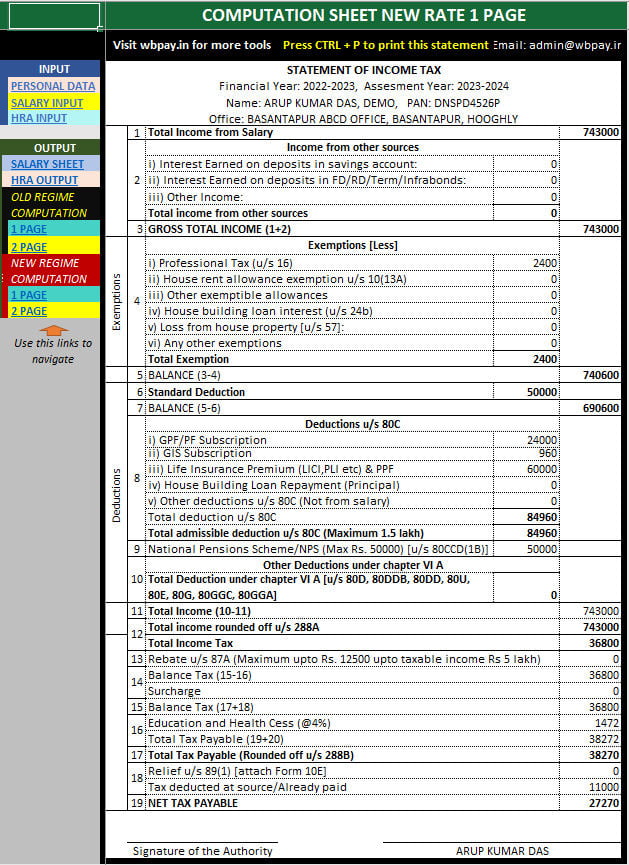

All In One Income Tax Calculator For The FY 2022 23

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

Income Tax Exemptions For Salaried Employees Business Times Of

https://timesofindia.indiatimes.com/photo/msid-65066913,imgsize-85689.cms

Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 16 Jan 2024 05 49 PM New Tax Regime Slabs Rates Exemptions Deductions Availability analysis The following are the income tax deductions applicable for both financial years 2022 23 and 2023 24 Salaried individuals opting for the new tax regime can avail of these benefits

New Income Tax Rules in India Applicable During FY 2022 23 May 26 2022Posted by India BriefingWritten by Naina BhardwajReading Time 6minutes We Income Tax Exemptions for Salaried Employees Instant Tax Receipt Top Tax Saving Plans 2024 You Invest 150 000 year Invest For 10 Years Age 30 Year Tax Saving 91 0 L

Tax Saving Guide 10 Smart Ways To Save Income Tax For Salaried Employees

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/07/20/986128-813334-saving-istock-041619.jpg

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c5e4dcf9aa033e3c571f177c87677452/thumb_1200_1698.png

https://www.incometax.gov.in/iec/foportal/help/...

ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

https://taxguru.in/income-tax/list-incom…

97 rowsLearn about income tax benefits for salaried

Income Tax Deduction From Salaries During The Financial Year 2022 23

Tax Saving Guide 10 Smart Ways To Save Income Tax For Salaried Employees

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Slab Rate 2021 2022 Tax Calculation For Salaried Person

Income Tax High Value Cash Transactions That Can Attract Income Tax Notice

New Income Tax Regime Salaried Employees

New Income Tax Regime Salaried Employees

Increased Limit For Tax Exemption On Leave Encashment For Non govt

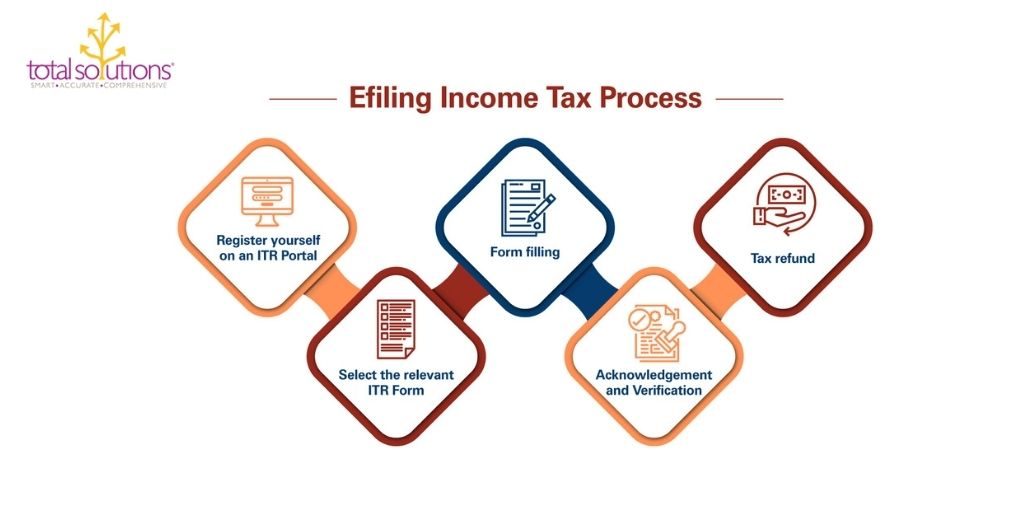

Easy Steps To File Income Tax Returns For Salaried Employees

Budget 2023 Those Earning Up To 7 Lakh A Year Need Not Pay Income

Income Tax Exemptions For Salaried Employees 2022 23 In India - The following are some of the most common income tax exemptions in India Table of Contents You may also like D ownload and Prepare at a time 50 Employees Form 16