Income Tax Exemptions For Salaried Employees 2024 25 97 rowsLearn about income tax benefits for salaried

In Budget 2023 the exemption threshold for leave encashment was increased 8 fold from 3 lakhs to 25 lakhs for non government employees Thus at the time of retirement Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

Income Tax Exemptions For Salaried Employees 2024 25

Income Tax Exemptions For Salaried Employees 2024 25

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/06/free-11-sample-employee-declaration-forms-in-pdf-excel-word-5.jpg

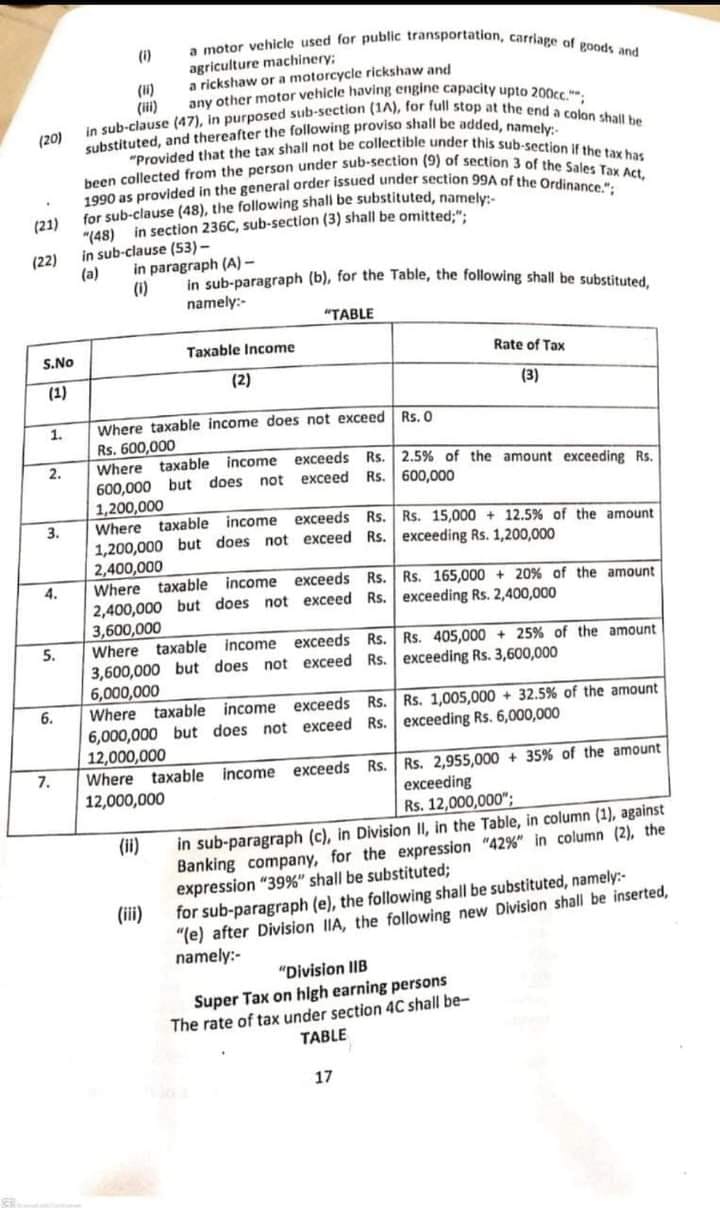

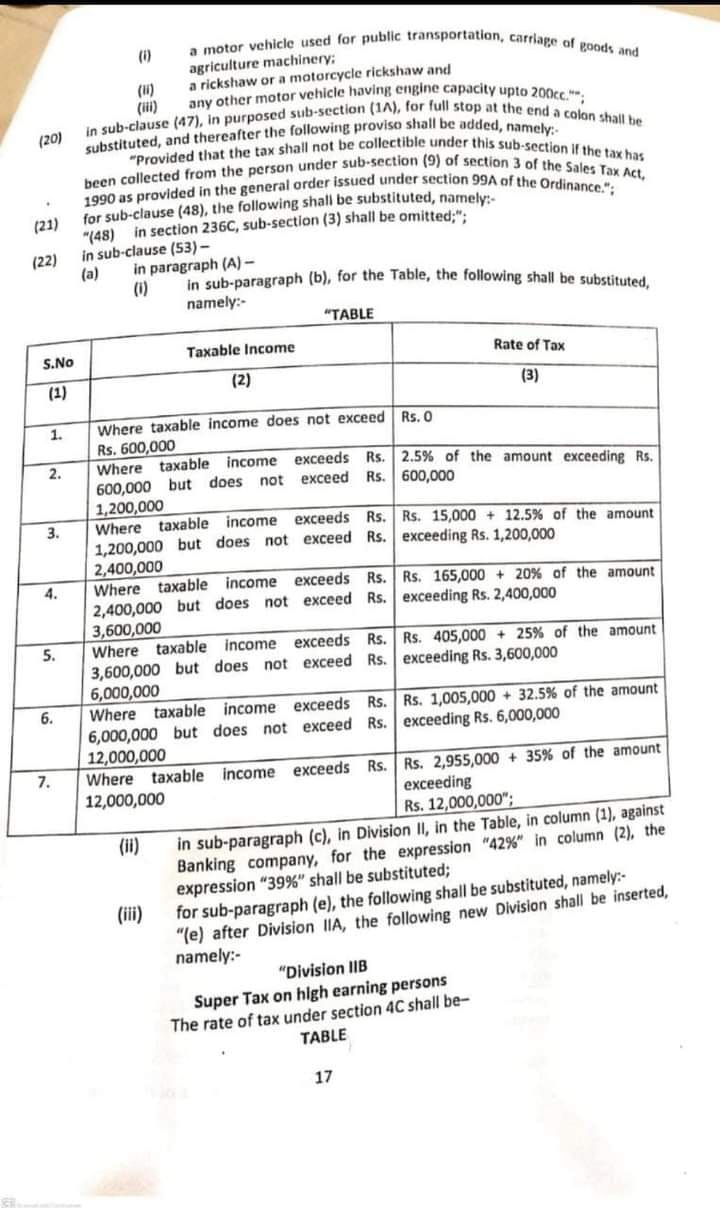

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Key Income Tax Exemptions Applicable To Salaried Individuals In FY 2023

https://anptaxcorp.com/wp-content/uploads/2024/01/image4567990ui879-768x508.jpg

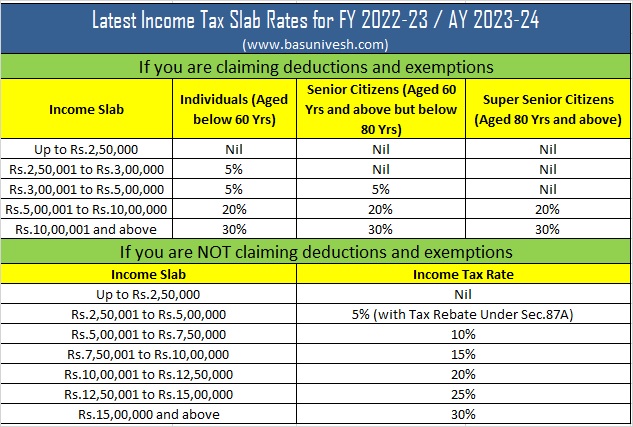

Latest income tax slabs for FY 2023 24 AY 2024 25 for salaried individuals and senior citizens by the IT department Discover the tax rates for both the new tax regime and the old tax regime For FY 2023 24 the default regime changed to the new tax regime now if you want to file the return under the old tax regime by claiming all the deductions

FY 2024 25 income tax rules remain unchanged Choose tax regime wisely for TDS consider basic exemption limits utilize tax rebates deductions and exemptions With the help of these deductions and exemptions one could reduce their tax substantially In this article we try to list some of the major deductions and allowances

Download Income Tax Exemptions For Salaried Employees 2024 25

More picture related to Income Tax Exemptions For Salaried Employees 2024 25

The Exempt Vs The Non Exempt Employees The Fair Labor Standards Act

https://wholeangel.files.wordpress.com/2021/07/exempt-vs-non-exempt-flsa.jpg?w=1024

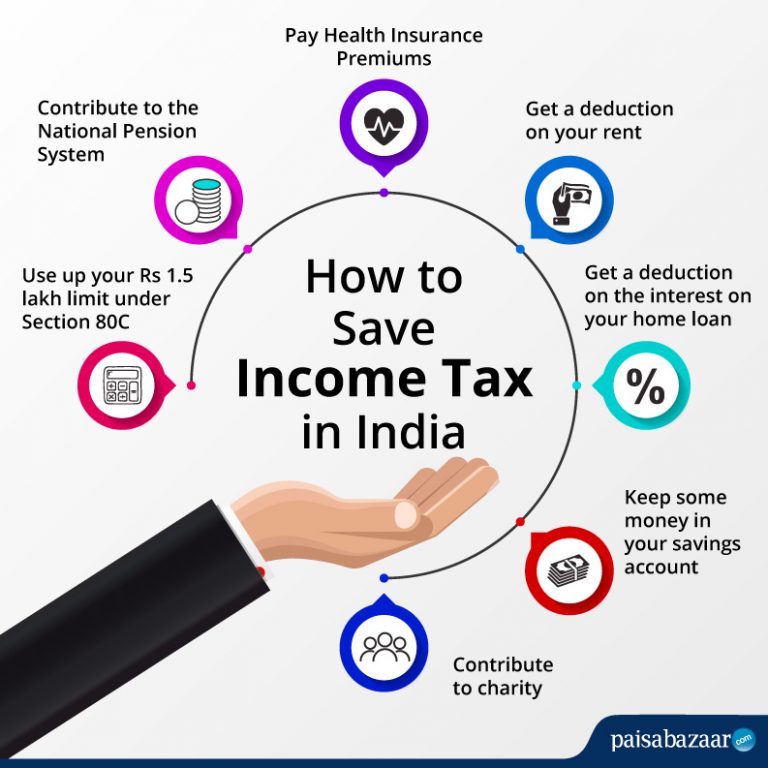

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/06/How-to-Save-Income-Tax-Photo-768x768.jpg

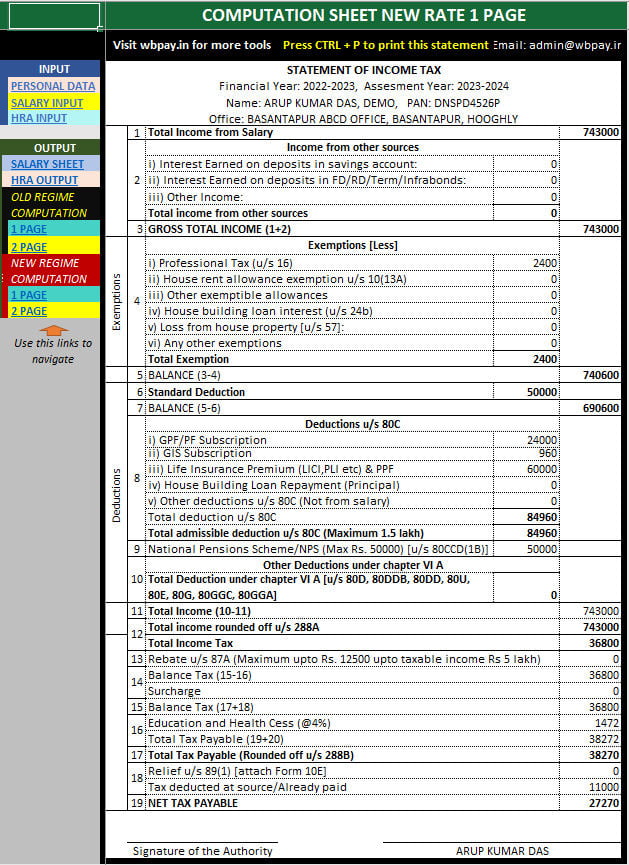

All In One Income Tax Calculator For The FY 2022 23

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is Income tax calculation for the Salaried Income from salary is the sum of Basic salary HRA Special Allowance Transport Allowance any other allowance Some components of your salary are exempt from tax

Calculate your Tax Burden for the F Y 2024 25 and A Y 2025 26 as per the Finance Budget 2024 by this Automatic Income Tax Calculator All in One in Excel for all Salaried In India income tax is calculated using income tax slabs and rates for the applicable financial year FY and assessment year AY For this year the financial year will be

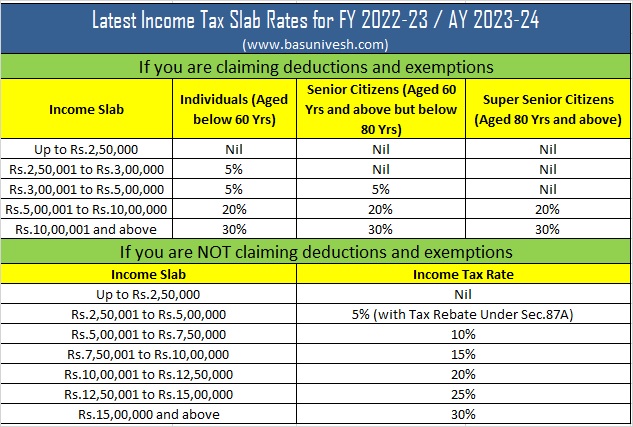

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

https://blog.saginfotech.com/wp-content/uploads/2022/02/income-tax-calculation-salaried-employee.jpg

https:// taxguru.in /income-tax/list-income-tax...

97 rowsLearn about income tax benefits for salaried

https:// cleartax.in /s/new-tax-regime-frequently-asked-questions

In Budget 2023 the exemption threshold for leave encashment was increased 8 fold from 3 lakhs to 25 lakhs for non government employees Thus at the time of retirement

Income Tax Exemptions For Salaried Employees 5min Guide

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

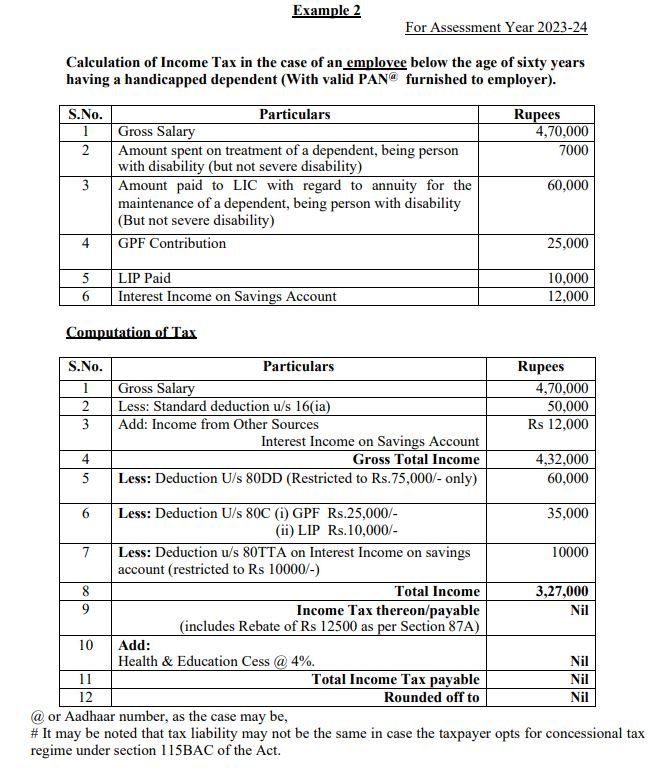

Income Tax Calculation Example 2 For Salary Employees 2023 24

8 Simple Tips For Salaried Employees To Gain Income Tax Exemptions

The Last Date For Filing Income Tax Returns ITR Extended Kanakkupillai

Income Tax Exemptions For Salaried Employees Business Times Of

Income Tax Exemptions For Salaried Employees Business Times Of

7 Useful Income Tax Exemptions For The Salaried Chandan Agarwal

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

Tax Planning Of Salaried Employees Goyal Mangal Company

Income Tax Exemptions For Salaried Employees 2024 25 - With the help of these deductions and exemptions one could reduce their tax substantially In this article we try to list some of the major deductions and allowances