Income Tax Filing Exemption Limit Details Verkko 20 marrask 2023 nbsp 0183 32 Instructions for filing the self employed These instructions describe what information a self employed individual must include in their tax return The self

Verkko The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Verkko 11 tammik 2023 nbsp 0183 32 The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income Tax Act talks about

Income Tax Filing Exemption Limit Details

Income Tax Filing Exemption Limit Details

https://www.thebuyt.com/wp-content/uploads/2021/11/filing-income-tax-return-scaled.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

![]()

Check Tax Documents Income Tax Filing refund And Payment Concept flat

https://static.vecteezy.com/system/resources/previews/013/259/794/original/check-tax-documents-income-tax-filing-refund-and-payment-concept-flat-design-icon-illustration-vector.jpg

Verkko The information on how much tax was paid to foreign countries is needed for the giving of relief for double taxation However if the category of income is tax exempt in Verkko According to Income Tax laws an Indian citizen must file an ITR only if his her taxable income exceeds the basic exemption limit In case the person s income falls below

Verkko 21 maalisk 2017 nbsp 0183 32 The foreign entity must pay income tax at the normal corporate tax rate which is 20 from 2014 Computations of taxable income are made using the Verkko 12 toukok 2023 nbsp 0183 32 Even on the tax front women enjoyed higher basic exemption limits as compared to men However from FY 2012 13 this system was abolished by the

Download Income Tax Filing Exemption Limit Details

More picture related to Income Tax Filing Exemption Limit Details

Tax Filing

https://uploads-ssl.webflow.com/619c430e4d10920d0cfbcaec/619c7330b263b653375b4f8f_Group 2199-p-1080.png

Tax Filing Status And Exemptions

http://blog.hubcfo.com/wp-content/uploads/2016/05/Tax-Filing-Status-Exemptions.png

Income Tax Filing At Best Price In New Delhi ID 2849250493533

https://5.imimg.com/data5/SELLER/Default/2022/12/SW/QO/WW/13558000/taxes-1000x1000.jpg

Verkko 22 hein 228 k 2022 nbsp 0183 32 Individual taxpayers whose accounts do not need to be audited have until July 31 2022 to file their ITR for the fiscal year 2021 22 AY 2022 23 If a Verkko 1 p 228 iv 228 sitten nbsp 0183 32 The annual tax free savings account contribution also rises from 6 500 in 2023 to 7 000 in 2024 The maximum insurable earnings ceiling for employment

Verkko 29 jouluk 2023 nbsp 0183 32 Impact If you opt for the new tax regime for FY2023 24 income tax return filing will not be mandatory if your gross taxable income does not exceed Rs 3 Verkko 14 jouluk 2023 nbsp 0183 32 Income tax law has prescribed a basic exemption limit for individuals upto which the taxpayers are not required to pay taxes Such a limit is different for

AY 2022 2023 Archives Income Tax Return

https://income-tax.co.in/wp-content/uploads/2021/07/income-tax-return-online.png

INCOME TAX FILING

https://atbsolutionsja.com/wp-content/uploads/2022/07/7.png

https://www.vero.fi/.../tax-return/instructions-for-filing

Verkko 20 marrask 2023 nbsp 0183 32 Instructions for filing the self employed These instructions describe what information a self employed individual must include in their tax return The self

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Verkko The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

The Latest Updates In Income Tax Filing What You Need To Know

AY 2022 2023 Archives Income Tax Return

Avoid These Common Mistakes In Filing Income Tax Returns Save More Money

E Filing Income Tax Return Service At Best Price In Gurgaon ID

Income Tax Return Filing Service Local Area B Tax Advisors ID

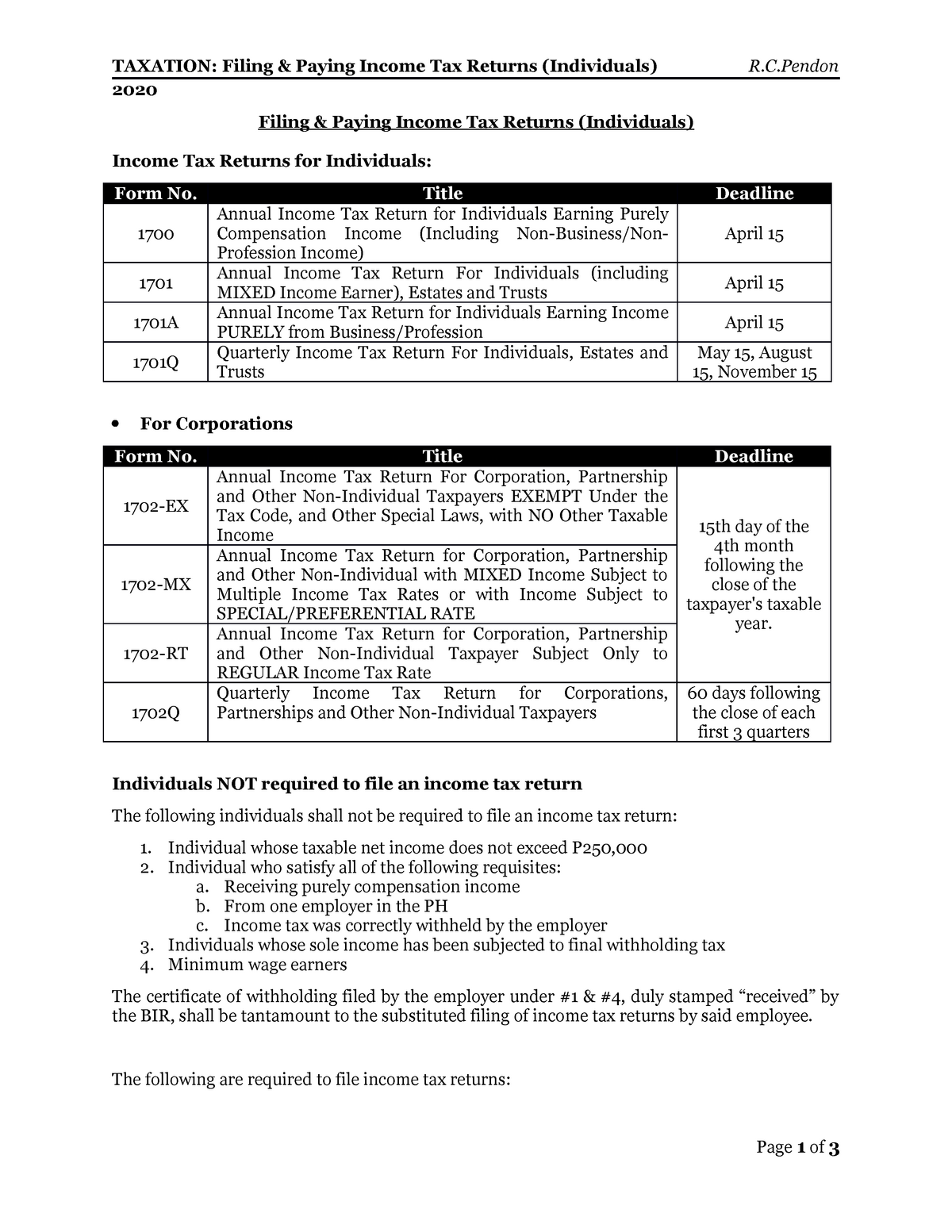

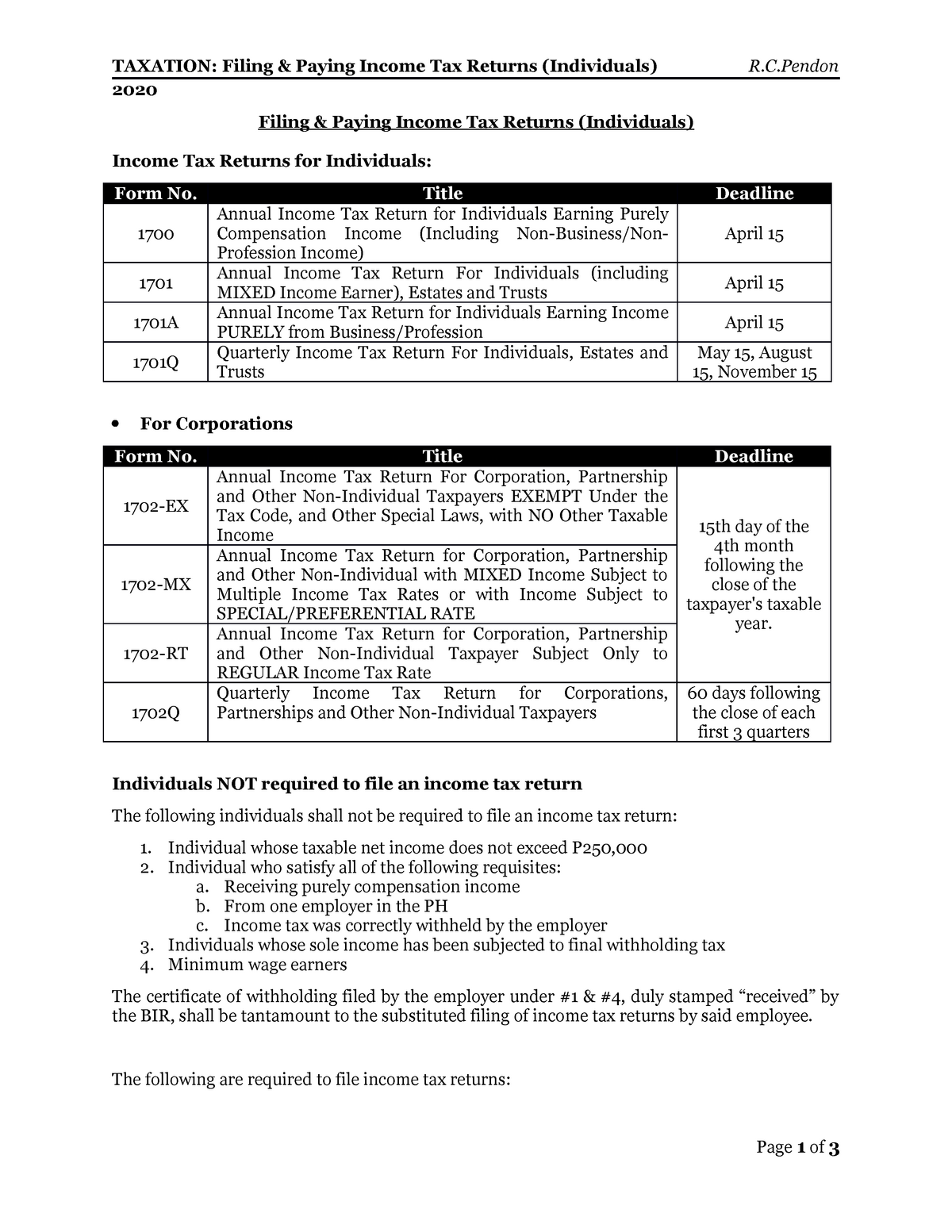

Income Tax Filing CORP TAXATION Filing Paying Income Tax Returns

Income Tax Filing CORP TAXATION Filing Paying Income Tax Returns

Sample Letter Exemption Doc Template PdfFiller

Income Tax Consultant At Rs 1000 session In Thrissur ID 27356721597

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Income Tax Filing Exemption Limit Details - Verkko 12 toukok 2023 nbsp 0183 32 Even on the tax front women enjoyed higher basic exemption limits as compared to men However from FY 2012 13 this system was abolished by the