Income Tax House Loan Interest Rebate Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

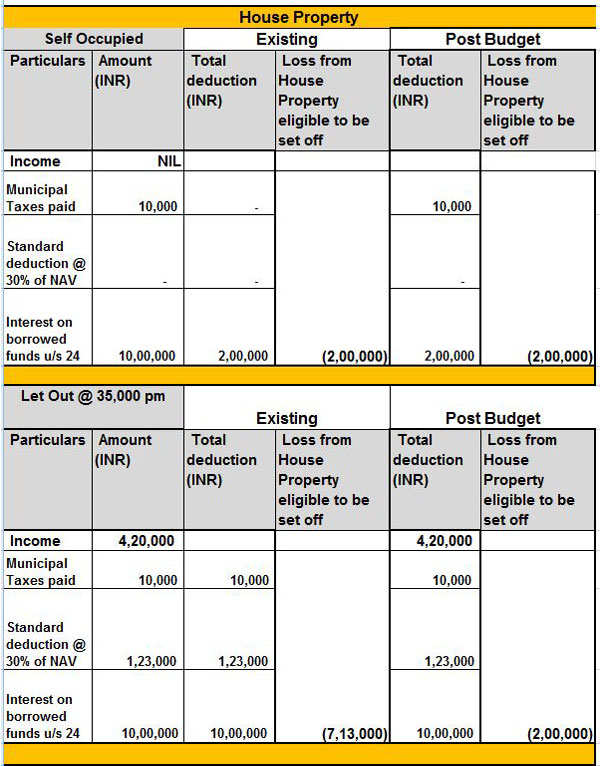

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 19 avr 2021 nbsp 0183 32 For interest on home loans the tax benefit is available under Section 24 b For a maximum of two self occupied properties taken together you can claim upto Rs 2

Income Tax House Loan Interest Rebate

Income Tax House Loan Interest Rebate

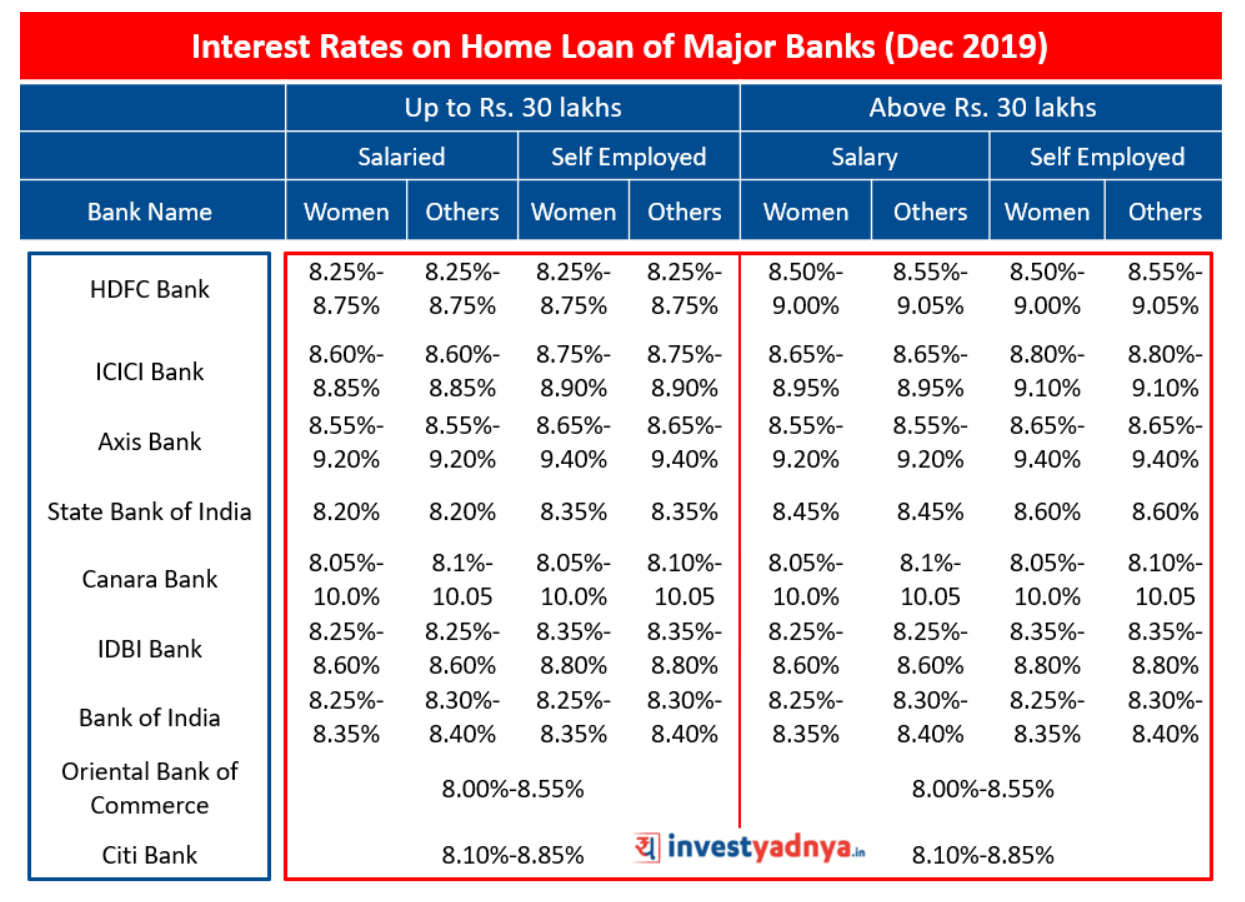

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

![]()

Section 24 Income Tax Benefit Of A Housing Loan OneMint

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

Web 9 f 233 vr 2018 nbsp 0183 32 Section 80EE Interest on Home Loan for first time home buyers If you are a first time home buyer you will be allowed an additional Rs 50 000 as a tax deduction This is for the interest paid on your Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Web 1 f 233 vr 2021 nbsp 0183 32 Like can both husband and wife claim income tax deduction for home loan repayment The answer is yes But with a condition The tax benefits for interest

Download Income Tax House Loan Interest Rebate

More picture related to Income Tax House Loan Interest Rebate

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

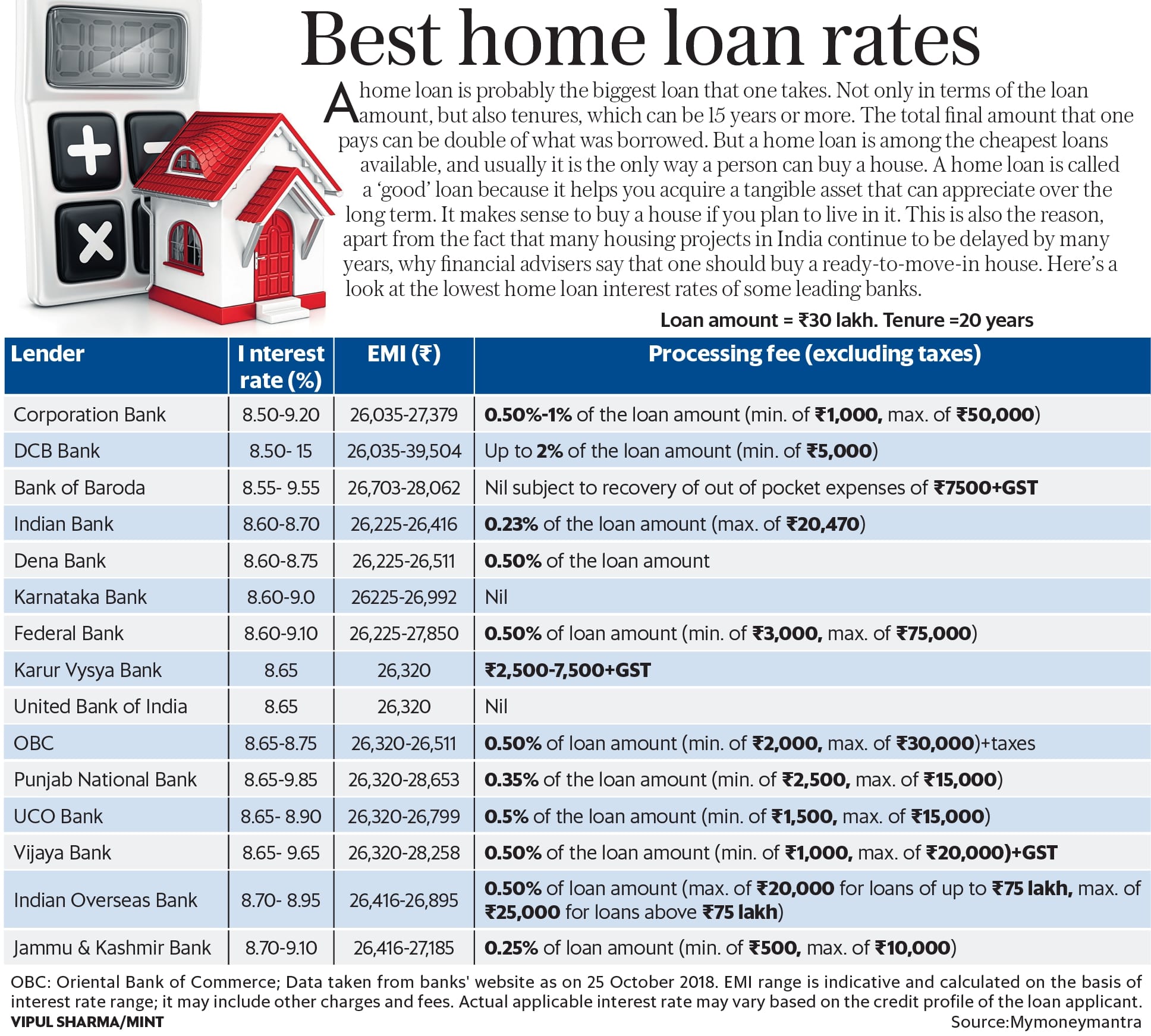

The Best Home Loan Rates Being Offered Right Now Livemint

https://www.livemint.com/r/LiveMint/Period2/2018/10/30/Photos/Processed/home_loan_interest rate.jpg

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income Web 20 juil 2023 nbsp 0183 32 A home loan borrower can claim only Rs 30 000 lakh as tax deduction against home loan interest payment if the loan has been taken for repairs and renovation work Deduction for interest on home loan

Web The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then Web 13 juin 2020 nbsp 0183 32 Interest Deduction Tax Exemption amp Rebate Updated on 13 Jun 2020 02 22 AM Interest Deduction On Rented House Property Income Tax Return

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

PNB Home Loan Interest Rates Are In The Range Of 8 65 To 9 25 With

https://i.pinimg.com/originals/7b/a3/fe/7ba3feb065678ed5eda4117d2f9de262.png

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Oct 2016 Best Home Loan Interest Rates In 2016

Home Loan Interest Exemption In Income Tax Home Sweet Home

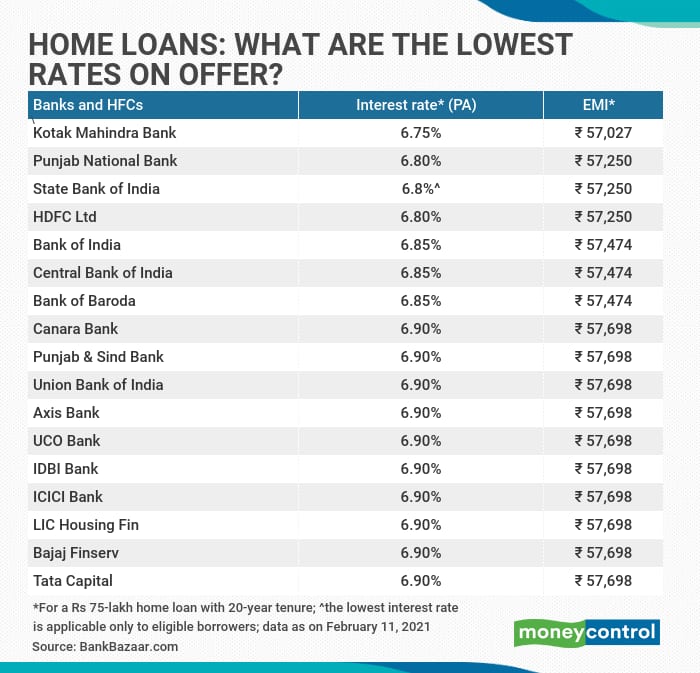

All You Need To Know About Low Interest Rates On Home Loans Kinta

Don t Just Consider The Interest Rates When Taking A Home Loan Mint

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Form 12BB New Form To Claim Income Tax Benefits Rebate

Form 12BB New Form To Claim Income Tax Benefits Rebate

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Home Loan Interest Rate Home Sweet Home Insurance Accident

Best Home Loan Interest Rates In India For Nri Home Sweet Home

Income Tax House Loan Interest Rebate - Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You