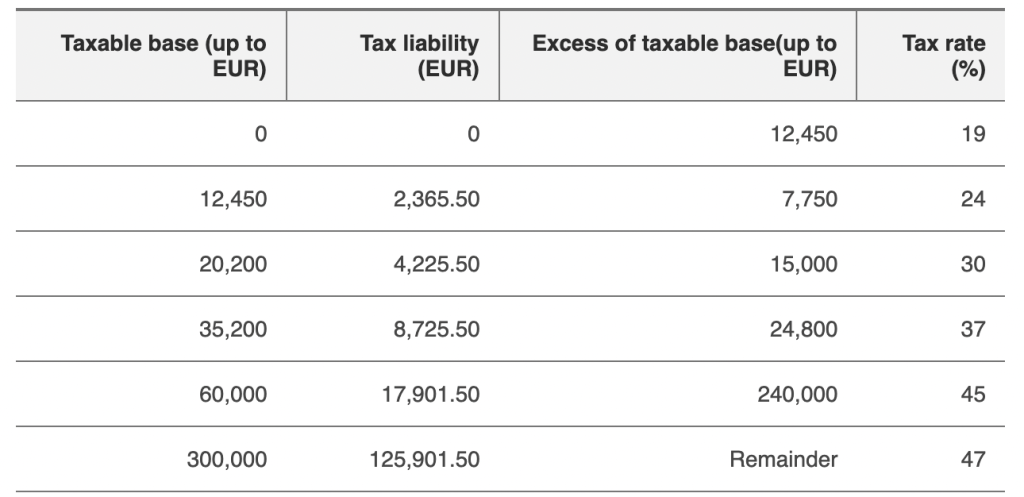

Income Tax In Spain Spanish income tax for incomes ranging from 35 201 to 60 000 37 Spanish income tax for incomes ranging from 60 000 to 300 000 45 Spanish income tax for incomes over 300 000 47 Always check with the local Comunidades Autonomas before making any assumption about the regional rate Spanish tax

Employees on assignment in Spain pay a 24 tax rate on income up to 600 000 Rules brought in in 2021 saw the government increase the tax rate on income exceeding 600 000 to 47 Additionally posted employees now pay a 3 tax on income above 200 000 that is generated from dividends interest or capital gains The income tax also called IRPF impuesto sobre la renta de las personas f sicas in Spanish is a direct tax applied to the difference between the incomes earned by an individual minus the expenses that can be deductible according to the Spanish tax system

Income Tax In Spain

Income Tax In Spain

https://axis-finance.com/wp-content/uploads/2015/10/Spanish-income-tax-chart.png

Tax Rate In Spain For An Individual Know Complete Overview

https://fxreviews.best/wp-content/uploads/2020/09/taxpratespai-2048x956.jpg

How To Pay Tax In Spain And What Is The Tax Free Allowance

https://images.ctfassets.net/qr8kennq1pom/5eRum50dCb1aDhd3CFt9Be/2fa529cdc5b986046ff94babc6bc84dd/Spain_wealth_tax_rate_2022.png?fm=jpg&fl=progressive&q=70&w=1680

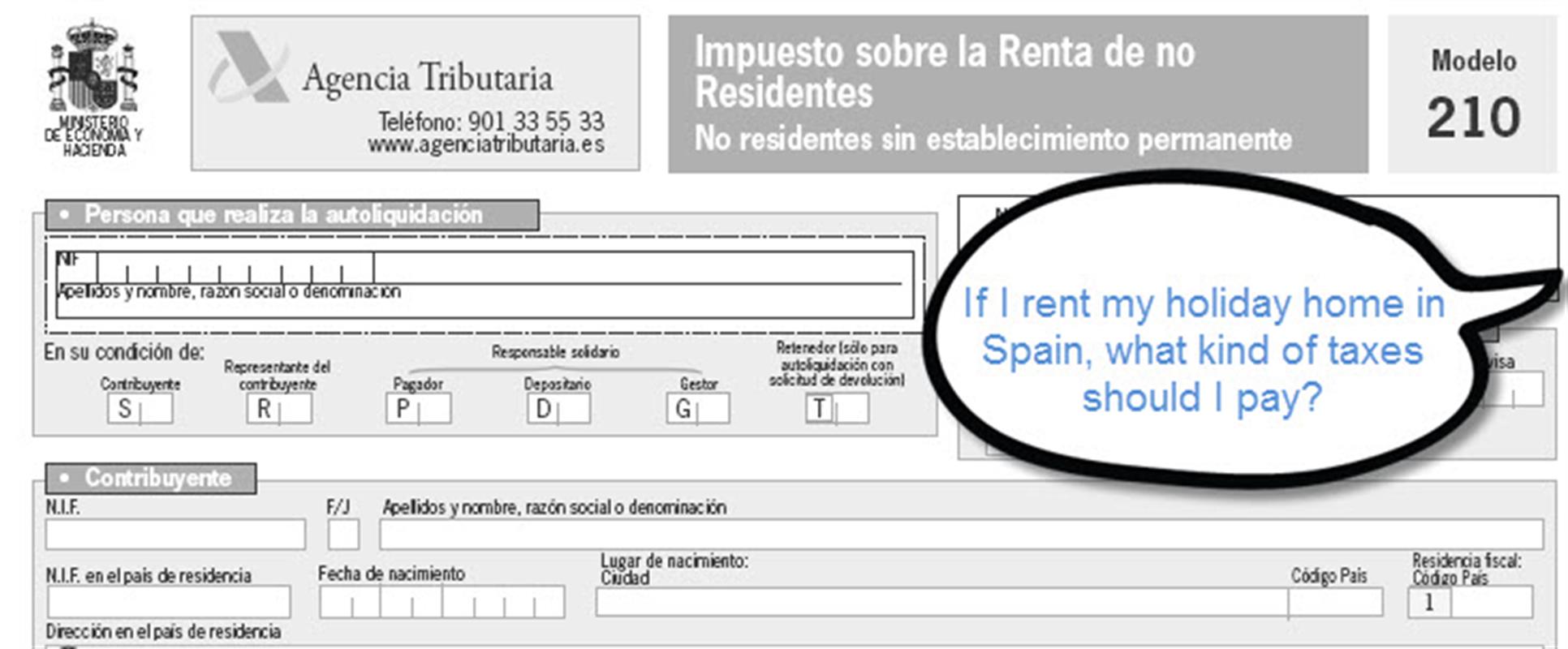

Your Spanish income will be taxed at flat rates with no allowances or deductions The rates are 24 or 19 if you are a citizen of an EU EEA state Non residents with a property in Spain must submit a tax return and pay a property tax for non residents This is what s known as imputed income tax on your property Personal income tax in Spain or Impuesto de Renta sobre las Personas F sicas IRPF is a direct tax on an individuals personal income It is not the same as corporate income tax Spanish personal income taxes are divided between the state and the autonomous regions

2022 Income Tax Campaign Access all the information and procedures for completing and filing your 2022 income tax return Latest updates on Income Tax Find out about the changes in the Personal Income Tax regulations and the new INFORMA references Mutualists return requests Access all the information and procedures to request your Income Tax Taxes in Spain Bands and allowances Spanish income tax rates Making your resident tax declaration Non resident Taxes in Spain Other Taxes in Spain Inheritance tax in Spain Capital gains tax in Spain when selling your property IVA or VAT in Spain Wealth tax in Spain Free consultation about your taxes in Spain

Download Income Tax In Spain

More picture related to Income Tax In Spain

Taxes In Spain What You Need To Know About Taxes In Spain

https://sirelo.co.uk/wp-content/uploads/2017/02/Taxes-in-Spain.png

Income Tax Bands Self Employed In Spain

https://i1.wp.com/selfemployedinspain.com/wp-content/uploads/2015/01/income-tax-spain-2015-2016.png

Expat Taxes In Spain 2023 Non Resident Tax Rates Spain

https://www.myspanishresidency.com/wp-content/uploads/2022/01/Screenshot-2022-01-05-at-18.58.37-1024x497.png

2 Income Tax In Spain 2 1 Savings Tax To Be Increased 3 Residents And Non Residents Must Register To Pay Spanish Taxes 4 Filing Your Spanish Tax Return 4 1 Filing US Taxes From Spain 5 Spanish Taxes For Non Residents 5 1 Foreigners Working On Assignments In Spain Are Subject To A Special Tax 6 Spanish Tax Deductions And For expats living under the Iberian sun our guide to income tax in Spain will help you file your Spanish tax return without stress in 2023

[desc-10] [desc-11]

Income Tax In Spain Exact Percentages Allowances

https://balcellsgroup.com/wp-content/uploads/2019/06/capital-gains-tax.png

Spain Personal Income Tax Rate 2024 Take profit

https://img.take-profit.org/graphs/indicatorspresident/14/1406/felipe-gonzalez-spain-personal-income-tax-rate-1982-1996.png

https://www.expertsforexpats.com/country/spain/tax/taxes-in-spain

Spanish income tax for incomes ranging from 35 201 to 60 000 37 Spanish income tax for incomes ranging from 60 000 to 300 000 45 Spanish income tax for incomes over 300 000 47 Always check with the local Comunidades Autonomas before making any assumption about the regional rate Spanish tax

https://www.expatica.com/es/finance/taxes/taxes-in-spain-471614

Employees on assignment in Spain pay a 24 tax rate on income up to 600 000 Rules brought in in 2021 saw the government increase the tax rate on income exceeding 600 000 to 47 Additionally posted employees now pay a 3 tax on income above 200 000 that is generated from dividends interest or capital gains

Income And Wealth Tax For Non Resident In Spain YouTube

Income Tax In Spain Exact Percentages Allowances

Income Tax Return In Spain Limit Consulting

Income And Wealth Tax For Residents In Spain JF B Lawyers

Tax In Spain Issues You Need To Be Aware Of Axis finance

2019 Taxes In Spain For Expats All The Taxes You Will Need To Pay

2019 Taxes In Spain For Expats All The Taxes You Will Need To Pay

Do I Have To File Income Tax Returns In Spain Expat Agency

Tax Return 2018 Holiday Rentals income Tax In Spain

Do I Have To File Income Tax Returns In Spain Expat Agency

Income Tax In Spain - Income Tax Taxes in Spain Bands and allowances Spanish income tax rates Making your resident tax declaration Non resident Taxes in Spain Other Taxes in Spain Inheritance tax in Spain Capital gains tax in Spain when selling your property IVA or VAT in Spain Wealth tax in Spain Free consultation about your taxes in Spain