Income Tax Incentive Rebate Web 13 ao 251 t 2022 nbsp 0183 32 In all consumers may qualify for up to 10 000 or more in tax breaks and rebates depending on the scope of their purchases The legislation is a win for

Web We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021 Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll

Income Tax Incentive Rebate

Income Tax Incentive Rebate

https://doubxab0r1mke.cloudfront.net/media/zfront/production/images/tax-incentives.width-800.png

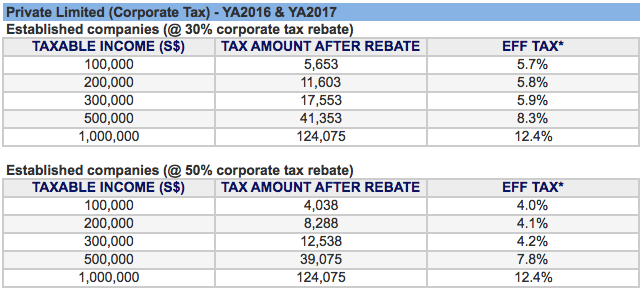

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

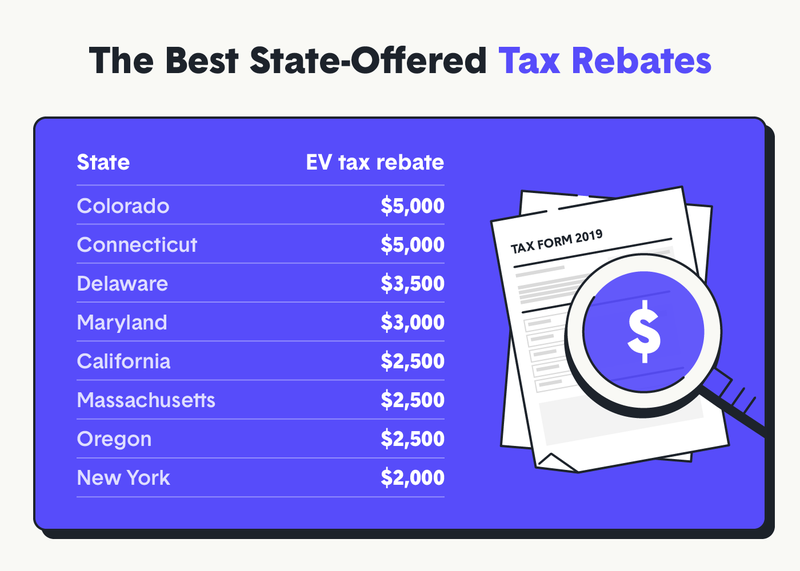

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to reduce their Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 22 ao 251 t 2022 nbsp 0183 32 A new state program for whole home energy efficiency retrofit projects will provide rebates of up to 4 000 for retrofits that will save 35 of energy use or more and 2 000 for retrofits that achieve savings Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Download Income Tax Incentive Rebate

More picture related to Income Tax Incentive Rebate

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

How To Solve For Income Tax Amy Fleishman s Math Problems

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Web 1 sept 2023 nbsp 0183 32 Inflation Reduction Act of 2022 Espa 241 ol The Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to

Web 20 juil 2023 nbsp 0183 32 The High Efficiency Electric Home Rebate Act HEEHRA offers low to medium income families as much as 14 000 per year in point of sale discounts for Web 9 sept 2022 nbsp 0183 32 The per household rebate is capped at 14 000 and households can t receive two rebates for the same upgrade For instance if they claim a HOMES Rebate

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://www.cnbc.com/2022/08/13/how-to-qualify-for-inflation-reduction...

Web 13 ao 251 t 2022 nbsp 0183 32 In all consumers may qualify for up to 10 000 or more in tax breaks and rebates depending on the scope of their purchases The legislation is a win for

https://www.irs.gov/corona

Web We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Income Tax Rebate Formula In Excel Printable Rebate Form

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

P55 Tax Rebate Form Business Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

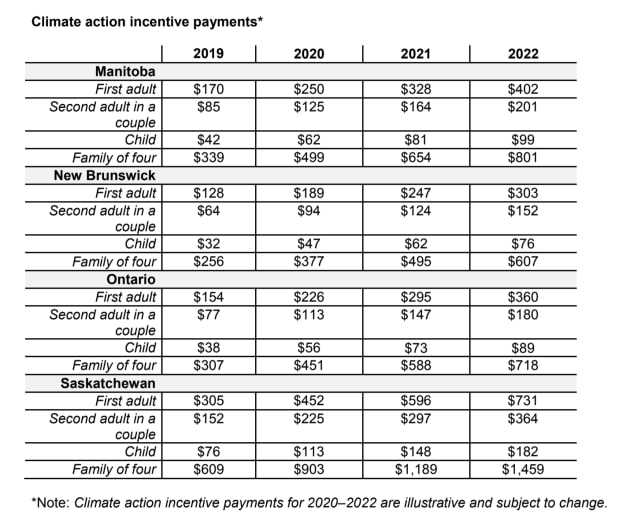

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Income Tax Deductions List FY 2019 20

Tax Rebate Checks Come Early This Year Yonkers Times

Income Tax Incentive Rebate - Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for