Income Tax Italy 2022 The main income tax levied on individuals is the personal income tax PIT also known as the Imposta sui redditi delle persone fisiche IRPEF In Italy the

Here are the new income brackets and rates in Italy in 2022 1st income bracket income between 0 and 15 000 euros The IRPEF rate is 23 As an example The Income tax rates and personal allowances in Italy are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include

Income Tax Italy 2022

Income Tax Italy 2022

https://www.worldwide-tax.com/italy/images/0018.jpg

Income Tax Hello

https://static.india.com/wp-content/uploads/2022/07/income-tax.png

INCOME TAX RATE IN ITALY 2020 GUIDE FOR FOREIGNERS Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/the-management-is-checking-the-accuracy-of-the-com-crw4jbl_orig-1024x681.jpg

How and when to file a tax return Latest update 06 03 2024 Natural persons file a tax return using form REDDITI PF or form 730 depending on the type of income The Italian tax system provides the six following categories of income Employment income Business income Self employment income Real estate

These are the personal income tax rates that apply before 1 January 2022 For applicable rates after that date please click this link FY 2021 Rates of Italian Income Tax based Italian income tax imposta sul reddito delle persone fisiche IRPEF is a progressive tax payable on earnings from employment and self employment Rates

Download Income Tax Italy 2022

More picture related to Income Tax Italy 2022

Income Tax Italy Tysma Lems

https://www.tysmalems.com/cache/ze/incometaxitaly.jpg

Income Tax Elimination Institute For Reforming Government

https://reforminggovernment.org/wp-content/uploads/2021/12/[email protected]

Important Tax Benefits To Know Before Renovating In Italy

https://www.italyirl.com/wp-content/uploads/2023/03/TaxBenefits.jpg

These are the personal income tax rates that apply from 1 January 2022 to 31 December 2023 For applicable rates before FY 2022 please click this link For applicable rates Personal income tax rates and relief Latest update 12 12 2020 For non national pensioners the standard progressive taxation with the relevant rates applies to

Our expat guide to income tax in Italy including income tax brackets income tax reduction and credits and how to pay income tax if you are self employed Learn how to file your income tax in Italy who needs to pay it and what happens if you don t do it on time

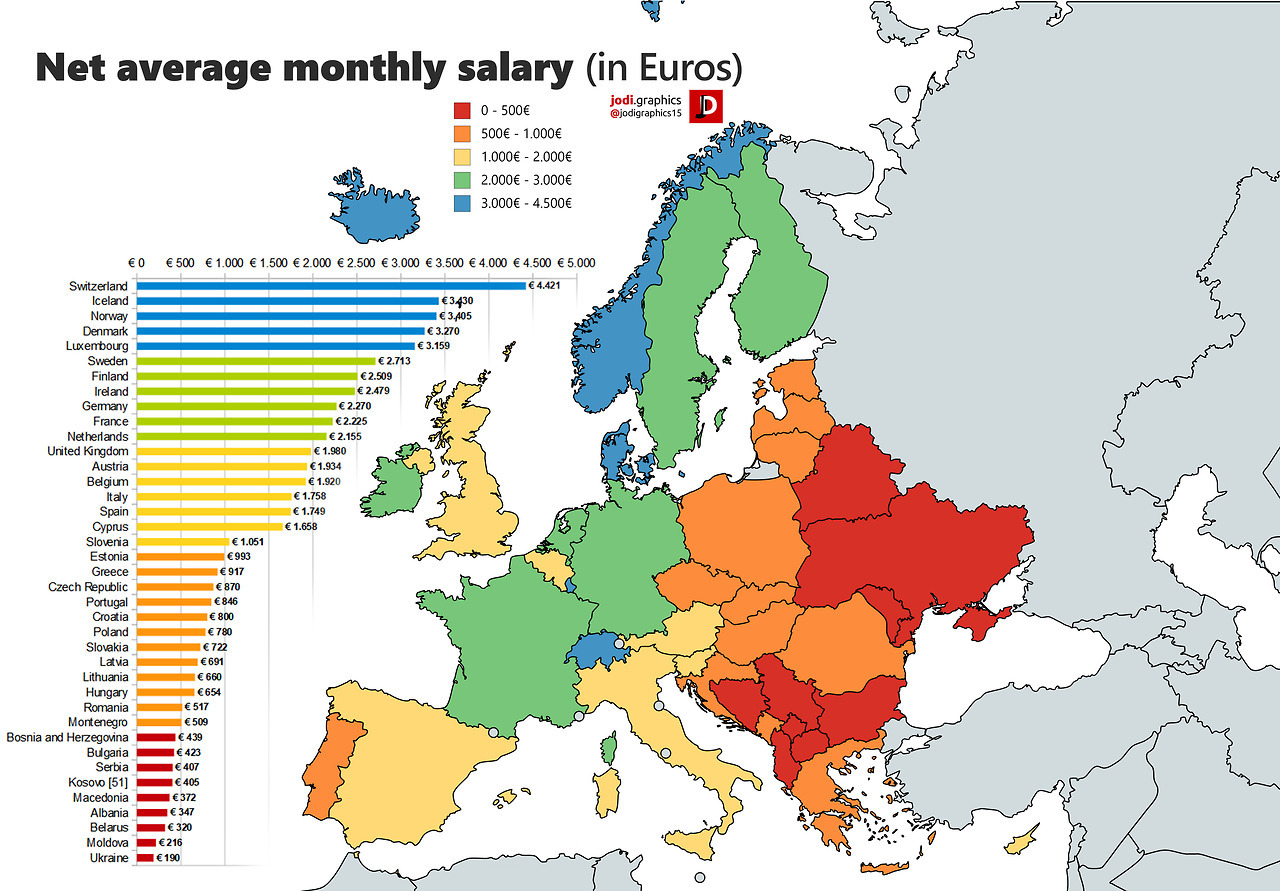

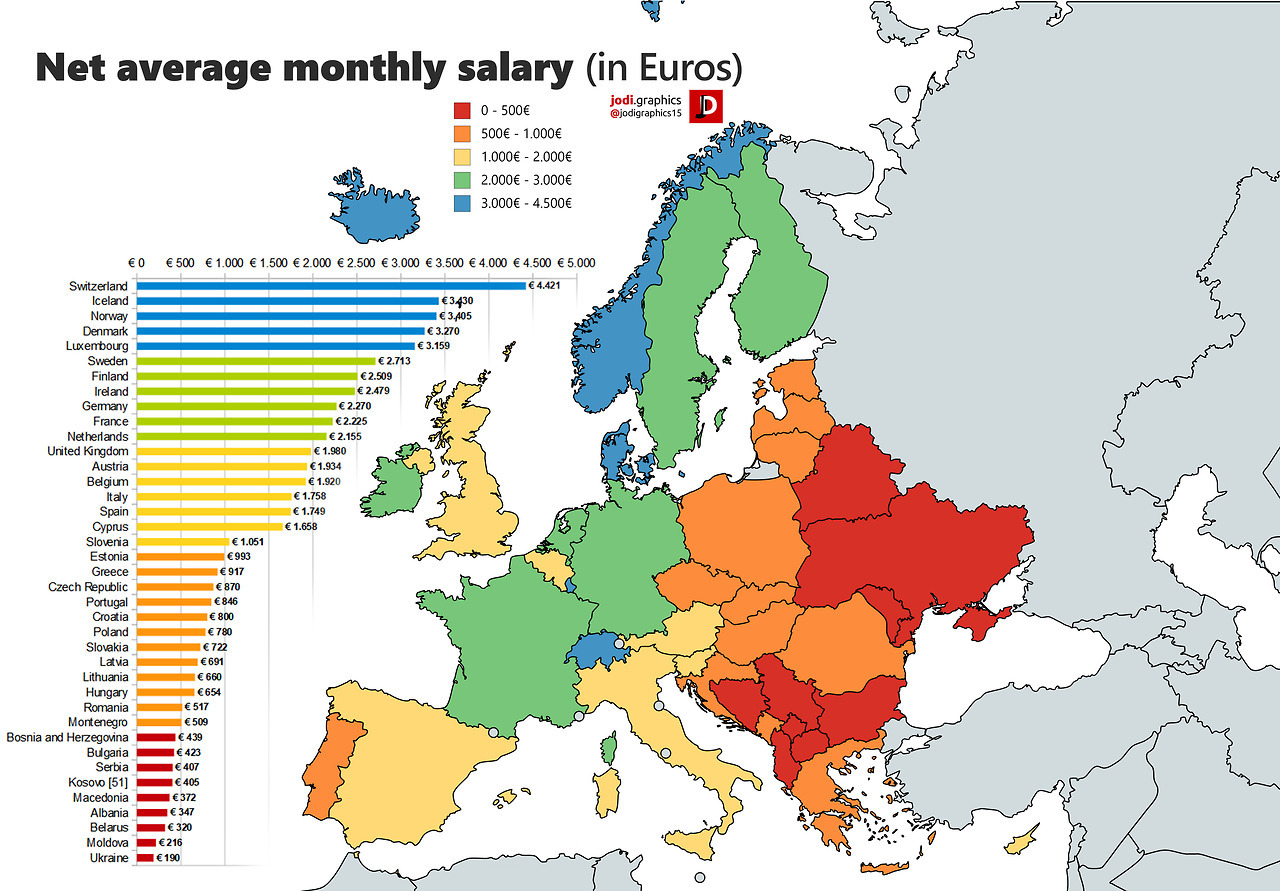

Net Average Monthly Salary In European Countries Maps On The Web

https://64.media.tumblr.com/9741b27e2bd9a409fe86140fe2a46fa1/tumblr_p070coplEo1rasnq9o1_r1_1280.jpg

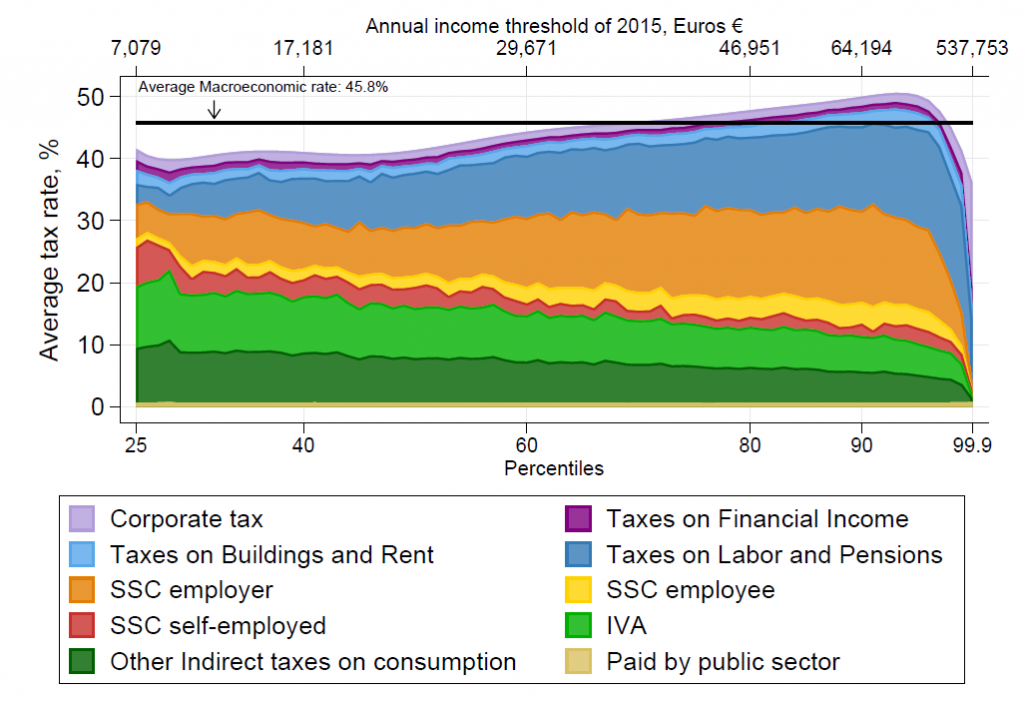

Income Inequality In Italy And Tax Policy Implications WID World

https://wid.world/wp-content/uploads/2022/02/TaxRateIncomePercentile_NT-1024x708.png

https://taxsummaries.pwc.com/italy/individual/...

The main income tax levied on individuals is the personal income tax PIT also known as the Imposta sui redditi delle persone fisiche IRPEF In Italy the

https://www.idealista.it/en/news/financial-advice...

Here are the new income brackets and rates in Italy in 2022 1st income bracket income between 0 and 15 000 euros The IRPEF rate is 23 As an example

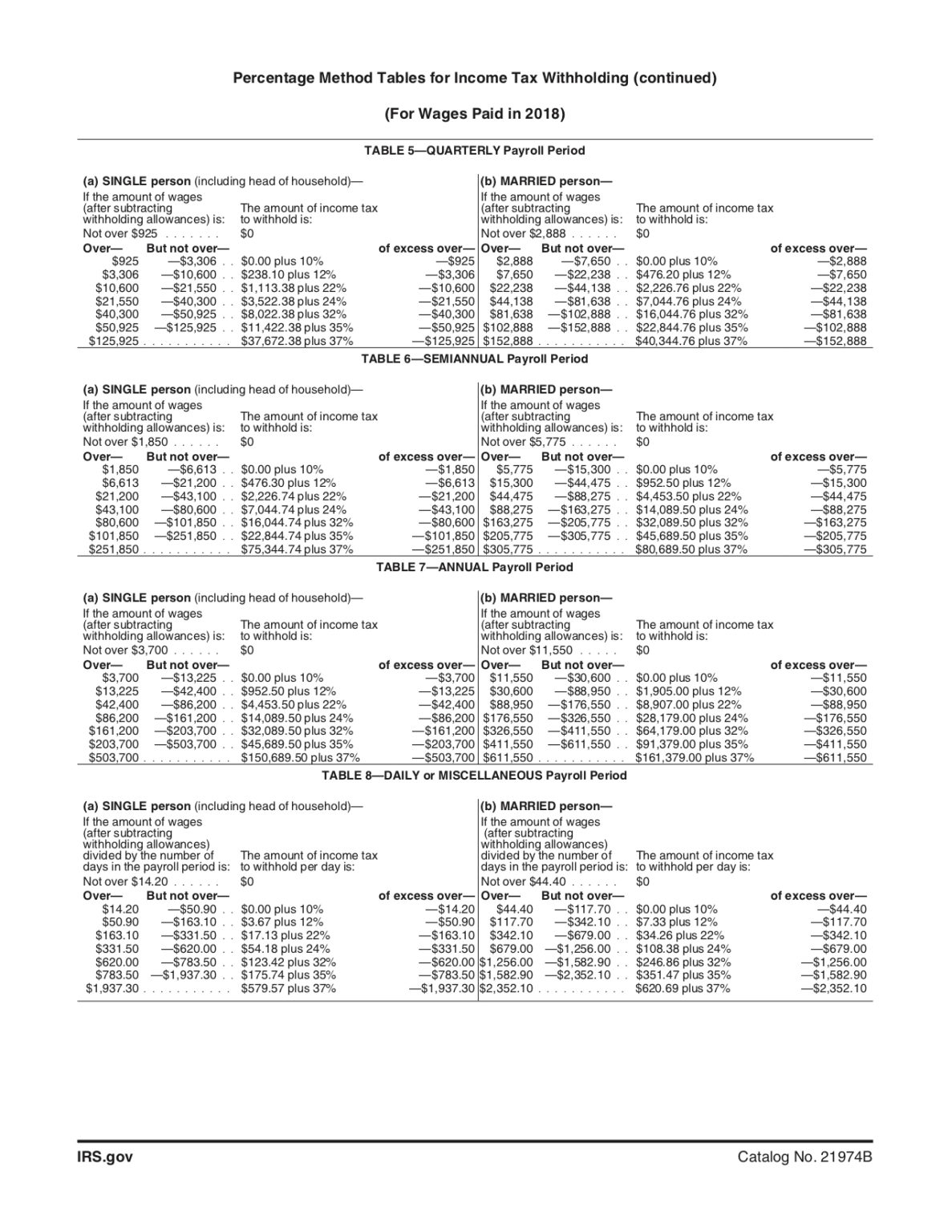

Income Tax Statistics 2023 Tax Brackets USA UK And More

Net Average Monthly Salary In European Countries Maps On The Web

How To Compute Income Tax On Salary Kanakkupillai

Missouri Income Tax Withholding Tables 2020 Federal Withholding

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.39.54AM-4a117e7e494c422ca6480746c97612a8.png)

Fillable Form 13 1 Financial Statement Printable Forms Free Online

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.39.54AM-4a117e7e494c422ca6480746c97612a8.png)

Fillable Form 13 1 Financial Statement Printable Forms Free Online

Income Tax Rates Free Of Charge Creative Commons Green Highway Sign Image

Income Tax New Slab Rate 2020 21 India Ka Budget 2020 21

Tax Table Internal Revenue Code Sales Revenue Net Income Tax

Income Tax Italy 2022 - If you reside in Italy we ve got great news in 2022 you may benefit from a tax cut The tax reduction legislation written up by the Draghi government calls for the lowering of