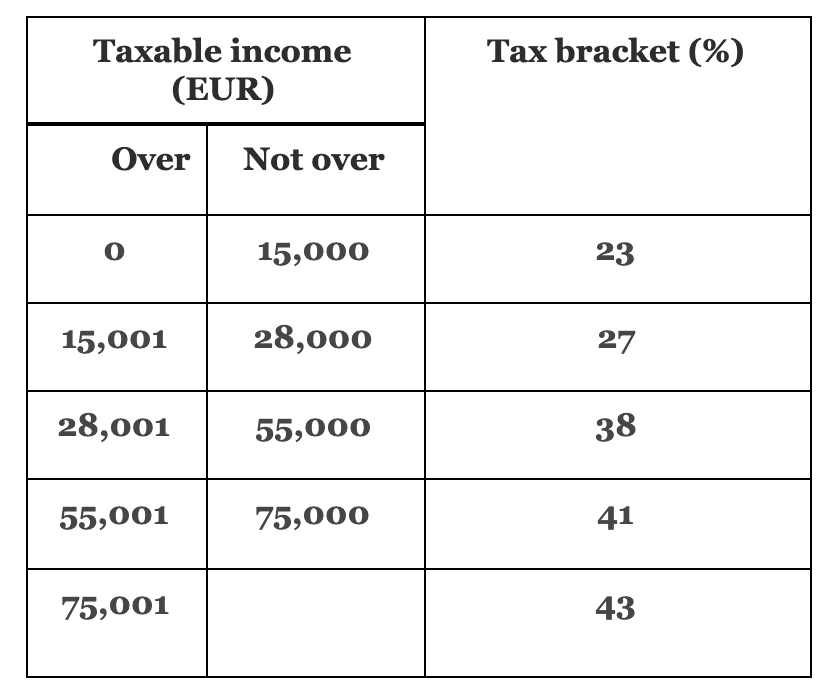

Income Tax Italy Personal income tax rates and calculation Latest update 23 01 2024 Personal income tax applies to an individual s total income Gross tax is calculated by applying the rates per bracket to total income net of deductible expenses

Italian income tax rates for tax years 2023 and 2024 Once you become an Italian tax resident your worldwide income will be taxed at the following rates You may also be subject to a regional tax between 1 23 and 3 33 as well as a municipal tax up to 0 9 depending on where you live in Italy Personal Income Tax Irpef General rules for individuals How and when to file a tax return Latest update 06 03 2024 Natural persons file a tax return using form REDDITI PF or form 730 depending on the type of income Employees and retirees who have income from employment a pension and some other sources may submit form 730

Income Tax Italy

Income Tax Italy

https://www.worldwide-tax.com/italy/images/0029.jpg

Italy Tax Exempt Income 2023 Italy Taxes Italy Income Tax Italy Tax

https://www.worldwide-tax.com/italy/images/0018.jpg

Income Tax Italy Tysma Lems

https://www.tysmalems.com/cache/ze/incometaxitaly.jpg

Income tax in Italy is called imposta sul reddito delle persone fisiche IRPEF It applies to earnings from employment pensions and investment dividends It is also affects three distinct forms of income Employment income Workers in Italy pay income tax on their earnings Rates are charged across three bands ranging from 23 to 43 The Italian tax system provides the six following categories of income Employment income Business income Self employment income Real estate income Investment income Capital gains The gross taxable income is determined by the sum of the taxable incomes of the above categories subject to ordinary taxation

Italian income tax imposta sul reddito delle persone fisiche IRPEF is a progressive tax payable on earnings from employment and self employment Rates range from 23 to 43 depending on your earnings Italian income tax rates Income between 0 and 15 000 23 15 000 28 000 25 28 000 50 000 35 50 000 and over 43 Regional tax ranges from 0 9 to 1 4 and a minor local tax ranges from 0 1 to 0 8 of gross income

Download Income Tax Italy

More picture related to Income Tax Italy

Italy Banks And Banking Sites 2023 Italy Income Tax Italy Tax Rates

https://www.worldwide-tax.com/italy/images/0031.jpg

Italy Exchange Rates 2023 Italy Taxes Italy Income Tax Italy Tax Rates

https://www.worldwide-tax.com/italy/images/0013.jpg

Italy Personal Income Tax Rate 1995 2018 Data Chart Calendar

https://d3fy651gv2fhd3.cloudfront.net/charts/italy-personal-income-tax-rate.png?s=itairstax&v=201707031823v

Personal income tax rates and relief Latest update 12 12 2020 For non national pensioners the standard progressive taxation with the relevant rates applies to income generated in Italy Italian individual income tax is called impostasulredditodellepersonefisiche or IRPEF Tax rates are progressive and range from 23 to 43 Additional taxes are due at the regional 0 9 to 1 4 and local 0 1 to 0 8 levels

[desc-10] [desc-11]

Taxes In Italy 2023 A Complete Guide Clear Finances

https://www.clearfinances.net/wp-content/uploads/2021/04/Taxes-in-Italy.png

Income Tax In Italy

https://lawyersitaly.eu/wp-content/uploads/2023/03/income-tax-in-italy1-480x1200.png

https://www.agenziaentrate.gov.it/portale/web/...

Personal income tax rates and calculation Latest update 23 01 2024 Personal income tax applies to an individual s total income Gross tax is calculated by applying the rates per bracket to total income net of deductible expenses

https://www.expertsforexpats.com/country/italy/...

Italian income tax rates for tax years 2023 and 2024 Once you become an Italian tax resident your worldwide income will be taxed at the following rates You may also be subject to a regional tax between 1 23 and 3 33 as well as a municipal tax up to 0 9 depending on where you live in Italy

Income Tax Exemption In Italy For Expats Its The Journey That Matters

Taxes In Italy 2023 A Complete Guide Clear Finances

Income Tax Relief For Residents Working In Italy

INCOME TAX RATE IN ITALY 2020 GUIDE FOR FOREIGNERS Accounting Bolla

Paying 2017 2018 Income Tax In Italy Read This Wise

Italy Car Rental Companies Rent A Car In Italy Italy Income Tax Italy

Italy Car Rental Companies Rent A Car In Italy Italy Income Tax Italy

Income Tax Hello

Business Income Tax In Italy Residence For Tax Purposes The Factual

Income Tax In Italy Italy Guide Expat

Income Tax Italy - The Italian tax system provides the six following categories of income Employment income Business income Self employment income Real estate income Investment income Capital gains The gross taxable income is determined by the sum of the taxable incomes of the above categories subject to ordinary taxation