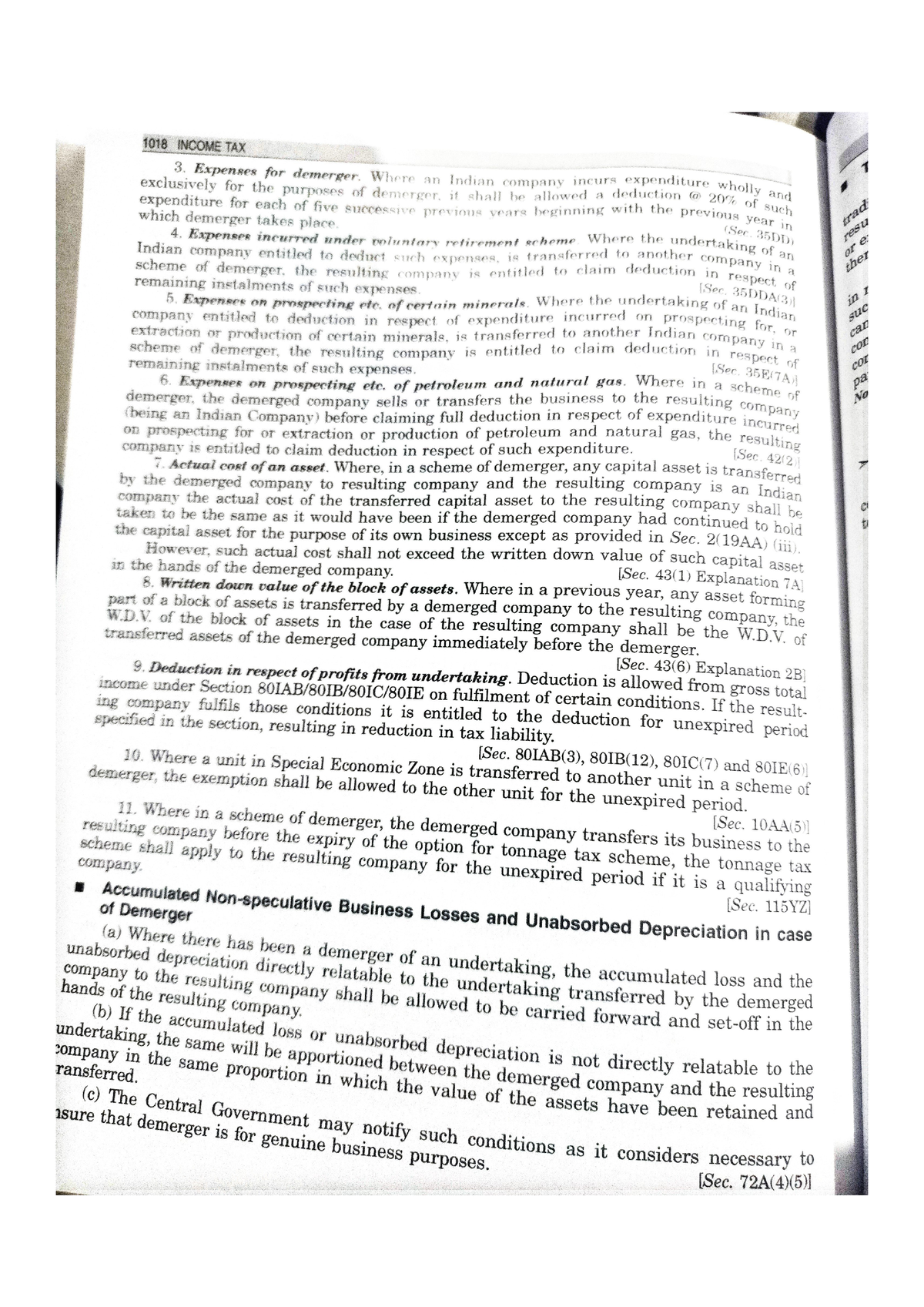

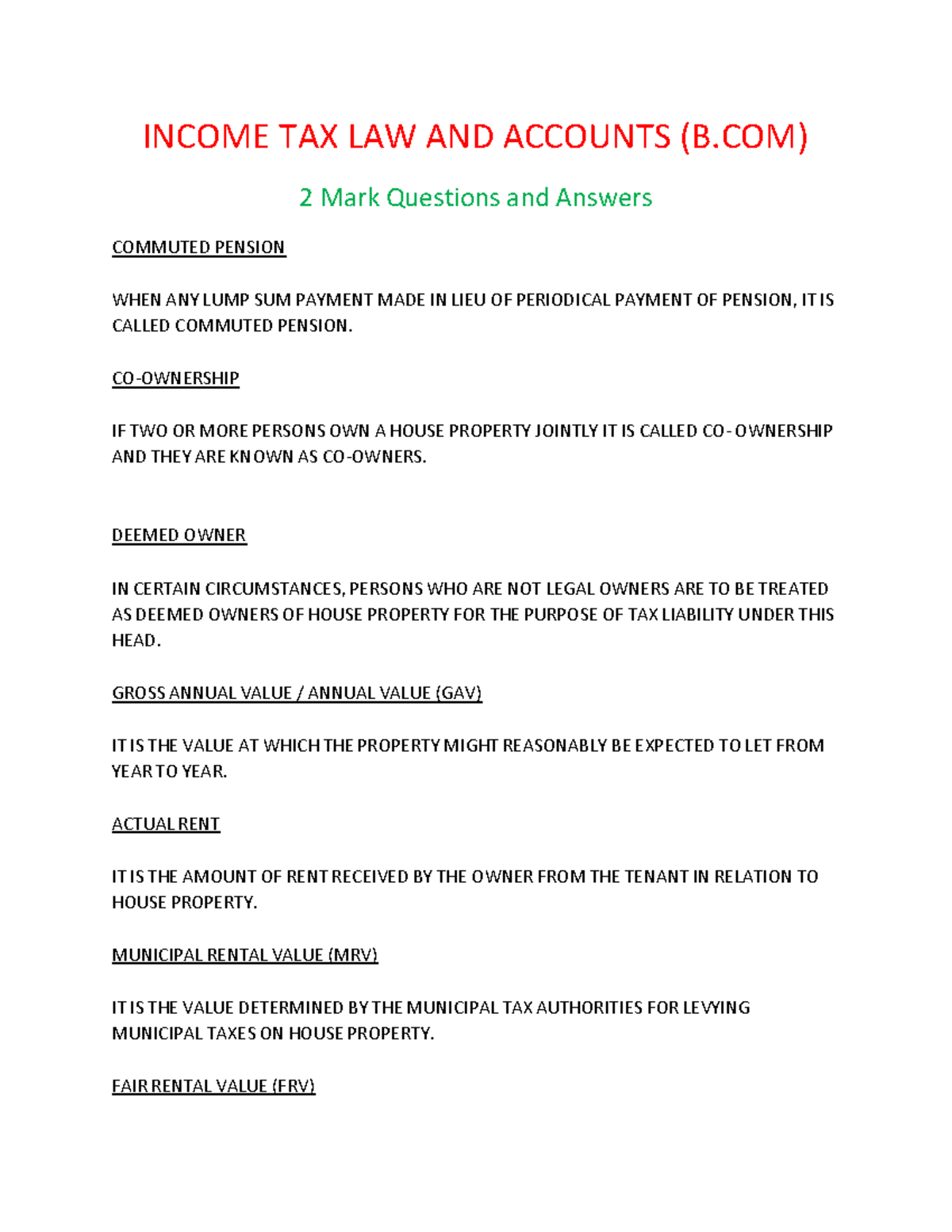

Income Tax Law Pdf Download Section 110 Determination of tax where total income includes income on which no tax is payable Section 115VF Tonnage income Section 14A Expenditure incurred in

This book is the 8th edition of a basic income tax text This edition incorporates the Tax Cuts and Jobs Act of 2017 It is intended to be a readable text suitable for a three hour course for a class comprised of The Law And Practice Of Income Tax Seventh Edition Vol ii Palkhivala N a Free Download Borrow and Streaming Internet Archive by Palkhivala N a

Income Tax Law Pdf Download

Income Tax Law Pdf Download

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/cbbe7fc8e21955d2fe64524bb50f5edb/thumb_1200_1553.png

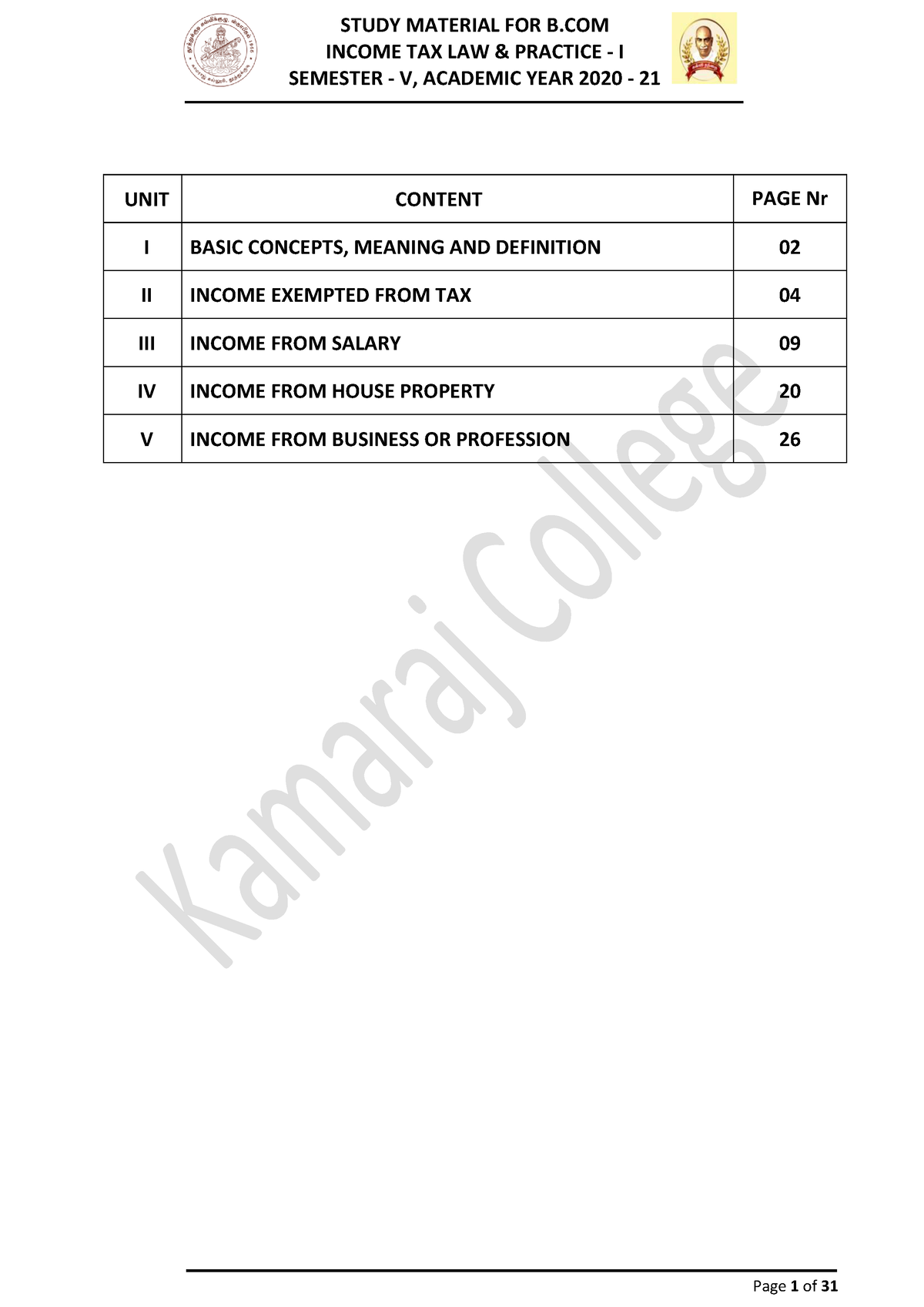

Income Tax Law Practice I V Sem INCOME TAX LAW PRACTICE I

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3d1c492ad83a0705ef9ae625fb844d80/thumb_1200_1697.png

INCOME TAX NOV 2023 CA ANU SHREE AGRAWAL Bhagwati Education LLP

https://beiguru.com/wp-content/uploads/2023/06/Income-Tax-full-course-BEI-revised-1024x1024.jpg

61st Edition of Income Tax Law Practice Assessment Year 2020 21 Book Largest Selling Book since 1964 and over the last 56 years of its existence the book Provides an overview of the principles underlying corporate income tax focusing primarily on the taxation of cross border income both under domestic laws and in the context of

Part One The Income Tax Return Chapter 1 Filing Information Chapter 2 Filing Status Chapter 3 Dependents Chapter 4 Tax Withholding and Estimated Tax Part Two Taxation and cross border transactions this book provides a comprehensive guide to topics including taxation schemes residence Double Taxation Avoidance Agreements

Download Income Tax Law Pdf Download

More picture related to Income Tax Law Pdf Download

Income Tax Law Notes Formated For MS Word Week 1 Income Tax Law

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/27fa0f0ddc8c856e82fdbe873ec8ba12/thumb_1200_1698.png

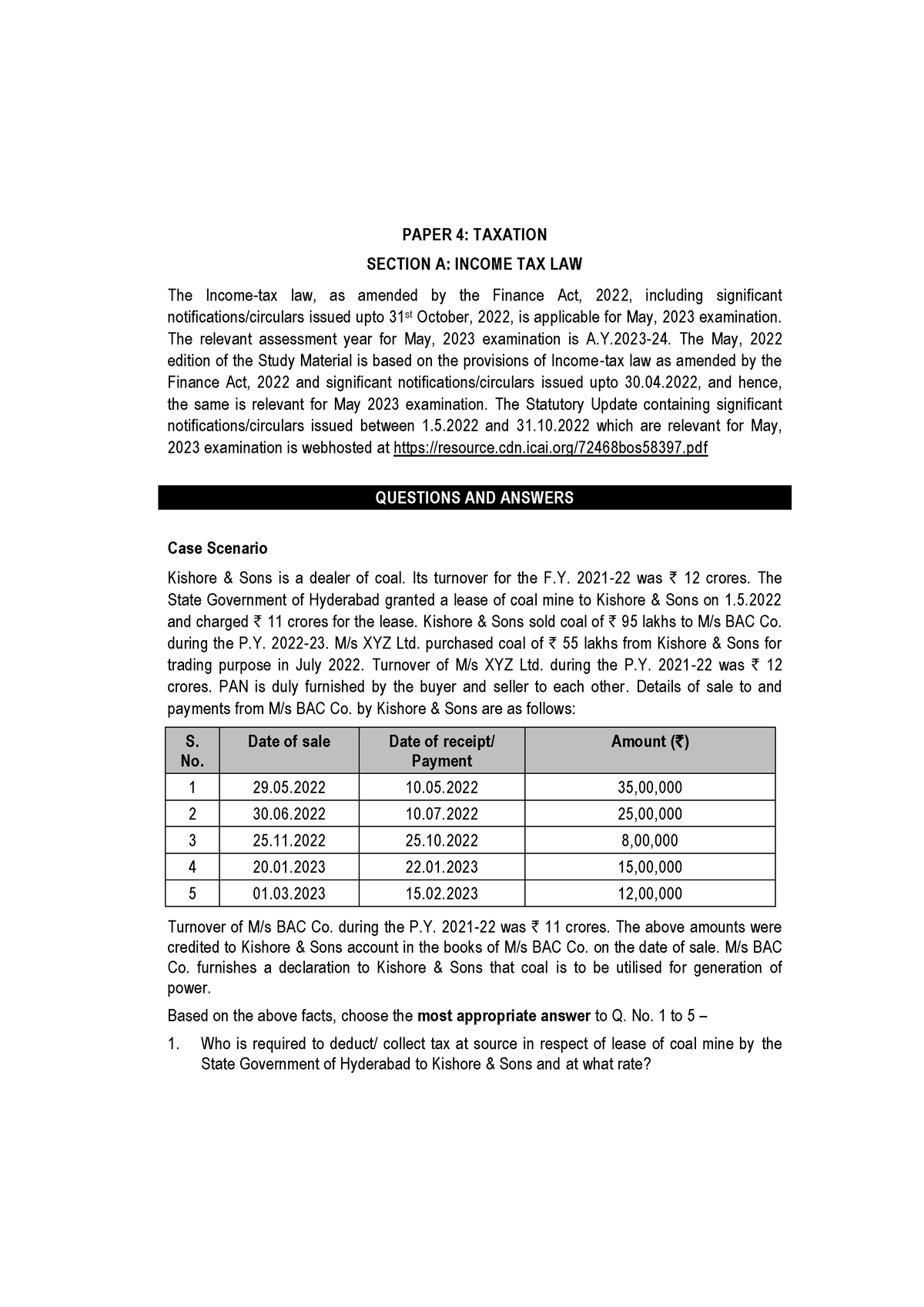

73149 Bos58999 p4 PAPER 4 TAXATION SECTION A INCOME TAX LAW The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d275a8a794672ab646a180c32422118c/thumb_1200_1697.png

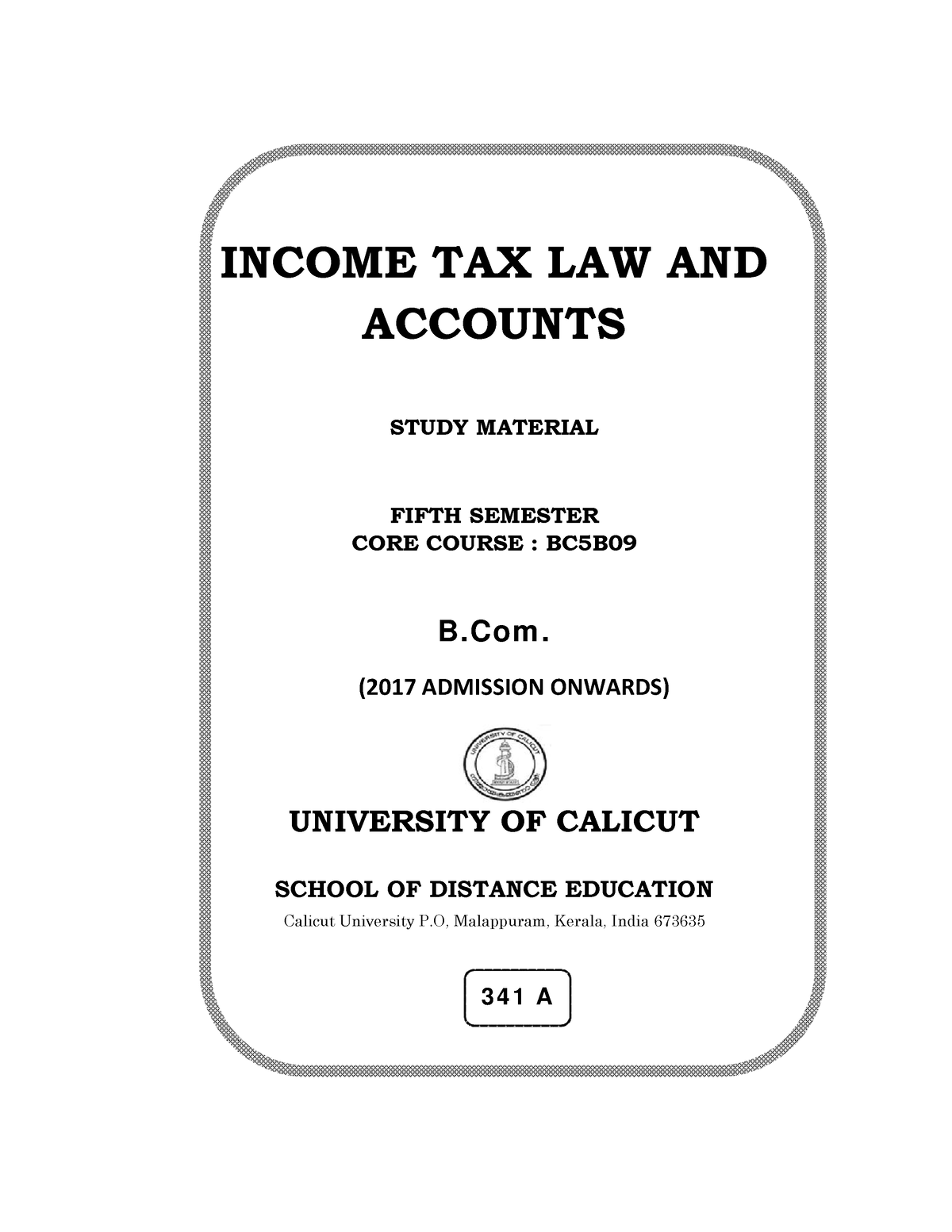

Income Tax Law Notes Income Tax Law Lecture Notes 10 Tutorial 30

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c231aa52ebb4ff28550422c038354440/thumb_1200_1697.png

You can download the PDF format of these ITR forms from the official website of the Income Tax department for AY 2024 2025 In this article you will learn how to download the ITR form for ITR 1 ITR 2 Part I Direct Tax Laws Module 1 Initial Pages Chapter 1 Basic Concepts Chapter 2 Residence and Scope of Total Income Chapter 3 Incomes which do not form part of

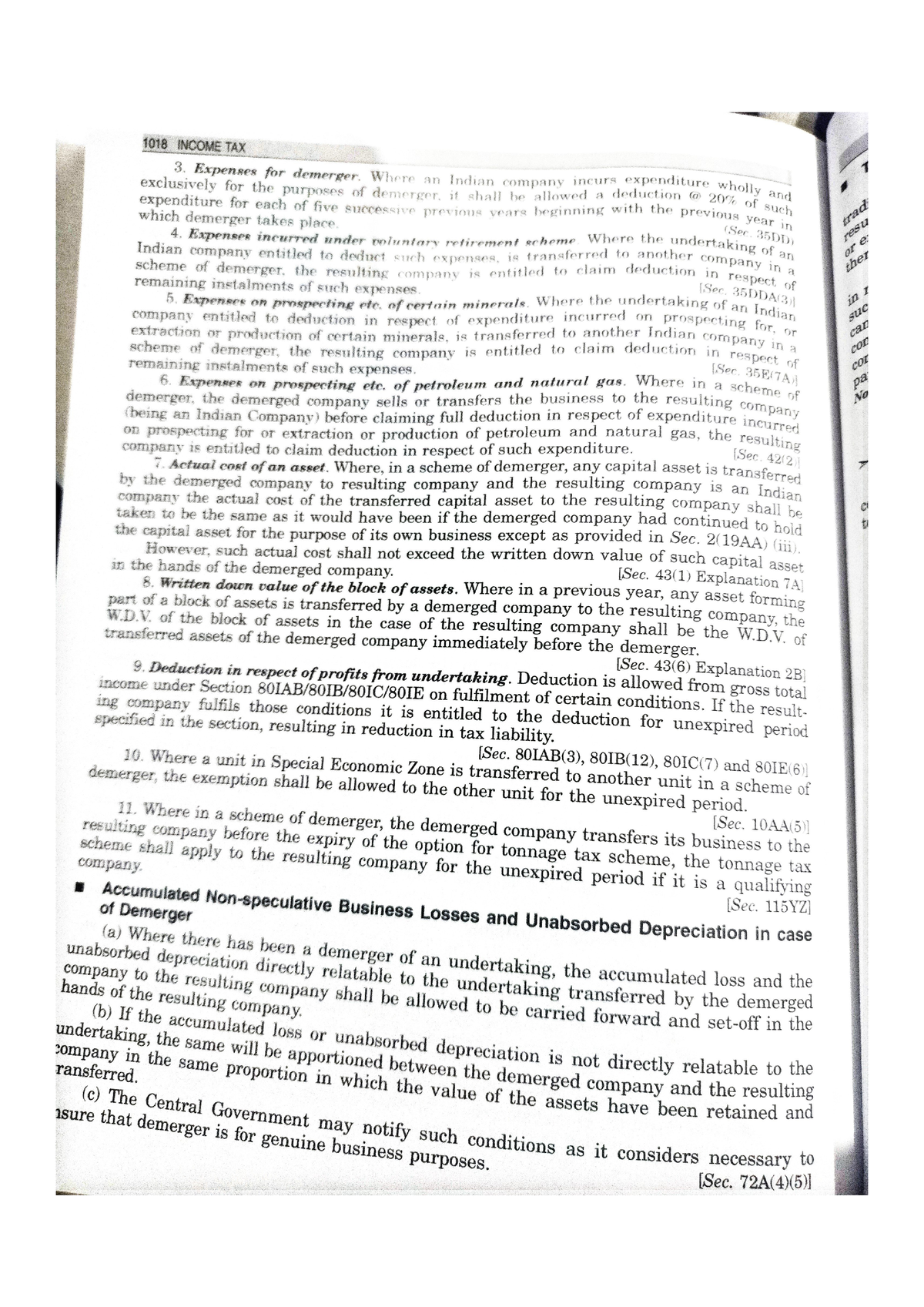

Income Tax Law and Accounts Page 3 CONTENTS 1 Module I Basic Concepts 5 2 Module II Computation of Income 48 3 Module III Income from House Property 88 4 Module IV Chapter 1 The Essential Structure of the Income Tax Chapter 2 Consumption Taxation and Our Hybrid Income Consumption Chapter 3 Ethical Debates Economic Theories

Image To PDF 20221112 07 Income Tax Law Practice II Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a0cb96024967dc281c87baa0bd1ed63d/thumb_1200_1697.png

Income Tax Law And Accounting Under The TRAIN Law And The CREATE Law

https://ph-test-11.slatic.net/p/c84f2a0071cc231815facd2bb05de443.jpg

https://incometaxindia.gov.in/pages/acts/income...

Section 110 Determination of tax where total income includes income on which no tax is payable Section 115VF Tonnage income Section 14A Expenditure incurred in

https://open.umn.edu/opentextbooks/tex…

This book is the 8th edition of a basic income tax text This edition incorporates the Tax Cuts and Jobs Act of 2017 It is intended to be a readable text suitable for a three hour course for a class comprised of

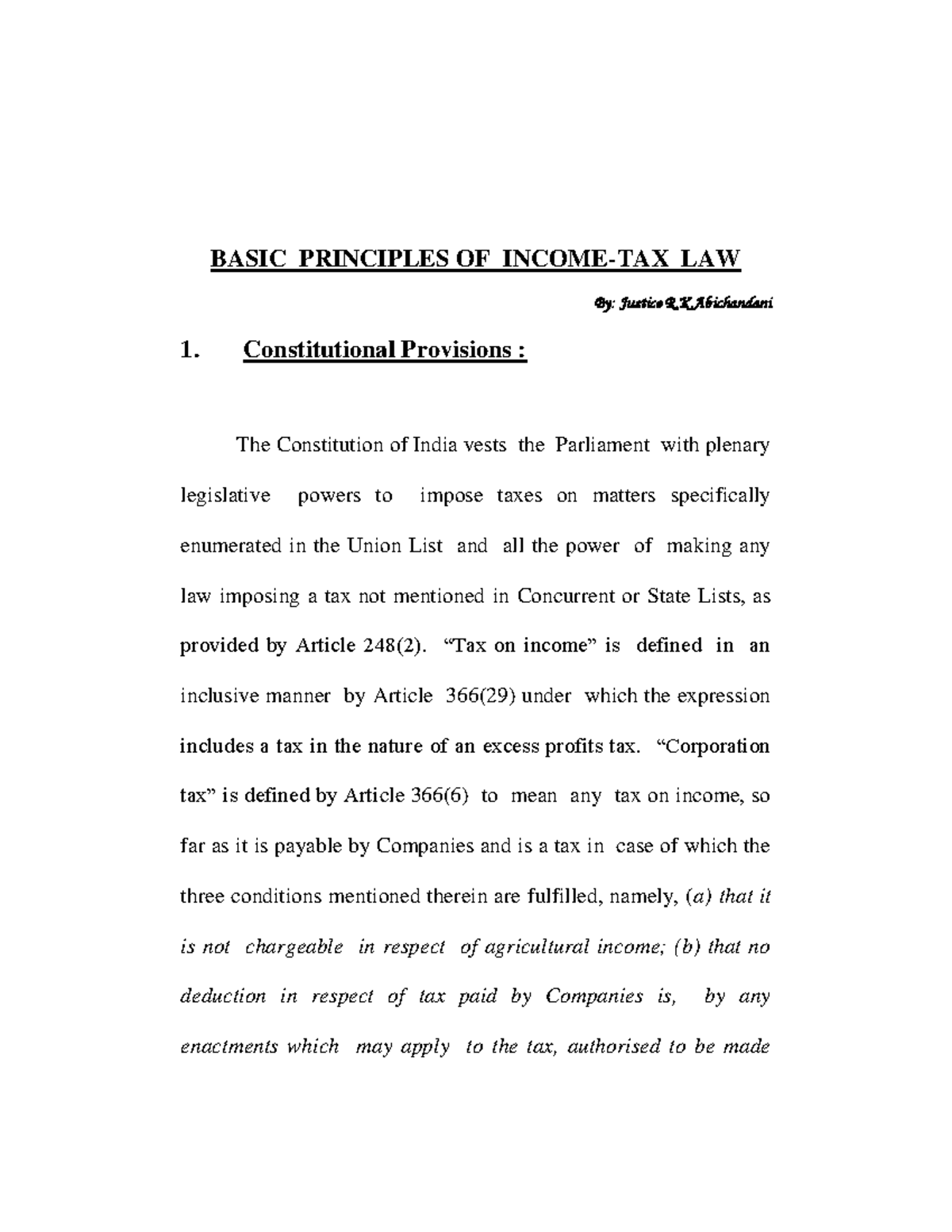

Basic Principles Of Income Tax Law Basic Principles Of Income Tax Law

Image To PDF 20221112 07 Income Tax Law Practice II Studocu

Basic Concepts Of Income Tax LAW PDF

Income Tax Law And Accounts INCOME TAX LAW AND ACCOUNTS STUDY

Tutorial No 1 Introduction And Income Tax Basics The University Of

Income TAX LAW AND Accounts 4 INCOME TAX LAW AND ACCOUNTS B 2 Mark

Income TAX LAW AND Accounts 4 INCOME TAX LAW AND ACCOUNTS B 2 Mark

Income Tax Law

Income Tax Law And Practice

Income Tax Law And Practice Ryan Publishers

Income Tax Law Pdf Download - Part One The Income Tax Return Chapter 1 Filing Information Chapter 2 Filing Status Chapter 3 Dependents Chapter 4 Tax Withholding and Estimated Tax Part Two