Income Tax Medical Bills Exemption Under Section 80d Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

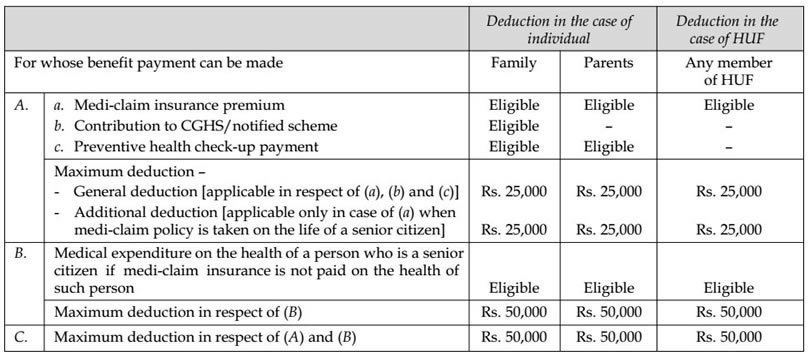

Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not be covered under any health insurance policy Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Income Tax Medical Bills Exemption Under Section 80d

Income Tax Medical Bills Exemption Under Section 80d

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

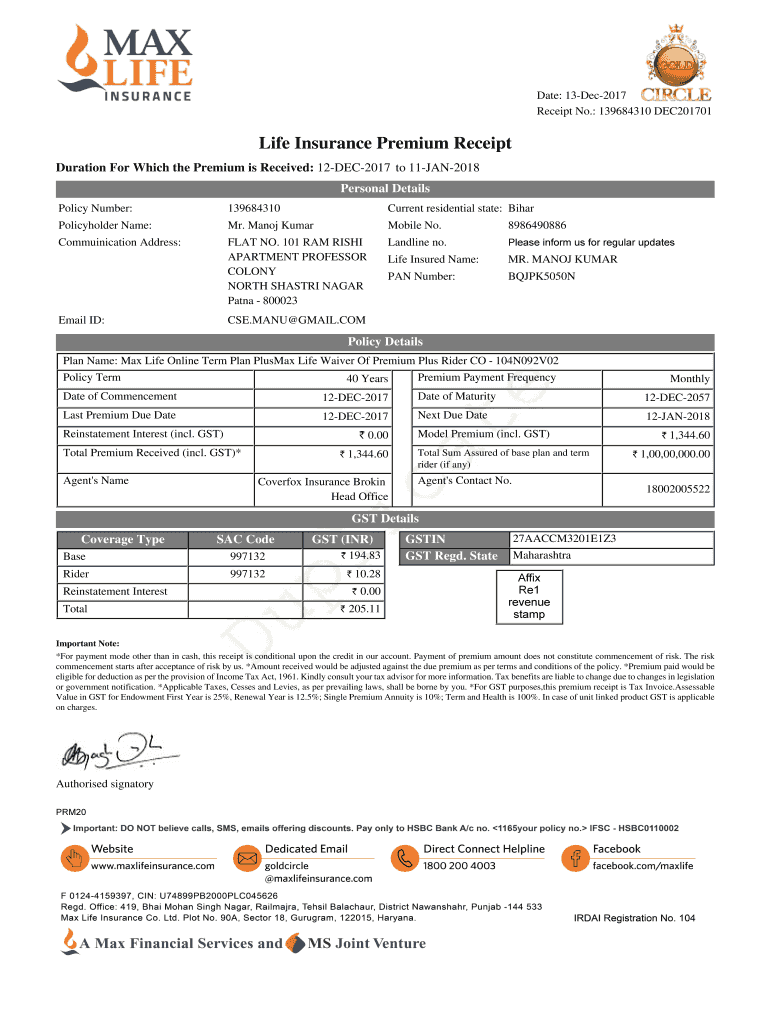

Mediclaim Premium Receipt PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/470/590/470590793/large.png

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers and the

Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section 80D s income tax benefits for paying medical insurance premiums for yourself your spouse children and your elderly parents as well as for healthcare related expenses Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive

Download Income Tax Medical Bills Exemption Under Section 80d

More picture related to Income Tax Medical Bills Exemption Under Section 80d

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Medical Bills Tax Exemption For AY 2019 20 Rules How To Claim

https://www.paisabazaar.com/wp-content/uploads/2017/06/img3.jpg

The Income Tax Act of 1961 permits taxpayers to deduct costs for preventative health checks and health insurance premiums under section 80D Both individuals and Hindu Undivided Families HUFs are eligible for these deductions which offer a substantial tax savings opportunity Every individual or HUF who has purchased medical insurance can claim for a tax deduction under Section 80D of Income Tax Act 1961 The taxpayer can avail tax benefits on insurance taken for self spouse dependent children and parents

Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a HUF This tax deduction is available over and above the An individual can avail tax benefit under Section 80D of the Income Tax Act for the payment of medical insurance premium for self spouse dependent children and for parents Up to INR 25 000 can claim for the medical insurance of self spouse and dependent children

Section 80D Deduction For Medical Insurance Health Checkups 2019

https://www.paisabazaar.com/wp-content/uploads/2017/04/02-5.jpg

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

https://tax2win.in/guide/section-80d-deduction...

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

https://economictimes.indiatimes.com/wealth/tax/...

Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not be covered under any health insurance policy

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80U Tax Deductions For Disabled Individuals Tax2win

Anything To Everything Income Tax Guide For Individuals Including

Income Tax Medical Bills Exemption Under Section 17 2 Compilance India

All You Need To Know On Exempted Income In Income Tax Ebizfiling

All You Need To Know On Exempted Income In Income Tax Ebizfiling

Health Insurance Tax Benefits Under Section 80D

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Income Tax Medical Bills Exemption Under Section 80d - Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied