Invite to Our blog, a space where curiosity satisfies info, and where daily subjects become interesting discussions. Whether you're seeking understandings on lifestyle, innovation, or a bit of every little thing in between, you've landed in the right place. Join us on this expedition as we study the worlds of the normal and remarkable, making sense of the globe one article each time. Your trip right into the fascinating and diverse landscape of our Income Tax Monthly Deduction Rules For Salaried Employees begins below. Discover the fascinating material that waits for in our Income Tax Monthly Deduction Rules For Salaried Employees, where we untangle the details of numerous topics.

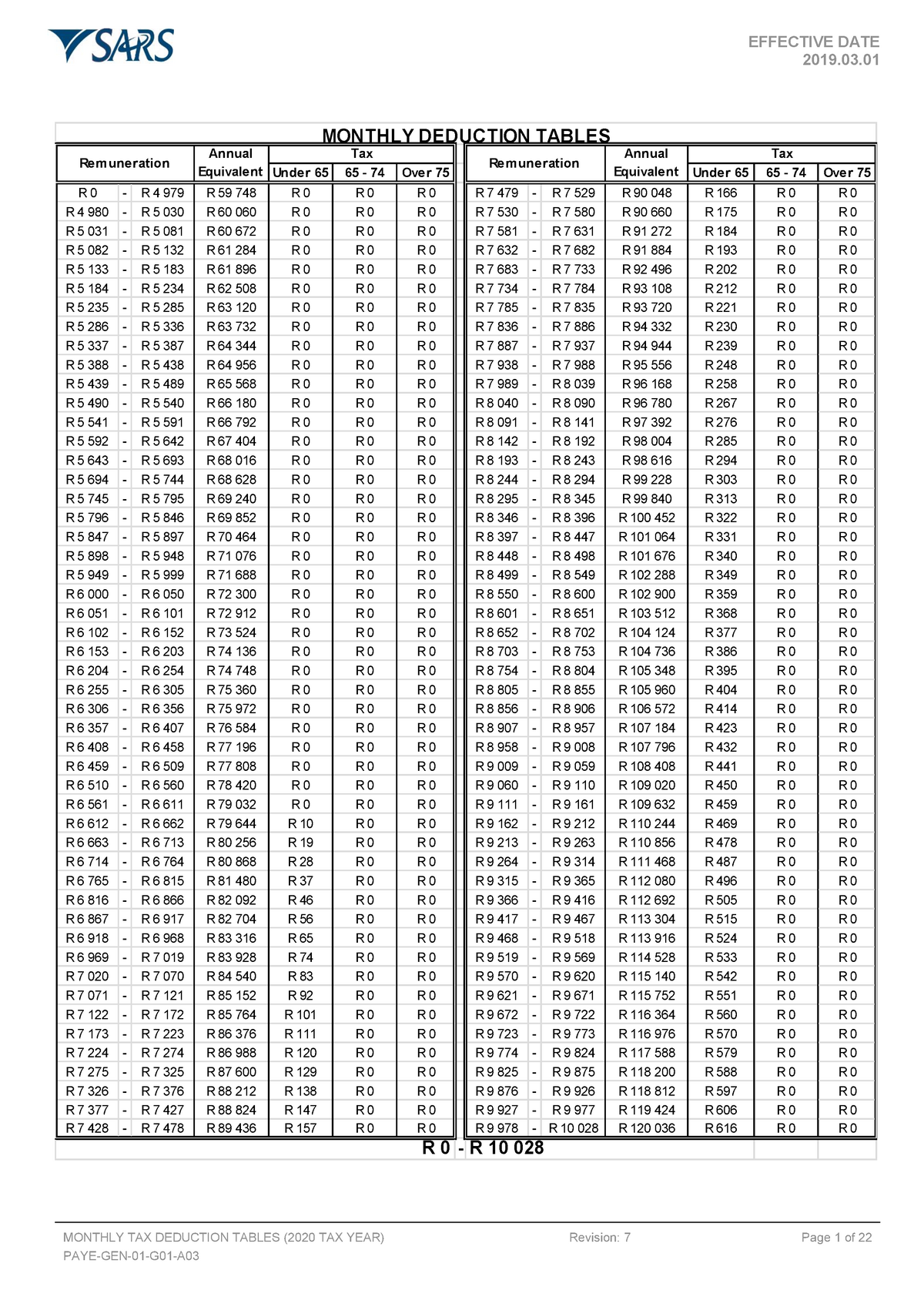

Income Tax Monthly Deduction Rules For Salaried Employees

Income Tax Monthly Deduction Rules For Salaried Employees

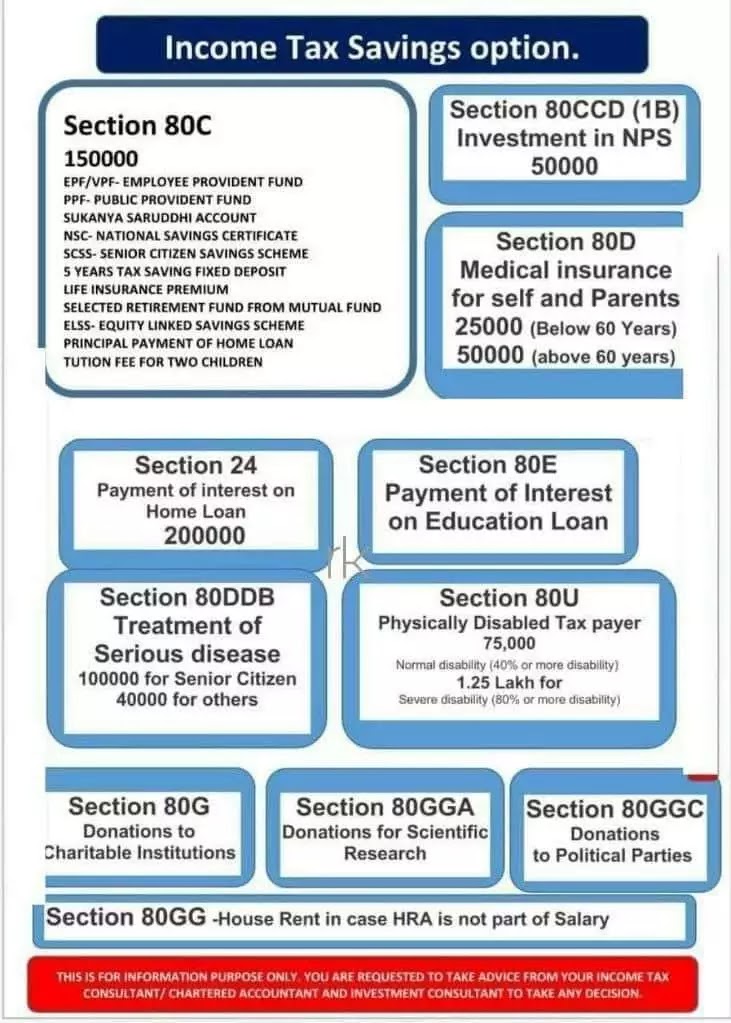

Income Tax Savings Options IT Savings Options For Salaried Employees

Income Tax Savings Options IT Savings Options For Salaried Employees

Income Tax Return Online Tutorials Finance Investing Development

Income Tax Return Online Tutorials Finance Investing Development

Gallery Image for Income Tax Monthly Deduction Rules For Salaried Employees

How To File Income Tax Returns For Salaried Employees By Raju Kumar On

New Income Tax Rules For Salaried Taxpayers From September 1st 2023

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Rules Regulations For Paying Salaried Employees Regulators Rules

New Compliance Rules For Salaried Employees HR Maximised

7 Useful Income Tax Exemptions For The Salaried

7 Useful Income Tax Exemptions For The Salaried

Income Tax Deductions Financial Year 2022 2023 WealthTech Speaks

Thank you for selecting to discover our web site. We best regards wish your experience exceeds your assumptions, which you discover all the information and sources about Income Tax Monthly Deduction Rules For Salaried Employees that you are looking for. Our commitment is to give a straightforward and informative system, so feel free to navigate via our pages easily.