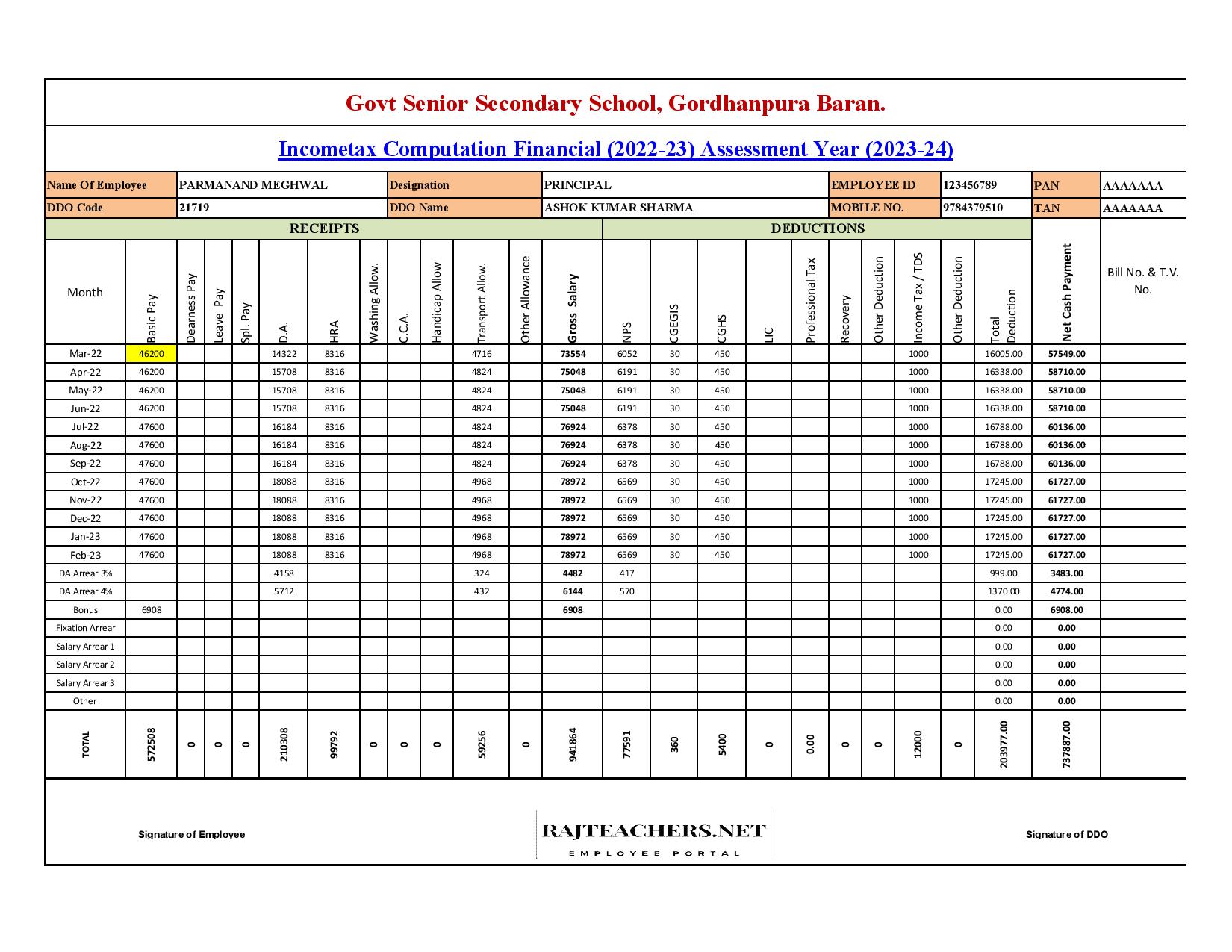

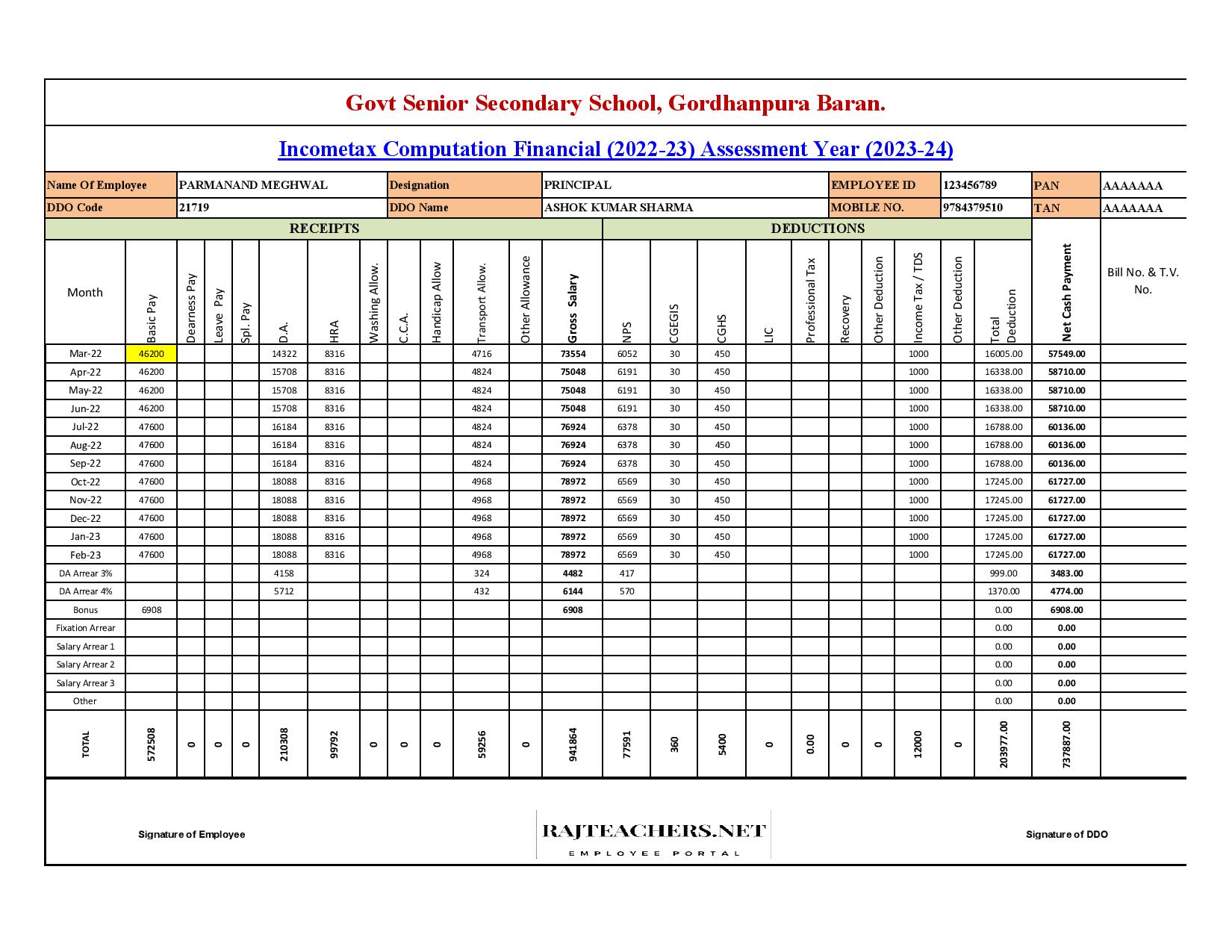

Income Tax Of Central Government Employees Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80 CCD 2 of the Income Tax Act 14 of salary for central government employees

The salary in case of central state Govt employees and 10 in any other employees 10 of salary in case of employees otherwise 20 of gross total income Section GConnect is a trusted portal for Central Government employees and pensioners for information about Pay Allowance Pension Income Tax LTC CGHS and more

Income Tax Of Central Government Employees

Income Tax Of Central Government Employees

https://rajteachers.net/wp-content/uploads/2022/12/Income-Tax-Calculation-for-Central-Government-Employees.jpg

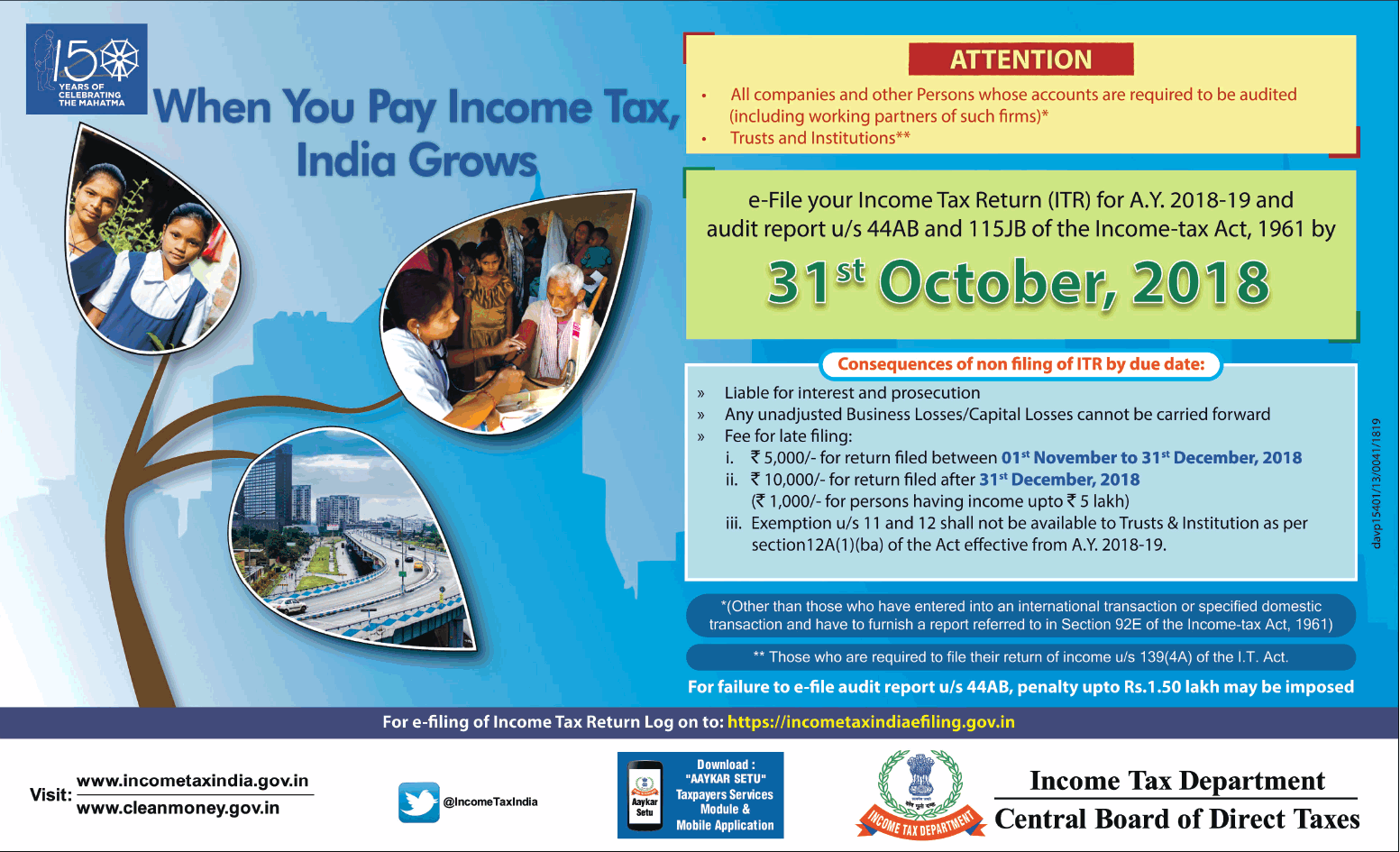

Income Tax Department Central Board Of Direct Taxes Ad Advert Gallery

https://newspaperads.ads2publish.com/wp-content/uploads/2018/10/income-tax-department-central-board-of-direct-taxes-ad-times-of-india-delhi-26-10-2018.png

7th Pay Commission News Salary Of Central Government Employees May

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/10/07/999830-da.jpeg

Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct position prevailing law before relying upon

Dearness Allowance is paid to Central Government and Public Sector Employees to meet the cost of inflation A guide for basic understanding and calculation EIS is employee information system deployed centrally for all central government employees It covers Pay bill Income tax and GPF modules For claiming income tax

Download Income Tax Of Central Government Employees

More picture related to Income Tax Of Central Government Employees

Confederation Of Central Government Employees Workers

https://2.bp.blogspot.com/-OSPy1WXXYOY/WxpHDQexIeI/AAAAAAAAGsw/2DehowroQ4kMaxSpFtUkgq8OiP2ScS4awCEwYBhgL/w1200-h630-p-k-no-nu/1.jpg

Daily Allowance Of Central Government Employees Hiked By 6 India

https://www.india.com/wp-content/uploads/2015/09/s2015082468862.jpg

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

Section 80CCD 2 of the Income Tax Act gives employed individuals the benefit of claiming income tax deductions for contributions made by their employer It Recently the government announced that the contribution of employers in NPS for the central government would rise from 10 to 14 Additionally the

Budget 2024 Expectations for Central Government Employees Union Finance Minister Nirmala Sitharaman is all set to present the Interim Budget on February 1 2024 ahead Employee s own Contribution towards NPS Tier I account is eligible for tax deduction under section 80 CCD 1 of the Income Tax Act within the overall ceiling of

7th Pay Commission DA Of Central Government Employees To Increase

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/08/06/989207-central-govt-employees.jpg

Central Government Employees Salary Latest News Today 2018 Salary

https://i.ytimg.com/vi/3D5UGYhfAR4/maxresdefault.jpg

https://www. financialservices.gov.in /beta/en/nps

Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80 CCD 2 of the Income Tax Act 14 of salary for central government employees

https:// incometaxindia.gov.in /Tutorials/80...

The salary in case of central state Govt employees and 10 in any other employees 10 of salary in case of employees otherwise 20 of gross total income Section

7th Pay Commission Revised Rates Of House Rent Allowance To Central

7th Pay Commission DA Of Central Government Employees To Increase

PDF Intervention Of Central Government In Local Government Budgeting

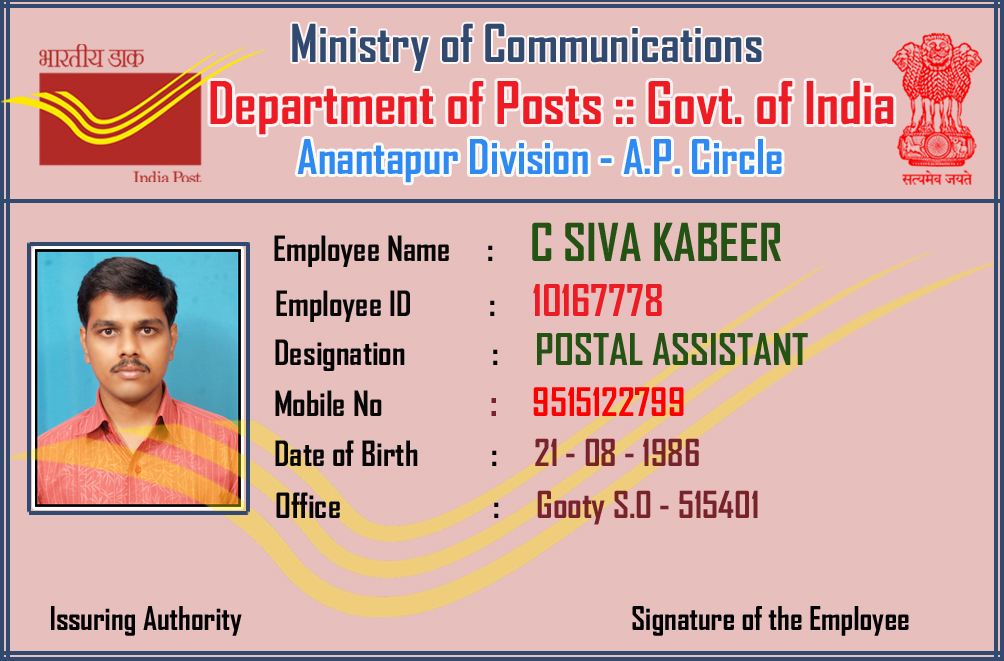

New Identity Card Design With Employee ID India Posts Retired

Central Government Employees Latest Salary Increased News Today 2018

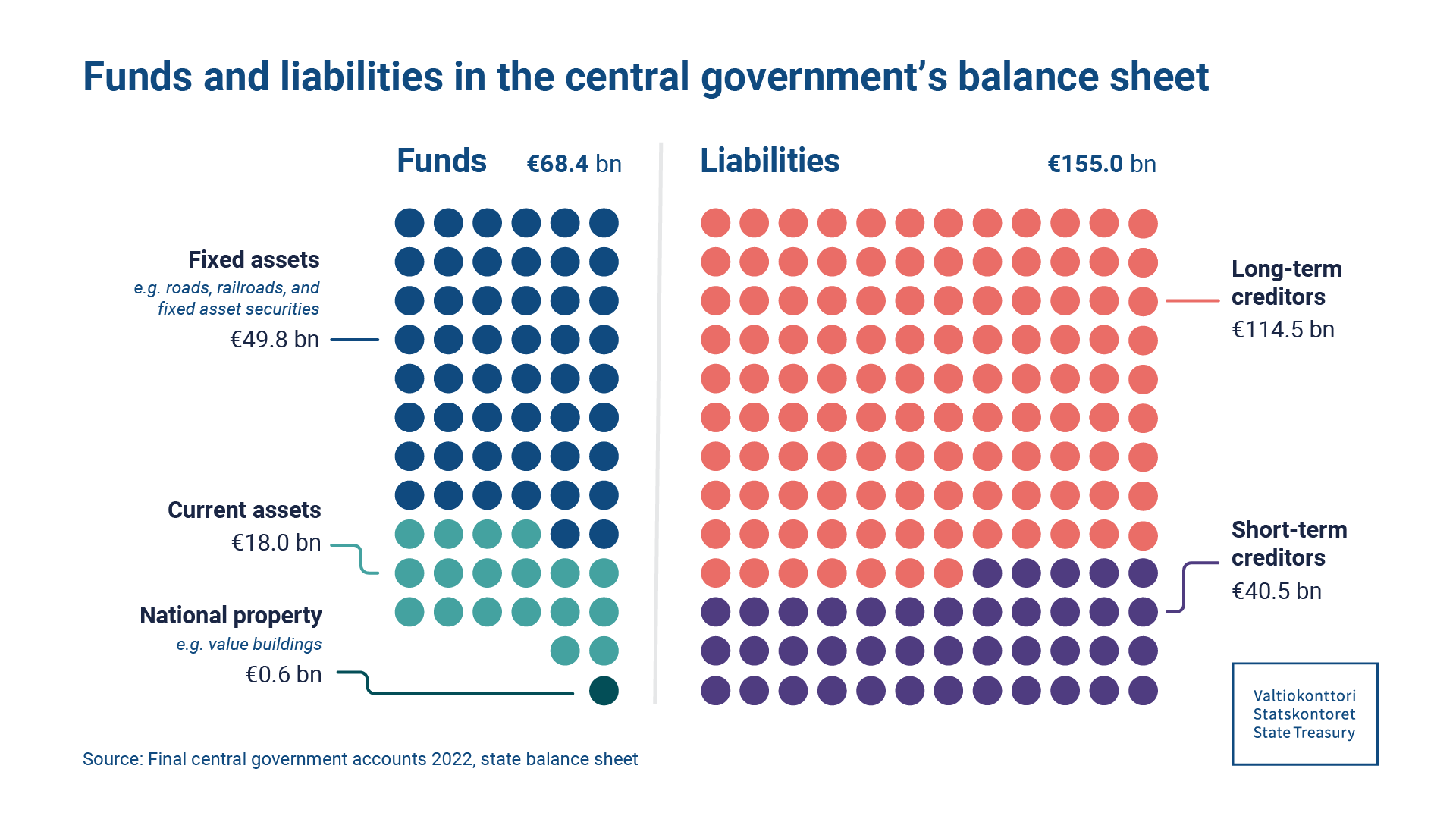

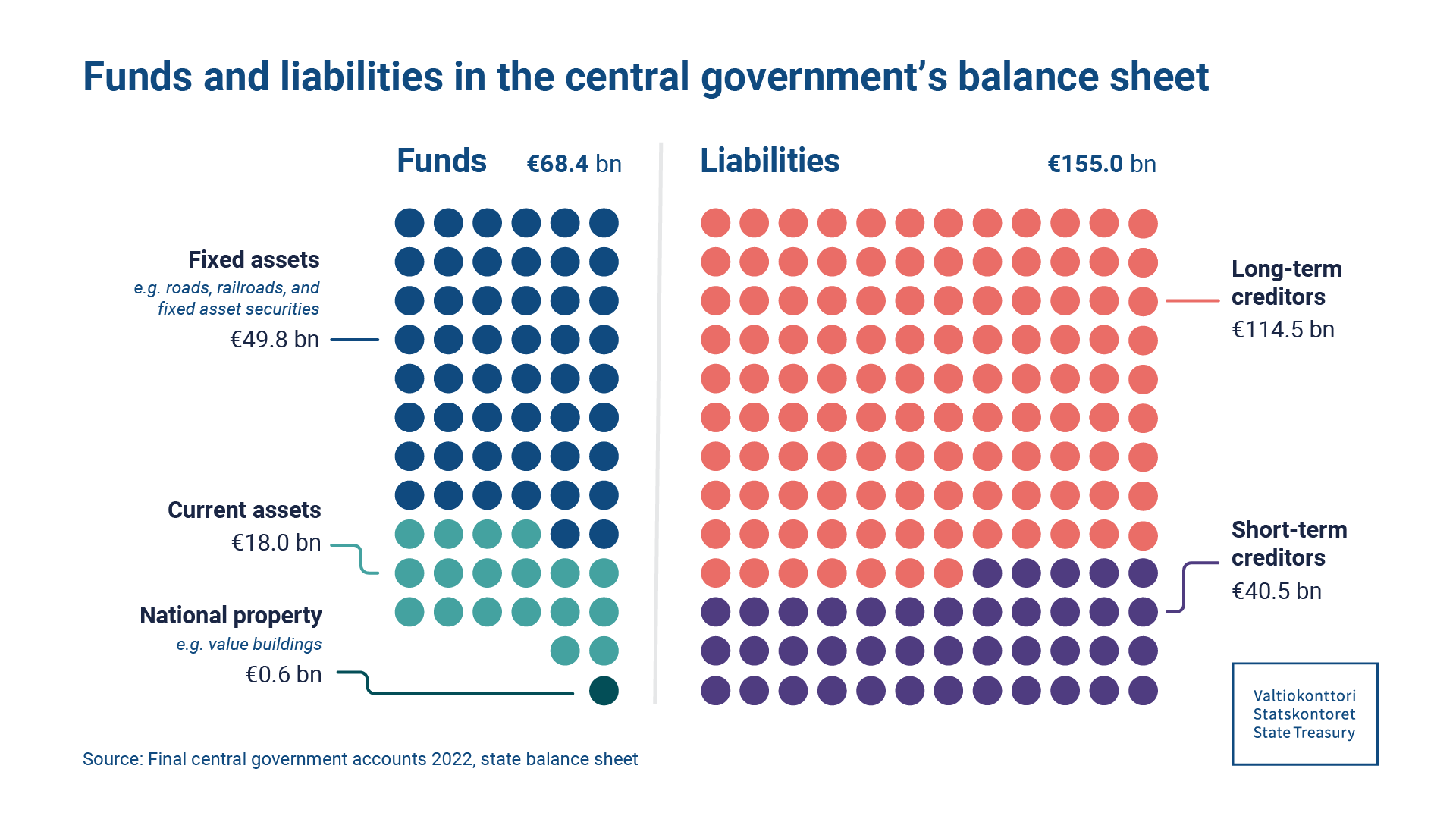

Final Central Government Accounts 2022 Exploreadministration fi

Final Central Government Accounts 2022 Exploreadministration fi

Confederation Of Central Government Employees Workers NPS Convention

Central Government Employees Group Insurance Scheme 1980 Benefits For

Central Government Employees Recommended By 7th Pay Commission

Income Tax Of Central Government Employees - Dearness allowance DA for central government employees was increased 4 per cent recently bringing it up to 50 per cent Dearness relief DR for central