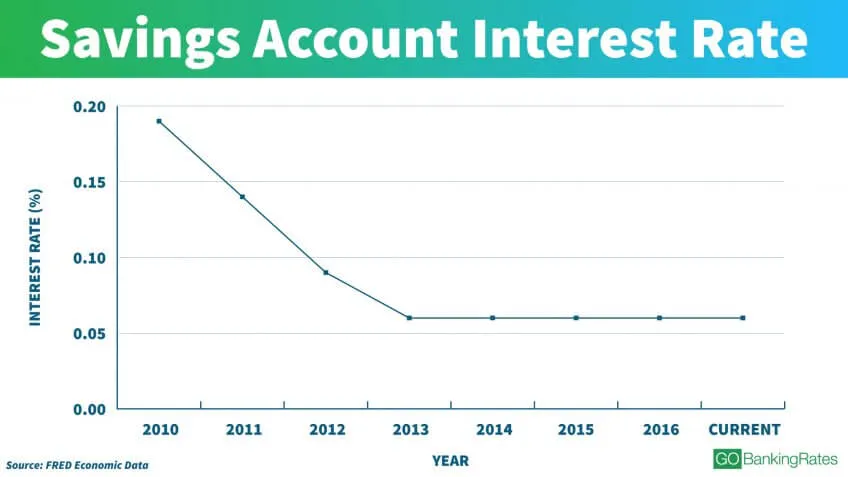

Income Tax On Savings Bank Interest Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 You must report any interest earned on a savings account

Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the federal income tax rates and tax brackets for 2023 The IRS treats interest earned on a savings account as earned income meaning it can be taxed So if you received 125 in interest on a high yield savings account in 2023 you re

Income Tax On Savings Bank Interest

Income Tax On Savings Bank Interest

https://bbbooksinc.com/wp-content/uploads/2020/02/tax-savings-image.png

Fixed Deposit Interest Income Taxable In Malaysia For Individual

https://www.tomorrowmakers.com/images/article/large/how-is-taxable-income-calculated-2.jpg

INCOME TAX ON SAVING BANK INTEREST AND INTEREST ON FIXED DEPOSITS YouTube

https://i.ytimg.com/vi/Qhdr8jcfEKk/maxresdefault.jpg

While you won t owe taxes on the principal account balance in your savings account any savings account interest earned is considered taxable income The IRS taxes interest from How the tax rate affects your savings account interest Your tax rate will depend on two things your income for the year and how much interest you earned on your accounts Your income determines which tax bracket you fall into For 2021 here are the income tax brackets based on your filing status Single Filers

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest earned from fixed deposits an recurring deposits Who can Claim 80TTA Deduction Can NRIs Avail of a Deduction under 80TTA Tax on savings interest Interest on savings for children Tax on shares Tax when you buy shares Tax when you sell shares Tax on dividends Tax efficient savings and investments

Download Income Tax On Savings Bank Interest

More picture related to Income Tax On Savings Bank Interest

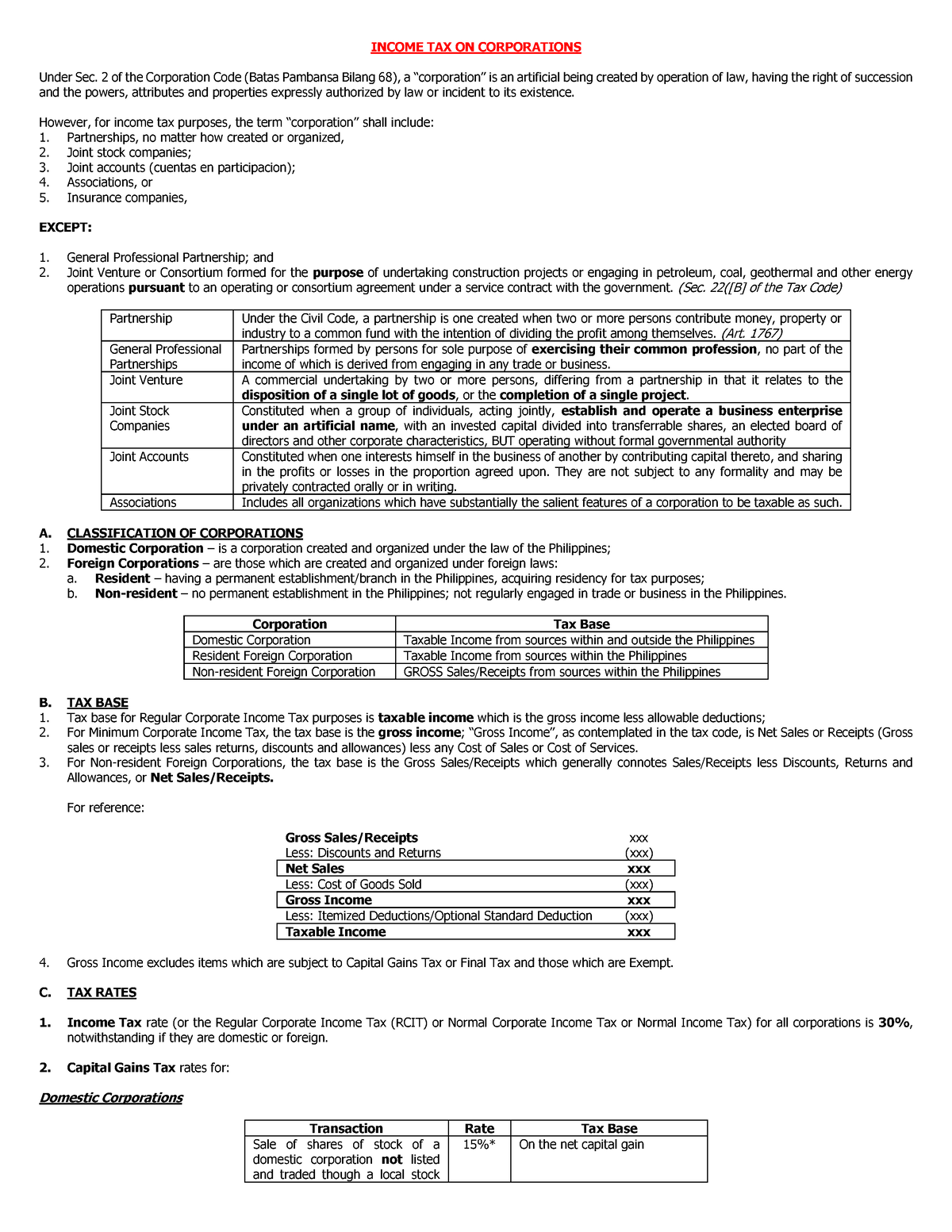

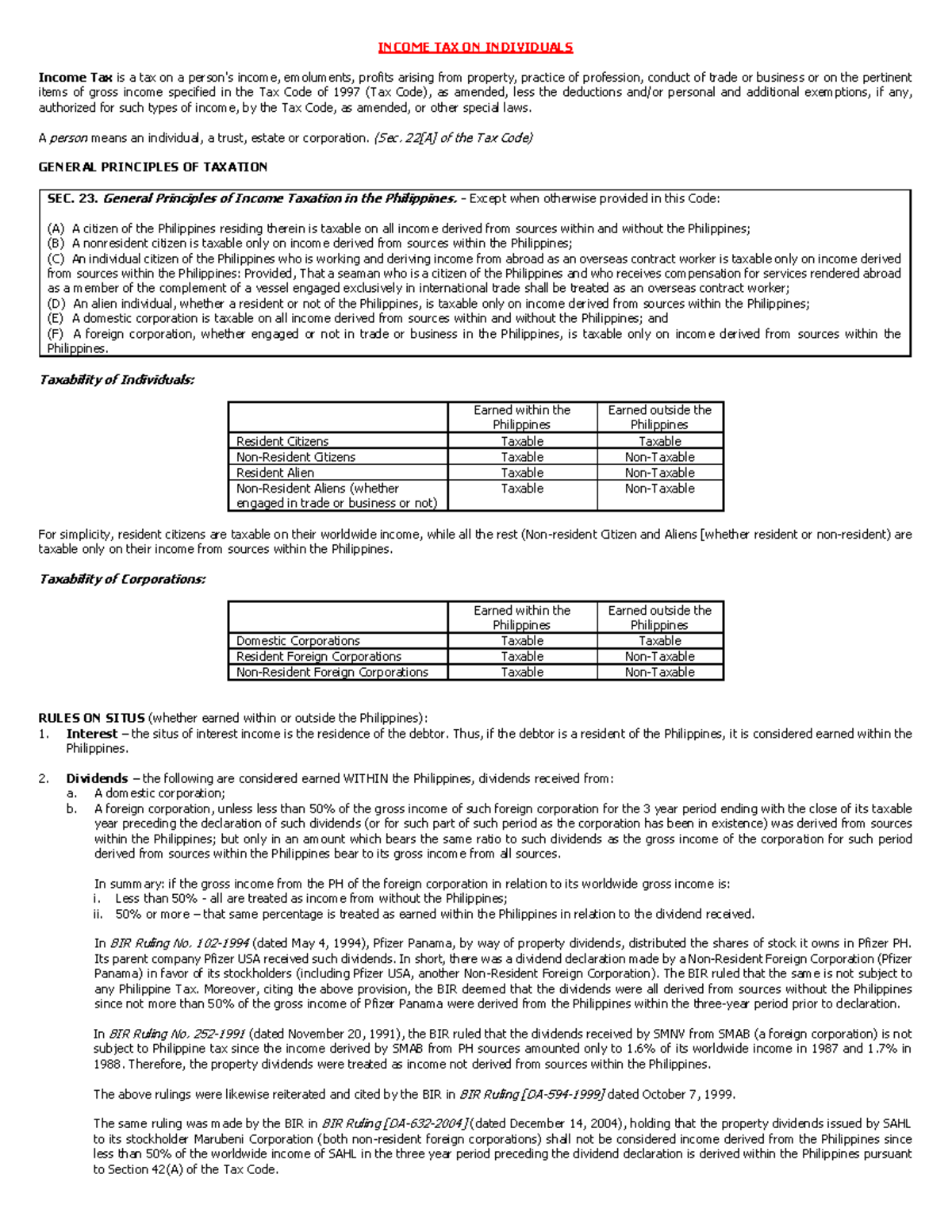

Chapter 05 Income Tax On Corporations C Income Tax On Corporatio s

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f82d51f886204e5746759dc357690e4f/thumb_1200_1698.png

How To Get Highest Savings Account Interest Rate Investdunia Free

https://investdunia.com/wp-content/uploads/2017/11/Savings-account-interest-rate-Dec-2020.png

Compare Interest Rates Uk Savings

https://cdn.gobankingrates.com/wp-content/uploads/2017/07/170524_gbr_interestrates100years_1920x1080_savings-848x477.jpg?webp=1

Does Your Balance Matter Tax Rates on Interest From Savings How to Reduce Tax Obligations on Your Savings Frequently Asked Questions FAQs Photo SDI Productions Getty Images A perk of savings accounts is that you earn interest but that comes with tax implications Learn how much tax you ll owe Interest on high yield savings accounts and CDs is subject to ordinary income tax You will receive Form 1099 INT from any account that earned more than 10 during the year For most savers

[desc-10] [desc-11]

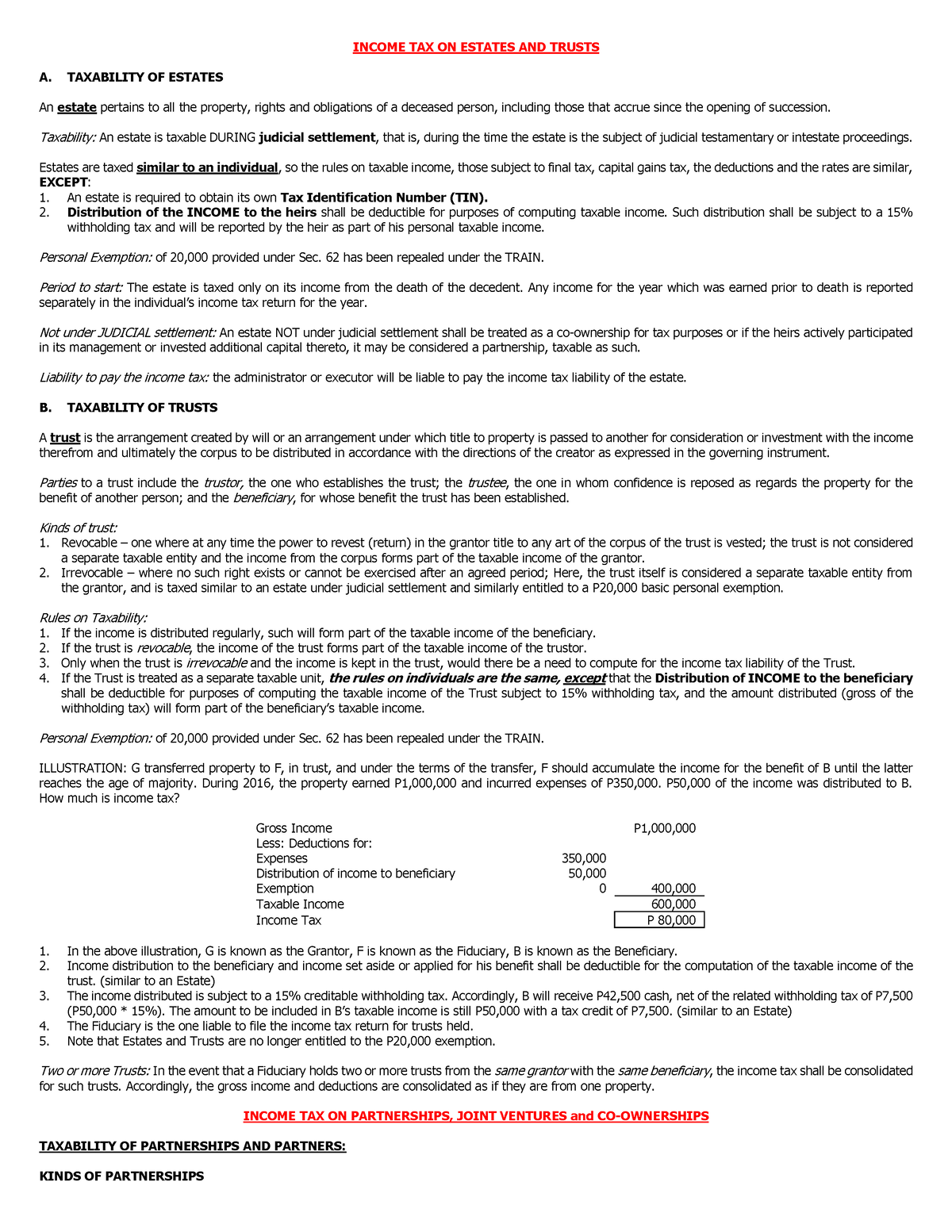

TAX Income Tax On Estates And Trust INCOME TAX ON ESTATES AND TRUSTS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7364fb57dd83ad933e94a7b0f24defee/thumb_1200_1553.png

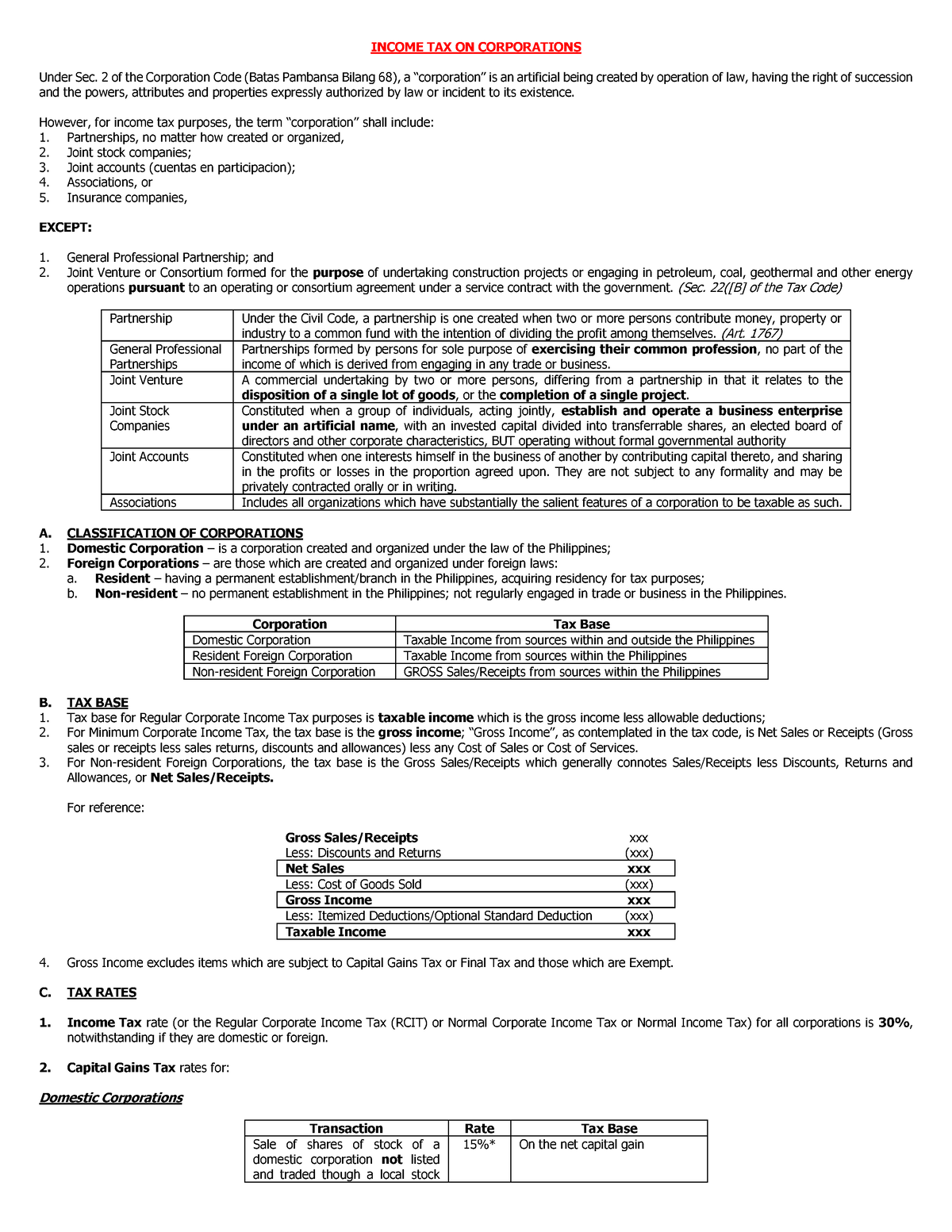

Income TAX ON Individuals INCOME TAX ON INDIVIDUALS Income Tax Is A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fd52bed5866978576d8660aa1b4b3310/thumb_1200_1553.png

https://www. investopedia.com /ask/answers/052515/...

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 You must report any interest earned on a savings account

https://www. forbes.com /advisor/banking/savings/tax...

Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the federal income tax rates and tax brackets for 2023

10 Banks Which Pay High Interest Rates On Savings Accounts YouTube

TAX Income Tax On Estates And Trust INCOME TAX ON ESTATES AND TRUSTS

A Complete Guide To Income Tax Calculation On Savings Bank Account

Bank Liable To Pay Income Tax On Interest On Sticky Loans NPAs On

Bank Of America Savings Account Interest Rates Nasdaq

TAX Income Tax On Corporations INCOME TAX ON CORPORATIONS Under Sec

TAX Income Tax On Corporations INCOME TAX ON CORPORATIONS Under Sec

Singaporean Talks Money Savings Plan Yes Or No

TAX Income Tax On Individuals INCOME TAX ON INDIVIDUALS Income Tax

Banks With The Best Interest Rates Bank Choices

Income Tax On Savings Bank Interest - How the tax rate affects your savings account interest Your tax rate will depend on two things your income for the year and how much interest you earned on your accounts Your income determines which tax bracket you fall into For 2021 here are the income tax brackets based on your filing status Single Filers