Income Tax Rate In Us Virgin Islands Web 90 reduction in personal income tax 100 exemption on excise tax 100 exemption on property taxes 100 exemption on gross receipts tax 1 duty on imported goods The top federal US income tax rate for 2023 is 37 meaning that successful EDC applicants can enjoy a tax rate as low as 3 37 quite a difference I m sure you ll agree

Web One of the differences is that in addition to the regular corporate tax rate corporations are also subject to a 10 corporate tax surcharge which brings the maximum corporate graduated rate to 38 5 There are no local income taxes or surcharges imposed on individuals over and above the mirror system rates so that the overall rate of income Web 31 Jan 2021 nbsp 0183 32 The Virgin Islands tax system includes income container gross receipts excise highway user s hotel room real property entertainment franchise fuel gift inheritance tire and stamp taxes

Income Tax Rate In Us Virgin Islands

Income Tax Rate In Us Virgin Islands

https://virgin-islands-hotels.com/wp-content/uploads/2022/07/Restaurant-Salt-Shack-768x512.jpg

The US Virgin Islands An Insider s Perspective On What To Expect For

https://caribbeansweethomes.com/wp-content/uploads/2023/06/01.UVI_.image-US-Virgin-Islands-_Insiders-Perspective-1-shstk_2292362067.webp

Can Us Citizens Buy Property In Us Virgin Islands

https://www.islandzine.com/img/754798994217fc6f603ee73a74e49667.jpg?30

Web IRC 937 establishes the criteria for determining the residency of an individual in American Samoa the CNMI Guam Puerto Rico and the U S Virgin Islands and for determining whether income is sourced in a U S territory Web 10 Feb 2023 nbsp 0183 32 Taxation In The U S Virgin Islands 10 February 2023 by TL Fahring Freeman Law The United States Virgin Islands quot USVI quot is an unincorporated territory of the United States 1 But that doesn t mean that they re subject to exactly the same laws as in the United States especially when it comes to taxes

Web Taxes imposed on residents of the Virgin Islands include Federal Income Tax same as US mainland Property Tax Employers are required to remove social security Medicare and income tax from employee pay same as US mainland There is no state tax in the U S V I Web 23 Mai 2023 nbsp 0183 32 Page Last Reviewed or Updated 23 May 2023 The USVI has its own income tax system based on the same laws and tax rates that apply in the United States An important factor in USVI taxation is whether during the entire tax year you are a bona fide resident of the USVI

Download Income Tax Rate In Us Virgin Islands

More picture related to Income Tax Rate In Us Virgin Islands

Which Island Has The Best Beaches In The Us Virgin Islands

https://www.islandzine.com/img/34b6c1c55e25b3adfca4a94d31467e0c.jpg?22

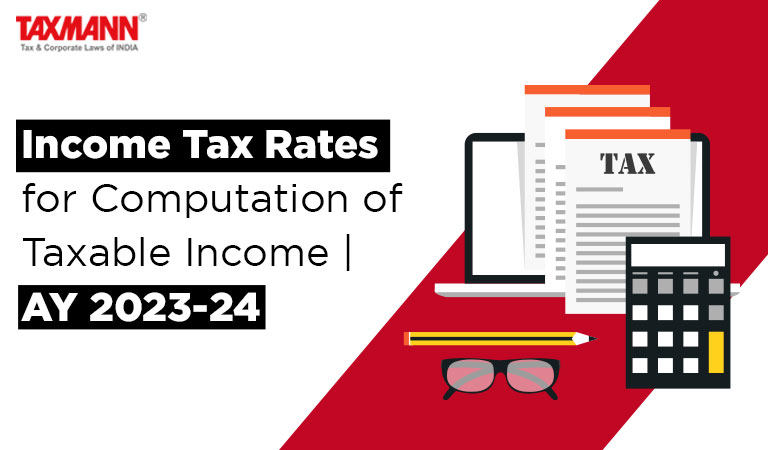

Income Tax Rates For Computation Of Taxable Income AY 2023 24

https://www.taxmann.com/post/wp-content/uploads/2022/11/income-tax-rates.jpg

Income Tax Rates In India For FY 2022 23

https://www.companiesnext.com/uploads/blog/1667303275-Income Tax Rates in India for financial year 2022-23.jpg

Web 90 reduction in corporate income tax 90 reduction in personal income tax 100 exemption on excise tax 100 exemption on property taxes and gross receipts tax No state or territory tax Paying Taxes in the U S Virgin Islands Web Add Tax on Earnings gt 200K 2 35 Net Tax Rate 0 6 Individual Contribution Limit Up to 3 850 Individual Contribution Limit Up to 3 050 Family Contribution Limit Up to 7 750 Family Contribution Limit 3 050 per FSA 401 k 403 b 457 amp Roth 401 k 22 500 401 k 403 b 457 amp Roth 401 k 7 500 Simple Plan IRA 15 500 Simple Plan IRA

Web 2021 35 717 checks totaling 91 164 846 2022 33 171 checks totaling 84 675 182 While the majority of refunds that were owed to taxpayers dated back to 2016 some of the refunds issued by BIR since the Governor took office date back to 2002 2003 and 3 770 of those refunds are for tax years 2002 2015 Web A USVI corporation pays an effective tax rate of approximately 23 1 on its eligible income and with the 90 tax credit the effective rate is 2 31 Salaries and other forms of compensation such as guaranteed payments are fully taxable Beneficiaries are also exempt from the territory s 5 tax on the USVI source gross receipts of a

Expatriation The Tax Rate In Canada Is Advantageous By Nomad Choice

https://miro.medium.com/v2/resize:fit:1200/1*cyhmOmu8HR7qO3soEDfhdw.jpeg

Loss Adjusters In US Virgin Islands Loss Adjusters By VI Adjusters On

https://cdn.dribbble.com/userupload/7047322/file/original-670747179ac89ad66ad72bbb440cfd37.jpg?resize=800x2000

https://nomadcapitalist.com/finance/how-lower-your-taxes-by-movin…

Web 90 reduction in personal income tax 100 exemption on excise tax 100 exemption on property taxes 100 exemption on gross receipts tax 1 duty on imported goods The top federal US income tax rate for 2023 is 37 meaning that successful EDC applicants can enjoy a tax rate as low as 3 37 quite a difference I m sure you ll agree

https://usvi.net/.../usvi-income-taxes

Web One of the differences is that in addition to the regular corporate tax rate corporations are also subject to a 10 corporate tax surcharge which brings the maximum corporate graduated rate to 38 5 There are no local income taxes or surcharges imposed on individuals over and above the mirror system rates so that the overall rate of income

Highest Marginal Income Tax Rate 1913 2023 Tax Policy Center

Expatriation The Tax Rate In Canada Is Advantageous By Nomad Choice

TAX SAVINGS Montreux

Those Earning Below RM230 000 Not Impacted By Income Tax Rate

Borough Of Brentwood Tax Collection

Top 10 Long Term Rentals In The U S Virgin Islands Updated 2024

Top 10 Long Term Rentals In The U S Virgin Islands Updated 2024

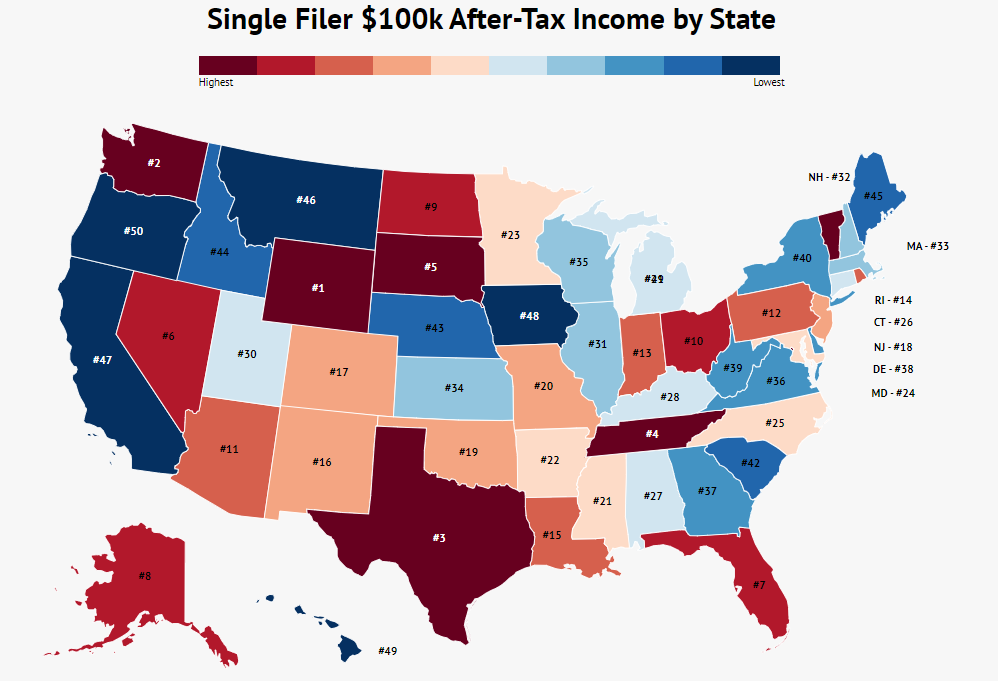

100k After Tax Income By State 2023 Zippia

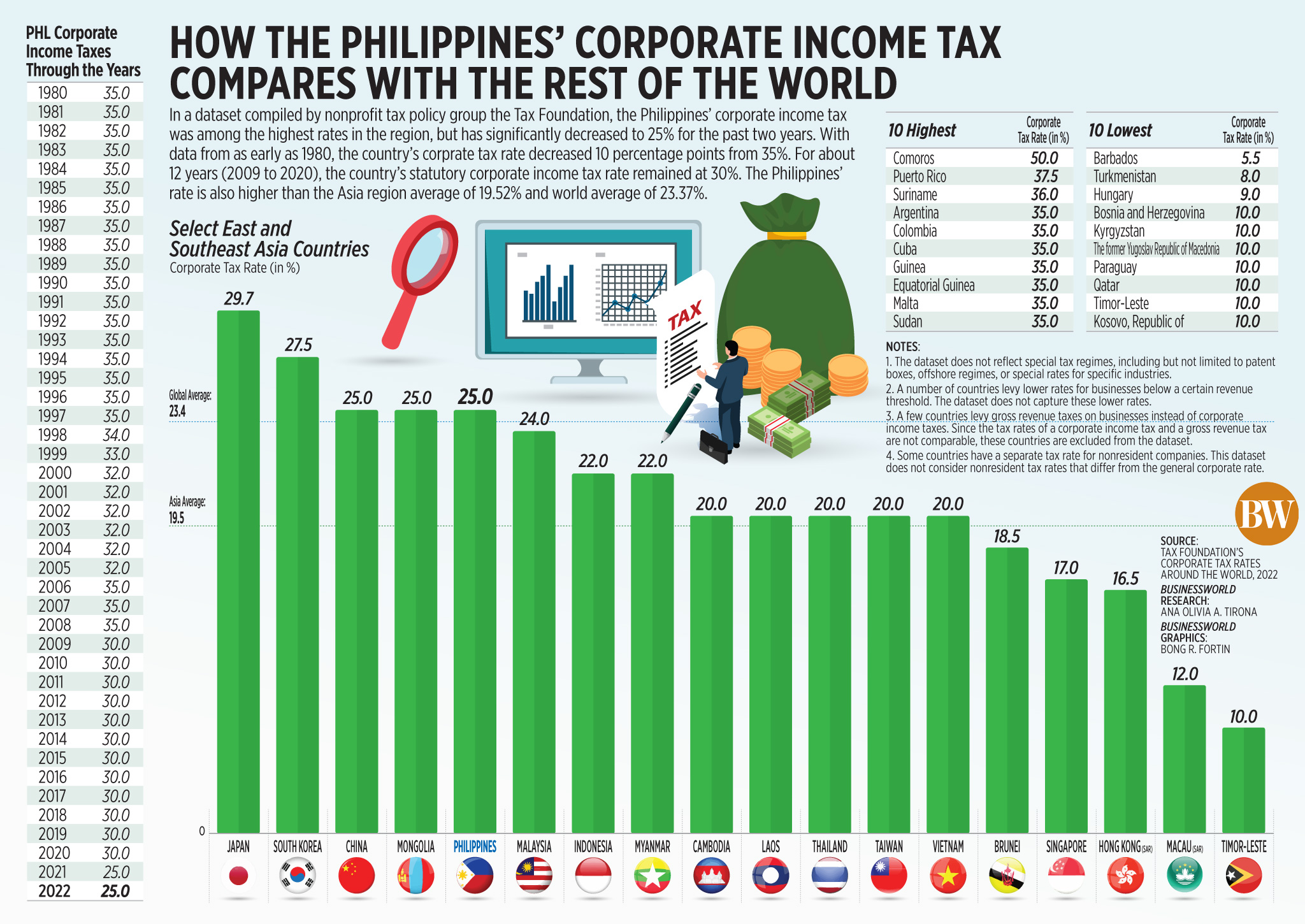

How The Philippines Corporate Income Tax Compares With The Rest Of The

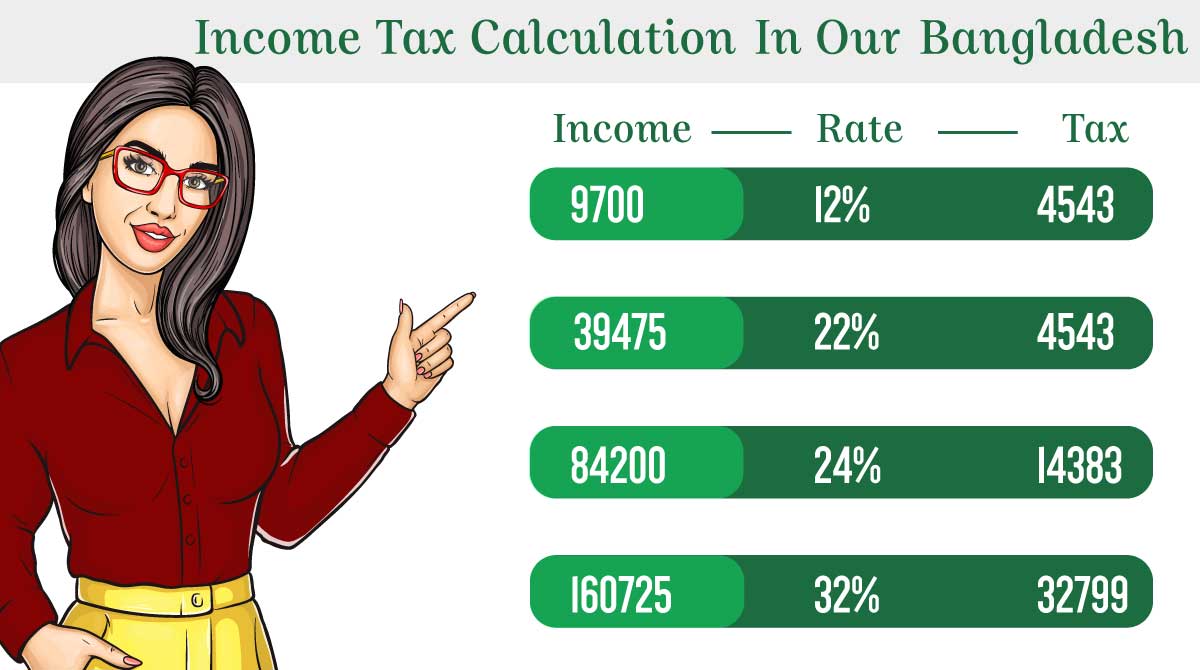

Income Tax Calculate And Submit Returns In Bangladesh

Income Tax Rate In Us Virgin Islands - Web Calculate your US Virgin Islands net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free US Virgin Islands paycheck calculator US Virgin Islands Change state