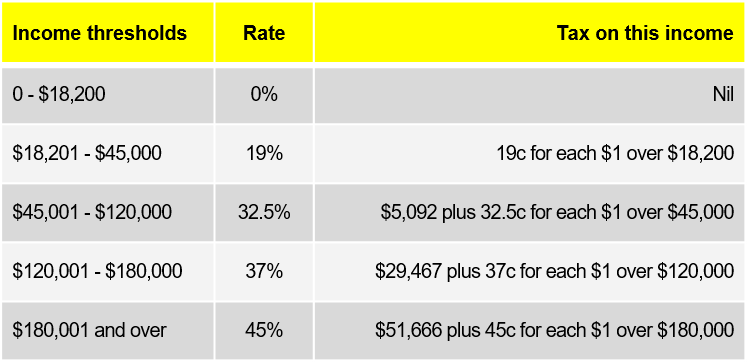

Income Tax Rates 2022 23 Australia Taxable Income Tax On This Income 0 to 18 200 Nil 18 201 to 45 000 19c for each 1 over 18 200 45 001 to 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 to 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

Australian income tax rates for 2023 24 and 2022 23 residents Australian income tax rates for 2024 25 onwards residents Tax cuts from 1 July 2024 How income tax is calculated What is the tax free threshold Tax offsets and deductions What is included in assessable income What deductions are you allowed What is taxable Tax Rates 2022 2023 Taxable Income Tax on this income 0 120 000 32 5c for each 1 120 001 180 000 39 000 plus 37c for each 1 over 120 000 Over 180 000 61 200 plus 45c for each 1 over 180 000 Compulsory superannuation rate 10 5

Income Tax Rates 2022 23 Australia

Income Tax Rates 2022 23 Australia

https://www.fitsnews.com/wp-content/uploads/2020/12/income-tax-rates.jpeg

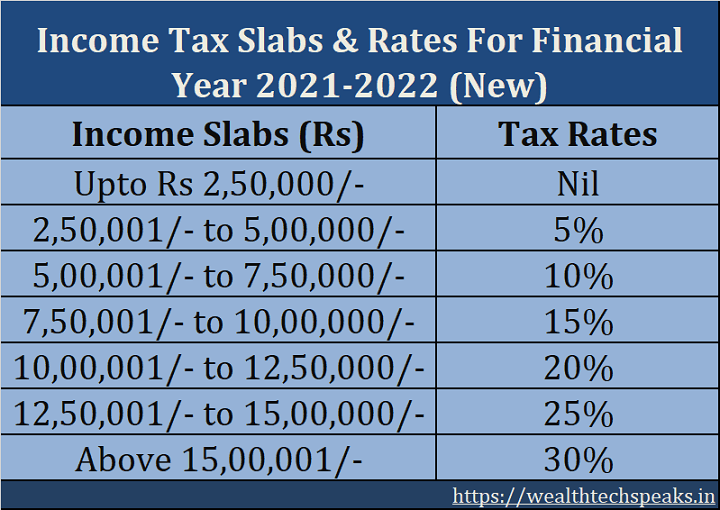

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

2020 21 Federal Budget Details What s In It For You

http://www.datatax.com.au/wp-content/uploads/2020/10/Rate-Table-1-1024x402.png

Individual income tax rates Australian Taxation Office Tax rates for individual taxpayers by residency status for tax purposes for 2024 back to 1984 Last updated 28 September 2023 Print or Download Tax rates Australian resident Tax rates for Australia residents for income years from 2024 back to 1984 Last updated 5 March 2024 Print or Download On 25 January 2024 the government announced changes to Individual income tax rates and thresholds from 1 July 2024 These changes are now law From 1 July 2024 the proposed tax cuts will reduce the 19 per cent tax rate to 16 per cent reduce the 32 5 per cent tax rate to 30 per cent

Simple tax calculator Calculate the gross tax on your taxable income for the 2013 14 to 2022 23 income years Last updated 29 June 2023 Print or Download The tax rates for 2022 23 and 2023 24 excluding the 2 Medicare levy are as follows 2022 23 and 2023 24 income year Non residents foreign residents Taxpayers who are not Australian residents are taxed at different rates The current rates for non residents for 2022 23 and 2023 24 are 2022 23 and 2023 24 income year Working Holiday Makers

Download Income Tax Rates 2022 23 Australia

More picture related to Income Tax Rates 2022 23 Australia

INCOME TAX SLAB FOR FY 2022 23 BBNC

https://www.bbnc.in/blog/wp-content/uploads/2022/10/2.png

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/Income-Tax-Rates-Slab-2048x1072.png

Income Tax Rates Australia 2023 TAX

https://www.nbc.com.au/wp-content/uploads/2019/04/Changes-to-personal-income-tax-rates.png

Calculate how much tax you ll pay In Australia income is taxed on a sliding scale The table below shows income tax rates for Australian residents aged 18 and over It does not include the Medicare levy of 2 Tax rates 2022 23 There are no Personal income tax PIT rates The following tables set out the PIT rates that currently apply to resident and non resident individuals for the year ending 30 June 2023 These rates and thresholds are planned to continue until 30 June 2024

Australia Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Australia are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Australia Tax Calculator 2022 Low Income Tax Offset in 2022 2022 23 Income Tax Rates for Australian Residents The Australian Tax Office ATO is responsible for collecting income tax from working Australians during each financial year In Australia the financial year starts on 1st July and concludes on

Income Tax Rates 2022 23 Scotland Ozella Runyon

https://downloads.thesaurussoftware.com/images/2223-R1.png

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay Mobile

https://wealthtechspeaks.in/wp-content/uploads/2020/07/New-Income-Tax-Slab-Rates-FY-2021-22.png

https://atotaxrates.info/individual-tax-rates...

Taxable Income Tax On This Income 0 to 18 200 Nil 18 201 to 45 000 19c for each 1 over 18 200 45 001 to 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 to 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

https://www.superguide.com.au/how-super-works/income-tax-rates

Australian income tax rates for 2023 24 and 2022 23 residents Australian income tax rates for 2024 25 onwards residents Tax cuts from 1 July 2024 How income tax is calculated What is the tax free threshold Tax offsets and deductions What is included in assessable income What deductions are you allowed What is taxable

The 2021 22 Scottish Income Tax Rates EQ Taxation

Income Tax Rates 2022 23 Scotland Ozella Runyon

TaxTips ca Business 2022 Corporate Income Tax Rates

2020 21 Tax Card

Individual Tax Rate Tax Rates Income Tax Rates For Resident

Income Tax 2022 23 Slab Bed Frames Ideas

Income Tax 2022 23 Slab Bed Frames Ideas

Ine Tax Brackets For 2020 21 Tutorial Pics

2022 Tax Brackets PersiaKiylah

2023 Tax Rates Federal Income Tax Brackets Top Dollar

Income Tax Rates 2022 23 Australia - Individual income tax rates Australian Taxation Office Tax rates for individual taxpayers by residency status for tax purposes for 2024 back to 1984 Last updated 28 September 2023 Print or Download Tax rates Australian resident Tax rates for Australia residents for income years from 2024 back to 1984