Income Tax Rebate 2024 Illinois The 2023 personal exemption amount is 2 425 The original due date for filing your 2023 Form IL 1040 and paying any tax you owe is April 15 2024 The extended due date for filing your return is October 15 2024

IDOR s taxpayer assistance numbers are available for tax related inquiries and include automated menus allowing taxpayers to check the status of a refund identify an IL PIN or receive estimated payment information without having to wait for an agent To receive assistance taxpayers may call 1 800 732 8866 or 217 782 3336 Updated Jan 25 2024 03 51 PM CST ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January

Income Tax Rebate 2024 Illinois

Income Tax Rebate 2024 Illinois

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Nearly 6 2 million IL 1040 returns were filed in 2023 Of those returns 90 3 or 5 6 million were filed electronically or 90 3 If a taxpayer electronically files an error free return they Email Changes for 2023 Illinois Income Tax forms and schedules for individuals and businesses 2024 Withholding Income Tax forms and schedules and tax preparers and software developers See FY Bulletin 2024 18 What s New for Illinois Income Taxes for more information

The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than

Download Income Tax Rebate 2024 Illinois

More picture related to Income Tax Rebate 2024 Illinois

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Illinois Income Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?resize=1024%2C576&ssl=1

In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing jointly or 200 000 if Illinois has a flat income tax rate of 4 95 without any higher tax brackets for those who earn greater incomes Taxpayers were required to submit their 2022 state income taxes on or before April 18 2023 And the rate remains the same for 2024

Understanding the Illinois Income and Property Tax Rebates is important for CPAs or Enrolled Agents because your tax clients will be inquiring about eligibility You must file the Property Tax Rebate Form IL 1040 PTR either electronically through MyTax Illinois or by paper form by October 17 if your client s 2021 IL 1040 has not been The Tax tables below include the tax rates thresholds and allowances included in the Illinois Tax Calculator 2024 Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

https://www.staffnews.in/wp-content/uploads/2023/02/budget-2023-24-finance-bill-2023-rates-of-income-tax.jpg

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

https://cdn.abcotvs.com/dip/images/12224518_091222-wl-pritzker-img.png?w=1600

https://tax.illinois.gov/research/publications/bulletins/fy-2024-18.html

The 2023 personal exemption amount is 2 425 The original due date for filing your 2023 Form IL 1040 and paying any tax you owe is April 15 2024 The extended due date for filing your return is October 15 2024

https://www.ibjonline.com/2024/01/26/illinois-department-of-revenue-announces-start-to-2024-income-tax-season/

IDOR s taxpayer assistance numbers are available for tax related inquiries and include automated menus allowing taxpayers to check the status of a refund identify an IL PIN or receive estimated payment information without having to wait for an agent To receive assistance taxpayers may call 1 800 732 8866 or 217 782 3336

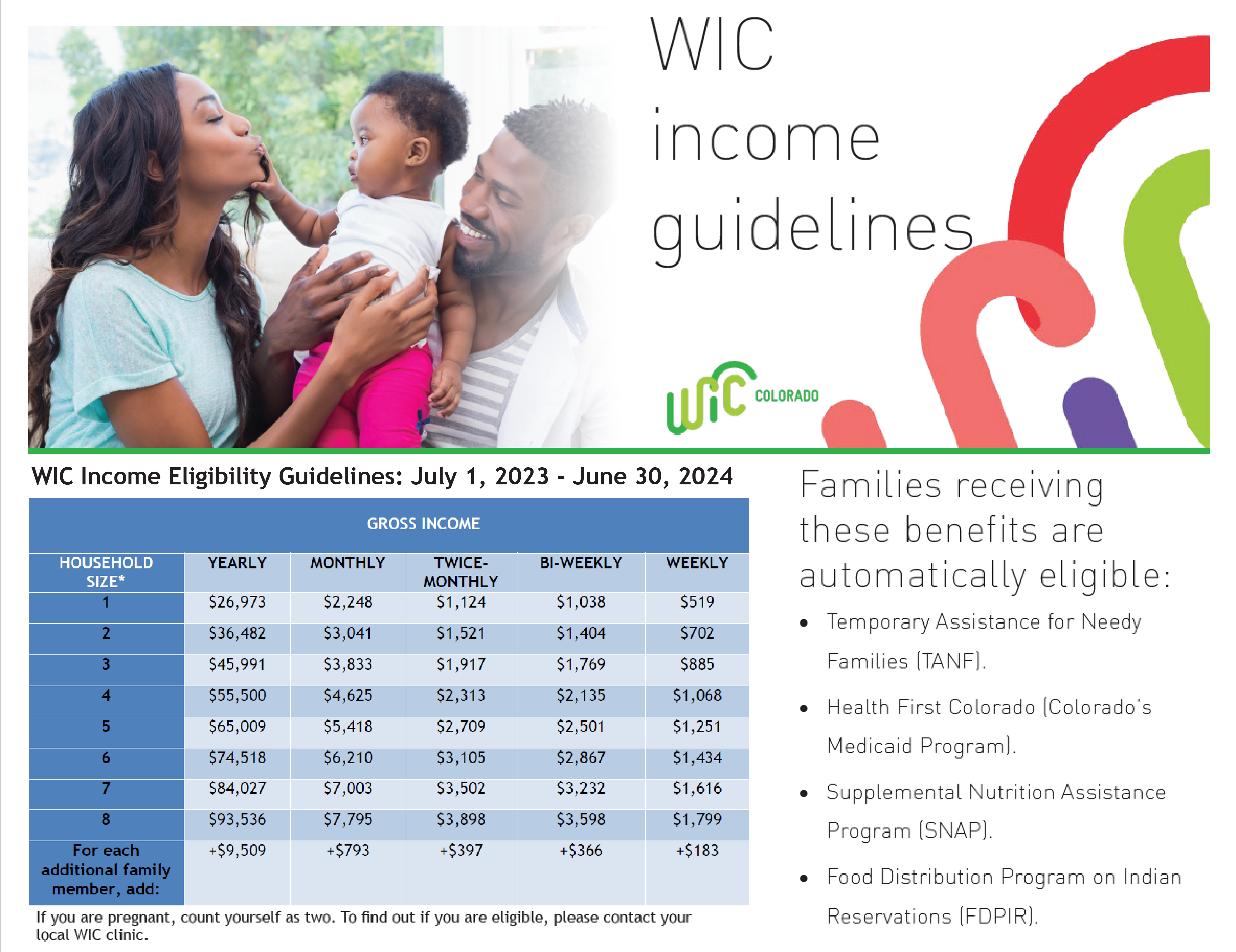

2023 2024 Income Eligibility Guidelines CDPHE WIC

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Fortune India Business News Strategy Finance And Corporate Insight

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Income Tax Rebate Under Section 87A Rebate For Financial Year GST Guntur

Income Tax Recruitment 2023 For Registrar Post Check Age Salary Qualification Eligibility

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Income Tax Rebate 2024 Illinois - The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than