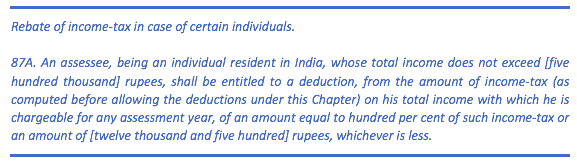

Income Tax Rebate Act Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less Web 20 ao 251 t 2022 nbsp 0183 32 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge Interest if any TDS Note

Income Tax Rebate Act

Income Tax Rebate Act

https://taxguru.in/wp-content/uploads/2021/08/Decoding-Section-87A.jpg

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

https://studycafe.in/wp-content/uploads/2019/12/Rebate-under-Section-87A-of-Income-Tax-Act.jpg

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

https://gstguntur.com/wp-content/uploads/2021/07/Section-87A-Rebate-Income-Tax-Act-768x432.png

Web An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the amount of Web 11 avr 2023 nbsp 0183 32 The Income Tax Act 1961 governs the provisions for income tax rebates in India According to this Act tax rebates are available for specific investments and

Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to Web 23 lignes nbsp 0183 32 Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose

Download Income Tax Rebate Act

More picture related to Income Tax Rebate Act

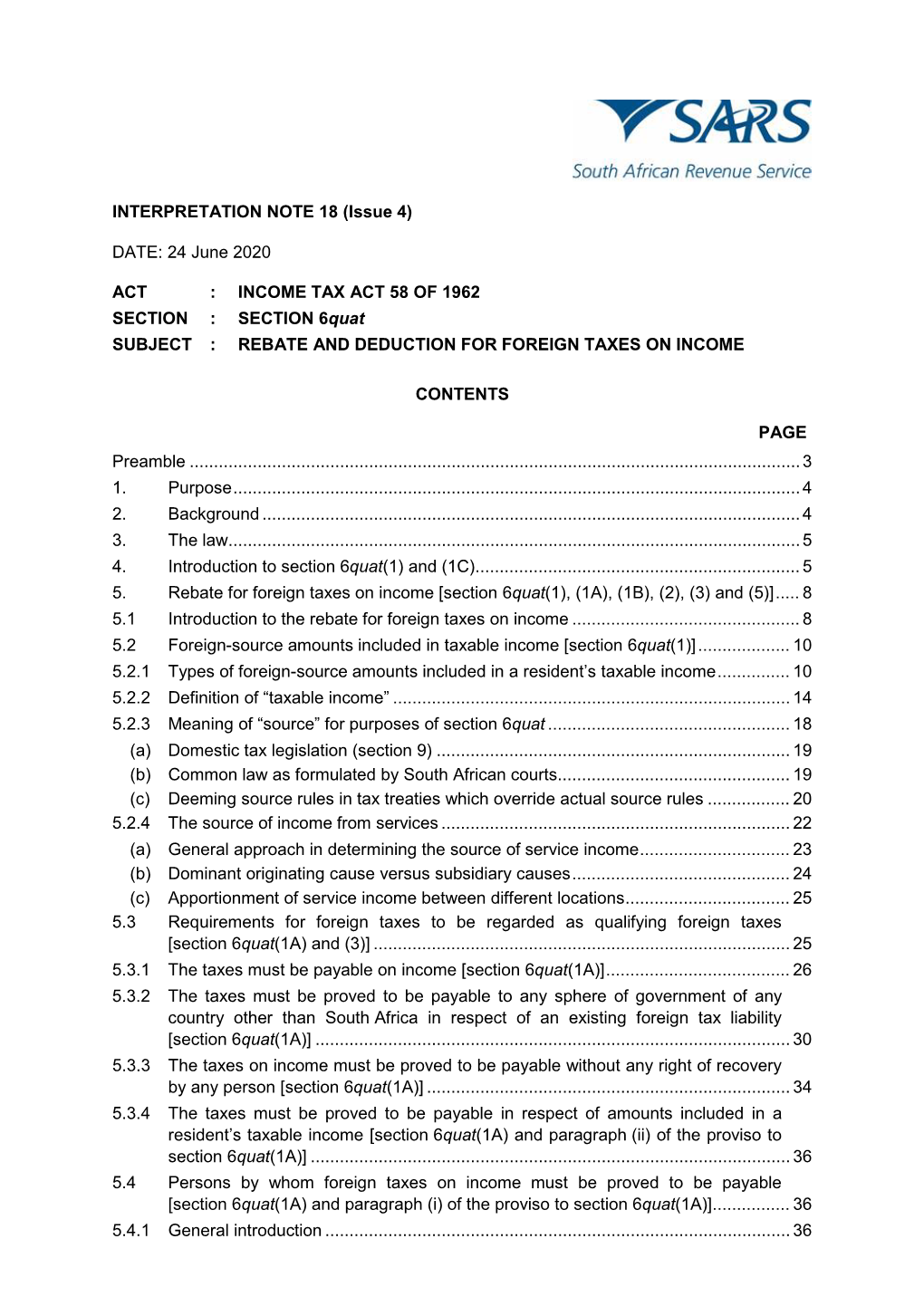

INTERPRETATION NOTE 18 Issue 4 DATE 24 June 2020 ACT INCOME TAX

https://data.docslib.org/img/962983/interpretation-note-18-issue-4-date-24-june-2020-act-income-tax-act-58-of-1962-section-section-6quat-subject-rebate.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Screen-Shot-2020-06-22-at-10.13.23-PM.png

Web 3 ao 251 t 2023 nbsp 0183 32 Total Taxable Income TTI Rs 4 00 000 Since his TTI is below the threshold of Rs 5 00 000 hence taxpayer Mr Virat is eligible for claiming rebate u s 87A for FY Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 3 janv 2022 nbsp 0183 32 On 31 December 2021 the Minister in the exercise of the powers conferred by subsection 6D 4 of the Income Tax Act 1967 Act 53 gazetted the Income Tax

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Section 87a Of Income Tax Act Income Tax Taxact Income

https://i.pinimg.com/originals/b3/57/9d/b3579d46d1a28f2b1180211b6e7a9b92.png

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Section 87A Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act Section 87A

Rebate Under Section 87A Of Income Tax Act YouTube

Rebate Under Section 87A Of Income Tax Act YouTube

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Income Tax Rebate Act - Web 11 avr 2023 nbsp 0183 32 The Income Tax Act 1961 governs the provisions for income tax rebates in India According to this Act tax rebates are available for specific investments and