Income Tax Rebate And Exemption Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

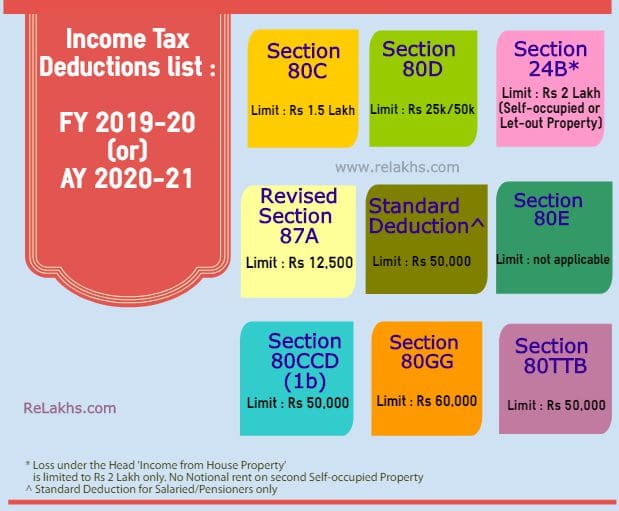

Web 1 f 233 vr 2023 nbsp 0183 32 How much tax deduction can you get in the current financial year Do you need clarification on the difference between a tax rebate and a tax exemption Are pension gratuity LTA HRA and tax exempted Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income tax

Income Tax Rebate And Exemption

Income Tax Rebate And Exemption

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Web 24 f 233 vr 2023 nbsp 0183 32 Difference between tax exemption tax deduction and rebate One can claim income tax deductions and tax exemptions from their income However one can claim Web Exemptions and deductions both reduce the taxable income and are allowed concession before the taxes are paid while rebates reduce the tax and are offered after taxes are filed Exemption The word exempt

Web 10 f 233 vr 2023 nbsp 0183 32 Tax exemptions are to be claimed only from a specific source of income and not from the total income For example exemptions under the salary head are not Web Corporate Income Tax Rate Rebates amp Tax Exemption Schemes On this page Corporate Income Tax Rate Corporate Income Tax Rebates Corporate Income Tax Rate Your

Download Income Tax Rebate And Exemption

More picture related to Income Tax Rebate And Exemption

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Difference-between-exemption-and-deduction-and-rebate-768x1256.png

2022 Deductions List Name List 2022

https://wealthtechspeaks.in/wp-content/uploads/2021/03/Tax-Deduction-Calculation.png

What Is Difference Between Tax Rebate And Tax Exemption Quora

https://qph.fs.quoracdn.net/main-qimg-9c96c274f3b130b088e6abfe87ee1ab2

Web 21 f 233 vr 2023 nbsp 0183 32 Exemption of Allowances House Rent Allowance A salaried individual having a rented accommodation can get the benefit of HRA House Rent Allowance Web 1 f 233 vr 2023 nbsp 0183 32 Income tax exemption as the word exemption suggests simply means that no tax needs to be paid Presently the government exempts income of up to Rs 2 5 Lakh per annum It basically means

Web 23 mai 2019 nbsp 0183 32 Here you can spot the difference between tax deductions tax exemptions and tax rebates You can claim tax deductions and tax exemptions from your income Web 12 mars 2020 nbsp 0183 32 The terms Income Tax Rebate Income Tax Deduction and Exemption are interchangeably used most times by the common man However the meaning amp

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

https://www.etmoney.com/blog/difference-bet…

Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

https://www.tomorrowmakers.com/tax-plannin…

Web 1 f 233 vr 2023 nbsp 0183 32 How much tax deduction can you get in the current financial year Do you need clarification on the difference between a tax rebate and a tax exemption Are pension gratuity LTA HRA and tax exempted

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Tax Rebate For Individual Deductions For Individuals reliefs

How To Choose Between The New And Old Income Tax Regimes Chandan

First Time Home Buyer Tax Questions

Income Tax Slab For Women Exemption And Rebates

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate And Exemption - Web 8 d 233 c 2020 nbsp 0183 32 Income Tax Basic Concept Exemptions Deductions Rebate and Relief Differences Explained YouTube In this video we have covered the important concept