Income Tax Rebate Exemption Income tax exemptions apply to specific sources of income making that income tax free while tax deductions reduce your taxable income by allowing you to deduct certain expenses or investments from your gross income

Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Income Tax Rebate Exemption

Income Tax Rebate Exemption

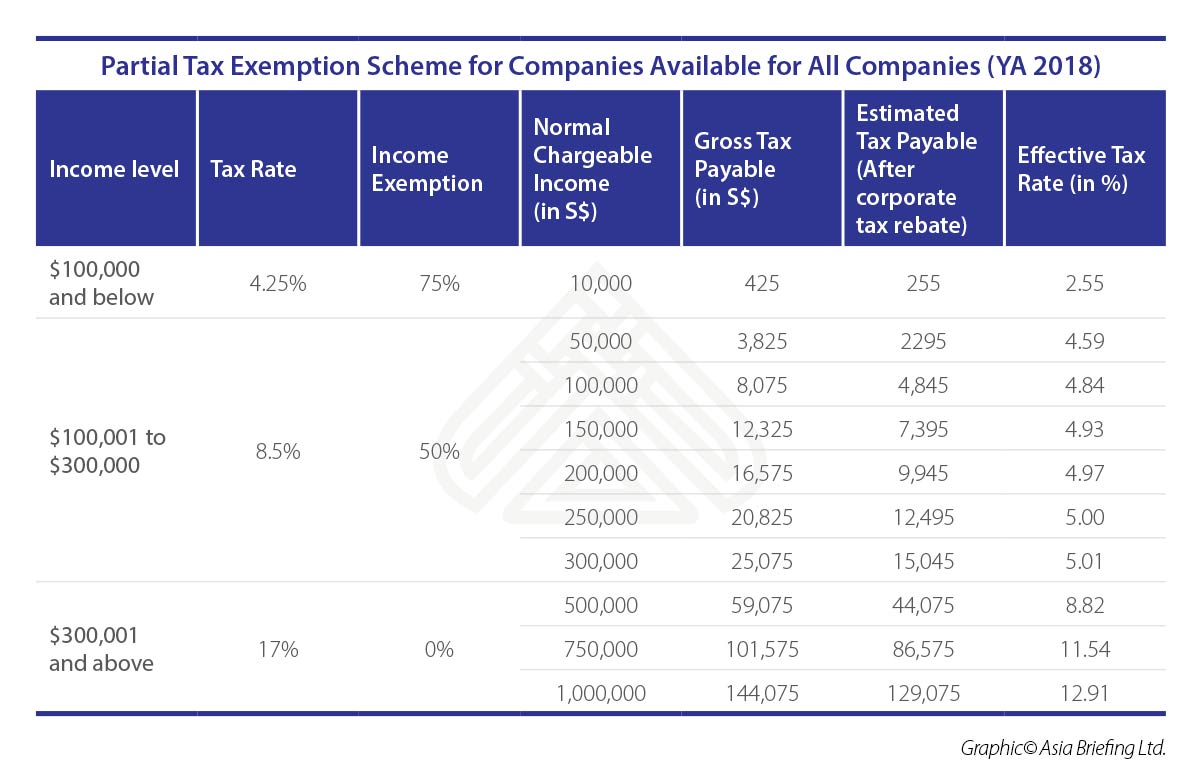

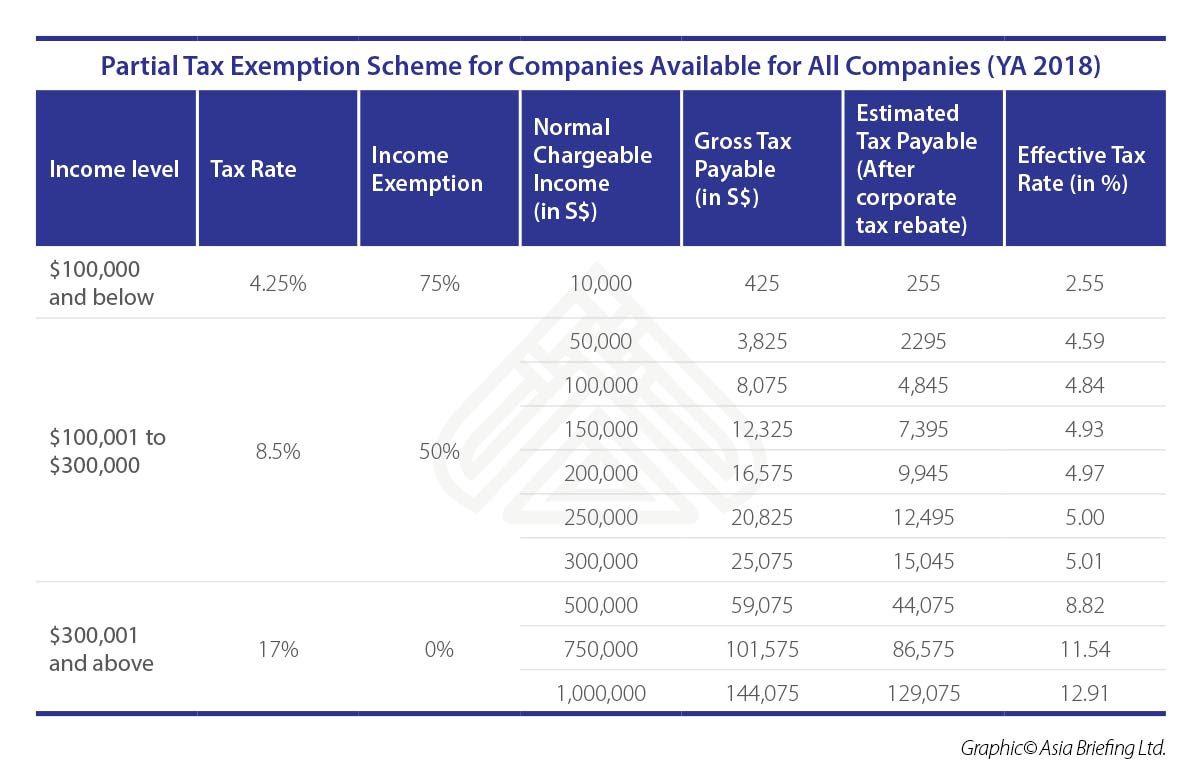

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2023/08/Difference-between-tax-exemption-tax-deduction-tax-rebate-tds-.jpg

IRAS SRS Contributions And Tax Relief 2023

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/srs-contribution-and-tax-relief.png?sfvrsn=befc84cc_3

For taxpayers registered through a tax agent lodgement program and with a December year end date taxable returns are due for lodgement by 30 June Also note that taxable returns will include those that have a taxable income but may be in a refund position due to the payment of sufficient provisional tax during 2020 Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs 12 500 then you will not have to pay any tax

A Super Senior Citizen is an individual resident who is 80 years or above at any time during the previous year Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above In the old tax regime the basic exemption limit for senior citizens is Rs 3 00 000 and for super senior citizens it is Rs 5 00 000 In the new tax regime no income tax is payable upto the total income of Rs 7 lakh

Download Income Tax Rebate Exemption

More picture related to Income Tax Rebate Exemption

Difference Between Tax Exemption Deduction And Rebate

https://housing.com/news/wp-content/uploads/2023/02/Difference-between-tax-exemption-tax-deduction-and-rebate-f.jpg

Office Of The Deputy Commissioner Champhai District Government Of

https://dcchamphai.mizoram.gov.in/uploads/attachments/2022/03/629bfa4f0179c259812ac813e7f29e11/1646650266815.png

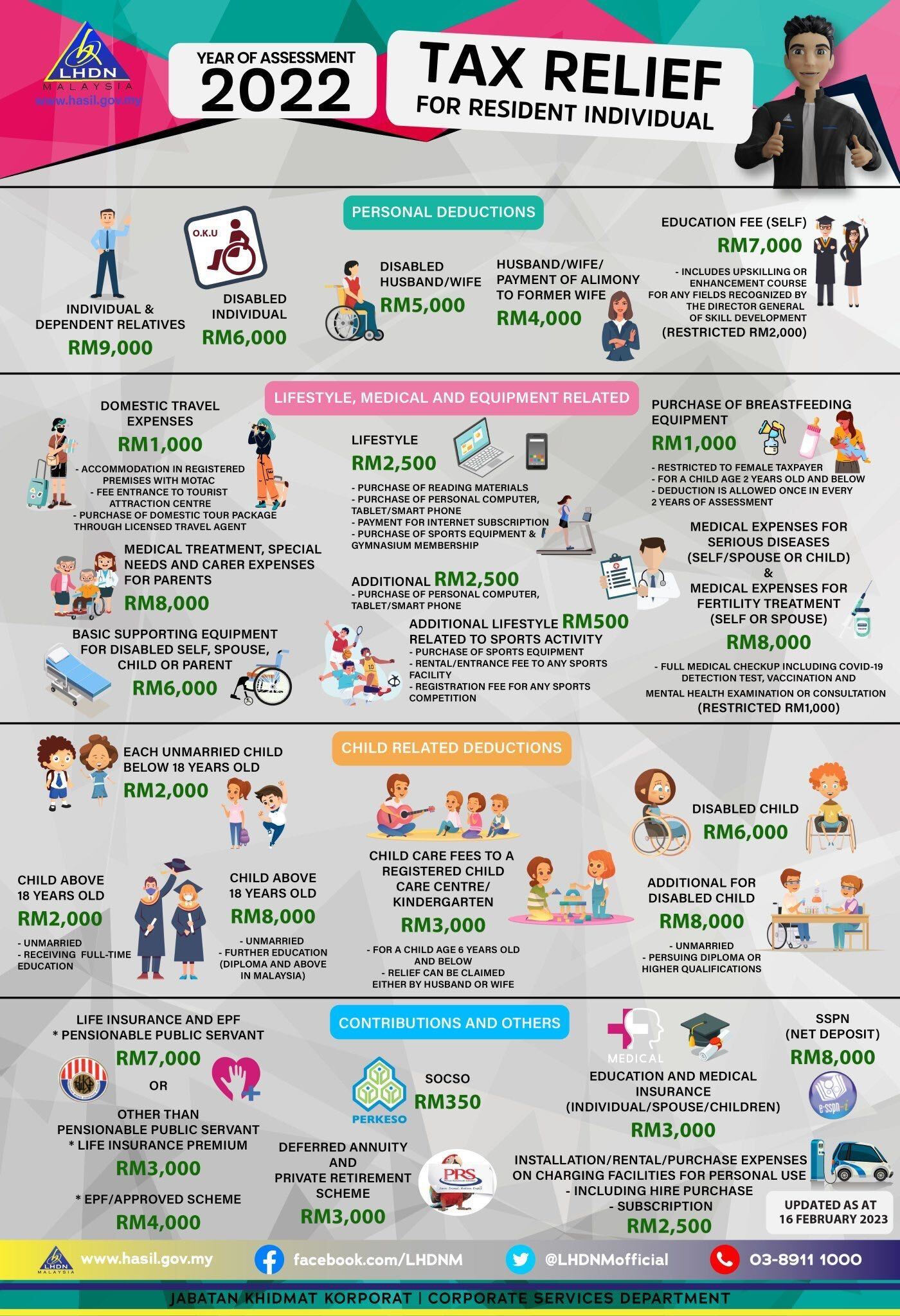

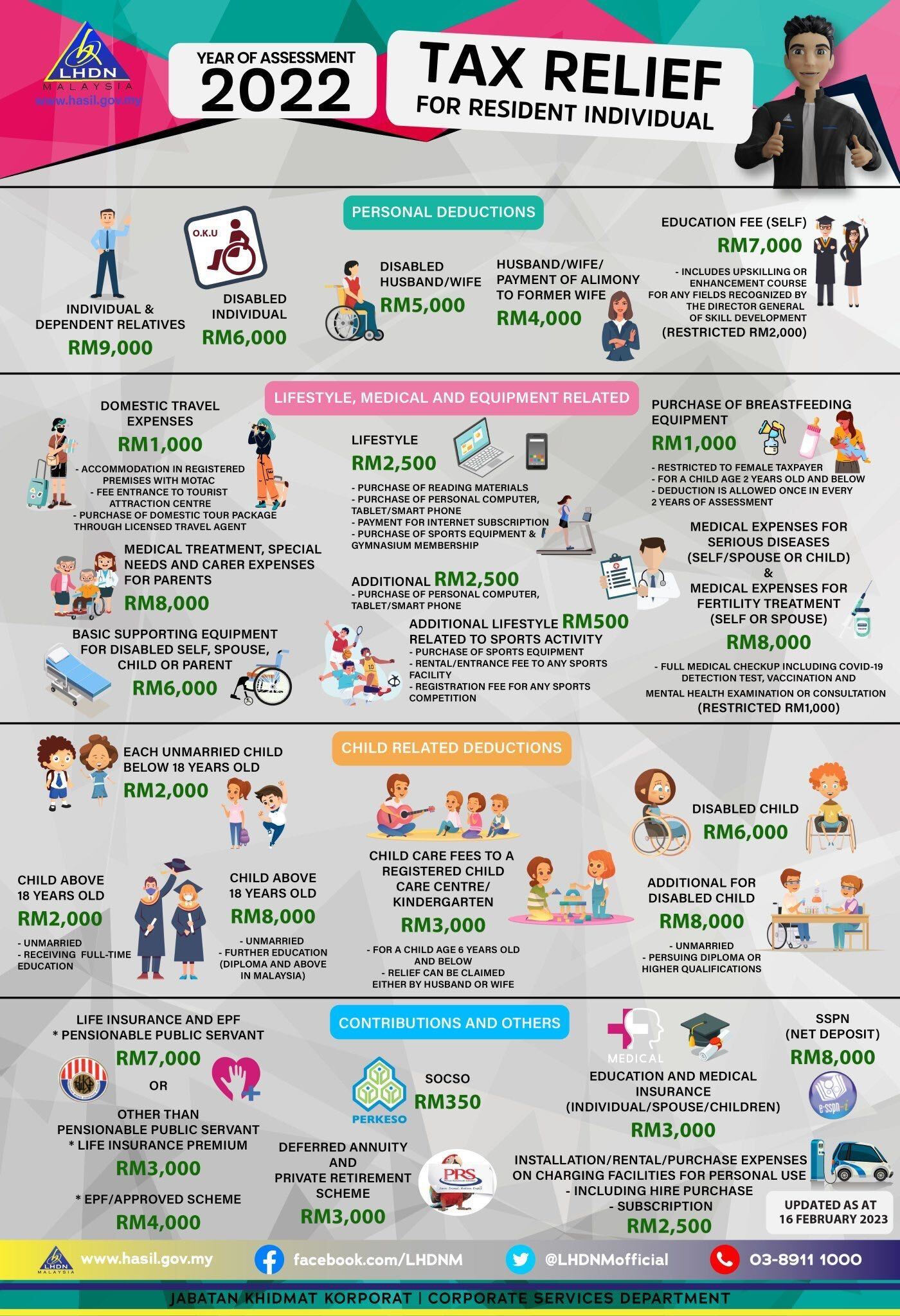

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

State and local taxes were front and center during the 2024 election This GT Alert highlights some of the major state and local tax initiatives decided Nov 5 Oregon Measure 118 People s Rebate Oregon Measure 118 would have imposed a 3 gross receipts tax on most businesses with Oregon gross sales exceeding 25 million Deadline extended to apply for your ANCHOR tax rebate in New Jersey What to know New Jersey residents now have until Dec 6 to apply for the state s Affordable New Jersey Communities for

A tax exemption reduces or eliminates a portion of your income from taxation Federal state and local governments create tax exemptions to benefit people businesses and other entities in A key provision of the CARES Act will send tax rebate payments to individuals The rebates will be up to 1 200 per taxpayer or 2 400 for married couples that file jointly There is an additional 500 rebate for each qualifying child These amounts phase out at moderate income levels

Budget 2023 Check The Difference Between Income Tax Exemption

https://images.news18.com/ibnlive/uploads/2022/08/income-tax-belated-itr-filing-16594291923x2.jpg?impolicy=website&width=510&height=356

Union Budget 2020 How Income Tax Rebate Tax Exemption And Tax

https://imgeng.jagran.com/images/2020/jan/29_08_2019-income_tax_195287911580362220002.jpg

https://cleartax.in/s/difference-between-tax...

Income tax exemptions apply to specific sources of income making that income tax free while tax deductions reduce your taxable income by allowing you to deduct certain expenses or investments from your gross income

https://cleartax.in/s/income-tax-rebate-us-87a

Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed

Window To Enjoy Tax Reliefs Closing CN Advisory

Budget 2023 Check The Difference Between Income Tax Exemption

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Huge Relief For Wage Earners Increase In Income

Virginia Department Of Taxation Review Letter Sample 1

LHDN Tax Relief List 2022 How To Fill In E Filing 2023 Pesan By Qoala

LHDN Tax Relief List 2022 How To Fill In E Filing 2023 Pesan By Qoala

Difference Between Income Tax Deductions Exemptions And Rebate Plan

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

Request Letter For Tax Exemption And Certificate SemiOffice Com

Income Tax Rebate Exemption - Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs 12 500 then you will not have to pay any tax