Income Tax Rebate For Buying A New Home Web 14 juin 2021 nbsp 0183 32 The First Time Homebuyer Tax Credit is a tax refund from the U S Treasury paid to eligible first time home buyers and cashed in when federal taxes get filed The refund is neither a loan like some

Web 28 nov 2022 nbsp 0183 32 In a nutshell this refundable tax credit may be applied to your tax return at the end of the year and is equal to 10 of a home s purchase price It cannot exceed Web If you bought a newly constructed home from a builder you may be able to claim a new housing rebate for some of the goods and services tax harmonized sales tax

Income Tax Rebate For Buying A New Home

Income Tax Rebate For Buying A New Home

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

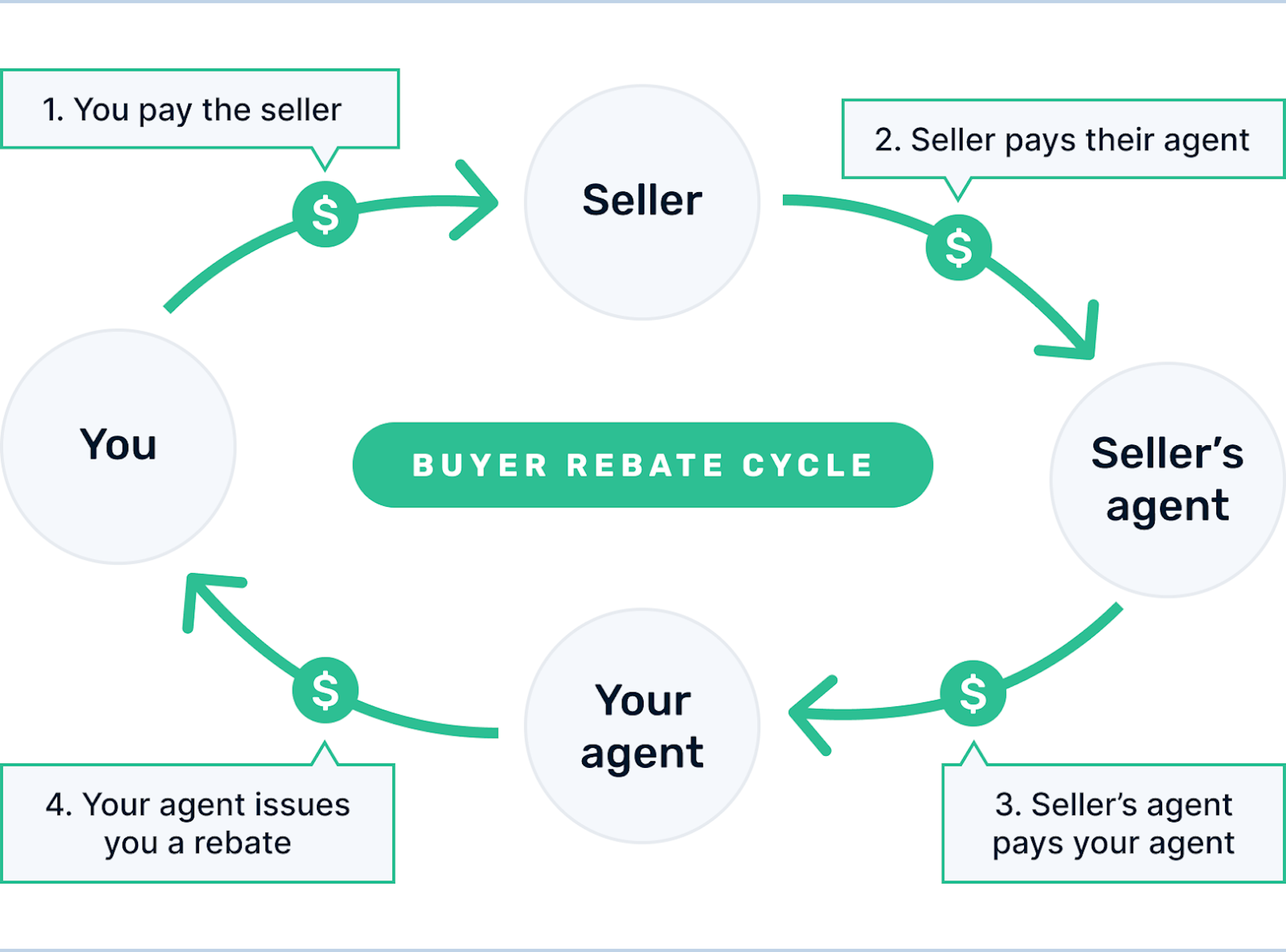

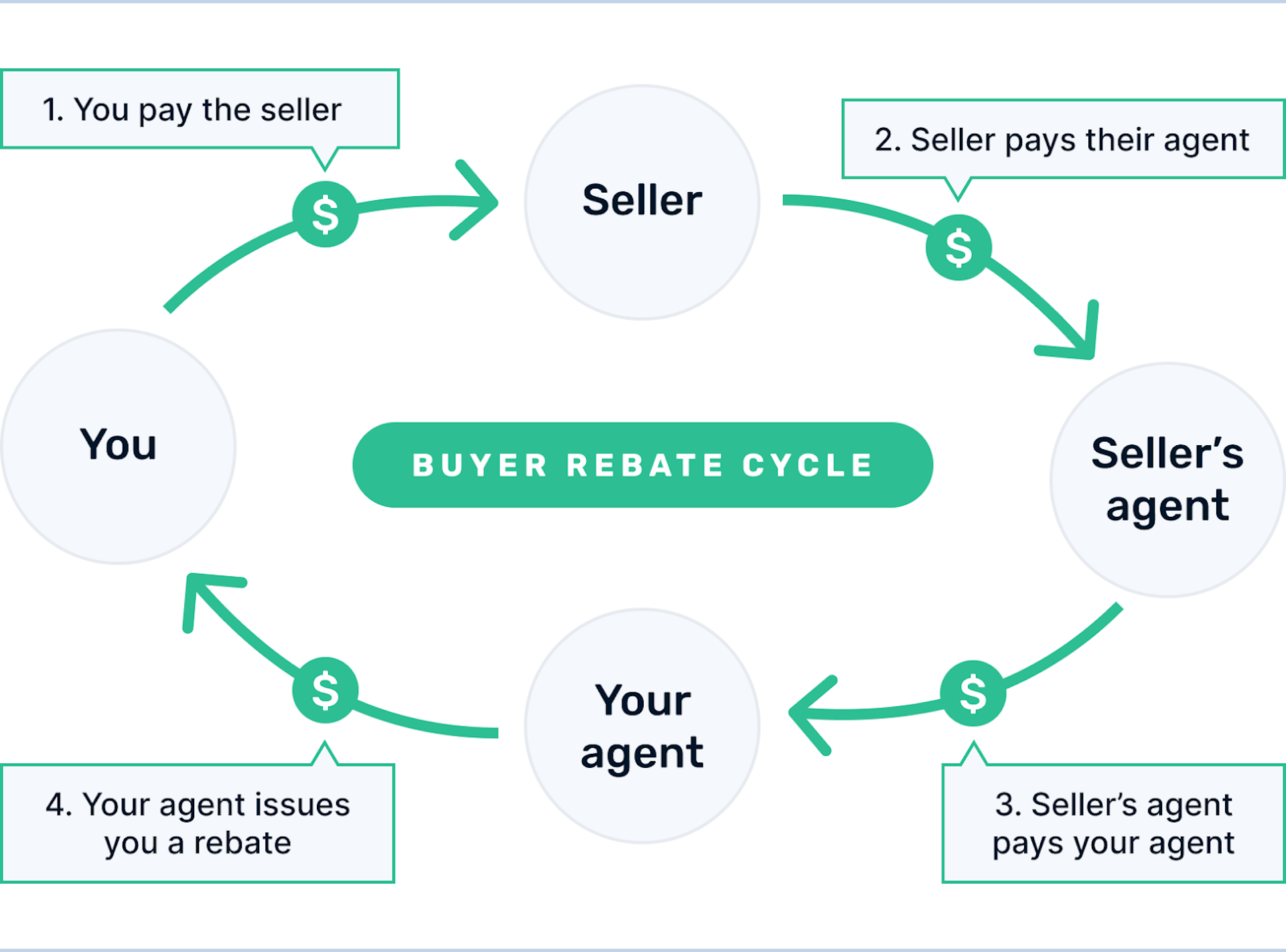

Home Buyer Rebates Get Cash Back When You Buy

https://cosmic-s3.imgix.net/463c8790-7c97-11eb-abfb-1b324c629d39-RebateCycle2.png?auto=format&w=1920&q=20

Pin On Moving Buying Selling Home

https://i.pinimg.com/originals/81/e9/64/81e9647776fe18b35ef4ed3d4c121000.jpg

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying Web 7 ao 251 t 2023 nbsp 0183 32 First the amount you can claim has been reduced to 750 000 This runs until 2025 when the 1 million limit will return There are no differences between filing separately or jointly However married

Web 23 mai 2023 nbsp 0183 32 After the passage of new legislation in December of 2022 eligible first time home buyers can claim a 10 000 non refundable income tax credit double what they could before which could Web Definitions Important terms Determining if you are a builder for GST HST purposes Determining what is considered a house for purposes of the new housing rebate Primary

Download Income Tax Rebate For Buying A New Home

More picture related to Income Tax Rebate For Buying A New Home

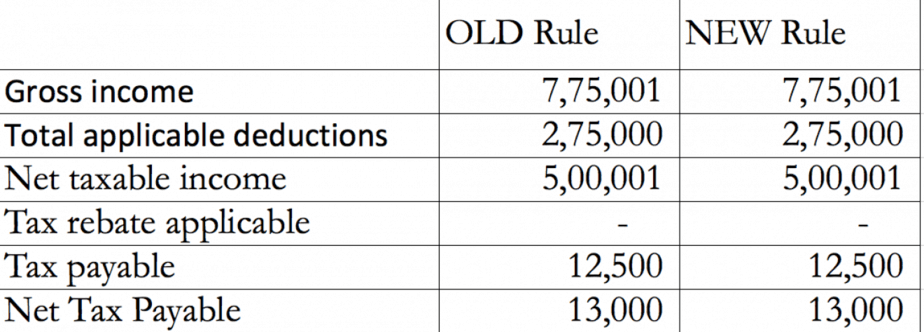

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Revised Tax Rebate Section 87A Examples Budget 2019 For FY 2019 20

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM-1320x474.png

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web The First Time Homebuyer Act of 2021 authorizes federal tax credits of up to 15 000 for first time homebuyers It applies to any home purchased after January 1 2021 and

Web 21 nov 2019 nbsp 0183 32 If you purchased a newly built home to use as your primary residence you can claim a rebate for goods and services tax harmonized sales tax paid on the Web The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as

Hidden Costs Of Buying A Home Plus Grants And Rebates Get The Kind Of

https://i.pinimg.com/originals/21/12/61/2112615f6903cb03a00fe9538d13eb52.png

Newbie Home Buyers Series Part 2 Drawing Up Your Dream House

https://i.pinimg.com/originals/67/ce/84/67ce8459c5d234cdc739f2b11670520b.jpg

https://homebuyer.com/learn/15000-first-tim…

Web 14 juin 2021 nbsp 0183 32 The First Time Homebuyer Tax Credit is a tax refund from the U S Treasury paid to eligible first time home buyers and cashed in when federal taxes get filed The refund is neither a loan like some

https://www.cambridgesage.com/blog/tax-credit-for-buying-a-house

Web 28 nov 2022 nbsp 0183 32 In a nutshell this refundable tax credit may be applied to your tax return at the end of the year and is equal to 10 of a home s purchase price It cannot exceed

What To Know About Montana s New Income And Property Tax Rebates

Hidden Costs Of Buying A Home Plus Grants And Rebates Get The Kind Of

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

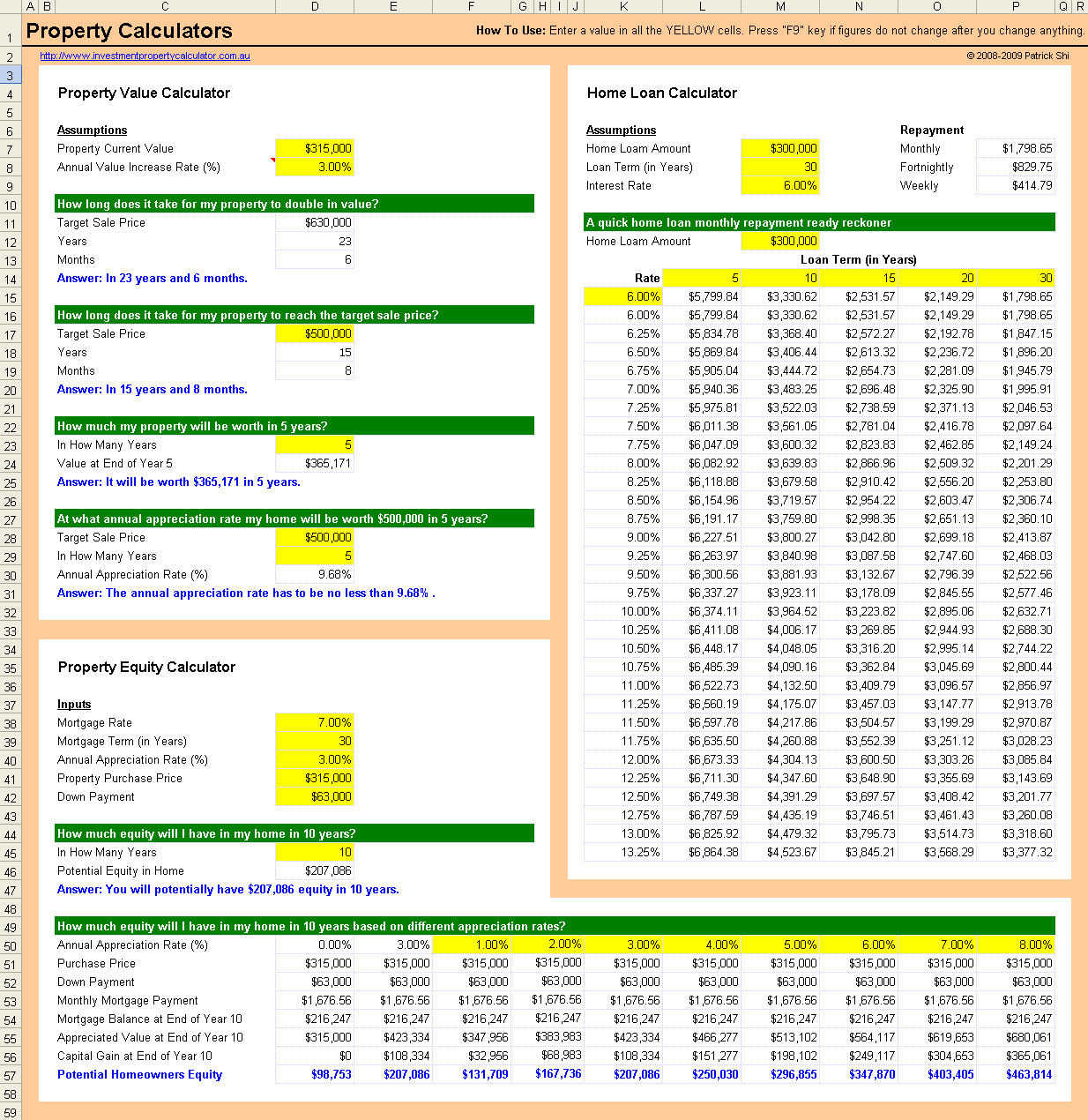

Home Buying Spreadsheet Template For House Buying Calculator

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Tds Slab Rate For Ay 2019 20

Pin By Coming Home Real Estate On Home Buying 101 Home Buying

Excel Mortgage Worksheet

Income Tax Rebate For Buying A New Home - Web 24 mars 2022 nbsp 0183 32 Claim the GST HST new housing rebate You may be able to claim a rebate for some of the GST HST you paid to buy a newly built house building and land