Income Tax Rebate For Disabled Child Web 19 juil 2023 nbsp 0183 32 The credit is non refundable meaning it can lower your tax bill to zero but you will not receive any part of it back as a tax refund The child and dependent care

Web benefits from your income if you adopt a child with special needs See IRS Publication 907 EITC for parents of children with disabilities You may qualify for this credit if your Web 20 juil 2019 nbsp 0183 32 Section 80DD of income tax act provides flat deduction irrespective of the amount of expenditure incurred by the family of

Income Tax Rebate For Disabled Child

Income Tax Rebate For Disabled Child

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Income Tax Rebate For Handicapped U s 80 U 80 DD YouTube

https://i.ytimg.com/vi/Jrs4fApB7Fs/maxresdefault.jpg

Web 20 juin 2023 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Web 27 juil 2023 nbsp 0183 32 If you your spouse or child has a disability that has been confirmed by a registered medical practitioner by way of an ITR DD form you can claim 33 3 of the

Web 3 ao 251 t 2023 nbsp 0183 32 Introduction Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and Web Find out about payments deductions and tax for participants in the National Disability Insurance Scheme NDIS Tax offsets for people with a disability Work out if you or

Download Income Tax Rebate For Disabled Child

More picture related to Income Tax Rebate For Disabled Child

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Disability Tax Rebate For Disabled Child Get The Maximum Disability

https://i.ytimg.com/vi/oppKdSz8XqA/maxresdefault_live.jpg

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

Web 11 sept 2023 nbsp 0183 32 Section 80DDB allows taxpayers to claim for the medical treatment of their dependents family members who are differently abled or disabled Here are more about Web 6 sept 2023 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability i e 80 or more of a disability he is eligible for a deduction of Rs

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is Web 24 juil 2018 nbsp 0183 32 Deduction allowed goes up to Rs 1 25 000 if disabled dependant is a person with severe disability Deduction not depend on amount of expenses incurred Even if

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Child Care Rebate Income Tax Return 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/daycare-business-income-and-expense-sheet-to-file-your-daycare-business-1.jpg

https://www.kiplinger.com/taxes/tax-breaks-for-parents-of-children...

Web 19 juil 2023 nbsp 0183 32 The credit is non refundable meaning it can lower your tax bill to zero but you will not receive any part of it back as a tax refund The child and dependent care

https://www.irs.gov/pub/irs-pdf/p3966.pdf

Web benefits from your income if you adopt a child with special needs See IRS Publication 907 EITC for parents of children with disabilities You may qualify for this credit if your

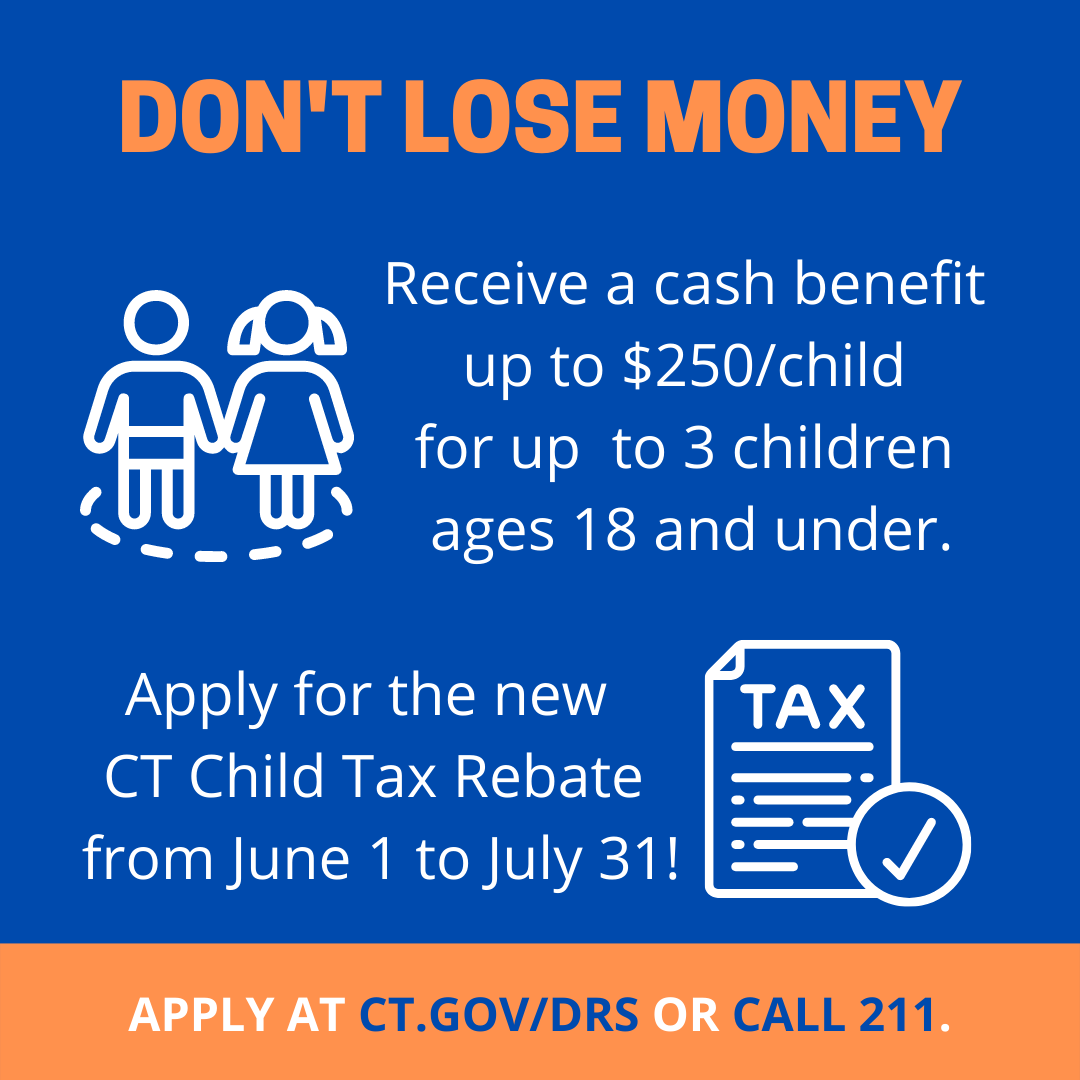

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Are YOU Eligible For The CT Child Tax Rebate

Ptr Tax Rebate Libracha

Ptr Tax Rebate Libracha

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

2022 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

Child Care Rebate Income Tax Return 2022 Carrebate

Income Tax Rebate For Disabled Child - Web 17 f 233 vr 2016 nbsp 0183 32 Tax Deduction under Section 80DD Disabled minimum 40 of the disability Rs 75 000 Severely Disabled 80 or more of the disability Rs 1 25 000