Income Tax Rebate For Donations India Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals Web 16 f 233 vr 2017 nbsp 0183 32 Effective from the assessment year 2018 19 a person can avail a maximum deduction of Rs 2 000 if the donation is made in cash

Income Tax Rebate For Donations India

Income Tax Rebate For Donations India

https://images.sampletemplates.com/wp-content/uploads/2017/03/Donation-Receipt-Tax-Form.jpg

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

https://www.autospyders.com/how-to/wp-content/uploads/2022/08/Meta-App-Installer-1.jpg

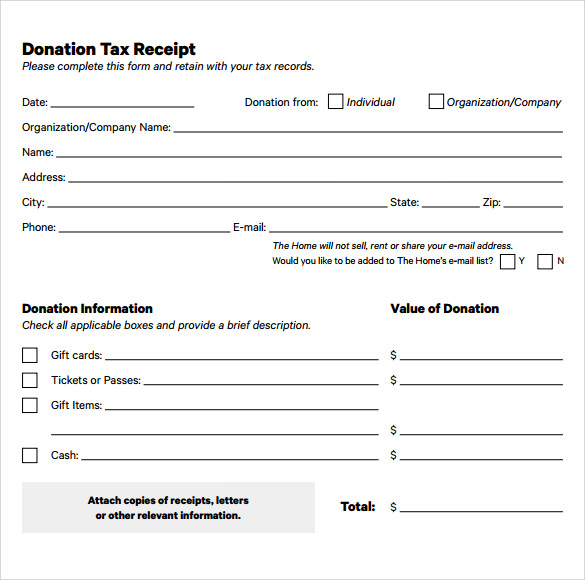

7 Donation Receipt Templates And Their Uses

https://neufutur.com/wp-content/uploads/2018/06/7-Donation-Receipt-Templates-and-Their-Uses-3-1.jpeg

Web 28 d 233 c 2020 nbsp 0183 32 Whenever someone donates to a charity they become eligible for Tax benefits under Section 80G of Income Tax Act However there are a few things one should keep in mind to become eligible for Web 7 sept 2021 nbsp 0183 32 Note that depending on the gross total income of a taxpayer donations made to certain organisations could also be restricted to an upper threshold for claiming

Web Donations made to World Vision India are eligible for tax deductions under Section 80G of the Income Tax Act It has been granted an 80G certificate by the Indian Income Tax Web 9 f 233 vr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 is an important section as it allows individuals and organizations to claim a deduction or rebate on the donation which they

Download Income Tax Rebate For Donations India

More picture related to Income Tax Rebate For Donations India

Random Thoughts Does Donating Money Actually Save You More Money From

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

Tax Rebate Digital Tax Filing Taxes Tax Services

https://i.pinimg.com/originals/d1/08/d6/d108d680f501d43a50b64f8f43eae623.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web Deduction in respect of donations to certain funds charitable institutions etc Deduction in respect of donations to certain funds charitable institutions etc 1 In computing the Web All donations are not treated equally under Income Tax Act Donations to certain funds and institutions qualify for 100 or 50 deduction without any qualifying limit On the other hand certain donations qualify for 100 or

Web 24 sept 2022 nbsp 0183 32 What is Section 80G Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Web You can claim either 100 or 50 of the amount donated as a deduction subject to With or Without the upper limit How much of the amount donated can be claimed

Donation Receipt Templates Artofit

https://i.pinimg.com/originals/09/16/c1/0916c1073f539bbd72c3d659172f148b.jpg

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

https://economictimes.indiatimes.com/wealth/tax/what-are-income-tax...

Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Donation Receipt Templates Artofit

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Daily current affairs

Daily current affairs

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

What Is The Income Tax Slab In India For FY 22 23

Tax Rebate For Individual Deductions For Individuals reliefs

Income Tax Rebate For Donations India - Web This Deduction for Donation can be claimed by any taxpayer whether Individual Partnership Firm HUF Company LLP etc irrespective of whether he is earning income