Income Tax Rebate For Extension Of House Web 4 sept 2020 nbsp 0183 32 Aggrieved the assessee preferred an appeal before the CIT A who confirmed the order of AO by holding that any investment made towards extension or

Web Watch on Tax Exemption for Home Construction Loan The pre construction phase is the time between the date of borrowing and the completion of the construction The Indian Web 1 mai 2019 nbsp 0183 32 Tax deduction on home renovation People who purchase or construct a house can avail tax deduction It also includes loans taken

Income Tax Rebate For Extension Of House

Income Tax Rebate For Extension Of House

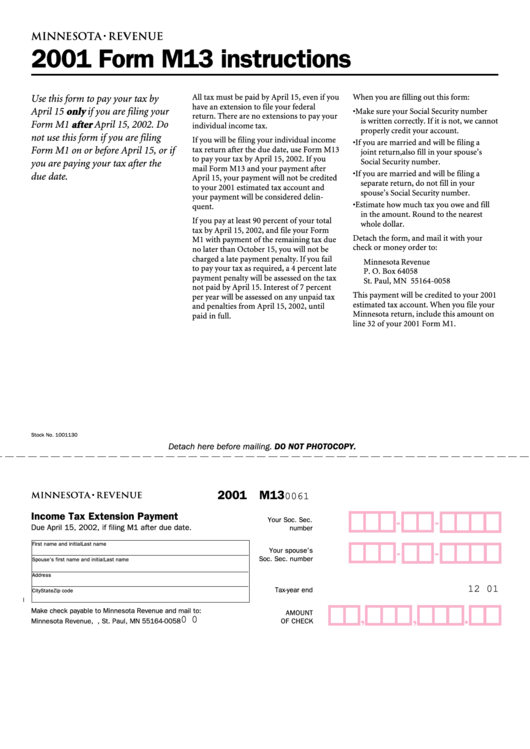

https://data.formsbank.com/pdf_docs_html/227/2270/227019/page_1_thumb_big.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

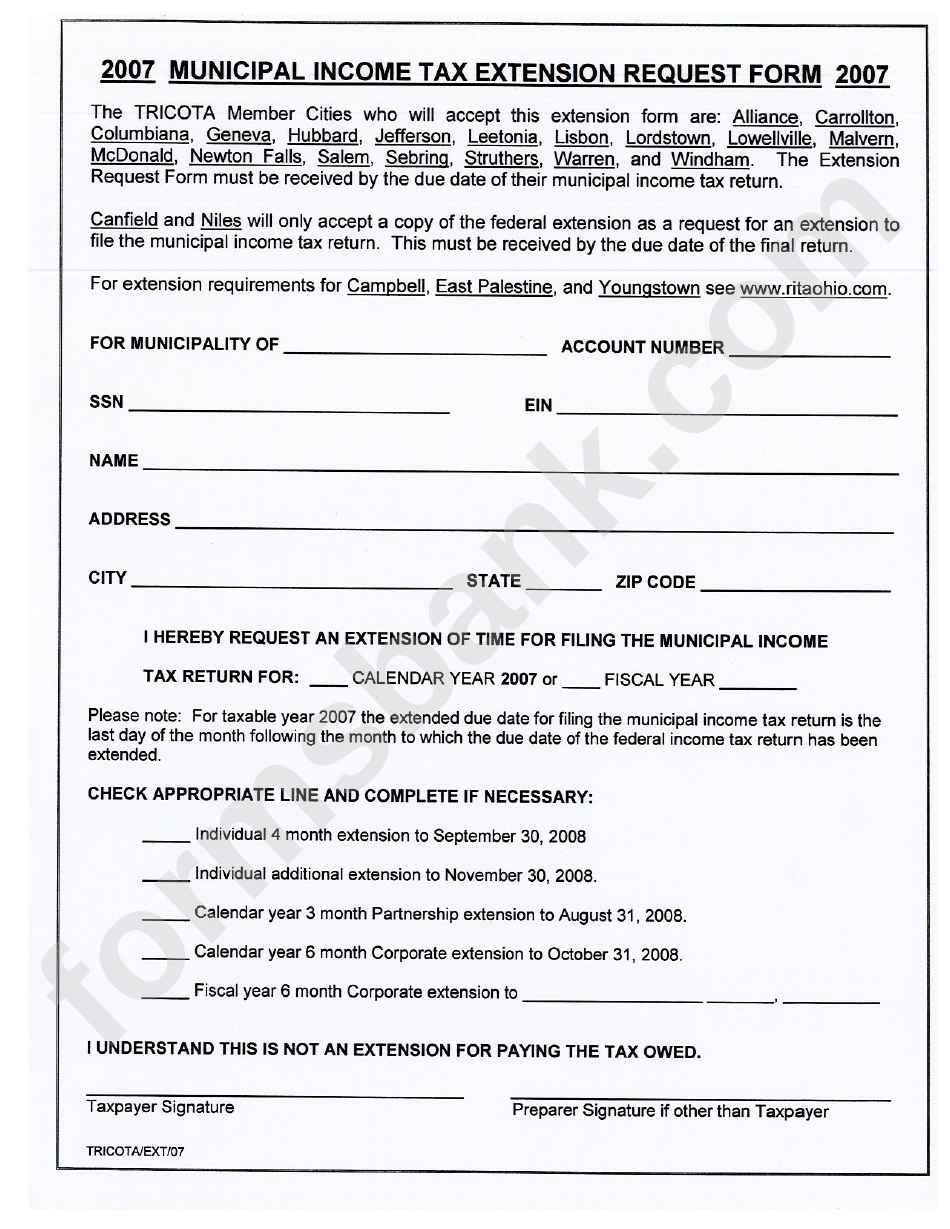

Municipal Income Tax Extension Request Form 2007 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/230/2300/230058/page_1_bg.png

Web Income Tax Income Tax Slabs efiling Income Tax Income Tax Return Income Tax Calculator Online Tax Payment Income Tax Refund Income Tax Refund Status Web Tax benefits on home extension loans are similar to those available on home loans Principal repayment on home extension loans are thus eligible for deduction up to Rs

Web 19 juil 2018 nbsp 0183 32 Under Section 80C of the Income Tax Act a home loan borrower can claim a deduction of up to Rs 1 lakh 1 50 lakh from AY 2015 16 from his taxable income on Web 3 mars 2023 nbsp 0183 32 March 3 2023 Everyone dreams to own a house someday As per the Indian act of Income Tax 1961 referred to as the Income Tax Act the government offers numerous tax rebates on house loans to

Download Income Tax Rebate For Extension Of House

More picture related to Income Tax Rebate For Extension Of House

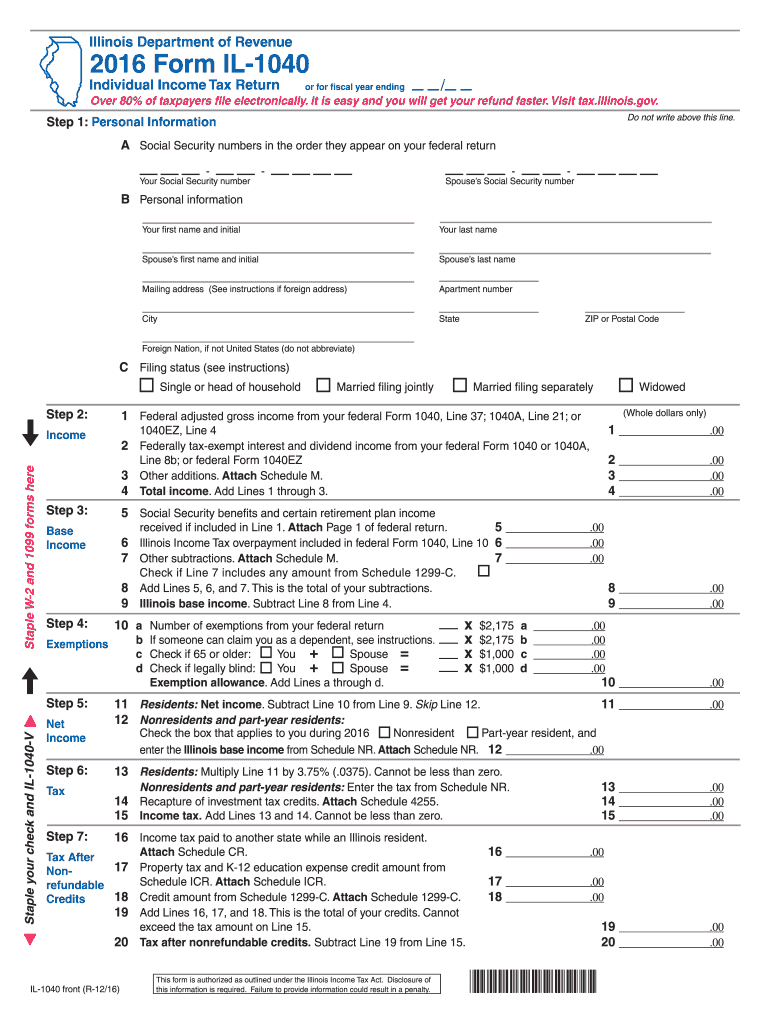

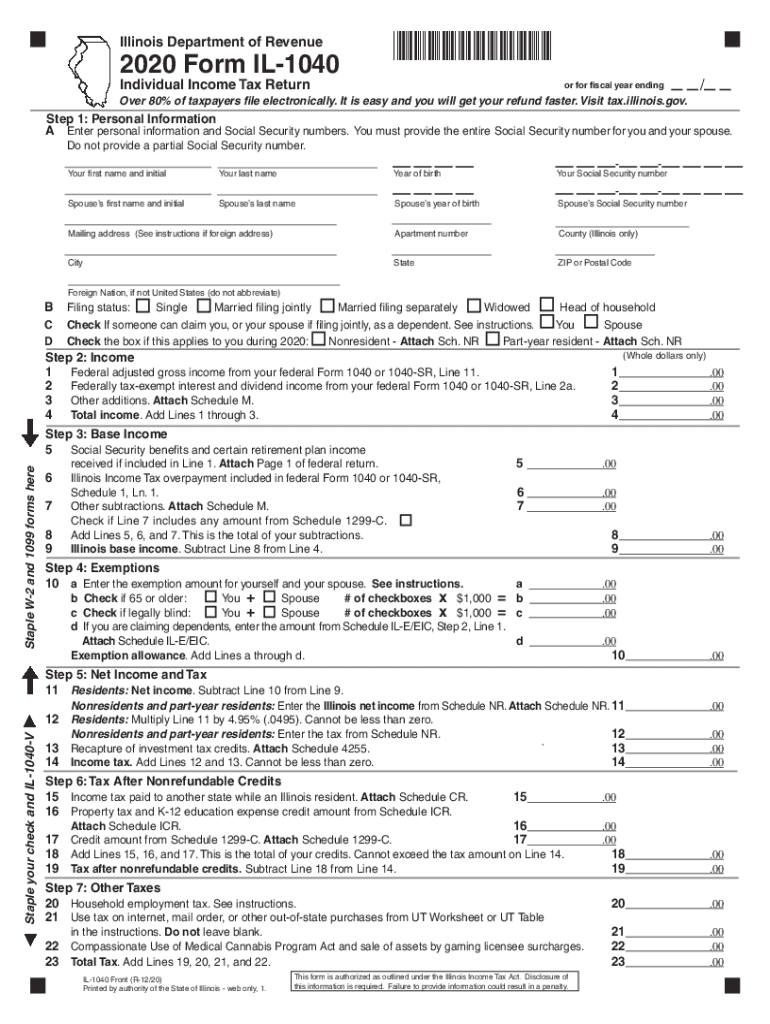

Illinois Form Tax 2016 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/396/726/396726807/large.png

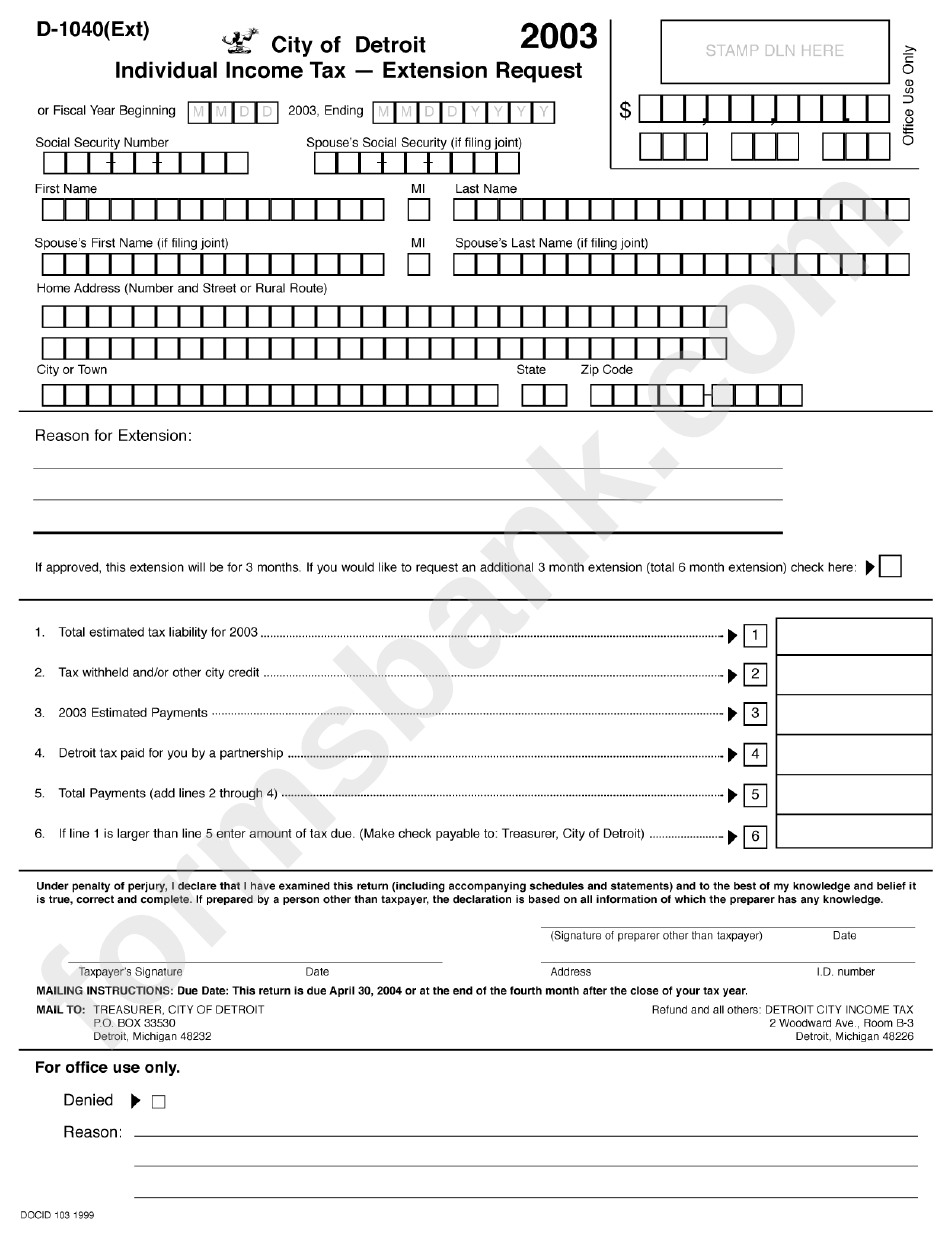

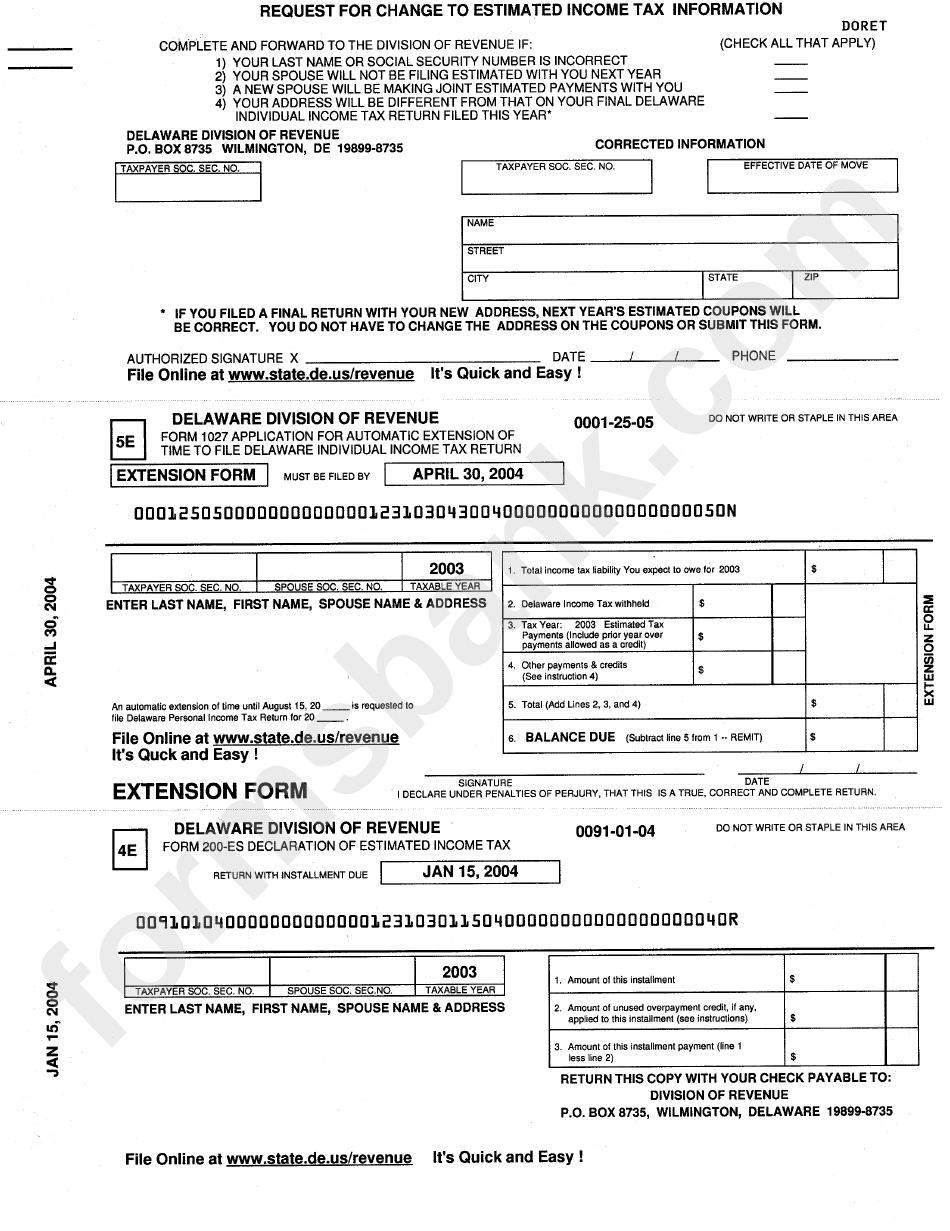

Form D 1040 Individual Income Tax Extension Request 2003 Printable

https://data.formsbank.com/pdf_docs_html/258/2582/258262/page_1_bg.png

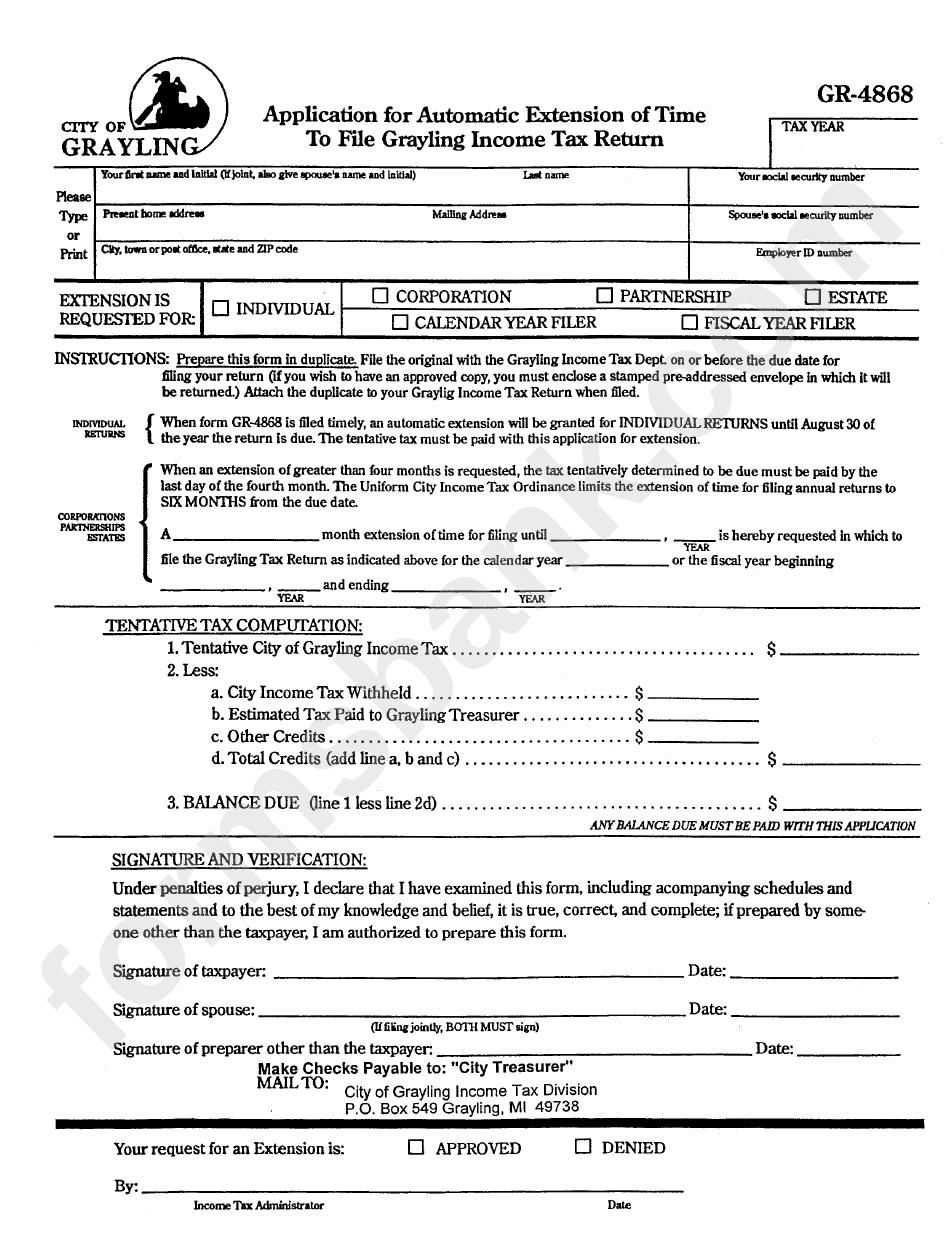

Form Gr 4868 Application For Automatic Extension Of Time To File

https://data.formsbank.com/pdf_docs_html/237/2376/237670/page_1_bg.png

Web Renovating your home can be very fulfilling Funding is the key A house renovation loan is cheaper than commercially available loans Other advantages of a house renovation Web If the home improvement loan is taken for second home you can claim tax deduction on interest repaid of upto Rs 30 000 over and above the interest repayment of your home

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as

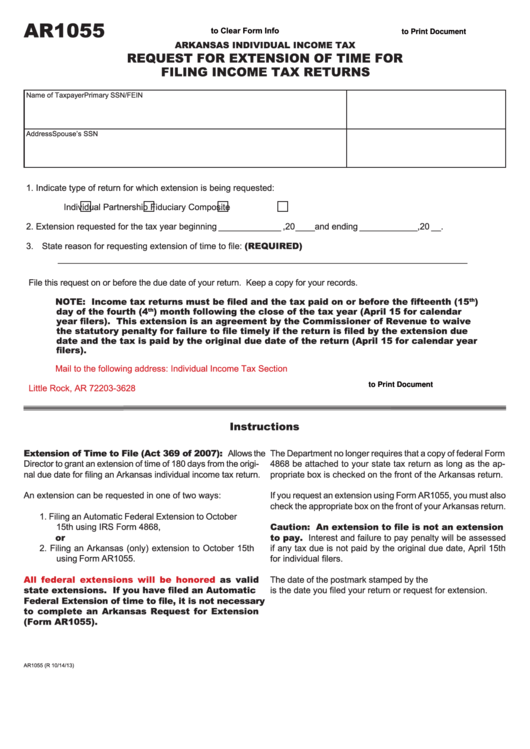

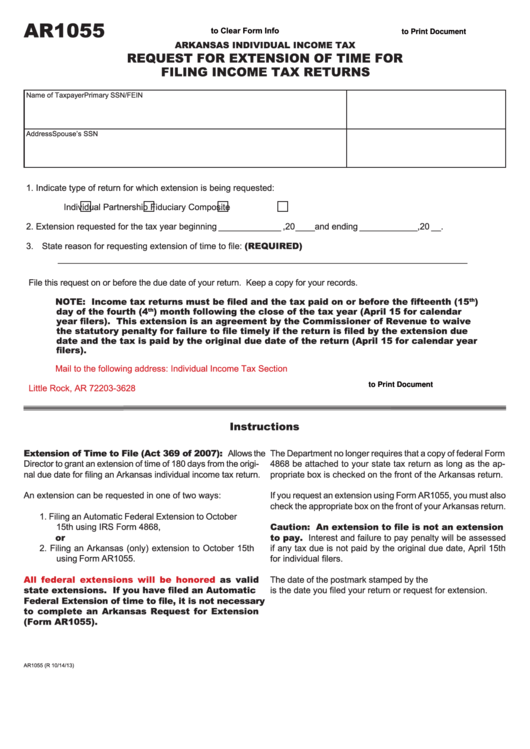

Fillable Form Ar1055 Request For Extension Of Time For Filing Income

https://data.formsbank.com/pdf_docs_html/330/3301/330136/page_1_thumb_big.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

https://taxguru.in/income-tax/section-54f-exemption-renovation-re...

Web 4 sept 2020 nbsp 0183 32 Aggrieved the assessee preferred an appeal before the CIT A who confirmed the order of AO by holding that any investment made towards extension or

https://homefirstindia.com/article/tax-benefit-on-home-construction-loan

Web Watch on Tax Exemption for Home Construction Loan The pre construction phase is the time between the date of borrowing and the completion of the construction The Indian

Form 4868 Application For Automatic Extension Of Time To File U S

Fillable Form Ar1055 Request For Extension Of Time For Filing Income

Tax Return Papers Jordhand

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Tax Rebate For Individual It Is The Refund Which An Individual Can

IRS Income Tax Extension E file Federal Extension

IRS Income Tax Extension E file Federal Extension

Application For Extension For Filing Individual Income Tax Return Free

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Form 1027 Application For Automatic Extension Of Time To File

Income Tax Rebate For Extension Of House - Web As per Section 24 of the Income Tax Act 1961 home improvement loan tax exemption is applicable on the interest paid against the home improvement loan However this tax