Income Tax Rebate For Financial Year 2022 23 Taxes for Financial Year 2022 23 ended on March 31 2023 The income slabs announced in the previous budget i e Budget 2022 shall be applicable for the income earned between April 1 2022 and March

Tax rebate up to Rs 12 500 is applicable for resident individuals if the total income does not exceed Rs 5 00 000 not applicable for NRIs Tax rebate up to Rs 25 000 is applicable Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their

Income Tax Rebate For Financial Year 2022 23

Income Tax Rebate For Financial Year 2022 23

https://static.india.com/wp-content/uploads/2022/03/Income-Tax-Return-Refund.jpg

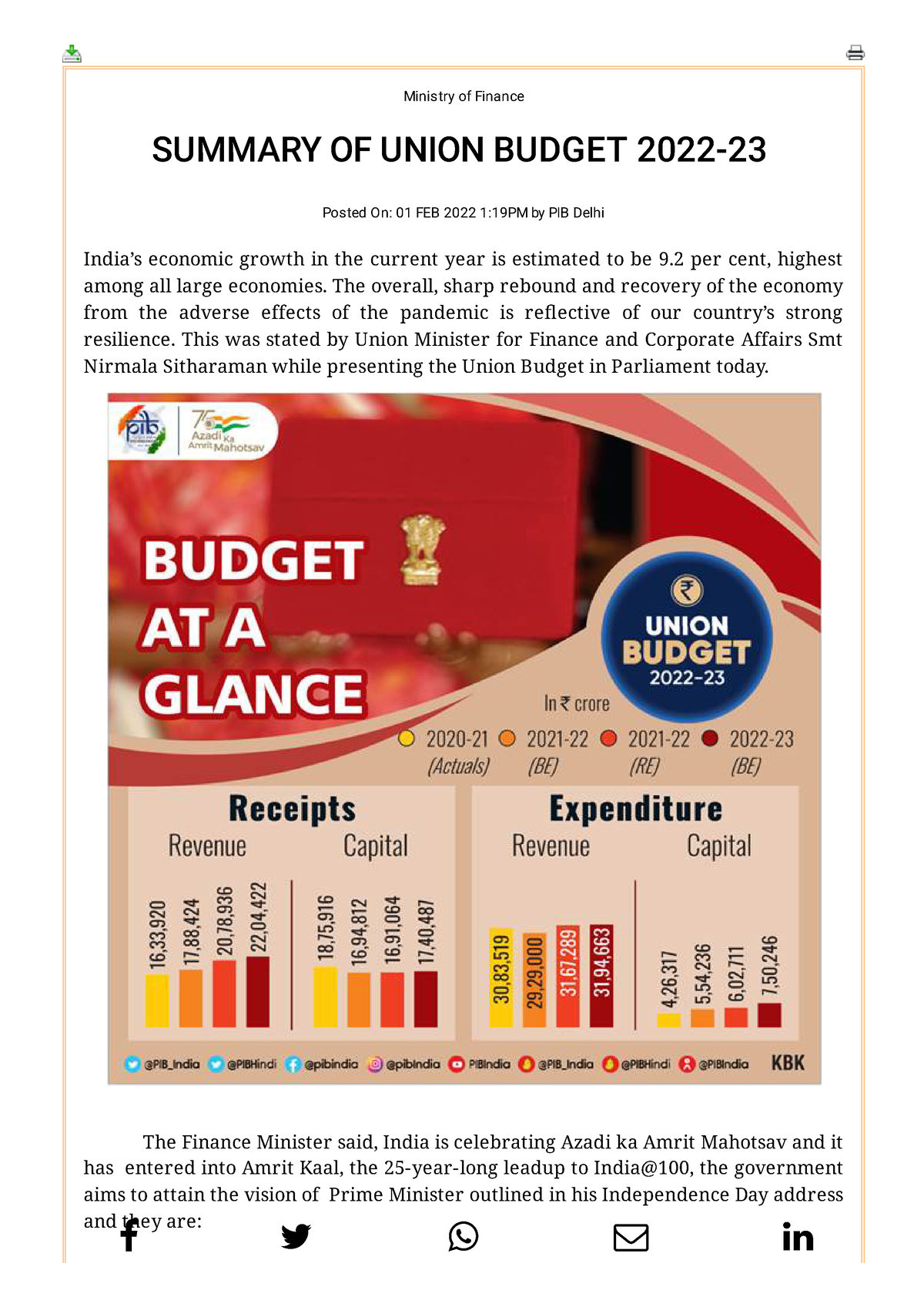

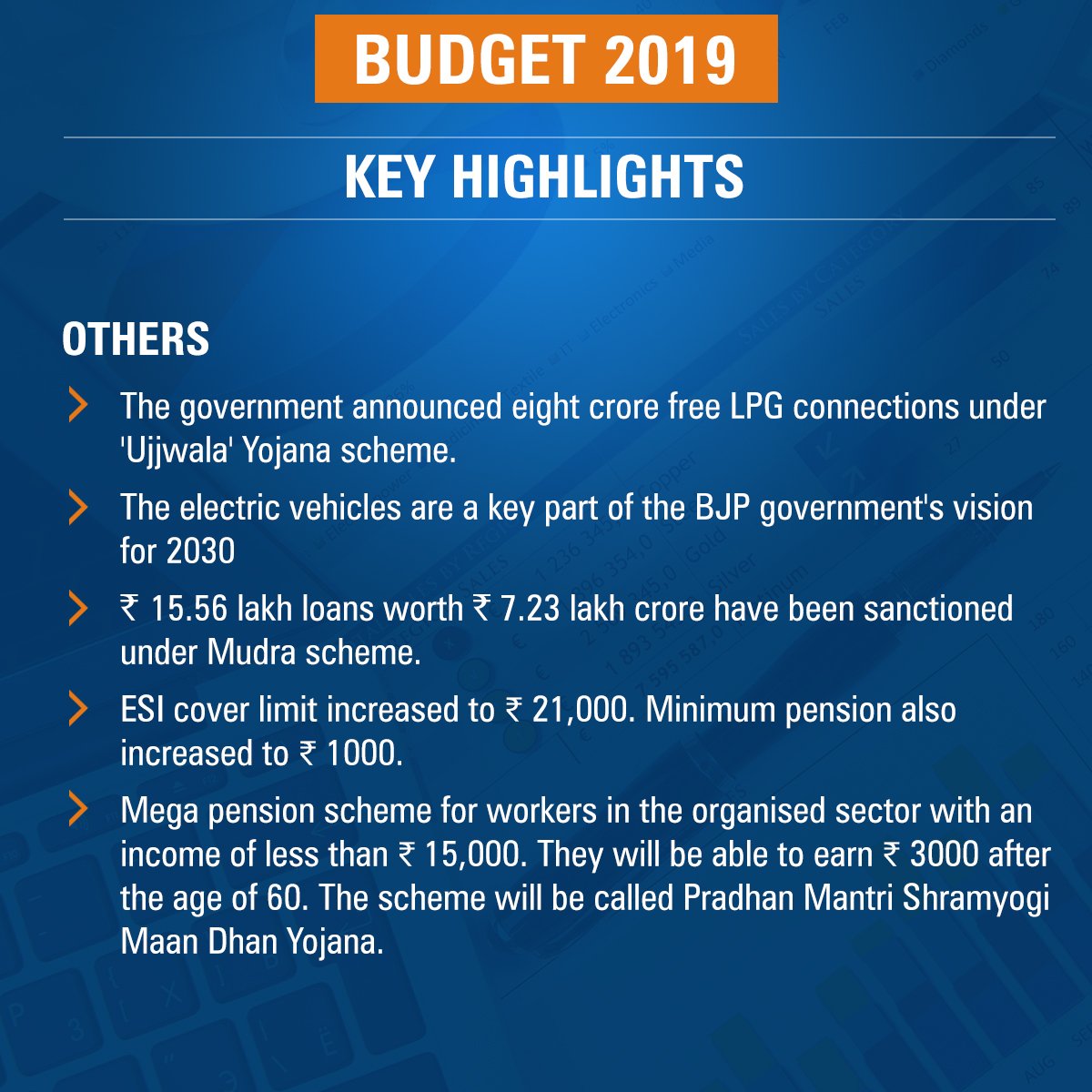

Government Of India Budget 2022 For Financial Year 2022 23 Ministry

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/9e48998d26846b7cbfad3e20e65a274f/thumb_1200_1697.png

Standard Bank Net Profit Up 4 At K24 8bn Malawi Nyasa Times News

https://www.nyasatimes.com/wp-content/uploads/Madinga-1-e1646013908359-1430x1536.png

In the case of lower income class of women where income is up to Rs 7 lakhs tax rebate up to Rs 25 000 can also be availed in case of the new regime Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed

The new financial year FY 2022 23 i e April 1 2022 to March 31 2023 is finally here Most of us leave our income tax planning till the last minute But it s always Income Tax Calculator How to calculate Income taxes online for FY 2023 24 AY 2024 25 2024 25 2023 24 with ClearTax Income Tax Calculator Refer examples tax slabs for easy calculation

Download Income Tax Rebate For Financial Year 2022 23

More picture related to Income Tax Rebate For Financial Year 2022 23

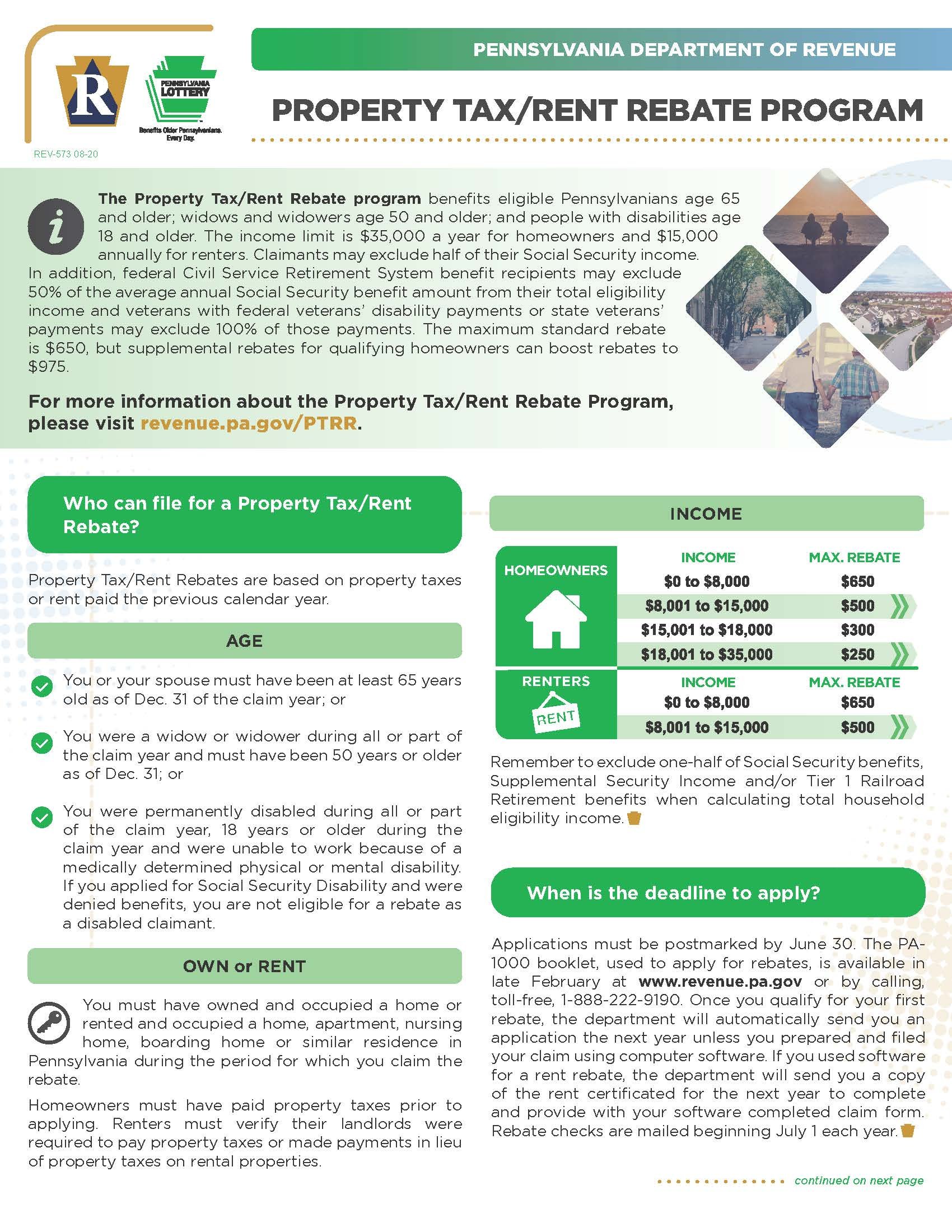

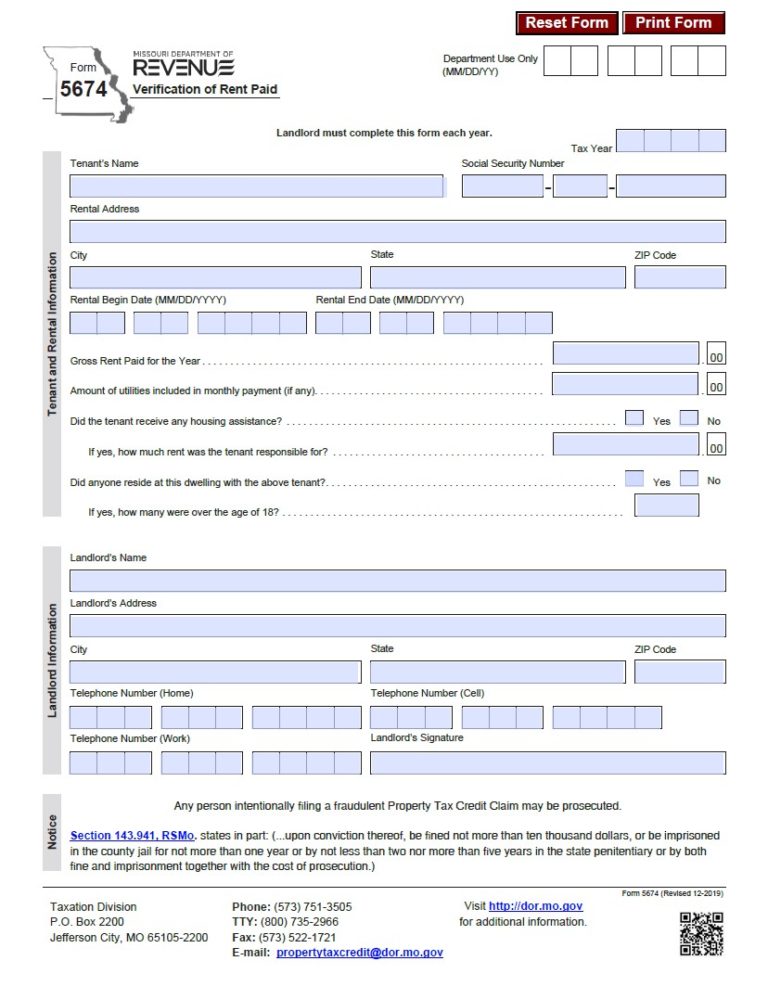

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

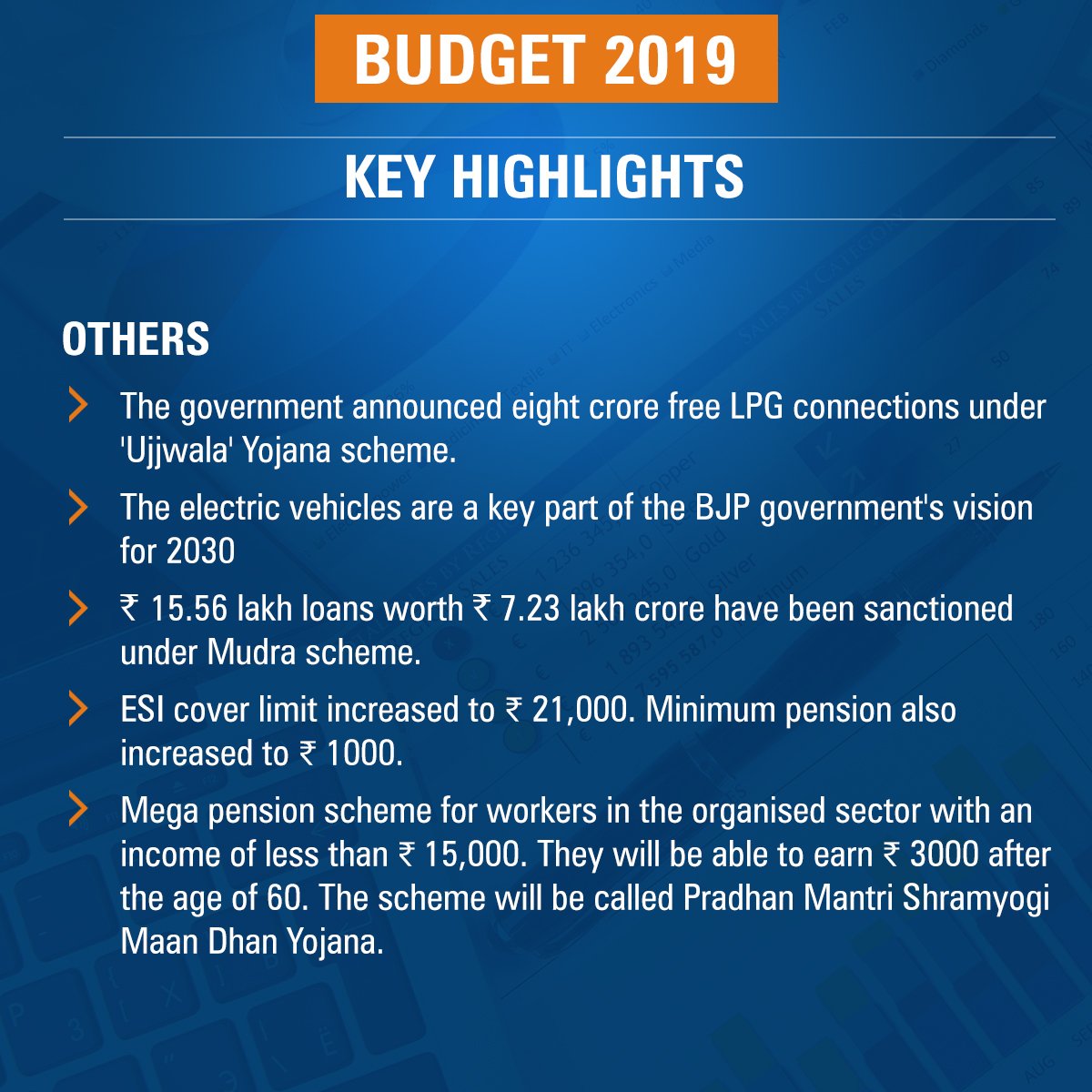

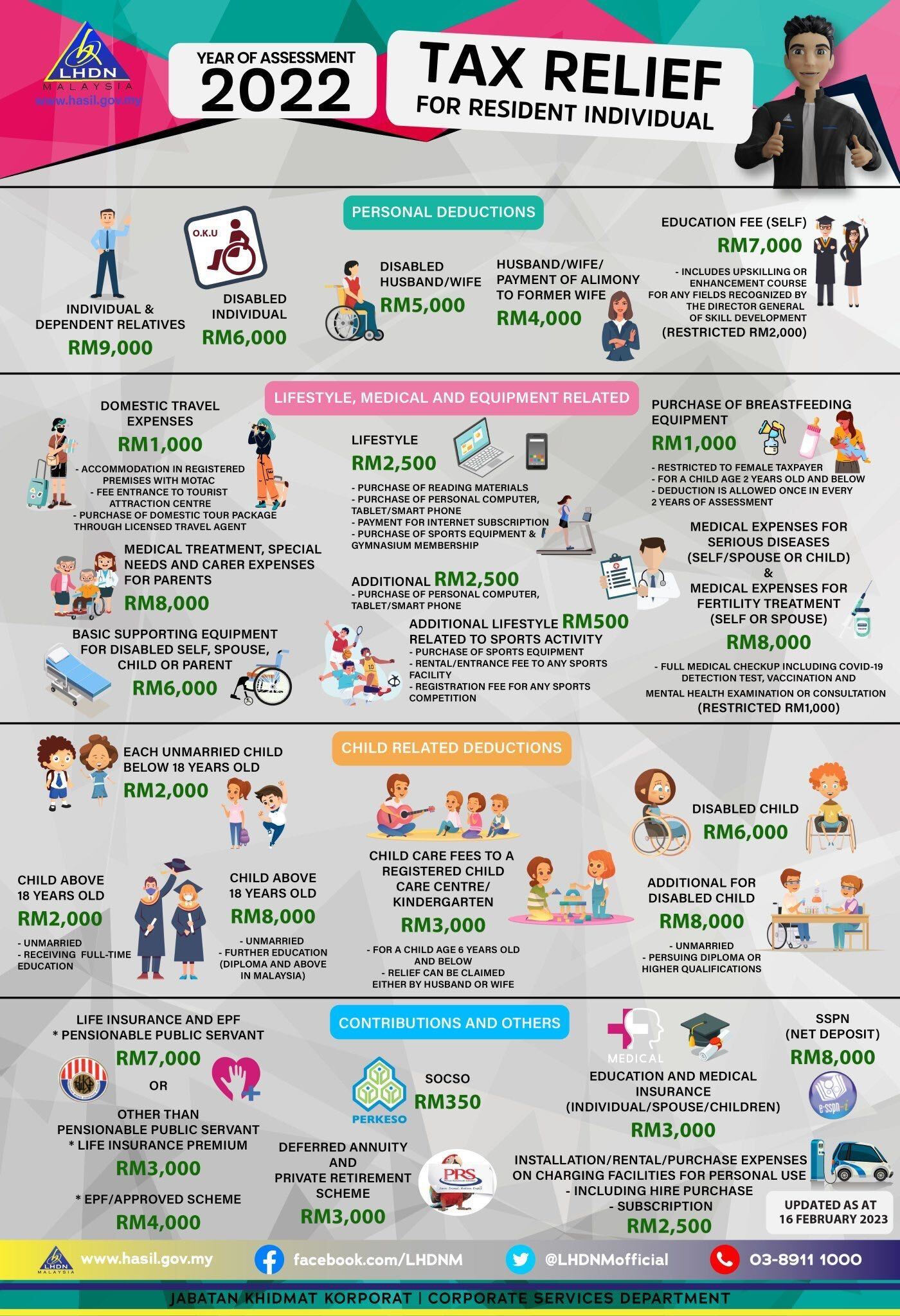

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

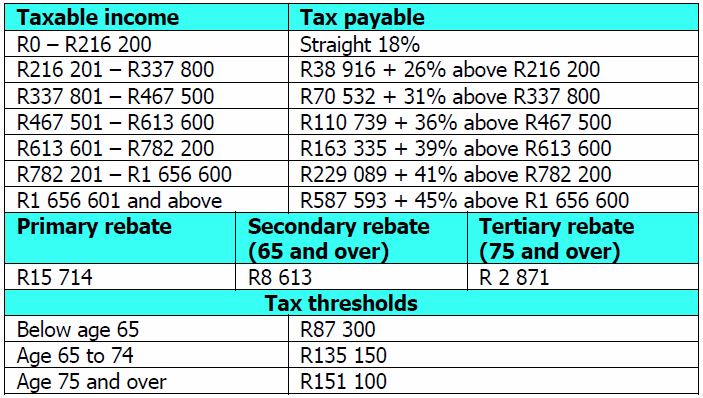

Income tax slabs and rates for FY 2022 23 Old tax regime With deductions and exemptions Total income New tax regime without deductions and exemptions Nil Up to Rs 2 5 lakh NIL 5 From Rs Supporting information Rebate income 2023 Work out your rebate income and if you re eligible for the seniors and pensioners tax offset at question T1 Last updated 24 May

Income Tax Slabs and Rates for FY 2022 23 All Salaried Taxpayers Need to Know from Budget 2022 Curated By Aparna Deb Last Updated February 02 2022 07 14 IST The income tax department of India has Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022 23 FY 22 23 i e Income Tax Assessment Year 2023 24 Income

Income Tax Rates In India For Financial Year 2022 23 By Companies Next

https://cdn.dribbble.com/userupload/8443561/file/original-fcf393cfab8549251788f2450fdfcabc.jpg?resize=960x466

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

https://taxguru.in/income-tax/exemption-7000…

Taxes for Financial Year 2022 23 ended on March 31 2023 The income slabs announced in the previous budget i e Budget 2022 shall be applicable for the income earned between April 1 2022 and March

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Tax rebate up to Rs 12 500 is applicable for resident individuals if the total income does not exceed Rs 5 00 000 not applicable for NRIs Tax rebate up to Rs 25 000 is applicable

2022 Tax Brackets JeanXyzander

Income Tax Rates In India For Financial Year 2022 23 By Companies Next

One time Direct Payments From 50 To 700 Still Going Out How You Can

Income Tax Declaration Form For Financial Year 2021 2022 PDF

Rent Rebate Missouri Printable Rebate Form

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

LHDN Tax Relief List 2022 How To Fill In E Filing 2023 Pesan By Qoala

Window To Enjoy Tax Reliefs Closing CN Advisory

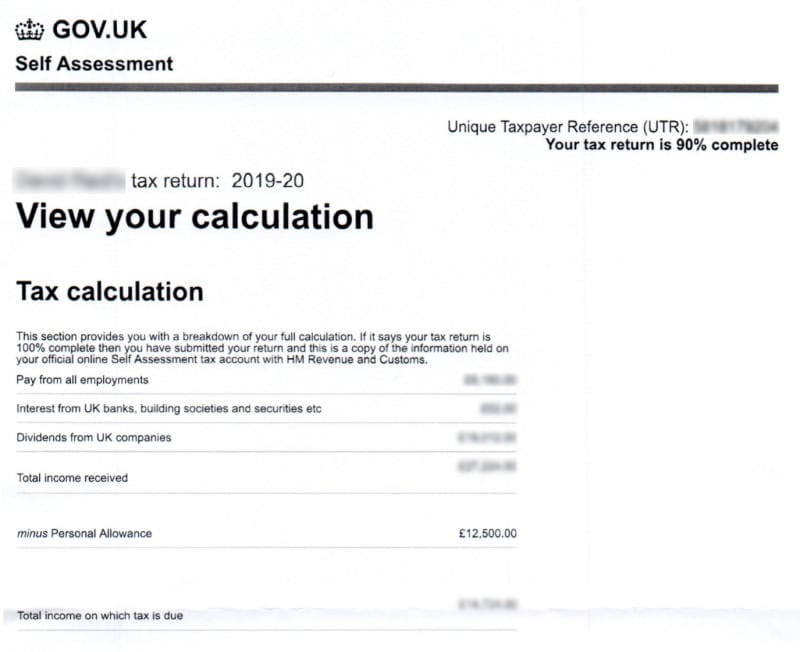

HMRC Tax Refunds Tax Rebates 3 Options Explained

Income Tax Rebate For Financial Year 2022 23 - The new financial year FY 2022 23 i e April 1 2022 to March 31 2023 is finally here Most of us leave our income tax planning till the last minute But it s always