Income Tax Rebate For Handicapped Dependent Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

Web 20 juil 2019 nbsp 0183 32 What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled Web If you no longer satisfy the conditions for Handicapped Parent Relief e g your dependant recovers from his her condition please withdraw the claim from your Income Tax

Income Tax Rebate For Handicapped Dependent

Income Tax Rebate For Handicapped Dependent

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Income Tax Rebate For Handicapped U s 80 U 80 DD YouTube

https://i.ytimg.com/vi/Jrs4fApB7Fs/maxresdefault.jpg

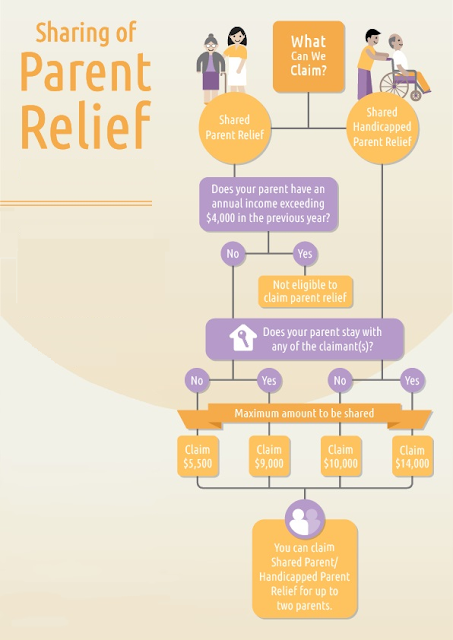

How To Reduce Your Income Tax In Singapore make Use Of These Tax

https://2.bp.blogspot.com/-N720ls7Vsnw/WsuZ2v9EW9I/AAAAAAAAYsA/5w4Clg9pP4cGP1pUnKBAbpIQgSDZeUhDwCLcBGAs/s640/Parent%2BRelief.png

Web 3 juin 2019 nbsp 0183 32 Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which is 80 or more get a deduction Web 7 d 233 c 2022 nbsp 0183 32 Disability Tax Benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may

Web 11 juin 2018 nbsp 0183 32 If the dependent disabled has disability between 40 to 79 you will be allowed a deduction of Rs 75 000 If the dependent disabled has 80 or above Web 30 juil 2023 nbsp 0183 32 Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent

Download Income Tax Rebate For Handicapped Dependent

More picture related to Income Tax Rebate For Handicapped Dependent

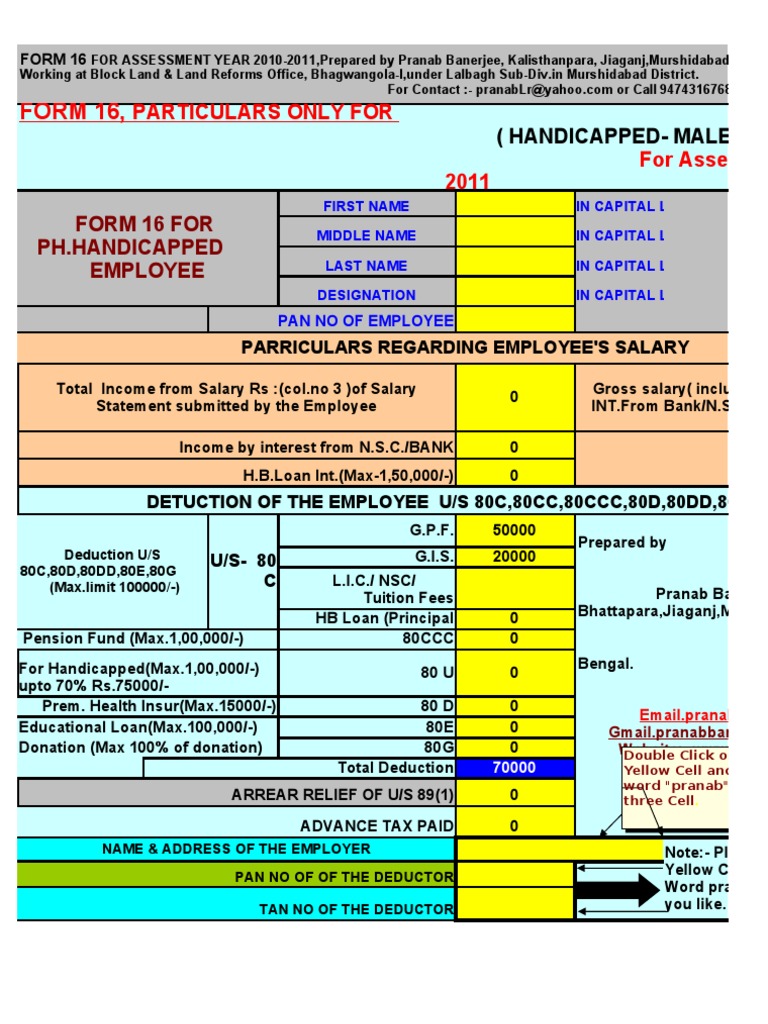

Handicapped Form 16 Tax Deduction Services Economics

https://imgv2-2-f.scribdassets.com/img/document/31061654/original/ee9210e4de/1586038626?v=1

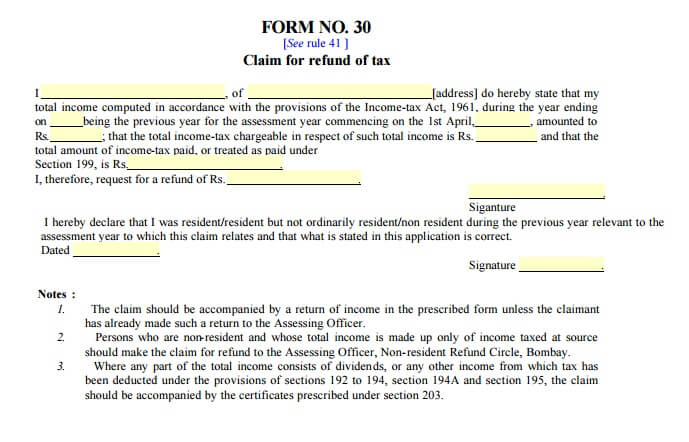

80DD FORM PDF

https://www.allindiaitr.com/App_Root/content/img/form30.jpg

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Web Earned Income Tax Credit EITC is a tax credit for certain people who work and have low to moderate earned income A tax credit usually means more money in your pocket It Web 2 d 233 c 2021 nbsp 0183 32 Successful claimants are eligible to receive Rs 75 000 for a disabled dependent with between 40 and 80 disability as defined by the Indian government

Web However there is a one special rule when it comes to claiming dependency exemptions for disabled family members There are two types of dependents a Qualifying Child and a Web 24 juil 2018 nbsp 0183 32 Deduction allowed goes up to Rs 1 25 000 if disabled dependant is a person with severe disability Deduction not depend on amount of expenses incurred Even if

2021 Form MI BCBS WF 10676 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/568/279/568279876/large.png

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

https://cleartax.in/s/section-80u-deduction

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

https://tax2win.in/guide/section-80dd

Web 20 juil 2019 nbsp 0183 32 What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

2021 Form MI BCBS WF 10676 Fill Online Printable Fillable Blank

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

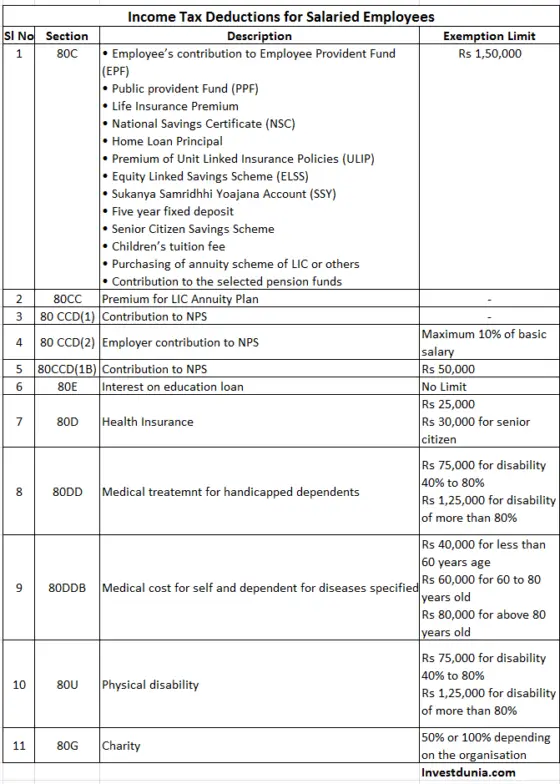

Income Tax Planning For Salaried Employees In FY 2017 18 Investdunia

Physically Handicapped Pension Karnataka Physicalad

Pin On Tigri

Pin On Tigri

Income Tax Rebate Is A Bait Video Dailymotion

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Section 87A Tax Rebate Under Section 87A

Income Tax Rebate For Handicapped Dependent - Web 7 d 233 c 2022 nbsp 0183 32 Disability Tax Benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may