Income Tax Rebate For Handicapped Person Web 7 d 233 c 2022 nbsp 0183 32 As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Web 7 avr 2023 nbsp 0183 32 April 7 2023 183 7 min read Why trust us Tax season in 2023 starts on January 24 and if you had income in 2022 you likely need to file a federal tax return by Tax Day

Income Tax Rebate For Handicapped Person

Income Tax Rebate For Handicapped Person

https://taxguru.in/wp-content/uploads/2018/07/Deducation-Under-Section-80U-of-Income-Tax-Act-1961-For-Disable-Persons-1280x720.jpg

Income Tax Deduction For

https://i.ytimg.com/vi/pV9QhdAvsxg/maxresdefault.jpg

Section 80U Deductions For The Disabled Eligibility How To Claim

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80u.jpg

Web 3 juin 2019 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability Web 24 juil 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80 in pursuance of which an individual Indian citizen and foreign national who is resident of India and who suffers from not less than 40 per cent of any

Web Tax Help for People with Disabilities For more information visit the Publication 907 Tax Highlights for Persons With Disabilities page visit the IRS forms webpage 800 829 1040 Web 1 f 233 vr 2022 nbsp 0183 32 Budget 2022 Tax Relief to Persons with Disability By Strategic Investment Research Unit SIRU While the Covid 19 outbreak has presented unprecedented

Download Income Tax Rebate For Handicapped Person

More picture related to Income Tax Rebate For Handicapped Person

INCOME TAX REBATES FOR FY 20 21

http://www.plannprogress.com/uploads/4/1/7/0/41706423/published/590533831_1.jpg?1598940645

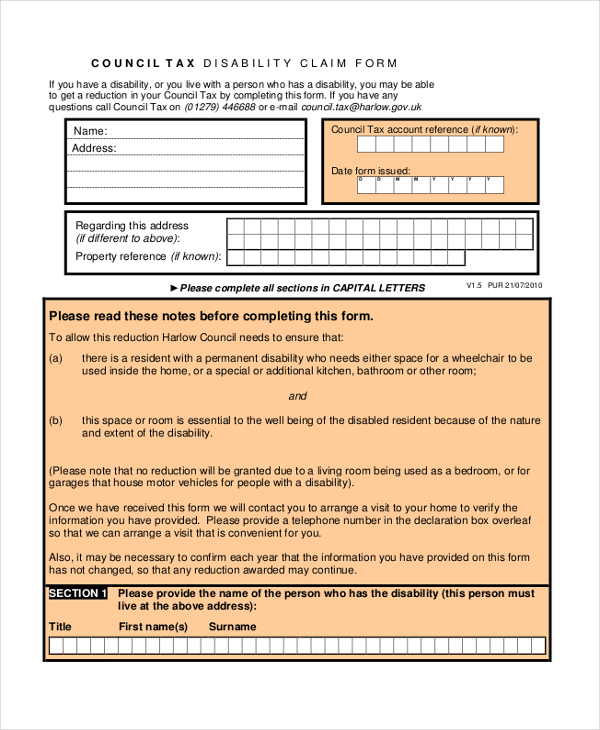

FREE 11 Sample Disability Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/11/Tax-disability-form.jpg

Image Showing Assured Income For The Severely Handicapped Explainer

https://i.pinimg.com/originals/d7/0a/73/d70a731f3a6b0b7158663e79b95c5b6e.jpg

Web 11 juin 2018 nbsp 0183 32 My father is a handicapped person polio effected with permanent disability 60 and he don t has any income He is not under any medical treatment except the medicines he take for some other Web 27 juin 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80U in pursuance of which an individual Indian citizen and foreign national who is resident of India and who

Web You are single and you receive disability benefits of 417 or more per month 5 000 or more per year You won t qualify for the credit You receive only 300 in SSDI per Web 1 f 233 vr 2022 nbsp 0183 32 Relief for persons with disabled dependents is available as a deduction of such amounts invested in annuity providing schemes and is limited to Rs 75000 or Rs

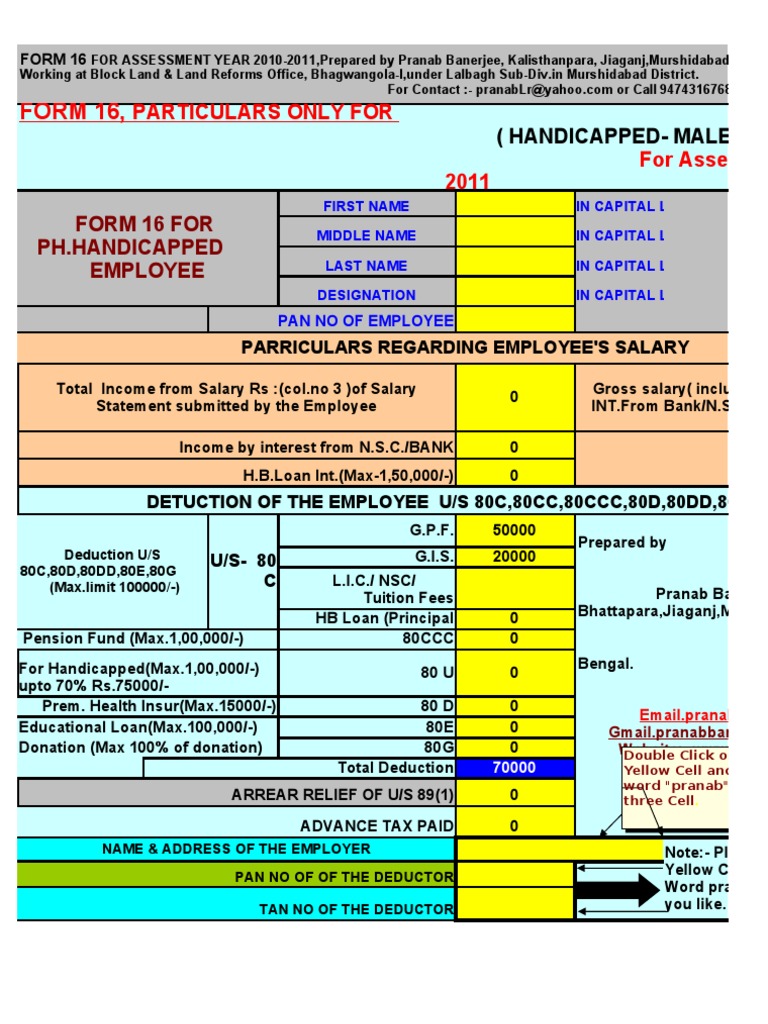

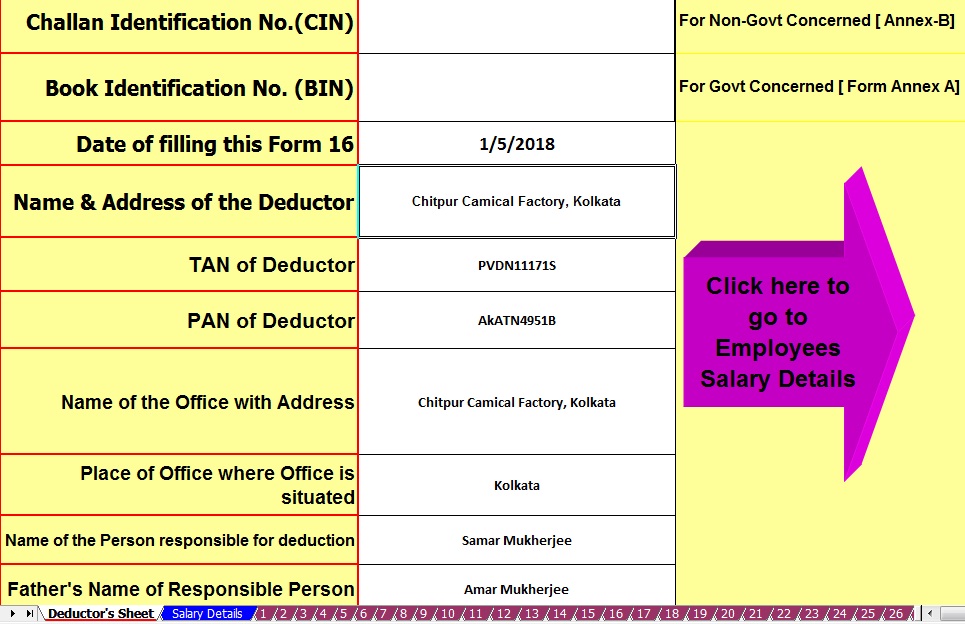

Handicapped Form 16 Tax Deduction Services Economics

https://imgv2-2-f.scribdassets.com/img/document/31061654/original/ee9210e4de/1586038626?v=1

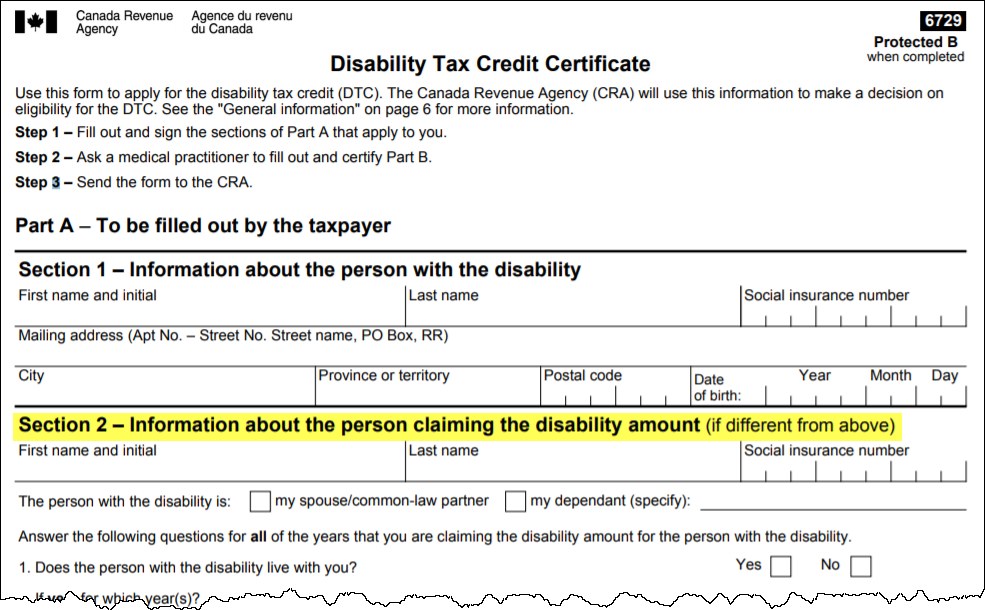

Does The CRA Have A Disability Tax Credit Certificate form T2201 On

https://support.hrblock.ca/en-ca/Content/Resources/Images/DIY_T2201_EN.png

https://www.irs.gov/individuals/more-information-for-people-with...

Web 7 d 233 c 2022 nbsp 0183 32 As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS

https://cleartax.in/s/section-80u-deduction

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

T1159 Fill Out Sign Online DocHub

Handicapped Form 16 Tax Deduction Services Economics

Pin On Tigri

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Income Tax Deduction For Handicapped Disable Person Section 80DD

What To Know About Montana s New Income And Property Tax Rebates

What To Know About Montana s New Income And Property Tax Rebates

Income Tax Arrears Relief Calculator U s 89 1 For The F Y 2023 24

Latvijas Balzams Secures Corporate Income Tax Rebate Amber Beverage Group

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

Income Tax Rebate For Handicapped Person - Web 3 juin 2019 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability