Income Tax Rebate For Heat Pump Web 15 ao 251 t 2022 nbsp 0183 32 This tax credit is good for 30 percent of the total cost of what you paid for your heat pump including the cost of labor up to 2 000 and it would be available

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat Web New Inflation Reduction Act heat pump tax credits 2023 through 2032 Starting January 1 2023 you may be eligible for the new and improved 25C Energy Efficiency Home Improvement tax credit and it s a 2 000

Income Tax Rebate For Heat Pump

Income Tax Rebate For Heat Pump

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/ameren-rebate-chart-heat-pumps-awtrey-heating-air-conditioning-5.png?fit=768%2C566&ssl=1

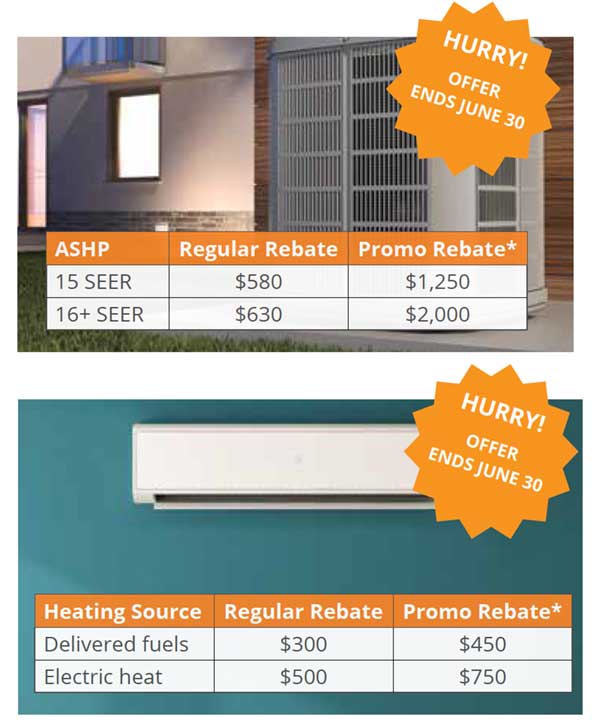

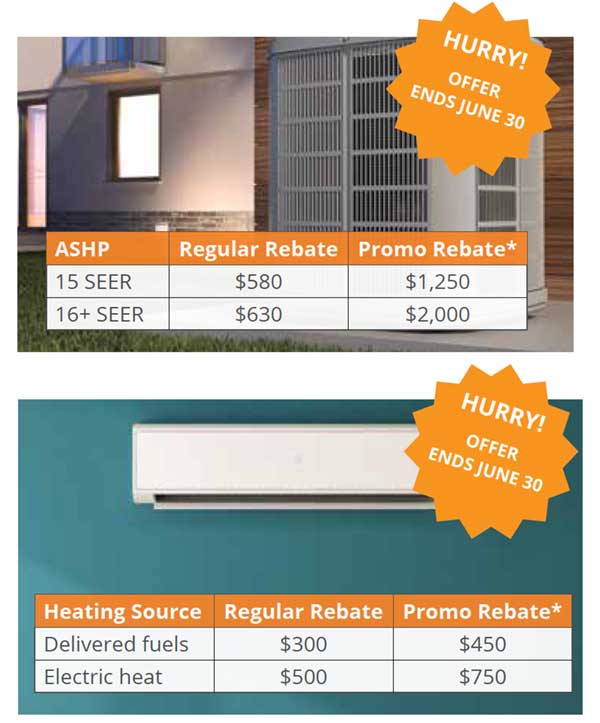

Rebates Offers To Save You Money Dakota Electric Association

https://www.dakotaelectric.com/wp-content/uploads/2019/04/heatpump-ads.jpg

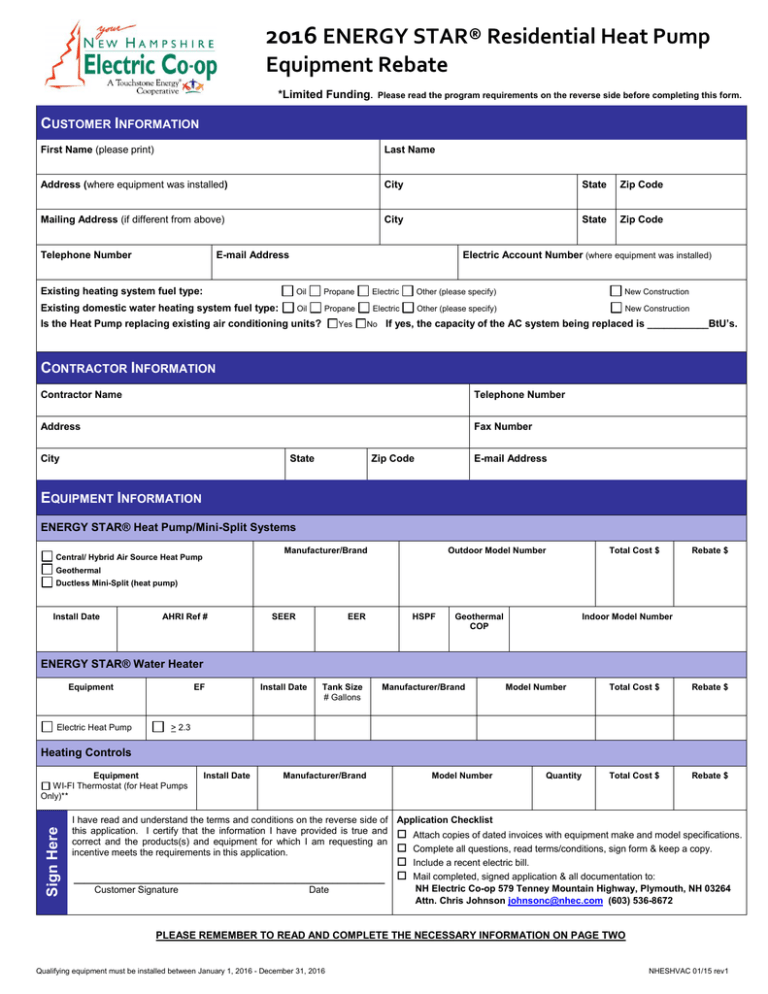

2016 ENERGY STAR Residential Heat Pump Equipment Rebate

https://s2.studylib.net/store/data/018074316_1-2b83875265f367a53696ca28ca1e9f8e-768x994.png

Web Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 qualified energy Web 16 ao 251 t 2022 nbsp 0183 32 Homeowners who do not qualify for the rebates can receive tax credits of up to 2 000 to install heat pumps and 1 200 a year for other energy saving

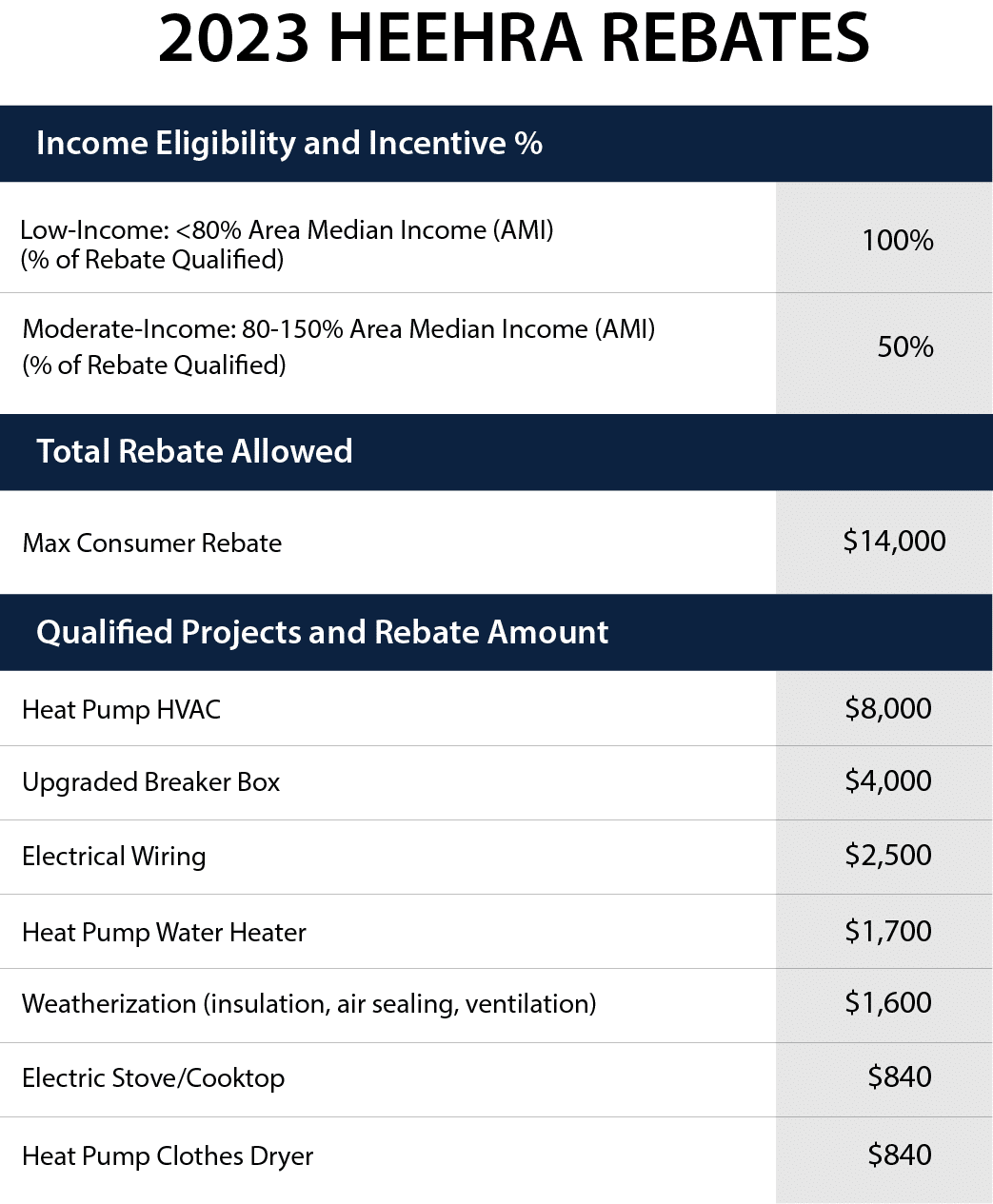

Web 12 ao 251 t 2023 nbsp 0183 32 For low income households it promises to cover 100 percent of the cost of a heat pump up to 8 000 and for middle income households 50 percent In some Web 4 mai 2023 nbsp 0183 32 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

Download Income Tax Rebate For Heat Pump

More picture related to Income Tax Rebate For Heat Pump

Tax Rebates For Heat Pumps 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/geothermal-rebates-take-up-to-45-off-your-total-cost-of-job-when-you-6.png

Federal Rebates For Heat Pumps HERETAB

https://i2.wp.com/www.advantagehcp.com/wp-content/uploads/2019/09/750-rebate-for-heat-pump-with-efficiency-90-HSPF14-SEER-or-higher-when-converting-from-an-electric-furnace-Additional-250-rebate-for-variable-speed.png

Peco Rebate For Heat Pump PumpRebate Gas Rebates

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/08/peco-rebate-for-heat-pump-pumprebate.jpg?w=577&h=746&ssl=1

Web 30 d 233 c 2022 nbsp 0183 32 Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000 Note ENERGY STAR Web 26 janv 2023 nbsp 0183 32 When it comes to paying for your heat pump there are two ways the Inflation Reduction Act can help tax credits and rebates Tax credits for heat pumps

Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements Web The U S Department of Energy DOE estimates that these rebates will save households up to a 1 billion on energy bills each year and support over 50 000 U S jobs This

Tax Credits For Heat Pumps 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebate-form-northern-wasco-county-peoples-utility-district-31.png?w=530&ssl=1

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10pC2V.img

https://www.consumerreports.org/appliances/heat-pumps/heat-pump...

Web 15 ao 251 t 2022 nbsp 0183 32 This tax credit is good for 30 percent of the total cost of what you paid for your heat pump including the cost of labor up to 2 000 and it would be available

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Federal Rebates For Heat Pumps HERETAB

Tax Credits For Heat Pumps 2022 PumpRebate

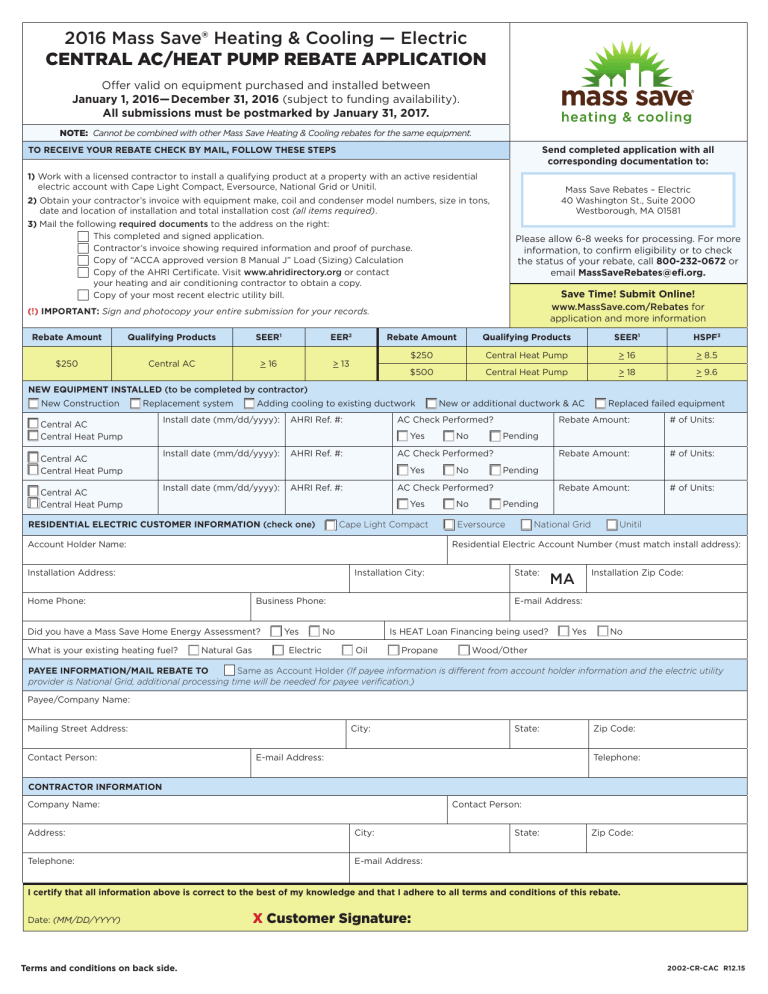

Electric CENTRAL AC HEAT PUMP REBATE

Federal Rebates For Heat Pumps HERETAB

Federal Rebate For Heat Pump 2023 PumpRebate

Rebates Hometown Heat Pumps

Rebates Hometown Heat Pumps

Connecticut Rebates

Form Rpd 41346 Geothermal Ground Coupled Heat Pump Tax Credit Claim

2023 Heat Pump Rebate For Texas HEEHRA

Income Tax Rebate For Heat Pump - Web Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home